Overview of the agriculture insurance market in China

Agriculture insurance in China belongs to the non-life insurance market. It is usually purchased by agricultural producers to protect loss of or damage to their crops or livestock, against natural disaster and other uncertainties that would eventually effect the prices of agricultural commodities. China’s agricultural insurance market is currently ranked second largest globally after the United States. However, agriculture insurance in China is difficult to implement in practice as its effectiveness is often constrained by lack of good product design.

The governments, globally, often puts heavy weight on the agriculture industry as it is closely linked to the nation’s economy and people’s livelihood. Therefore, agriculture insurance is often supported and subsidised by the local governments.

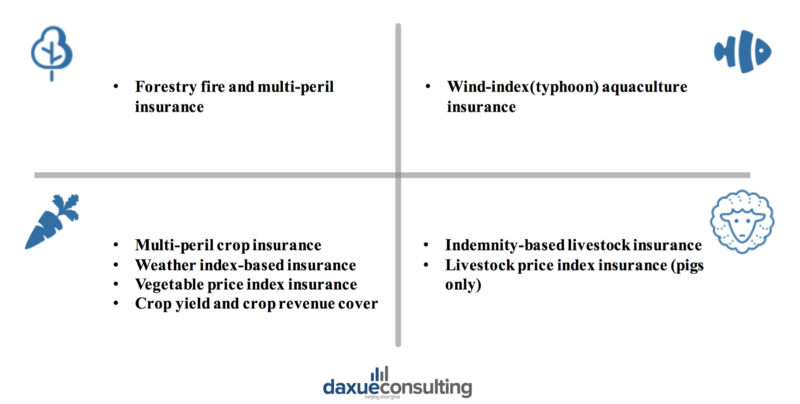

There are three main insurance types within the agriculture insurance market in China:

Plantation Insurance in China (种植业保险)

Plantation insurance in China is for agricultural producers such as farmers and ranchers to protect against the loss of their crops due to natural disasters, or the loss of revenue due to price fall. It includes two broad categories: crop insurance (农作物保险) and forestry insurance (林木保险). Crop insurance in China can be purchased for many different kinds of crops such as rice, tobacco leaf, and cotton etc. Consumers can also purchase insurance according to the growth or harvest period of their crop. Crop insurance in China is the most important product type within the Chinese agriculture insurance market.

Livestock Insurance in China (畜禽养殖保险)

Livestock insurance in China provides provision of mortality cover for livestock due to diseases and accidental injury. The coverage is usually limited to adult animals. The insurance can be taken out on an individual animal or herd basis. China is planning to increase subsidies provided upon livestock insurance in China to further reduce the pressure on the farming industry.

Aquacultural Insurance in China (水产养殖保险)

Aquacultural insurance in China protects fresh water and salt water fish farming enterprises against mortality to fish stocks caused by storm, disease, pollution, contamination, collision, theft, predators and other malicious damage. As at 2018, aquacultural insurance in China only covers approximately 5% of the total fish farming industry production.

[Source: daxue consulting, Agroinsurance Products in the agriculture insurance market in China]

Agriculture insurance in China: The world’s second largest agriculture insurance market

Market Size of agriculture insurance in China

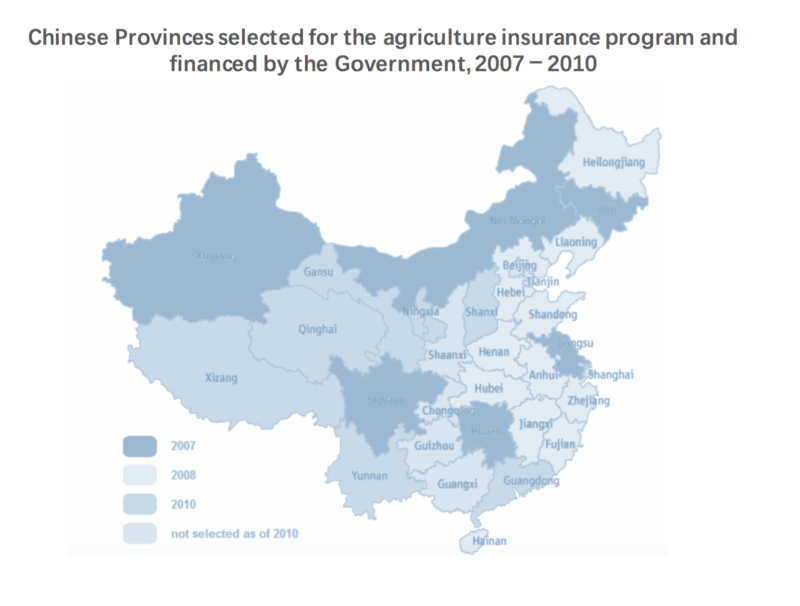

According to NBS, at the end of 2016, China had a total of 167 million hectare of plantation area, 616 million tons of grain production and 115 million tons of imported grain. The statistics together suggest a food self-sufficiency rate of 84.31% that leaves China with some degree of food supply risk. Hence, China has recognised the importance of agriculture insurance by subsidising the industry. However, despite that the Chinese agriculture economy is fairly large and that the Chinese government has been constantly pushing for the growth of the agriculture insurance market in China, it only contributes to around 4% of the total insurance market in China as at 2018.

[Source: agroinsurnace.com, Chinese provinces with agriculture insurance program implemented]

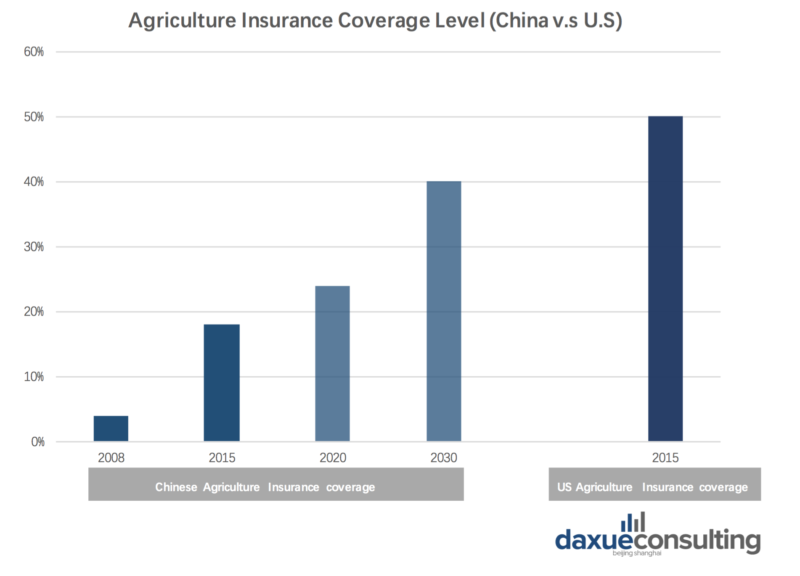

Chinese agriculture insurance market now covers all Chinese provinces with its scope extending to 211 agricultural products. The insurance coverage for corn and rice has exceeded 70%. In comparison with the United States, which had a 50% agricultural insurance coverage ratio in 2015, the Chinese agriculture insurance market exhibited a large growth potential as its 2015 coverage ratio was only around 18%. Although the overall scale of agricultural industry in China will decrease slightly in the coming year due to supply-side structural reform, new opportunity may be foreseen as the plantation area may increase dramatically for some agricultural products such as soybean due to supply-side structural imbalance. Nonetheless, Chinese agricultural insurance market coverage ratio is expected to increase to 24% by 2020, and 40% by 2030 with more product innovation and more effort to push for agriculture insurances in regional areas.

[Source: McKinsey&Company Agriculture Insurance coverage China v.s U.S]

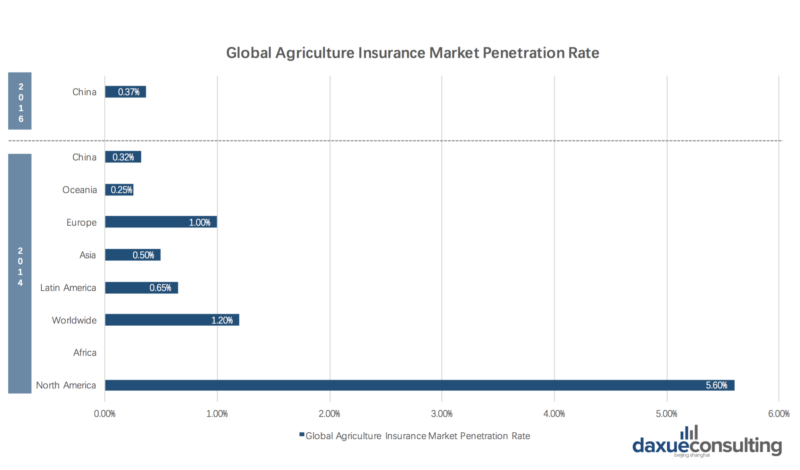

Market penetration rate refers to the percentage of agriculture insurance premium earned as a total of Chinese agricultural GDP. Comparing to developed countries with high market penetration rate as high as 5.6, the market penetration rate of the agriculture insurance market in China is fairly low with only around 0.32.

[Source: McKinsey&Company Global Agriculture Insurance market penetration rate]

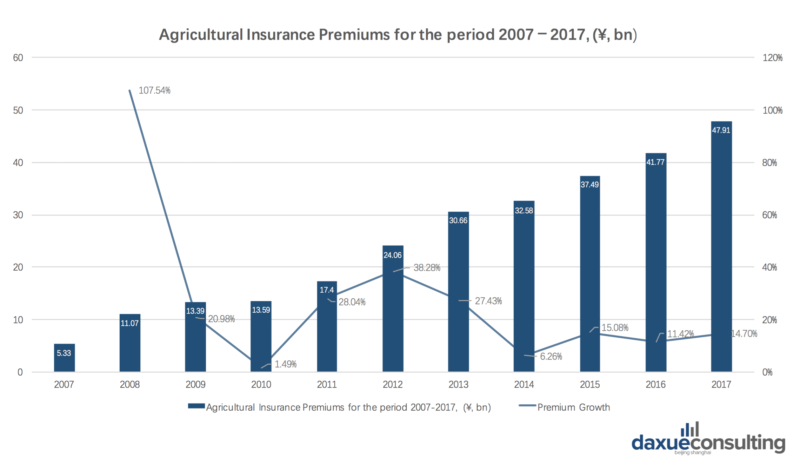

Agriculture Insurance Premium in China

Ever since the Chinese government began subsidising the Chinese agriculture insurance market from 2007, agricultural insurance premiums in China have been constantly growing year-on-year.

In 2016, the total amount of agricultural insurance premiums in China collected was CNY 41.77 billion. Around 115 million hectares of crops were covered, which accounts for 75% of the nation’s cultivated area. Moreover, the overall agricultural insurance premium in China is growing in a stable rate during the recent years.

[Source: qianzhan.com Premium and premium growth of Agricultural insurance market in China]

Breaking down to each category within the Chinese agriculture insurance market, while the coverage for plantation agriculture insurance in China will remain stable, livestock agriculture insurance in China will experience over 20% growth acceleration as more product varieties become available on the market providing insurance coverage. In addition, growth of forestry agriculture insurance in China will generally attribute to commercial forests.

Consumers of agriculture insurance in China

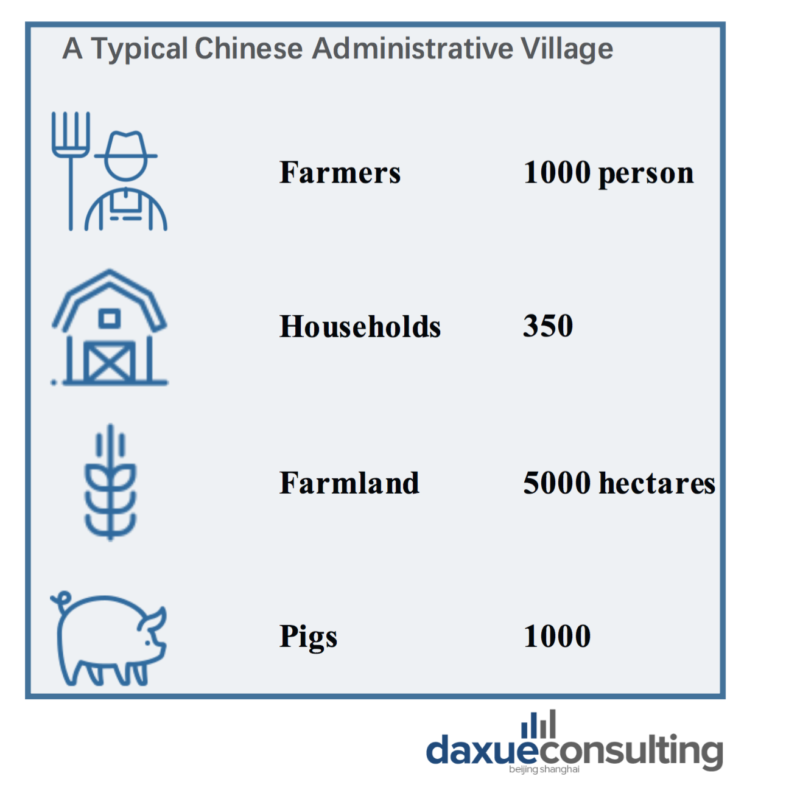

Agriculture insurance products in China are either purchased by farmers or by villages in rural areas. If farmers are properly educated and insurance system are properly implemented, each typical Chinese administrative village can contribute around CNY 100,000 agricultural insurance premium, let alone other types of insurance premiums may be generated along the way.

A special thing to note is that there is usually an appointed or elected village chief who holds a full-time job financed by the government in every village in China. The village chief usually works with local insurers on agricultural insurance program related issues and is entitled to act on behalf of the insurers for different decisions to be taken. The issues village chief need to take care of may range from maintain record of farms insured and crops produced in within a village, to assessment of large-scale damage events and identity which areas are more prone to disasters.

[Source: McKinsey&Company A typical Chinese administrative Village]

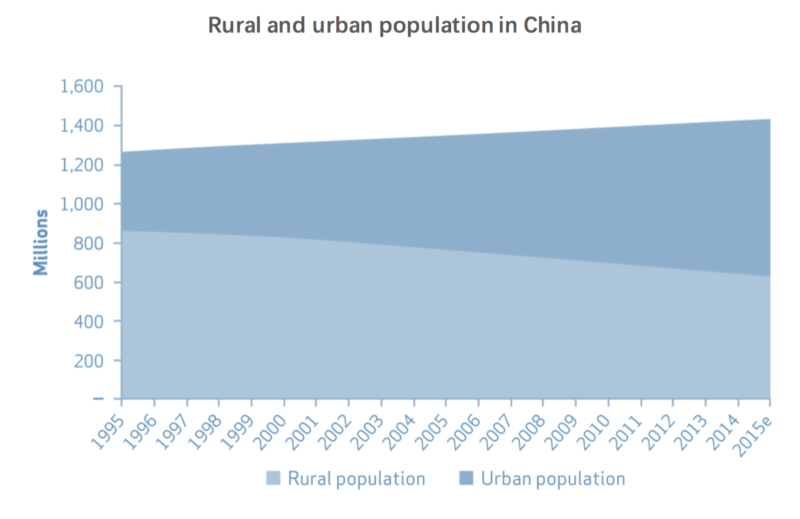

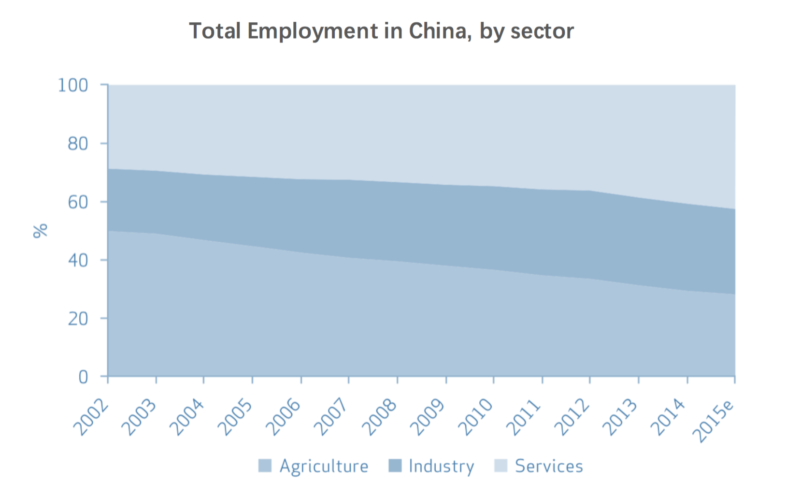

Decreasing rural population

Due to economic development in China, increasing number of people are moving away from rural areas to more urbanized areas. According to FAO, Chinese population lived in rural area decreased from 61% in 2002 to 45% in 2014, while the number of agricultural workers in China had experienced more significant decrease from 50% in 2002 to only 30% in 2014. As rural area population contributes to both the existing and the potential consumers of the agriculture insurance market in China, the decrease of population may post great threat on the development of the sector. As a result, the Chinese government have launched pilot premium subsidy programs in 2004 in selected provinces to support for sector development and make up for the potential consumer loss.

[Source: FAO, FAOSTAT, Country indicators & peak-re Rural and urban population in China]

[Source: The World Bank, Databank & peak-re Total employment in China]

Small farms are unwilling to purchase agriculture insurance products in China

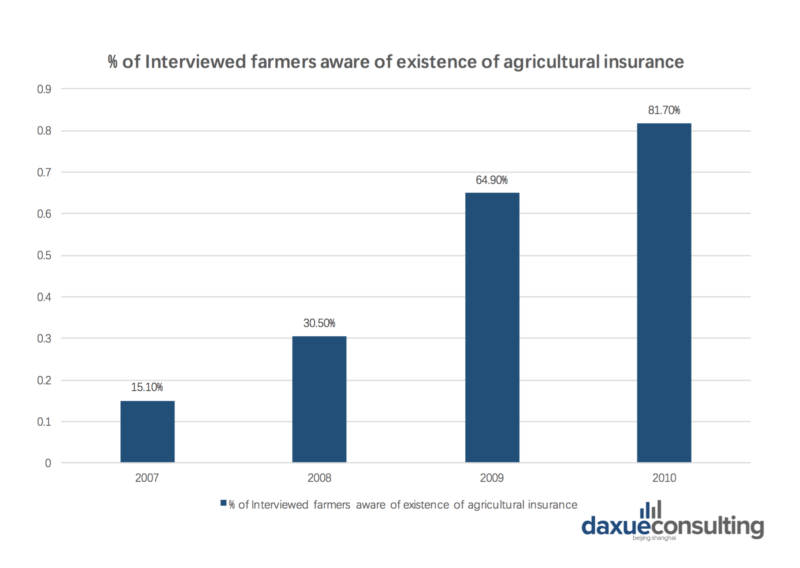

A large obstacle facing the Chinese agriculture insurance market is that many potential consumers are unwilling to purchase the agriculture insurance. Although the subsidy scheme introduced in 2007 has increased the awareness of agricultural insurance products in China amongst rural households, it does not necessarily lead them to consider purchasing cover. This is especially true for smaller farm owners with land size equal to or less than 0.6 ha as they often find insurance premium too expensive compared to the scale of their business.

[Source: Peak-re, Percentage of interviewed farmers aware of existence of agricultural insurance products in China]

Many mid-sized farm owners hold a pessimistic perception of the agriculture insurance products in China. Unsatisfied experience such as low insured sum and slow claims processing encountered with previous insurers are the main reasons of their negative perceptions. However, they are still willing to continue to purchase the insurance cover if no additional premium will be added to reduce revenue.

Lager farm owners, on the other hand, hold a rather positive perception of agriculture insurance products in China, and recognised the benefit and protection it would potentially offer in case of any market shocks. They even welcome increase in the cover limit, as additional premium only represents a small percentage of their total revenue.

Competitors within the agriculture insurance market in China

Market Share of Agriculture Insurance in China

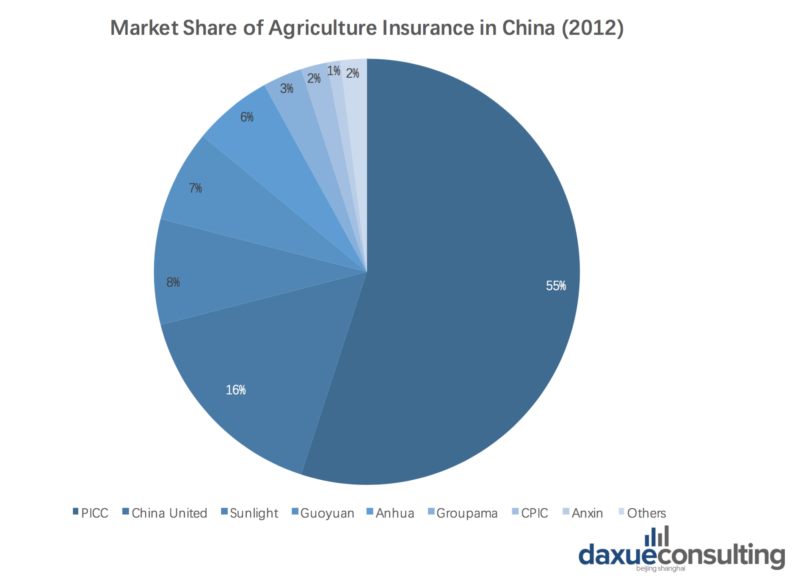

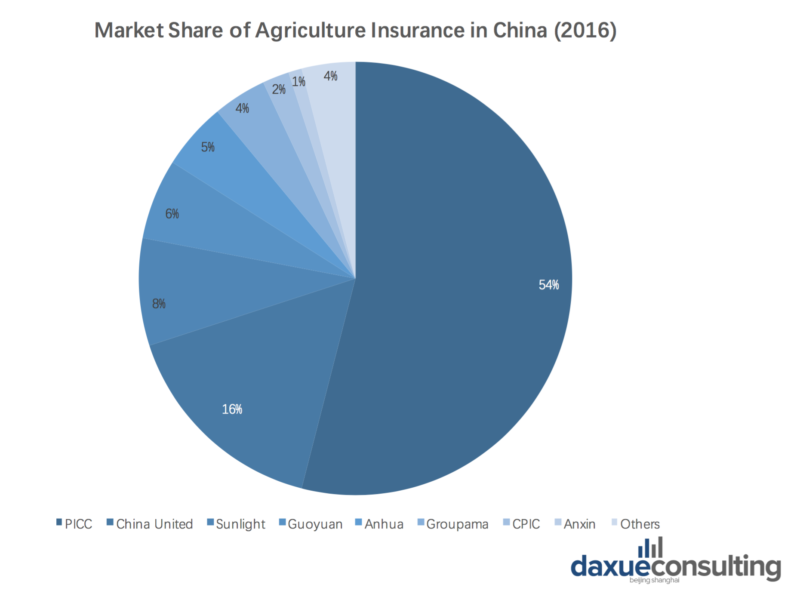

Market Share of the Chinse agriculture insurance market has been fairly stable since 2012. In 2016, there were around 26 insurance companies operating in the agriculture insurance market in China. Amongst the 26 insurers, 6 insurance companies are specialised in the agriculture field (Anxin, Anhua, Sunlight, Guoyuan, Gropama and Zhongyuan).

The structure of the agriculture Insurance market in China makes it very difficult for smaller insurance companies to penetrate the market. Larger insurance companies like PICC have been controlling over 50% of the total market share ever since 2012, while around 93% of the agricultural insurance business in China have been divided between the six major insurance companies.

[Source: Peak-re Market Share of Agriculture Insurance in China 2012]

[Source: agroinsurance Market Share of Agriculture Insurance in China 2016]

Agriculture Insurance products in China are subject to different provinces

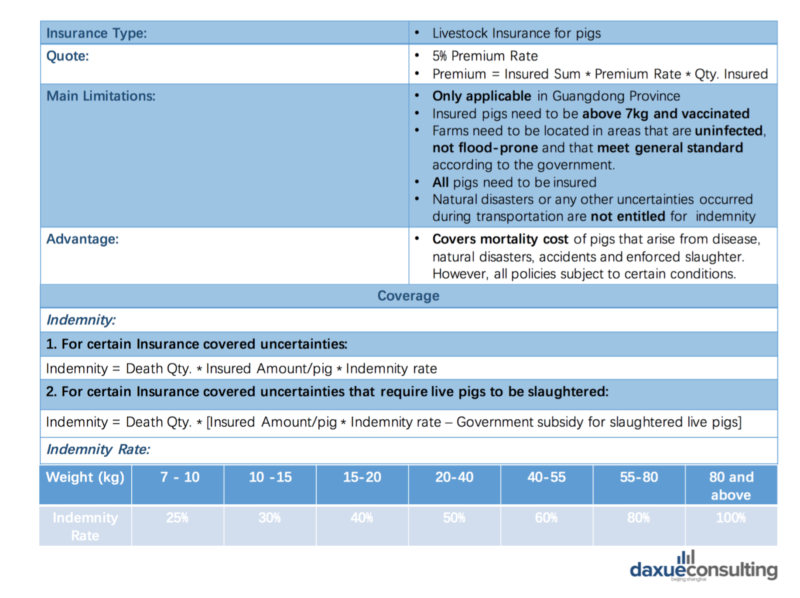

Sunlight agricultural mutual insurance company is the third largest player in the Chinese agriculture insurance market. All of its product offerings are centred around the agriculture industry, ranging from crop and forestry to livestock and aquaculture. Each insurance product is linked to a specific province in which it will only provide protection and coverage in that area.

[Source: Samic.com.cn Livestock Insurance Provision offered by Sunlight Agricultural Mutual Insurance Company]

All clauses for the livestock insurance for pigs are clearly outlined on Sunlight’s webpage. The livestock insurance for pigs offers protection over many diseases, natural disasters and accidents that may lead to mortality of pigs. However, the clauses are fairly complicated in which covered conditions are subject to many limitations. Consumers will have to understand that not all uncertainties are necessarily covered. The indemnity amount is determined by the quantity and weight of dead pigs. It excludes government subsidy given in case of any involuntary slaughter of pigs.

Consumers can not purchase the insurance products directly online. They are encouraged to call the number listed on the page to discuss their purchase decisions further with the sales persons.

[Source: Samic.com.cn Clauses for Livestock Insurance for pigs]

The claim process offered by Sunlight is quite complicated. There is no specific processing period promised. At least 11 steps are required to be taken in order for a claim to be successfully processed. Generally, claimers will have to report the loss first, while the insurer have to prepare and submit information regarding the incident in order for compensation to be finalised. The company offers 24 hour services for claim report and loss assessment.

[Source: Samic.com.cn Claim process of Sunlight Insurance Company]

As the loss of agriculture products are often difficult to be precisely calculated, more steps and more human staffs are required in order to provide a complete purchase and claim process for insurance consumers.

Future outlook of the agriculture insurance market in China

Challenges facing the Chinese agriculture insurance market

Comprehensive claim settlement process

The claim settlement process is usually very comprehensive due to the lack of transparency of the loss assessment and adjustment methods, as well as the vast farmland that are hard to control over. This means increasing amount of time are needed to process the claims properly and potential fraud cannot be eliminated. In addition, farmers’ lack of familiarity with and understanding of the eligible claims further limits the attractiveness of agriculture insurance products in China. Although the government had responded by enforcing insurers to pay claims within ten days after agreeing compensation, new agriculture insurance models or designs must be implemented to reduce the complexity of claim assessment and increase the credibility of assessment results.

Limited product availability

Due to the limit availability of agriculture insurance products in China, many large and mid-sized farms still have areas that are left uninsured. Despite that the amount of products available in the Chinese agriculture insurance market is increasing year by year, the Chinese government is constantly pushing for more product innovation, again by premium subsidy. Product innovation is largely dependent upon the new technologies available in the market and the availability of human specialists to examine the viability to provide insurance coverage on new agriculture products. Hence, new agriculture insurance products in China can only be gradually released.

Innovative Agricultural Insurance Model

Agriculture Insurance has long been hard to manage properly due to its vase area covered and uncontrollable weather conditions that may incur. As the world becomes increasingly big-data driven, new innovative agricultural insurance model is likely to bring an evolution to the Chinese agriculture insurance market. The model developments in foreign markets suggests many opportunities for the Chinese market to take on in the foreseeable future.

The Climate Corporation has led the way to this innovation. Important information regarding the weather, field health and nutrient availability can be evaluated using big data, and insurance decisions in this case can be made more accurately than just by pure guesswork. The company offers FieldView™ products that feature hyper-localized weather monitoring, agronomic modelling, and high-resolution weather simulation that can help farmers to maximize profitability and production.

[Source: airbus.com Farmers using digital tool to keep track of their crops]

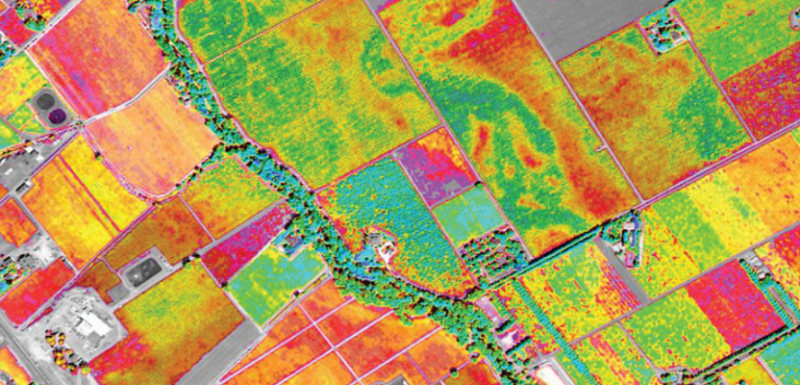

Moreover, many foreign insurance companies had begun using satellite technology to manage agriculture insurance products. Satellite imagery used along with farm-level yield data can reduce the amount of crop sampling that is required to provide area yield index insurance products. As less labour-intensive measurements are required to determine average yields in remote areas, delivery costs can be greatly reduced and quality of agricultural insurance can be greatly improved. Furthermore, implementing agricultural insurance at a larger scale can also be achieved.

[Source: xhyt.com Satellite Imagery for precision agriculture decisions]

The potential of the agriculture Insurance Market in China

The Chinese agriculture insurance market is estimated to expand from its current size to around CNY 75 billion in 2020, and between CNY 80-100 billion by 2023. The annual growth rate is expected to be around 10% to 15%. The growth will mainly be driven by scheme expansion of the government, and by coverage expansion on more corps and agricultural products. Agriculture insurance market in China is expected to benefit from the increase in subsidy provided by the government to sub-lines such as aquaculture, livestock and horticulture products. Moreover, improvement and innovation of agriculture insurance products to incorporate more big-data driven designs will provide better claim estimation and further sector growth.

Overall, the agriculture Insurance market in China retains potential to further develop as the Chinese government continues to support the sector. However, more effort is required on product designs to enhance the viability of many agriculture insurance products in China.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes