As lockdowns prolong in cities of China like Shanghai, people appear to be less high-spirited due to problems like food shortages and overpriced supplies, which potentially increase the demand for mental health services in China. The impact of long-period home quarantine could be detrimental to mental health, which could potentially lead to a serious mental health crisis across the nation, making it ever so important to understand the current landscape of China’s mental health service market and how the zero-COVID policy impacts the industry.

Apart from the impacts of prolonged lockdowns due to the pandemic, there are also concerns about worsening mental health in the context of a fast-paced life. The increasing awareness of mental health among Chinese employees could cause backlash on the hustle culture in China, unraveling the “996” culture of working from 9 a.m. to 9 p.m., six days a week. However, as a nation that is still recovering from taboos around the topic, the supply does not meet the demand in the mental health care market in China.

According to the White paper on the mental health of Urban Residents in China, among 1.1 million people in the sample, nearly 75% suffer suboptimal levels of mental health while only 10.3% enjoy a healthy mental status. The paper also indicates that there is a relationship between mental health and physical health. 50.1% of people who have physical health issues also suffer from mental health problems. Specifically, people who are diagnosed with tumors and hypertension are more likely to have anxiety and depression.

A survey by Teenager Newspaper reported that in 2018, more than a third of young adults in the age group of 14-35 were at risk for depression and 10% had severe depression. The rate of young adults with no mental health issues dropped by 5.3% between 2008 and 2018. The risk of mild-to-moderate depression increased by 5% (compare to 2008) and the risk of severe depression was also higher than in 2008. All the evidence points out the fact that more and more people in China are facing mental health problems.

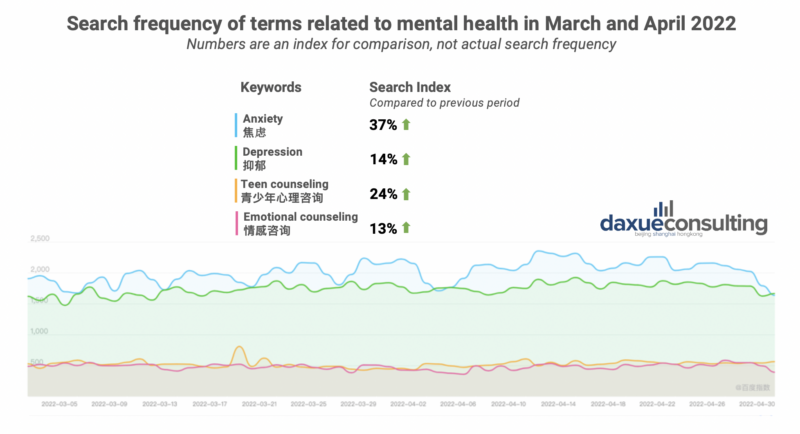

The search frequency of terms related to mental health in March and April 2022, during which China reports surges in covid cases, was also seeing a rise as compared to the previous period last year, especially in “anxiety” and “teen counseling.” In 2019, the Chinese government announced a series of documents (Health China movement 健康中国行动) to urge local schools and institutions to pay more attention to the psychological wellbeing of children and teenagers. However, there is a major shortage of mental health counselors. For every 100,000 people, there are only 2.2 psychologists and psychiatrists in China according to the WHO, compared to 42.4 in the US.

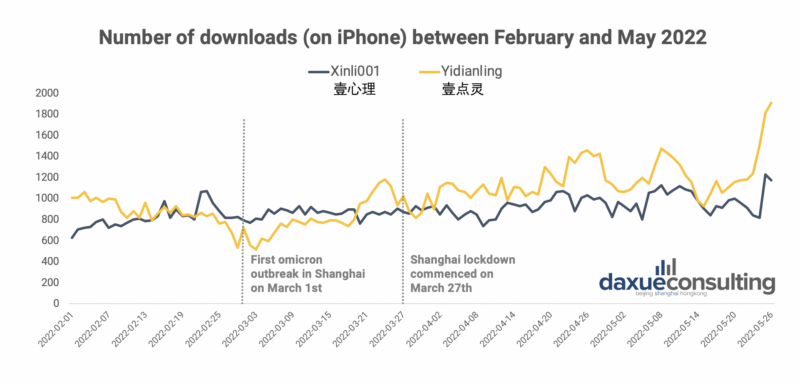

Mental health apps are seeing a surge of downloads amid the zero-COVID lockdowns

According to the Blue Book on the digital mental health industry, about 33.2% of the 14,592 respondents reported having experienced strong psychological shock due to the pandemic. In the meanwhile, rather than offline services, people are increasingly choosing online medical services in the context of COVID-19. The scale of online medical users in China reached 298 million as of December 2021, an increase of 38.7% compared to the same period of last year.

Yidianling (壹点灵), an online psychological service platform founded in 2015, raised 200 million RMB in B+ round financing in December 2021. Yidianling provides both online and offline counseling, instant talk, and online courses and tests, with 25 million registered users and 30,000 professional psychological counselors. Another popular psychological service platform called Xinli001 (壹心理), which provides consultation, assessment, and online courses, has over 22 million users and 500 psychological counselors. Both Yidianling and Xinli001 experienced an increase in users amid the zero-COVID lockdowns since the first omicron outbreak in Shanghai in March 2022.

Apart from Yidianling and Xinli001, Song Guo Qing Su (SGQS 松果倾诉) and Hao Xin Qing (HXQ 好心情) are also trending e-commerce psychotherapy platforms. Both SGQS and HXQ use a C2C business model to deliver their service. SGQS attracts many independent yet less qualified therapists to join the platform. A client can choose either to communicate via text or a call and the therapists will charge accordingly. The price is in a wide range and is usually much cheaper than the professional therapist in the hospital. However, SGQS does not guarantee the quality of the therapists. The same kind of services are proposed on Tao Bao (淘宝) as well.

In contrast, HXQ is relatively more professional in terms of the quality of therapists. According to the HXQ website, the therapists registered with HXQ are all from public hospital psychiatry, neurology, and psychology departments doctors. Almost 40 thousand psychiatrists, accounting for 90% of the psychiatrists nationwide, are registered with HXQ. HXQ uses cloud and big data technology that share the sources with the supply chain of medical and health products. Hence, HXQ is not only a provider of psychological consulting services but also a health supplement retailer.

Supply in the mental health care market in China

In a China Paradigms interview, Zhang Ying Fei, a psychological therapist in China, points out that the Chinese mental health market is underdeveloped. Although many people want to become a therapist and some of them do obtain a certificate, low future income and high upfront investment are obstacles. In order to get the certificate, aspiring therapists need to invest time and money in training, which normally lasts six months to one year.

Independent therapists face unstable income and high investment in training

The supply of therapists in China is short partly due to the sacrifices that therapists must make. According to Zhang, “Even if someone has the certificate, they are not going to be a therapist. Who can really be a therapist; according to what I observed are those that are really determined and so they have to sacrifice many things; their time, their current job.”

See our China Paradigms episode with Zhang Ying Fei

Zhang says the length of the training is not enough to train people professionally. Therefore, an extra investment of time and money is needed for more professionalism. This normally takes a few years and the student needs to be financially independent to do so. Low income is another obstacle, being an independent therapist in China does not guarantee a high income. It is quite the contrary, most people take this profession as a part-time job because of the low income and unstable consumer leads. The pay is around 200 to 300 RMB per hour which is a relatively low return on the prior investment. Additionally, time is needed to manage the clients. To summarize, there are four obstacles to becoming an independent therapist: high investment in time and money for training; low future income; unstable consumer leads, and difficulty in self-managing clients.

COVID-19 is accelerating the digitalization of the mental health service industry in China

Due to the relatively conservative Chinese society which possesses a stigma against mental disorders, in combination with expensive consulting fees, Chinese people with mental sub-health are often not willing to seek professional help. According to the 2019 white paper on Mental and Psychological, 92% of Chinese who suffer from mental health problems never receive any treatment. People with problems such as depression and anxiety are often ignored, some of whom even refuse to admit to having mental problems. However, providing an online platform protects the patient’s confidentiality, increasing the likelihood of seeking consultation and treatment for potential patients.

The white paper also indicates that indirect mental treatment via online platforms costs an average of 350 RMB while the direct treatment via offline hospital costs 1,032 RMB, meaning a 50% reduction in cost via online platforms which reduces the cost for both sides. To better cater to the needs of the patients, online mental health service providers like HXQ have been building up an offline network of psychological consultancy clinics since 2019 to incorporate online and offline services.

Growing challenges for future market entrants

First, the therapist’s certificate in China is easy to obtain. This reduces the quality of the therapists and increases the complaints from the consumers. This lack of regulatory policies in the mental health market makes it difficult for people with complaints to report. Secondly, there is no standard fee in the industry. Companies charge differently, raising concerns about the quality of the service as well as a barrier to client trust. Therefore, regulations are necessary for the future to guarantee the growth of the mental health market in China.

Opportunities outside mental therapy: Rise in the mindfulness economy

The rise in downloads and usage of counseling and meditation apps indicate the potential growth in the “mindfulness economy”. This includes services and mobile apps for meditation, apparel brands, and mobile apps for yoga, and any platforms providing mindfulness information. In 2021, only 1% of Chinese regarded meditation as a daily habit compared to 14% of Americans, implying that the mindfulness market in China is far from saturated.