If you are looking for a brand that best represents the craze of C-beauty consumption in 2020, Perfect Diary has no rivals. Founded in 2017, the Chinese makeup brand Perfect Diary gained widespread support on social media, with its unique brand positioning “high-end quality at a lower price point”. Its products mainly range from lipsticks, eyeshadow palettes, foundation, and brushes and so on. During the Alibaba’s Double-11 shopping holiday in 2019, the brand managed to generate 15.4 million USD in sales within 13 minutes. Now, the C-beauty brand has turned its attention to outside China, the potential for Perfect Diary in the western market is wide open.

Because of such quick success, Yatsen (逸仙电商), Perfect Diary’s parent company, became one of the most successful companies in the beauty industry in China. On November 19th, 2020, shares of Yatsen Holding debuted on the NYSE and increased almost 75% from an opening price of $10.50 to the closing price of $18.40 on the first day of listing, according to Yahoo Finance. While its products stand out because of their unique design, Perfect Diary’s success is largely attributed to its edgy market strategies. This article discusses how Perfect Diary markets itself in China and potential strategies of Perfect Diary in the Western market.

Can Perfect Diary’s China market strategy convert to the west?

Perfect Diary’s China market strategy is famous for being a pioneer of private traffic, which is equivalent to a “VIP customer emailing list” or a personalized coupon code in western countries. Since most Chinese customers don’t use emails to check brand promotions, Perfect Diary has created a fictional avatar “Xiao Wanzi” on WeChat that connects with customers and operates WeChat groups to cultivate a loyal customer base. Some of the C-beauty brand’s other China market strategies include:

- Working with KOCs or micro-influencers on platforms like Xiaohongshu (小红书). For example, when Perfect Diary launched Daydream, a new product launched for Chinese Valentine’s Day, they collaborated with over 150 KOCs. The majority of these KOCs have less than 10,000 followers..

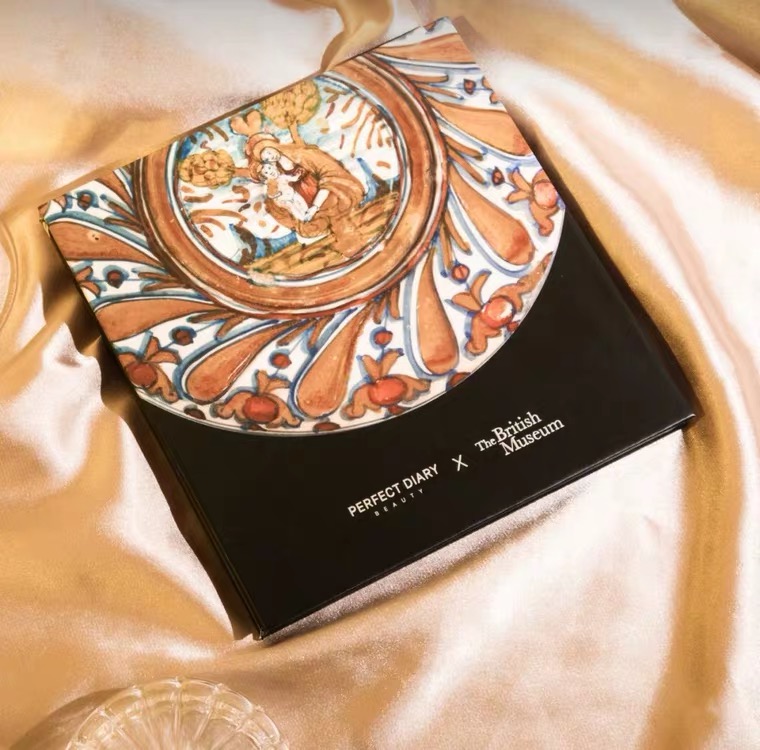

- Culture-focused co-branding, such as the 2018 collaboration with the British Museum for an eyeshadow palette released exclusively for the Double-11 shopping extravaganza. Working with large intellectual property (IP) not only wins traffic, but it also allows Perfect Diary to stand out by bringing out products that are in line with sophistication, novelty and diversity, which Gen-Z care about most. In 2020, Perfect Diary worked with the Chinese Discovery Channel to design its animal-themed eye shadow, featuring different animals including panda that the Chinese regard as the “national treasure”.

Click to download our report on Perfect Diary’s China market strategy

We know these marketing strategies work spectacularly well in China, the question is, how can Perfect Diary adapt their strategy for the west?

Source: Perfect Diary x British Museum eyeshadow palette released in 2018, Tmall

Perfect Diary’s Western market entry strategy

Influencer marketing: Working with beauty influencers on YouTube

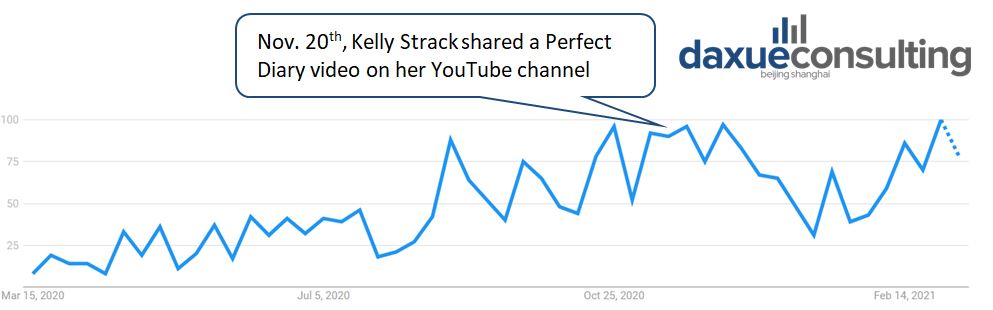

In an attempt to break into the highly competitive western beauty market, Perfect Diary started to work with beauty Youtubers. On November 20th, 2020, just a day after Yatsen Holdings (Perfect Diary’s parent company) went public on NYSE, Kelly Strack, a famous beauty guru with over 886K subscribers posted a video named “Testing New Makeup Brand Perfect Diary” in collaboration with Perfect Diary.

This is one of the first American Youtubers that Perfect Diary worked with, and the outcome is encouraging: this review video attracted over 50K views and over 300 comments. The majority of the comments about the brand are something along the lines “I have never heard of this brand, thanks for sharing”. According to Google Trends, web searches have been climbing, and reached a new high around the time of the video. Due to the timing of being published only a week before Black Friday, Perfect Diary was able to gain a wider consumer base and a possible sales boost.

Data source: Google trends, Perfect Diary global web search interest index, 2021

Celebrity endorsements: Appointing Troye Sivan as the face of its eye shadow collection and collaboration with the Flaunt Magazine

In October 2020, Perfect Diary appointed Troye Sivan as its latest brand ambassador for the animal eye shadow collection. Although this campaign was officially promoted in China, the campaign videos featuring the eminent music artist was uploaded all over online platforms in western countries such as Twitter, YouTube and Instagram. The population base is much smaller in Western countries, but the market for beauty products is relatively more saturated than in China. Having products promoted indirectly on Western social media platforms is an effective channel to westward expansion without setting up bricks-and-mortar stores early on in the expansion process.

Moreover, in an interview with Emilia Clarke, Flaunt Magazine used Perfect Diary makeup products. As the interview page or the video description page does not indicate that this is a collaboration between Flaunt Magazine and Perfect Diary, this is one of many first big moves/success for Perfect Diary. Although Perfect Diary is a fledgling makeup brand in the Western market with a limited market share, mainstream Western magazines have begun to use their products on large-scale shooting scenes. Undoubtedly, this is a kind of special recognition for the early stage of Perfect Diary’s western market entry process, which will also lay the foundation for the subsequent market development.

Source: Flaunt Magazine, Instagram, 2019, Perfect Diary being noticed by foreign models is a big step for the C-beauty brand’s global market strategy

Acquiring western brands: Perfect Diary’s parent company Yatsen Holdings acquired EVE LOM

On March 2nd 2021, Yatsen Holdings announced the purchase of the prestigious British make-up brand EVE LOM from Manzanita Capital, who will still retain a minority stake in the business, according to Yahoo Life. As more western brands are interested in expanding to the Chinese market, not that many Chinese brands have started to break into the western world, let alone acquiring an established, high-end brand originated in the UK.

Behind the success of Perfect Diary in the Chinese market

Unlike mature beauty brands in the west, Chinese makeup brands lack longstanding history and a product formula that’s been tested over and over. Although EVE LOM was originally a niche skincare brand, after 20 years of history, it has successfully penetrated the North American, European and Asian markets. The benefits of the acquisition of EVE LOM is more than EVE LOM’s existing consumer base and brand influence: it represents the opportunity for Perfect Diary to learn from EVE LOM’s international market entry experience, access to unique formulas and manufacturing plants. Such an opportunity will not only improve the quality of the Perfect Diary product itself but also make its production more in line with the preference of Western consumers.

What are Perfect Diary’s chances of success in the west? A SWOT analyis

| Strength |

| Perfect Diary is well-versed in social media or general online marketing. While a large proportion of Chinese brands fail to break into the Western market because of their lack of experience in effective communication with Western customers, Perfect Diary is confident to make a positive, lasting impression through its efficient social media strategy Perfect Diary has already gained some popularity because it collaborated with big IPs such as the MET and the British Museum |

| Weakness |

| “Cruelty-Free” commitment is prevalent in Western countries. However, after checking Perfect Diary’s website and connecting with customer service on the Tmall shop, it seems that Perfect Diary refuses to take a stand regarding whether they have used animal testing for their products. As one of the first Chinese makeup brands trying to break into the Western market, Perfect Diary does not have many precedented Western market entry case examples to consult |

| Opportunity |

| As one of the several Asian beauty brands in the western market, Perfect Diary can differentiate itself by designing and targeting its products towards Asian skins and features. Perfect Diary can leverage collaborations on different channels a bit more. “Referrals” only account for 4.34% of the total traffic source of the Perfect Diary’s Website. |

| Threat |

| Cultural gap: Political and cultural considerations make Chinese brands often misunderstood (i.e. the “cheap and nasty” connotation). With Perfect Diary’s brand positioning of “an affordable makeup”, it is questionable if it won’t suffer from such accusations. The western beauty market is already relatively saturated, the stiff competition may make it extra difficult to own a big market share. |

How Perfect Diary international gets web traffic

Source: Perfect Diary Traffic Sources in the west, SimilarWeb, designed by daxue Consulting, 2020

A high proportion of Perfect Diary’s web traffic is organic – with display ads only making a fraction of a percent, and web search and direct traffic making the majority. In most cases, up to 60% of “direct traffic” is actually web searches or other organic sources. A high amount of organic traffic for Perfect Diary’s foreign facing website means high brand awareness and good SEO practices.

According to SimilarWeb, 10.9% of total website traffic to Perfect Diary Website is in the United States, and only 4.3% of the total traffic sources account for referrals. Compared to established beauty brands who are experts in leveraging traffic on YouTube or other social media, Perfect Diary still has some room to improve. This tactic will not only improve product awareness among western shoppers but also implement that “KOC reviews” style of marketing tactic which has already succeeded on Xiaohongshu (小红书). This strategy would work well early on in the expansion process because customers of Perfect Diary in the western market would heavily rely on each other’s opinions before making a purchase, as they are not familiar with the products and the products are not widely accessible as other established brands.

A promising future ahead of Perfect Diary‘s westward expansion

All in all, the future of Perfect Diary in the western market looks promising. YouTube collaborations help Perfect Diary gain a customer base who follows trends and are interested in new, unique C-Beauty brands. Working with big celebrities like Troye Sivan allows Perfect Diary to have a first taste of the influence of this campaign overseas while also leveraging on Troye’s popularity in China to build a solid base of Chinese consumers. Moreover, the newest acquisition of EVE LOM allows Perfect Diary to build a more diverse consumer base and an international network with western brands through the connection of EVE LOM. Though Perfect Diary is still in the preliminary stage of its westward expansion, the success of Florasis abroad sets a great example to follow.

If you are interested in learning how Daxue Consulting can help your company with international market entry strategies, please feel free to reach out to us at dx@daxueconsulting.com.

Author: Jenny Wu

Listen to Daxue Talks to receive China business and market insights

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

See the full report on market strategies of rising C-beauty brands

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast