The Chinese art market: young collectors fuel contemporary art surge

The global art market is a multi-billion-dollar industry, playing a significant role in cultural exchange and economic development. While its artistic roots stretch back centuries, China’s art market has boomed in recent decades, becoming a major player on the global art scene. In recent years, the Chinese art market has witnessed a meteoric rise, solidifying […]

Community group buying in China: from rural to the mainstream

In recent years group buying in China has gradually changed the consumer behavior of many Chinese people. Group buying refers to a way of buying in which consumers unite to increase their bargaining power. Making the sacrifice of small profits for more frequent turnover, merchants can offer discounts for group purchases below retail prices. As […]

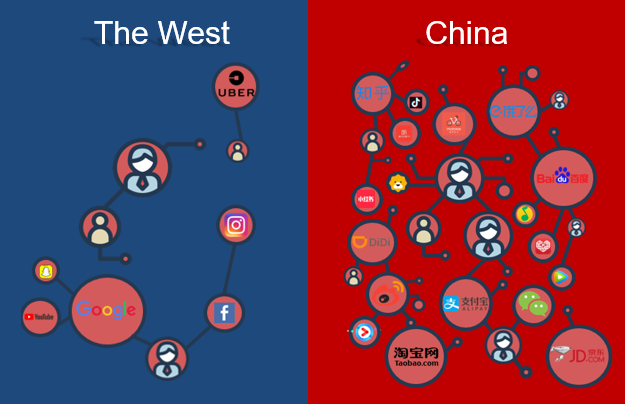

Comparison of market research in China vs the West: what you may not know about market research in China

The common Framework of Market research Market research is important in helping organizations to make informed business decision by collecting insights and using data. Through market research, a company could identify the potential growth possibilities and risk factors by learning about the consumer market, the local cultural and the unique challenges of the industry. Market […]

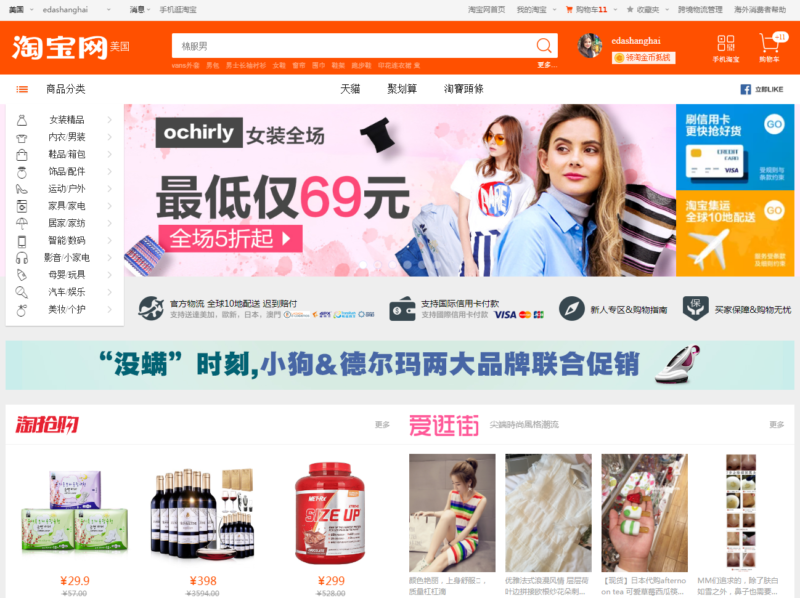

The success of Taobao on the Chinese Internet

How have Taobao on the Chinese internet evolved compared with its Western counterparts? In many ways, the Great Firewall has allowed China to develop unique applications, and not equivalent versions, of the biggest online platforms the West enjoys. Just as Baidu (百度) is not China’s Google, nor is Tencent (腾讯) China’s Facebook, their similarities are […]

China Report: A quick overview of the Country

China Report GENERAL INFORMATION GDP: USD 10360bn Population: 1,364 billion Languages: Mandarin, (Putonghua), Yue (Cantonese), Wu (Shanghainese), Minnan (Hokkien-Taiwanese), Xiang, Gan, Minbei (Fuzhou), Hakka dialects, other smaller minority languages. Form of state: Communist State Next elections: 2018, presidential and legislative COUNTRY RATING Economic overview China has become the world’s manufacturing Hub since the country opened […]

Sensory analysis in China

It is easy for a market researcher to define if consumers like a product or do not like it. However, it is quite difficult to understand why. This is probably because while most people accept or reject a product based on its sensory characteristics, they fail to distinguish one sensory characteristic from the others or […]

Customer satisfaction survey in China

Customer satisfaction survey in China Why you need Customer research in China China has the largest single potential consumer market in the world and the forecast of its economic growth rate remains strong in the next two decades. Therefore, China is one of the most popular markets for different international companies, and this means the […]

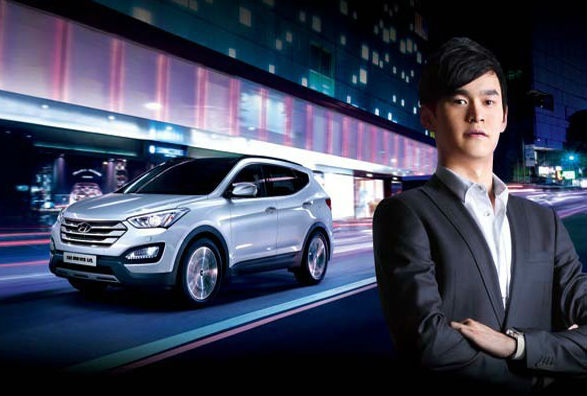

Market Research on Car sales in China

Market Research on Car sales in China [more about market research in China] China` spectacular economic growth over the past 20 years has been reflected in the emergence of the world`s fastest growing consumer market and a vibrant, burgeoning middle class. As incomes in China have risen, so have Chinese consumers` interest in products that […]

Matthieu David about Senior Market in China – Daxue Consulting

Matthieu David Experton, founder and CEO of Daxue Market research China, talks about the Senior Market in China for Thoughtful China. How to reach the China’s silver generation ? Our report on Silver Economy in China: Silver economy in china by Daxue consulting de Daxue Consulting

Market Research China: identify trends in China

Market Research China: identify trends in China [to see more about market research in Shanghai] FMCG Trends in China China’s FMCG sector suffered a bit of a setback at the start of 2014, with a 1.3% drop in growth from 7.4% last year to 6.1% by end of Q1. Consultants suggests that the slowdown is […]

Online Shopping Industry in China

Online retailing in China is going through a period of exceptional boom. Regardless of world economic condition, online retailing in China has experienced an explosive growth. Customers appreciate online price advantages over offline stores and love purchasing online. The number of online buyers reached 310 million by the end of 2013, quadrupled from the figure […]

Market research on cars in China

China` spectacular economic growth over the past 20 years has been reflected in the emergence of the world`s fastest growing consumer market and a dynamic, burgeoning middle class. As incomes in China have risen, so have Chinese consumers` interest in products that were previously out of their reach, for example, cars. In 2013, car sales […]