The 618 2025 sales results showed that the total online sales during the festival period (spanning May 13–June 18) reached RMB 8.6 trillion, a 15.2% increase from the previous year. Platforms named this year as the “史上最长618” (the longest 618 in history), a format designed to sustain consumer interest and enhance the festival with additional holidays such as Chinese Valentine’s Day on May 20th and the Dragon Boat Festival on June 19th. However, the shift from a single-day flash sale to a month-long shopping season blurred the line between 618 and regular e-commerce activity.

Download our full Green Guilt Report on Sustainable Consumption in China

Importantly, 2025’s 618 was the first big sale after China’s call to end the price competition among major platforms, prompting simpler discounts and more rational consumption rather than bargain-hunting. In past years, consumers dreaded complex “满减” thresholds, cross-store coupon stacking, pre-sale deposits, and other tricks. This year, Tmall led with an “官方立减” (official discount), and JD.com likewise advertised “simplified gameplay” that involved more direct subsidies. This simplicity lowered decision-making costs, and as a result, users spent less time strategizing and more time actually buying.

How 618’s GMV growth signals a shift toward content commerce

Tmall retained the largest market share, accounting for roughly half of 618’s GMV, and JD.com was second with roughly 19.3% share, both platforms’ GMV grew 9-10% compared to last year. Douyin, known as TikTok in China (Douyin vs TikTok), surged to No. 3 platform in 618 sales, tying Pinduoduo in transaction volume, driven by the rise of livestream and short-video commerce. Douyin’s 618 GMV grew by an estimated 15.2%, which is the fastest among major platforms.

Pinduoduo, ranked #4, stuck to deep “百亿补贴” discounts on essential goods. Kuaishou, another video-commerce platform, ranked #5 with a smaller share but still double-digit growth around 10.6% compared to last year. Notably, content-driven commerce (Douyin and Kuaishou) contributed over 22% of total 618 GMV, underscoring the rise of alternative e-commerce channels.

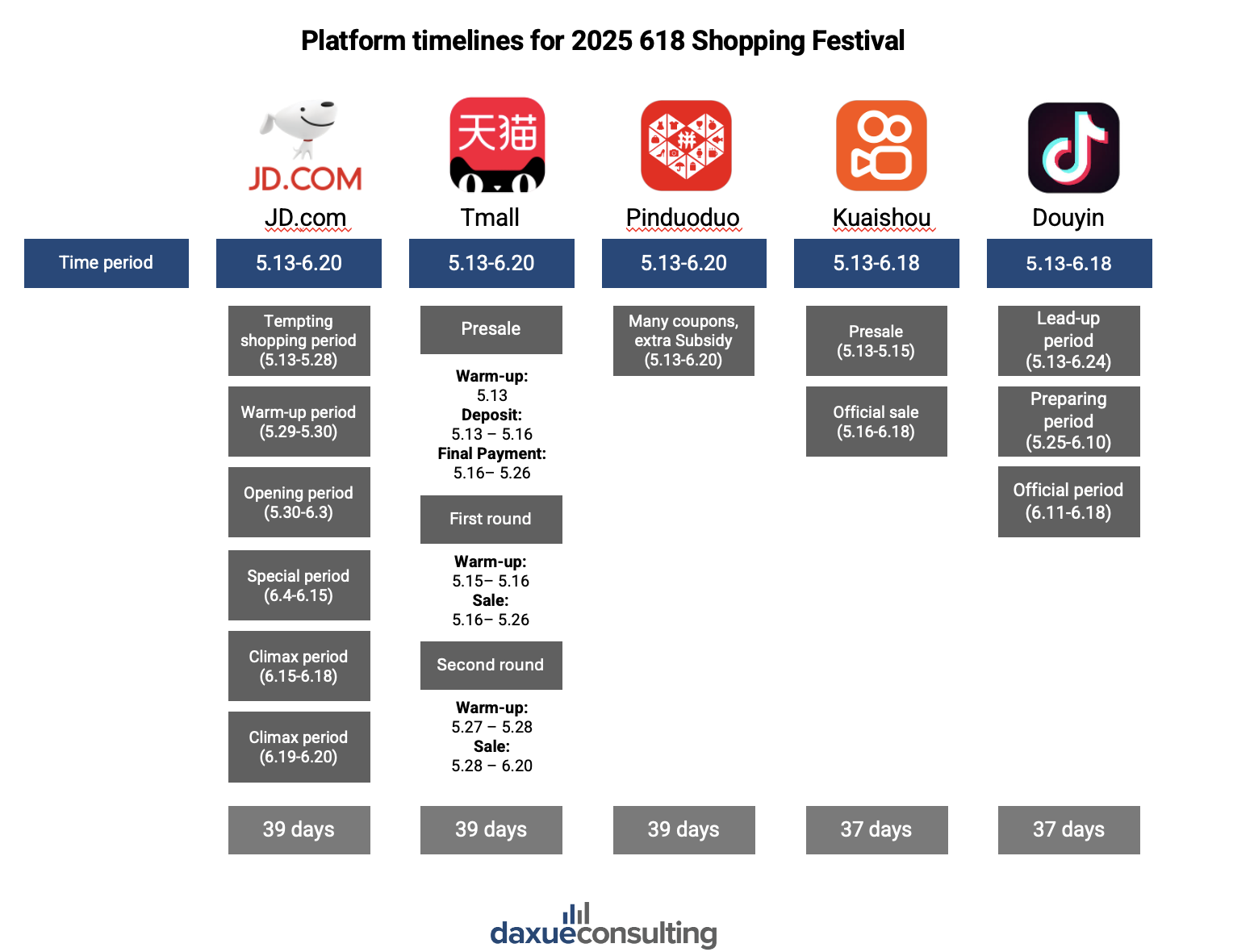

The above chart shows that 2025’s “618” evolved into a six-week-long campaign with major platforms each running 39-day promotions but taking different strategic approaches. JD.com broke the event into six tightly timed waves to sustain consumer excitement and drive repeated traffic spikes. Tmall followed a more structured format with a presale phase and two main sale rounds, aiming to optimize logistics and inventory planning. Pinduoduo, known for its price-sensitive user base, skipped formal phases in favor of continuous coupon drops to maintain a high-urgency and low-price appeal. Meanwhile, Douyin and Kuaishou, platforms that focus on livestreaming, ran shorter 37-day campaigns.

The rise of China’s domestic brands at 618

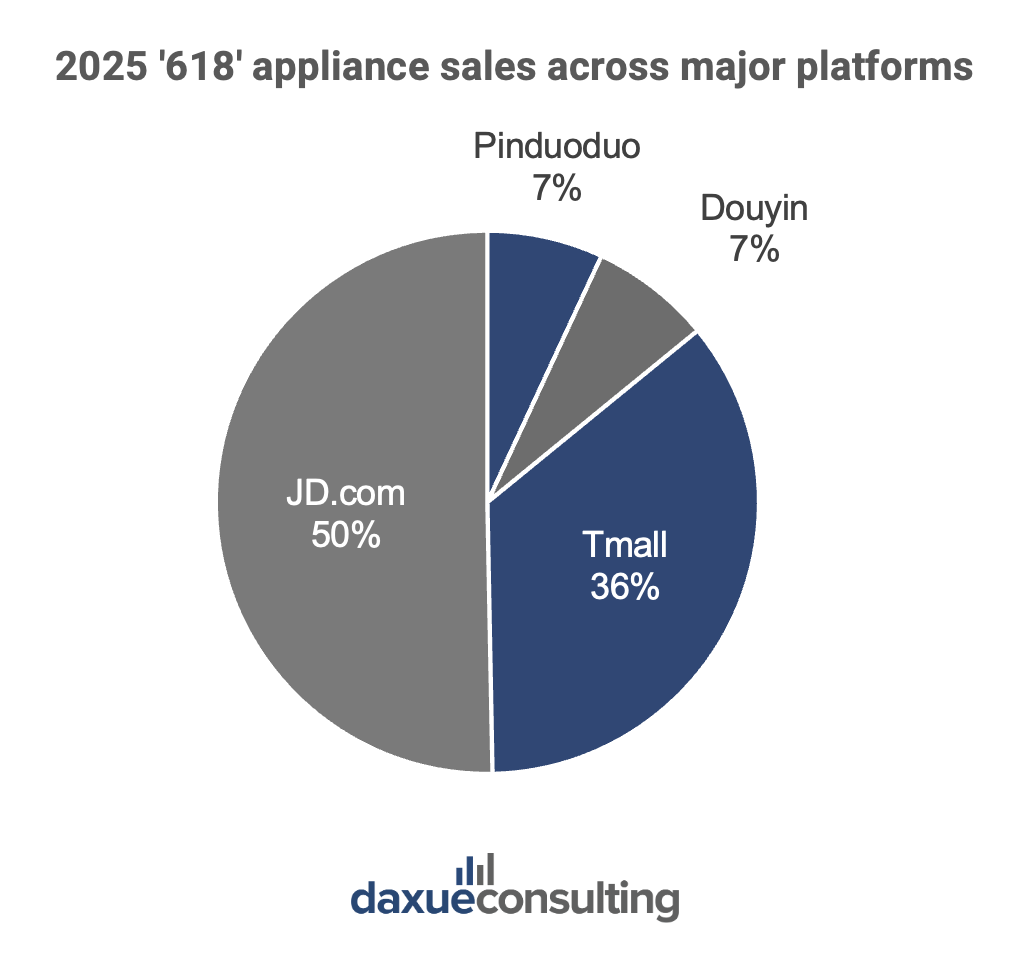

Home appliances were the standout category, with about RMB 1.101 trillion in sales during the event. This was supported by many discounts, government subsidies and “trade-in” options that prompted consumers to upgrade to smart, high-end appliances.

Beauty and skincare ranked next at RMB 432 billion, a 65% increase from the previous year, as Chinese domestic brands such as Proya and Hanshu gained popularity by offering quality at attractive prices. Household cleaning products also saw RMB 233 billion in sales.

Within top categories, there are many leading domestic brands. Appliance brands such as Midea, Haier, and Xiaomi dominated sales rankings on Tmall, JD, and even Douyin. In beauty, local skincare and cosmetics brands outperformed, and consumers showed growing preference for products with natural ingredients and proven efficacy. The emphasis on value and quality helped “国货” (domestic brands) expand market share in 618, a trend noted across appliances, beauty, and other sectors.

How consumers prioritize essentials and value

Unlike the 618 promotions of years past, 2025’s event felt “calmer” for many shoppers. Social media and news coverage of 618 were relatively less, and some consumers weren’t even aware the festival had started until well into the cycle. Analysts attribute this to promotion saturation: with over 100 e-commerce sale events a year in China, discounts are now “month by month, even daily,” making any single festival less of a novelty.

Consumers this year showed a clear preference for practical, high-value purchases. Core keywords were “cost-performance” and “essentials,” with staples and daily goods seeing robust growth. Indeed, some noted that 618’s savings on certain products “weren’t even as good as a few food delivery coupons”, underscoring how deal-savvy and selective buyers have become. Overall, this more rational mindset led to a better consumer experience that fewer felt tricked or exhausted by the process compared to earlier years of complex promotions.

618 taps new demographics in 2025

Interest in 618 grew at the margins of age groups. Young adults (18–30) increased their engagement, with their 618-related online activity share rising 2.5% to 29.5%. Even more notably, senior shoppers (51 and above) showed a 3.3 point jump in interest, reaching 19.5% for 618. This indicates that marketing efforts and subsidy programs successfully drew in more Gen-Z and older consumers in 2025.

In terms of geography, platforms had many buyers from lower-tier cities after giving promotions and subsidies, expanding the user base beyond saturated megacities.

What drove 618’s record growth in 2025

- China’s 2025 618 festival generated RMB 8.556 trillion in GMV, up 15.2% YoY. The campaign stretched over six weeks, the longest in history, and incorporated other holidays to maintain consumer attention.

- Simpler discount structures like Tmall’s “official markdowns” and JD’s “easy gameplay” replaced layered promotions, reducing buyer fatigue and decision-making time.

- Tmall retained its lead with ~50% GMV share, followed by JD.com at ~19.3%. Content-driven platforms (Douyin and Kuaishou) accounted for over 22% of total GMV. Moreover, these platforms took different strategic approaches to their 39-day (or 37-day) campaigns

- Home appliances led all categories with RMB 1.101 trillion in sales, driven by trade-in programs and government subsidies. Beauty and skincare followed at RMB 432 billion (+65% YoY), powered by rising trust in local brands like Proya and Hanshu.

- Domestic brands ranked top across categories, with consumers favoring value, quality, and natural ingredients, helping “国货” (Guohuo) expand their 618 market share.

- 618 felt “calmer” to many shoppers in 2025, with lower social media buzz and a growing sentiment that discounts were less novel. Saturation from year-round promotions led consumers to shop more rationally and selectively, prioritizing everyday essentials and cost-performance.