An Introduction to Chinese Taxation

For an increasing number of foreign entrepreneurs and SMEs, Chinese markets are an incredibly exciting prospect. Breaking into these untapped opportunities soon becomes more complicated, however, in the face of the Chinese taxation system. Currently there are few comprehensive resources information online that tackle both Chinese income tax and business taxes in China making it difficult to find the right answers.

With this in mind, this overview offers light on the Chinese taxation system – including VAT, consumption tax, business tax, tax policies and tax exemption in China – key points for expats, and making receipts, or ‘fapiaos’ ( 发票), work for you.

In partnership with S.J. Grand, we answer some of the most common queries of foreign businesses new to Chinese markets. S.J. Grand is a boutique professional services firm in China that provides tax, accounting and corporate advisory services to foreign-invested companies in China.

Taxes in China: what tax rate applies to your personal income?

Knowing which tax rate to apply for your personal income, according to the IIT

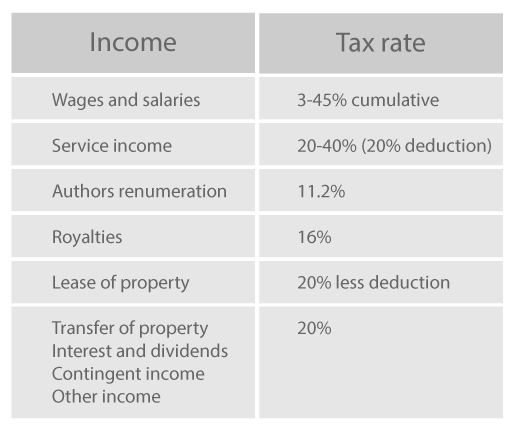

According to the Individual Income Tax (IIT), the Chinese income tax rate for wages and salaries accumulates proportionately from 5% up to the highest rate of 45%. Find in the table below the marginal tax rates relevant to personal income tax in China:

Important points for founders/CEOs and senior managers in the Chinese taxation system

- Founders who are direct legal investors will be taxed from 5% to 10% on dividends based on the tax treaty held by their country of origin with China.

Do you have “director” status?

- According to the tax treaty signed with the PRC, founders, general managers, CFOs, COOs etc., may all have “Director” status under Chinese legislation. This variant is important to check, as for instance whilst French senior management employees are not considered directors, in Canada senior management does fall under this bracket.

- Crucially, while “general employees”working abroad can obtain tax exemptions, “directors”face full taxes for income derived from a company in China – even if the person stays out of China.

What parts of worldwide income does an individual have to tax in China and when?

Expats with domicile in China or who have resided in the country for 5+ years must declare all worldwide income, and pay tax according to the tax treaty signed between China and the employee’s home country.(This total must include dividend, lease income, property transfer income, royalties and stock option; exempting only inheritance income.)

Taxes in China: point to note

Worldwide income should be declared within 30 days after the fiscal year ends, from January 1st until the 30th of the following year. And what are the consequences for not taxing correctly? Failure to properly declare taxes results in late payment fees of 0.05% per day, with penalties for evasion reaching up to 500%.

What are Fapiaos and how do they work in the Chinese taxation system?

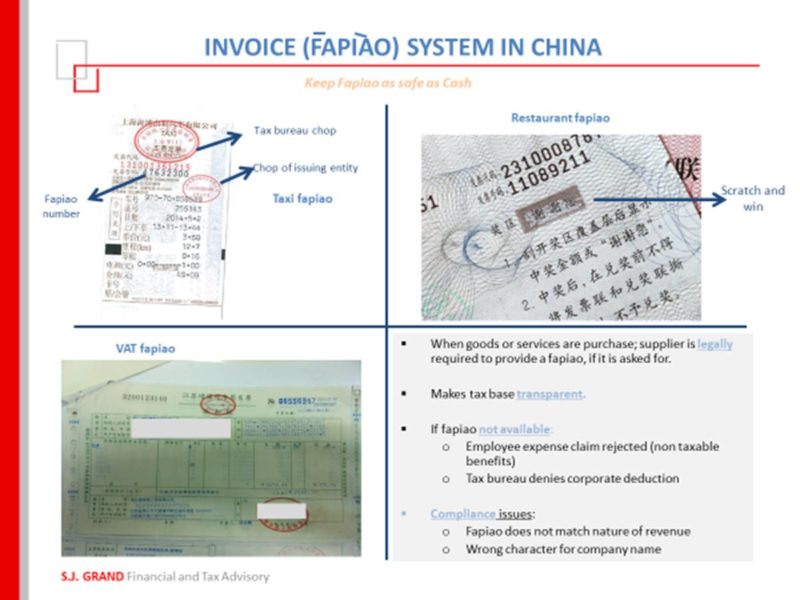

Fapiaos are official payments and receipts that are issued for both providers and consumers of goods and services.

Features of Fapiao

More than an invoice, fapiaos are in a fixed format, published and authorised by tax authorities and monitored by the state administration of taxation.

Types of Fapiao and VAT in China

Several types of fapiao include VAT special fapiao, VAT general fapiao and specific formats such as flight or train tickets and postal receipts.

Depending on their tax status, different businesses must use different fapiaos. Those considered a VAT Small Tax Payer must use VAT general fapiao, whilst corporations with a VAT General Tax Payer status will need a special fapiao to recover VAT.

What if a company fails to supply a fapiao?

Companies are obliged to issue these receipts. If a company fails to do so, consumers retain the right to complain to tax authorities or refuse payment.

Successfully claiming business expenses

- Submit original documents with all content completed correctly.

- State the company title rather than an individual’s

- Ensure that the expense description relates to business operations – i.e. not clothing, luxuries, gyms or private travel etc.

- With a Fapiao stamp

- For business trips outside of China, keep hold of official receipts and supporting documents such as boarding passes.

Business tax in China and its impact

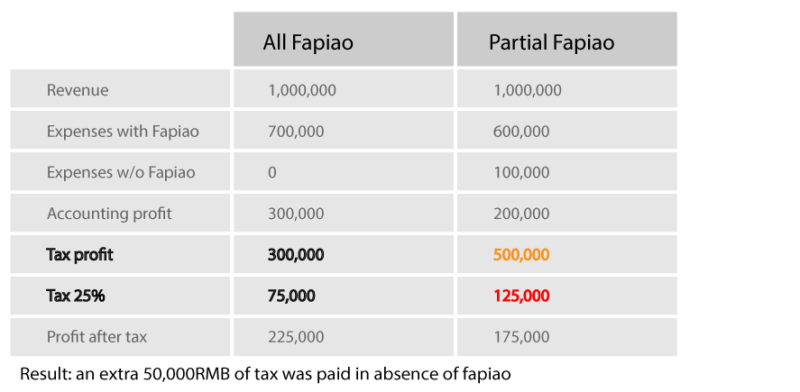

Crucially, these taxes should not impact a company’s pricing strategy. The absence of a fapiao will not only inhibit the recovery of VAT but also theoretically cost 25% as any profits without a fapiao become tax-deductible.

What is the process for sending corporate income back home?

Things to consider

Are the initial costs of sending corporate income back to head office in a corporation’s home country really worthwhile? Work out the potential savings versus the profit from tax exemptions as a foreign enterprise in China.

Four methods (depending on the nature of the company):

- Given a certain level of profitability, the first option involves sending dividends to back to home headquarters with a normal rate of 5%-10% CIT depending on the relevant tax treaty.

- A second option would be to set up a services contract with the home offices, so that the China offices receive a service from the home location which can then be invoiced on the Chinese side.

- Suitable for temporary fund transfers during times of lacking funds. Sign a loan agreement with head office, and transfer funds as a loan. Bear in mind that loan allowance is limited depending on the financial results of the WFOE and must be approved by the state administration of foreign exchange. Remember to account also for the interest the head office must pay to WFOE. Loans must be returned to WFOE when due.

- Applicable to foreign enterprises that use trademarks and licenses. Sign a royalties agreement (e.g. trademark, licence fee) with head office and transfer funds to head office in the name of a royalties payment. WFOE should withhold CIT 10% and VAT 6% (deductible).

For further guidance, please get in touch with one of our consultants to hear more on taxation and market entry in China for foreign enterprises and entrepreneurs. See below for more information on our partner S.J. Grand.

S.J. Grand Company Profile

S.J. Grand Financial and Tax Advisory is a tax & management consulting boutique founded in 2003 in China. S.J. Grand has been advising over 1000 international clients on their development and profitability strategies in the PRC, including BNP Paribas and Bank of the West. Believing in transparency and internal control as tools to succeed in China, the firm delivers practical solutions from accounting and taxation to restructuring and optimization, with a strong reputation in dealing with fraud prevention and risk mitigation.

S.J. Grand created OBK Labs, in which it developed its proprietary APP: a powerful workflow management system that exploits the power of artificial intelligence and data analytics in multilingual environments to boost efficiency, slash costs and root out fraud.

Founded by Stephane J. Grand, alumnus of HEC Paris (MBA), La Sorbonne (Ph.D. in Chinese contract law) and the Fletcher School of Law and Diplomacy (MALD), the firm now counts four offices in China and one liaison-office in Paris.