In recent years, China’s luxury e-commerce has redefined luxury shopping in China through livestreaming, which accounted for about 25% of all online shopping GMV in China in 2023, showing its significant impact on the industry. The livestreaming sales phenomenon in China dates back to 2016, spearheaded by Alibaba during its Singles’ Day promotion. From its inception, it took only eight years to burgeon into a market worth RMB 4.9 trillion. With over 2.7 million active e-commerce anchors and more than 10 million employees engaging in the industry, livestreaming has become a cornerstone of China’s social economy.

Download our 2024 China Summer Sports Market report

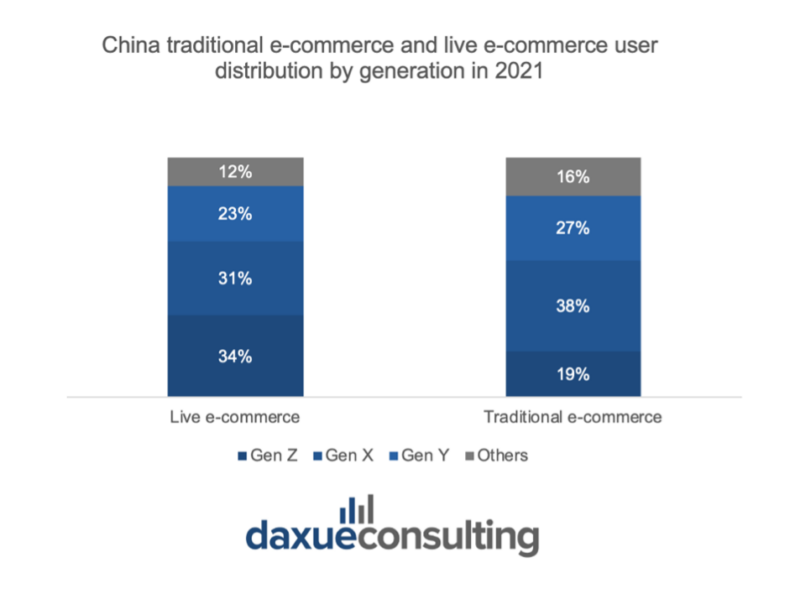

With 1.03 billion short video users and 530 million live e-commerce users, representing 59.5% of online shoppers, the demand for luxury goods in China remains substantial. Chinese luxury e-commerce consumption in 2023 was estimated to account for 22-24% of the world’s total, with 52% of Chinese luxury consumers aged over 30. Notably, 53% of these consumers have made online purchases, with short videos and livestreaming being pivotal in discovering luxury items and businesses. Thus, creating compelling digital content is crucial for luxury brands in China to build brand value and convert sales.

Riding the wave: e-commerce and livestreaming sales trends in China

In 2023, China’s live e-commerce industry witnessed significant growth, with the market size reaching 4.9 trillion yuan, a 35.2% year-on-year increase. According to a KPMG and Alibaba report, the market of e-commerce livestream in China reached its growth peak in 2019, marking an annual growth of 210%. The Chinese e-commerce market is projected to reach 5.8 trillion yuan in 2024. This marks a 19.1% increase from the previous year. However, this growth rate is anticipated to decelerate over the next three years, indicating a potential market stabilization.

China’s e-commerce transformation

Despite a market slowdown, 2023 set a record of live e-commerce sales exceeding 10 billion RMB for the first time, highlighting the sector’s potential and ongoing transformation. One newly emerged e-commerce platform, Kuaishou, has stood out in particular, as reported in its 2023 results. The platform highlighted that its e-commerce segment achieved an impressive annual GMV of around 1.2 trillion RMB, establishing Kuaishou as one of the fastest e-commerce platforms in China to surpass the trillion-GMV mark.

In the last three years, 20 million creators have earned income on Kuaishou. This is achieved through providing a “Whole Site Promotion” feature. It covers investment diagnosis, post-investment review, and real-time material analysis. These features enable creators and merchants to achieve more efficient asset allocation and achieve higher GMV conversions on the platform.

Needless to say, given the continuous growth performance in livestream e-commerce, the revenue distribution in livestreaming comes with its drawbacks, with 80% of revenue generally going to anchors and platforms, leaving only 20% for the product side. With the slowdown in growth and the small profit margins for platforms, it is clear that platforms are seeking alternative avenues in e-commerce sales, such as driving in-platform organic sales.

For 2024’s 618 Shopping Festival, JD.com states they will eliminate pre-sale periods and shift their focus on enhancing the user shopping experience by offering more significant discounts, faster logistics, and superior after-sales service. The company aims to leverage its strong supply chain capabilities and integrate online and offline retail channels to provide a seamless shopping experience.

Popular e-commerce and social commerce platforms for luxury shopping in China

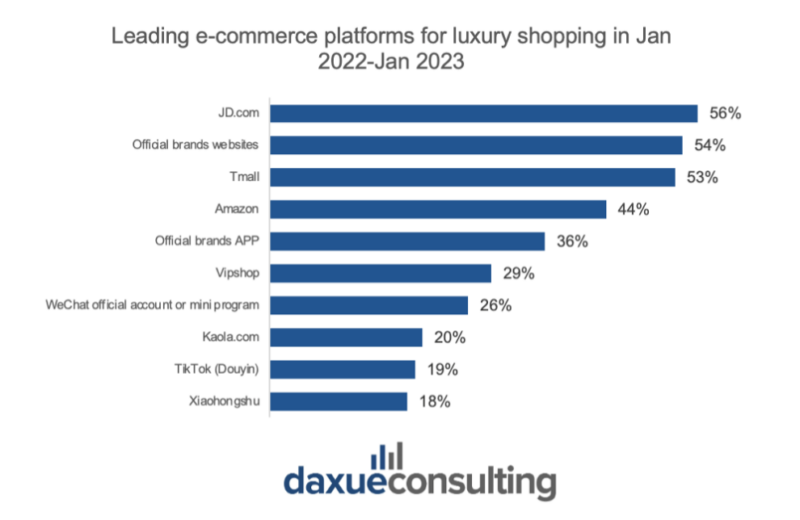

China’s digital landscape, characterized by multiple touchpoints, rich content, and a comprehensive value chain, is creating a distinctive local luxury ecosystem. Luxury e-commerce consumers in China are increasingly using diverse online platforms, with JD.com, the official brand website, and Tmall being the three most used platforms for consumers to buy luxury products online.

Taobao and its livestream app Diantao remain popular among consumers, but in terms of GMV, Douyin and Kuaishou are surpassing Taobao and Diantao. Kuaishou’s core users, dominated by consumers in third-tier cities, are projected to represent “luxury’s next consumption powerhouse”. This is due to the fact that younger consumers in top-tier cities like Beijing and Shanghai are increasingly drawn to niche designer brands reflecting their evolving identities. This forced luxury brands to simultaneously target consumers in lower-tier cities with high aspirations and rapidly increasing incomes.

How social media is shaping China’s luxury market

Common social marketing strategies in China include content marketing, referral links on videos, and affiliate marketing with live streamers, with platforms like Weibo, Xiaohongshu, and Douyin. These strategies are reported to be very effective in reaching new and diverse customers. Hence, high-end brands are leveraging social media to build loyalty and drive word-of-mouth growth.

In the first half of 2023, Douyin emerged as a crucial channel, engaging 150 million users interested in high-end products, with 73% of China’s luxury consumer base actively using the platform. In the first half of 2023, 66% of the top 100 search terms on Douyin were brand-related, including Chanel, Louis Vuitton, Prada, Cartier, and Bulgari, which saw a surge in popularity. Douyin’s luxury GMV rose by 254% year-on-year in 2023. This data reflects the ever-growing demand for luxury goods in China. By 2030, China’s luxury market share is projected to rise to 40%, surpassing Europe and the Americas to become the largest single market globally.

The new trend of livestreaming: quiet selling and AI integration

Quiet selling: A new approach for China’s luxury e-commerce

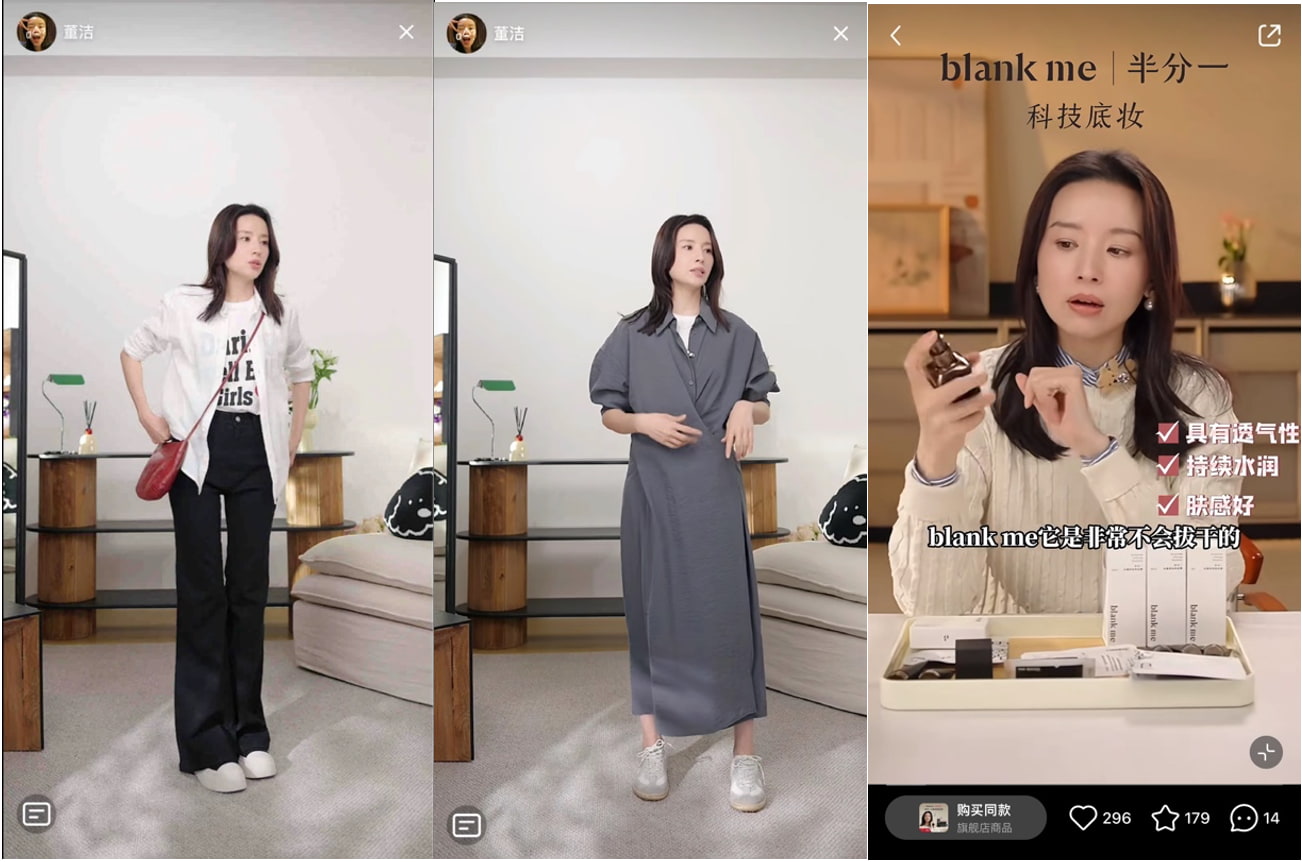

With the rise of quiet luxury in China, the concept of quiet selling is gaining traction. Notable quiet-selling hosts like Teresa Cheung and Dong Jie are leading this trend. According to Xiaohongshu, Dong Jie’s April 2023 livestream achieved 60 million RMB in GMV, and her eight-hour-long livestream on May 25, 2023, attracted over 2.2 million views.

The next level of China’s luxury e-commerce livestream

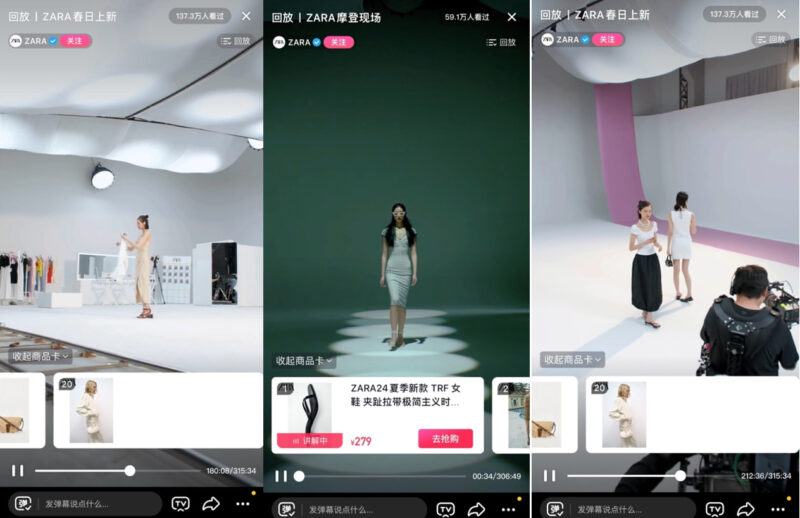

Chinese shoppers are becoming increasingly irritated by loud anchors peddling cheap products. Consequently, Zara’s innovative approach to livestreaming in China marked a pivotal shift in luxury brand engagement strategies. Departing from the traditional sales-centric model, Zara’s focus on brand positioning through livestreaming not only set a new benchmark. It also revolutionized how luxury brands interact with consumers in the digital realm. By creating a shooting set specially dedicated for livestreaming, Zara crafted immersive experiences that emphasized storytelling, creativity, and brand ethos over direct sales pitches. This approach resonated deeply with Chinese consumers, who increasingly prioritize authenticity and connection with brands. Zara’s success in redefining livestreaming as a tool for brand building rather than just sales underscores the evolving landscape of luxury retail in the digital age, where meaningful engagement holds more value than immediate transactions.

AI in livestreaming: the future of engagement for luxury e-commerce purchases

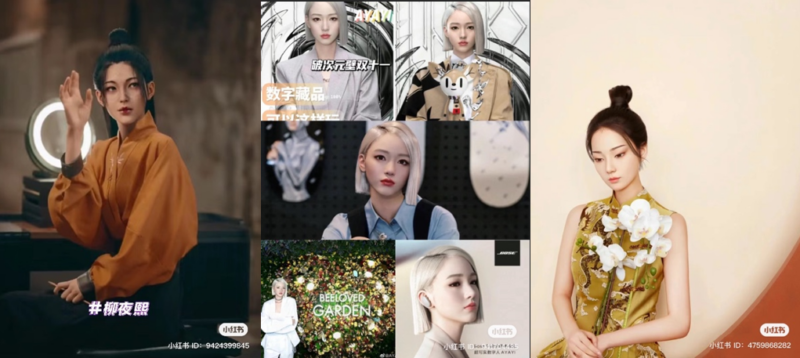

With internet celebrity livestreamers frequently embroiled in scandals and facing backlash from netizens, the introduction of AI-generated live streamers presents a promising solution. These virtual influencers help maintain brand integrity and consistency, avoiding the negative impact on sales that is often caused by human-led controversies. AI-generated virtual humans are revolutionizing how brands engage with tech-savvy digital natives. The market for AI in livestreaming is projected to reach a valuation of $440.3 billion by 2031, according to Allied Market Research. AI is transforming Chinese e-commerce, introducing virtual influencers like Liu Yexi, Ayayi, and Ling, who collaborate with brands like Prada and Tissot. By leveraging AI technology, brands can ensure a reliable and scandal-free representation, fostering consumer trust and potentially boosting long-term sales stability.

Luxury brand success stories in China’s e-commerce landscape

Among luxury labels in China, Dior stands out for its marketing impact. The brand was the biggest spenders on magazine advertising in 2021 and actively engaged with audiences on Weibo and other social media channels. Its effort is evident in being the second most selling luxury brand in China and the most successful luxury brand in Douyin in 2024.

Following this path, Saint Laurent has meticulously recreated its livestream recordings to distribute across social platforms in China, resulting in a 78% growth in followers. Fendi, Gucci, and Loewe have also embraced e-commerce livestream in China, drawing in over 10,000 followers in single sessions.

Prada has effectively leveraged Douyin Content Lab to highlight female power in sports during the 2022 Beijing Winter Olympics. By designing custom SS22 pieces for female athletes and collaborating with Chinese fashion icon Hung Huang, Prada’s campaign video garnered 48 million views and over 100 million online exposures. Searches for “Prada” increased by 56% compared to the previous year. In July, Prada became the official partner of the Chinese women’s national football team, and their subsequent campaign video on Douyin received over 130 million views within 48 hours.

The evolution of livestreaming for China’s luxury e-commerce brands

- Since its introduction in 2016, the market of e-commerce livestreams in China has expanded significantly. It reaches a valuation of 4.9 trillion yuan with a 35.2% year-on-year increase in 2023.

- In the previous year, Kuaishou set a record as one of China’s fastest-growing e-commerce platforms. It surpassed the trillion-GMV milestone, achieving an annual GMV of 1.2 trillion yuan. The platform is expected to become a key player in luxury consumption.

- The livestreaming market is evolving towards a quiet selling approach. Teresa Cheung and Dong Jie’s popularity in hosting such livestreams has highlighted the phenomenon.

- AI-generated virtual humans are emerging as potential replacements for internet celebrity livestreamers, addressing concerns over scandals and backlash.

- Luxury brands such as Dior, Gucci, Loewe, and Prada are actively engaging on social commerce platforms. These brands achieved positive results in both engagement and sales growth.