Chinese city dwellers have embarked on a residential buying spree, snapping up flats and other properties and inflating an enormous bubble in the process. Prices have soared in recent decades due to rampant demand for the coveted residences, a market already hampered by a widespread housing scarcity. According to the National Bureau of Statistics, in Shanghai, the average residential housing price was RMB 3102/㎡ (square meter, 1㎡ equals 11 square foot) in 1999. In 2016, the price was 47,625/㎡. Supposing a person bought a 90 ㎡ flat in 1999, now he will earn RMB 4 million by selling his home, 15 times more than two decades earlier.

In 2016, the housing market once again made news when prices in many cities increased dramatically due to the government’s propagation of measures to balance the oversized housing inventory. The government’s policies had an instant effect on the housing market. In October 2016, once the mania had been subsided, authorities in many cities unveiled comprehensive regulations to cool the market. But the measures only seem to have limited the volume of transactions; prices still veer upward.

When the rising cost of the downtown real estate has forced many of China’s urban middle class to consider a move to the suburbs, experts and civilians alike question whether the bubble will continue to balloon and whether or not staunching unhinged price increases is feasible in today’s market.

Supposing a person bought a 90 ㎡ flat in 1999, now he will earn RMB 4 million by selling his home, 15 times more than two decades earlier.

Real estate in China: One more housing bubble

Country leadership’s pledge ‘to reduce the housing inventory by all means’ triggered sales mania last year.

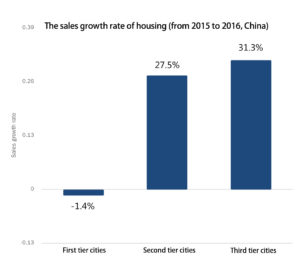

Chinese buyers are scrambling to claim coveted urban real estate in droves, leading to a major paucity of homes to quench the unprecedented demand. Just last year, the housing inventory—the number of homes on the market—in many first and second tier cities shrank by 40%, according to JLL Research. Among first-tier cities, the number of sales made on housing decreased by 1.4% because of the fall in Q4, 2016. But in second and third-tier cities, where the market is less saturated, growth rates reached 27.5% and 31.3%, respectively. Despite dropping in Q4, the total sales volume in 2016 marked an increase of 25% from 2015.

The sales growth rate of housing: decreased in first-tier cities, increase in second and third-tier cities. Source: JLL Research. Reproduced by Daxue Consulting.

Boiling sales led to soaring prices in upper-tier cities.

In 2016, the housing prices in Suzhou (苏州) rose by 104%; in Nanjing (南京) and Shanghai (上海), prices climbed 97% and 74%, respectively, according to JLL Research. Meanwhile, real wages increases for Chinese workers are expected to dip 2.4% from last year’s increase of 6.3% to 4% in 2017, according to a study conducted by the Hay Group. Worth noting though, is the increase in disposable income of 7% year over year, according to an official report published by the National Bureau of Statistics of China. Despite this, clearly, the current price trend is not sustainable in the long run; it does not appear that housing prices’ skyward run will abate anytime soon.

Despite a spike in sales, real estate prices remain out of reach for most in major cities.

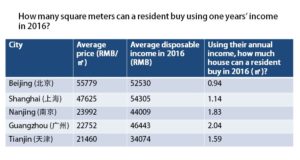

Housing in China’s upper tier cities is just too expensive for the average household. Comparing the price of housing and average annual income in various cities reveals the striking disparity. In 2016, if a homebuyer in Beijing were to spend an entire year’s worth of wages, she could afford only 0.94 ㎡, or less than 6,750 ft2 of a house. Residents in Guangzhou would fare slightly better, hypothetically exchanging their yearly income for 2.04 ㎡ (just over 14,600 ft2). By comparison, in 2016, the average homebuyer in Manhattan, New York (another city where housing is increasingly too expensive for the middle class) would be able to buy less than 30 ft2 or less than 1 m2 with a year’s income.

Considering that, before the reforms of 1978, “the [Chinese] state [was] solely responsible for housing provision,” and set “extremely low rental standards,” whereby in the 1950s, “rent accounted for about 1% of an average worker’s annual income,” the state of today’s housing market marks a dramatic upheaval of historical norms. (Yang, Zan, and Jie Chen. “Housing Reform and the Housing Market in Urban China.” Springer Briefs in Economics (2014): 15-43. Springer. Web. 3 May 2017.)

In 2016, if a homebuyer in Beijing were to spend an entire year’s worth of wages, she could afford only 0.94 ㎡, or less than 6,750 ft2 of a house.

Since most people cannot afford to buy a flat, they borrow more money from banks. In Q1-Q3, 2016, among all the new loans in RMB, 36% of them were individual housing mortgage loans. (from CBRE)

How has the bubble grown? And how is the government dealing with it?

In 2016, the Chinese government tightened lax policies, triggering an infection point of sales.

Last year, when central policies on housing were relatively lax, the lowest down payment ratio (首套房首付比例) decreased from 30% in 2015 to 20% in February 2016. Cheaper down payments encouraged more homebuyers to borrow money from banks. But the borrowing spree cooled last October when the government rolled out stricter policies in 20 cities. Affected by the tightened measures, the sales volume for housing in many major cities decreased by 6%, quarter by quarter. This shows how drastically top-down policies influenced the volume of transactions in the market; prices, however, only saw a marginal decrease.

Last year, Shanghai witnessed a 74% growth in prices, the greatest increase of any first-tier city.

Loose lending regulations led the rise in prices in early 2016. Real estate sales in Shanghai in February and March 2016 broke records unbeaten for 7 and 10 years, respectively.

On March 25th, the government introduced its strictest policy, called Hujiutiao (沪九条), or “the nine policies of Shanghai,” to cool the Shanghai housing market. One of the policies raised the down payment ratio for families who had already taken out a mortgage from 30% to 50% (residential) and 70% (non-residential). Once Hujiutiao was implemented, housing sales dipped sharply by 55.6% month on month.

Housing prices in Shenzhen increased by an incredible 40% from 2014 to 2015.

Shenzhen (深圳) housing is the priciest in China.

Data from Colliers shows that housing prices in Shenzhen increased by an incredible 40% from 2014 to 2015. Prices grew at the same rate in 2016, as well. Indeed, residential real estate prices seem to be going nowhere but up in Shenzhen.

To enforce a price ceiling for housing, in October 2016, Shenzhen, like Shanghai, also unveiled a package of strict policies, dubbed shenbatiao (深八条) or “the eight policies of Shenzhen,” the tightest rules ever directed toward housing in the city’s history. Also, this April, Shenzhen began to clamp down on lending from commercial banks, to show its aim of controlling housing prices. Some banks in Shenzhen have lowered their discounts on down payments from 10% to 5% for individuals buying their first flats.

According to People’s Daily Online (人民网), due to the new policies, in Q1 2017, though the area of real estate sold in Shenzhen declined 63.83% since last year, prices only dropped by 0.75%. The policies did cool down transactions in the market but did not affect prices much.

The price in Shenzhen from 2012 to 2016: from 19,000 yuan/㎡ to 53,000 yuan/㎡ (179 % increase) Source: fang.com (房天下, a leading online housing agency). Reproduced by Daxue Consulting.

Prices in Suzhou (苏州) rose 104% in 2016, the highest among first and second tier cities.

Prices in Suzhou were able to rise so much partly because they had plenty of room to grow; they started lower than those of any first-tier city.

To limit prices, in Suzhou (苏州) and Nanjing (南京), authorities increased down payment ratios for consumers buying a second flat with an outstanding mortgage on another home by 50%, from 30% to 80%. (JLL Research)

According to E-house China R&D Centre (易居研究院), a housing market research institution in Shanghai, the sales volume dropped significantly after the strict policies went into effect in Suzhou. By Q1, 2017, the sales volume fell by 70%, falling farther than all second tier cities.

Future scenarios: the impact of shifting policies on investors. How are investors reacting to the bubble?

The aim in 2017 is to balance the Chinese real estate market.

It is estimated that the sales volume in 2017 in first and second tier cities will plummet, while prices are set to remain stable. There will be some downward pressure on the prices in third and fourth tier cities, where demand for improved living standards outweighs that for flats.

Investors are likely to react in two ways to the bubble.

Investors may choose to liquidate their flats for cash they will then invest overseas. This points to the trend of investors snapping up urban real estate as a way to stash wealth, inconveniencing middle-class prospective homebuyers in the process. Unlike in China, investors may own real estate permanently abroad, and may even own the land itself.

Conversely, investors could capitalize on profits made by the breakneck rise in housing prices, which could happen only in China, and not divest.

Last year, China’s richest man, entrepreneur Wang Jianlin (王健林) said: “Although the bubble in China is huge, the real estate industry won’t collapse.”

The future will depend on government policies.

Two scenarios—one good and one bad—could unfold as a result of the current trends in the Chinese housing market. If the government controls spending (investments and purchases) in Shanghai and implements the same policies nationwide, investors will be pessimistic in the short run. Ideally, though, investors will still buy in the short term, and in the long term, consumers will invest in real estate outside of China (a two-year-old phenomenon sparked by investors’ distrust of the government). Although the restrictions will cool the market, the government will ensure that the bubble is kept at a certain size and does not burst. Last year, China’s richest man, entrepreneur Wang Jianlin (王健林) said: “Although the bubble in China is huge, the real estate industry won’t collapse.”

But that is just one possibility. If the bubble does burst, property values could nosedive as much as 80%, causing the market to collapse. Investors will pull their money out of the crippled market and invest abroad, further damaging the Chinese economy.

Shanghai authorities aim to optimize the housing structure to meet consumers’ demand for small flats.

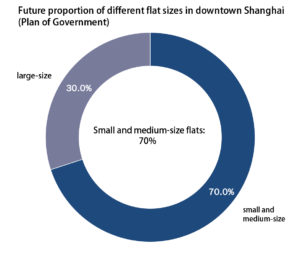

The Shanghai municipal government recently announced its plan to increase the proportion of medium and small-size flats (with an area no greater than 90㎡) within the market. The project stipulates that medium and small-size flats shall account for no less than 70% of all flats on the market in downtown Shanghai. This policy encourages consumers to buy small flats, which are cheaper and will boost demand for large properties.

The Shanghai government’s plan: 70% of the flats in downtown Shanghai will be small and medium-sized flats. Source: People’s Daily Online (人民网). Reproduced by Daxue Consulting.

Conclusion

The government will retain residential investment in China by striking a fine balance between regulatory support and communication with the public. Policymakers in Beijing do this for the benefit of investors. The short-term outlook is bright, but ultimately investors will wise up to the new policies. The bubble cannot last forever, and it will never burst like this again.

Infographics produced by Daxue Consulting, All Rights Reserved.

If you’d like to follow our weekly updates on the China market, visit www.daxueconsulting.com, and connect with us on LinkedIn, Facebook, and Twitter.

See also China marketing agency