Every company which ever tried knows it: sending international payments to China is costly and time-consuming. To solve the problem, Remitsy uses the blockchain technology and conversions in Bitcoin, with fees as low as 1% and speeds as quick as six hours. A revolution.

Every company which ever tried knows it: sending international payments to China is costly and time-consuming. To solve the problem, Remitsy uses the blockchain technology and conversions in Bitcoin, with fees as low as 1% and speeds as quick as six hours. A revolution.

When working in risk and compliance management in the financial sector, Richard Bensberg came across Bitcoin. Since then, he kept trying to understand this virtual currency and the blockchain technology supporting it. After working for OKCoin, the largest Bitcoin company in China, he decided to use this technology to solve real business problems: international payments to China. He founded Remitsy in April 2015.

Remitsy is using the blockchain technology to make faster and cheaper payments to China. How does it work?

Richard Bensberg: What we do is take advantage of blockchain technology’s ability to digitize value across a decentralized network, and thus making it accessible almost instantaneously anywhere around the world. In other words, this allows us to convert any amount of money across multiple currencies via a record on the blockchain – making it available to us in China within seconds. Then we just have to convert this digitized asset into Chinese Renminbi, which we do at the real exchange rate (the mid-market rate used across the financial sector). This is what makes the payment process as fast as six hours.

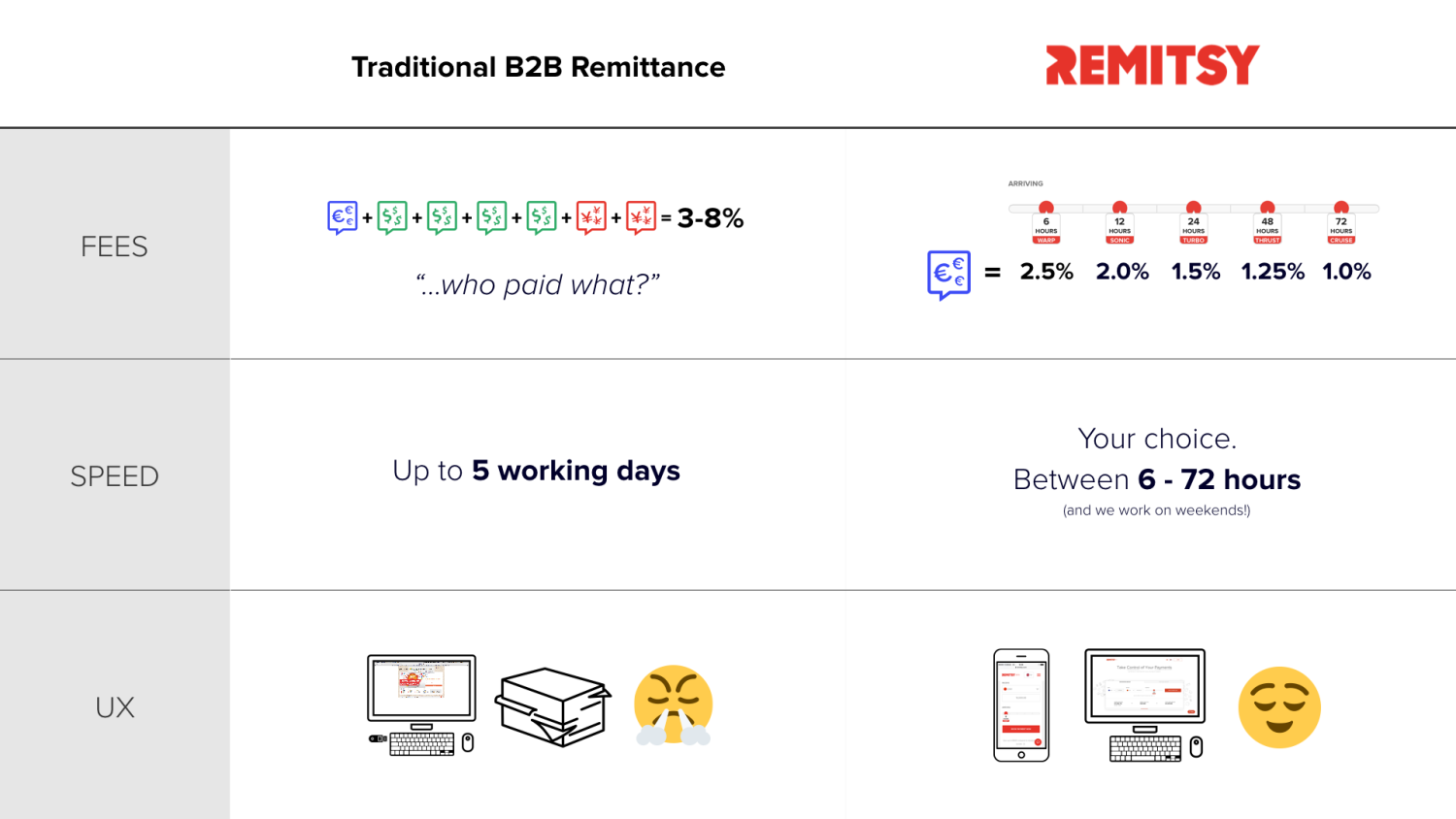

Doing so, we don’t have to pass on currency exchange spreads to our customers, and we can provide a quick service at low cost. Our standard 1% fee is for a transaction completed in 72 hours, and we can make payment as quickly as six hours for a 2.5% fee. And by using the mid-market rate our customers know they’re getting the best deal available, whilst our technology keeps the value of a stable conversion.

So it is a real improvement compared to bank services…

Yes. The SWIFT messaging system used by banks nowadays to record international payments was developed back in the 1970s! Essentially, a message is sent from the payment bank to the receiving bank in China, and each side records the transaction accordingly, using correspondent banks where necessary to ensure that each party’s balances can be reconciled. But each step of this process incurs, and there is a risk of temporarily losing the payment in the system as well as a lack of transparency as to where the funds are throughout the lifecycle of the transaction. It takes, even more, time and money where multiple currencies are involved. A European company making payment to China may need to convert Euros to USD before being sent to China and finally converted into Renminbi.

When we started Remitsy, our aim was to disrupt the traditional banking sector. But we quickly realized that a lot of international business uses PayPal and other such payment channels, even though with processing fees, exchange rate spread, and withdrawal fees the overall transaction cost can be as high as 9% of the total invoice value! There is a big inefficiency in the way international payments are handled today, and we want to solve it.

But why don’t you propose this service to individuals rather than businesses only?

China is taking steps to liberalize use of the Renminbi. However, they have focused on the country’s current account, which has been open since 2009. There are still strict controls on capital. In order to work within the existing restrictions, all our transactions are current account transactions as payment for goods and services. This is an area where there is a clear benefit to all parties in more efficient trade, which is something the government supports. We are working with foreign-based companies buying Chinese goods (anything from samples, professional/marketing fees, or whole shipments for instance) or paying subcontractor invoices in China (and with the “sharing economy” the need to make smaller payments to independent subcontractors in China is growing daily).

Furthermore, one needs to be cautious when creating an innovative product. We spend a lot of time and effort on our Risk & Compliance functions: by focusing our service on enterprises sending payments to China (and not out of China), no money is leaving China. Our ability to combat the risk of money-laundering is significantly enhanced.

The Chinese government has been cracking down on the Fintech sector recently. How does it perceive your activity?

Since Remitsy is simply facilitating a currency conversion in a transparent way and not pooling or holding client money, I think it is outside of the current focus. New regulations in the sector are targeting lack of transparency and consumer protection, and for now have mainly affected P2P lending.

In fact, there is a strong need for solutions facilitating international payments to China which can only help boost trade. With the governmental push for an increased use of the Renminbi as an international currency, the Yuan is more tradeable today, and Fintech solutions will no doubt be part of enabling companies across the world to engage in new ways. The blockchain is one of the technologies with huge potential for social good.

But you are not the only one to have perceived its potential…

Of course, the possibility of sending fast international payments with small fees has attracted the attention of banks too. Everywhere commercial and central banks have teams focused on examining the blockchain capabilities. In China, the People’s Bank of China is working on a virtual currency and the bank card organization Union Pay is also interested. But banks cannot change their whole business model overnight.

How do you see the future of the blockchain and the Bitcoin?

There are a number of different blockchains competing for prominence and disagreements as to the role of this technology. In the case of bitcoin (the most well-established blockchain), should it be used as a store value? Or as a payment method? What is the optimum number of transactions per second, and what is the appropriate trade of between network security and transaction fees? A lot of the answers to these questions will depend on how consensus is built and what new features are built into this up-and-coming open-source software. But regardless of how each blockchain evolves and the expansion of other virtual currencies, by developing on the blockchain, companies are able to deliver services today to meet real-world demand.

Article written by Juliette Boulay, Consultant at Daxue Consulting

To get more insights about China’s market, follow us on our Social Media or contact us at dx@daxueconsulting.com

See also:

- Mobile banking in China

- SJ Grand: Tax and accountancy expert in China