To know more about Airbnb in China, contact Daxue Consulting at dx@daxueconsulting.com

Airbnb Officially Enters China

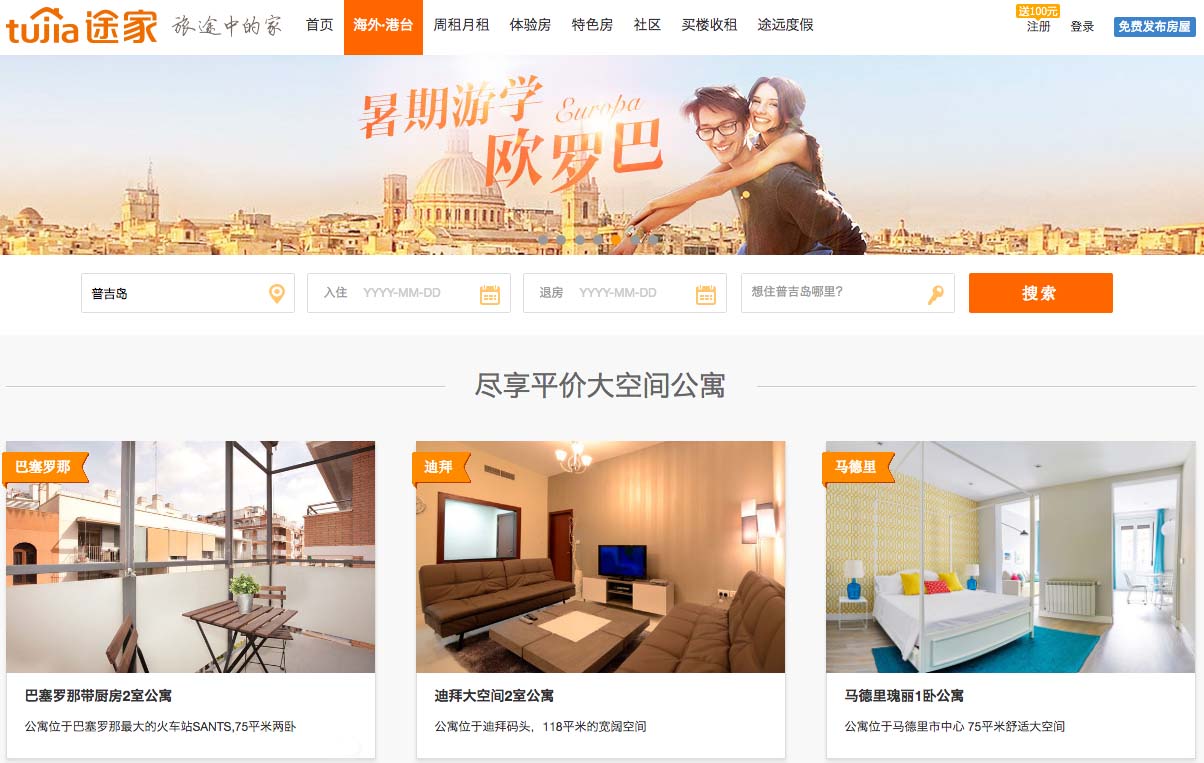

Upon entry to the Chinese market, foreign businesses often face stiff competition from their Chinese counterparts. Airbnb is no exception. Indeed, Tujia provides accommodation services for travellers in China by using a model similar to that originally constructed by Airbnb in the west. They have, however, used their local knowledge to construct services that directly address trends in Chinese consumer behaviour. They recognised that Chinese consumers dislike industry intermediaries. Consequently, they manage 10 000 of their listed properties themselves rather than solely connecting travellers with local homeowners. Accordingly, their services are becoming very popular as they now operate in 250 destinations across China. Airbnb, therefore, faces a challenge to replicate their global popularity in China. The market is already both mature and competitive. Moreover, this is a ubiquitous obstacle confronting foreign businesses in a range of sectors in China.

Upon entry to the Chinese market, foreign businesses often face stiff competition from their Chinese counterparts. Airbnb is no exception. Indeed, Tujia provides accommodation services for travellers in China by using a model similar to that originally constructed by Airbnb in the west. They have, however, used their local knowledge to construct services that directly address trends in Chinese consumer behaviour. They recognised that Chinese consumers dislike industry intermediaries. Consequently, they manage 10 000 of their listed properties themselves rather than solely connecting travellers with local homeowners. Accordingly, their services are becoming very popular as they now operate in 250 destinations across China. Airbnb, therefore, faces a challenge to replicate their global popularity in China. The market is already both mature and competitive. Moreover, this is a ubiquitous obstacle confronting foreign businesses in a range of sectors in China.

In 2015, Airbnb released a statement announcing their desires ‘to clearly understand the needs and desires of Chinese travellers going overseas and partner with Chinese companies to create a truly localised platform’. Airbnb’s approach to the Chinese market is measured and steady. They are not rushing, but intent on obtaining an understanding of their customer before expanding throughout the mainland. Indeed, they have sought local help by raising investment worth $1 500 000 000 from China Broadband and Sequoia Capital. Both have experience in helping foreign internet platforms integrate in China. Airbnb acknowledges that this will help them ‘continue to navigate the China market and create a truly localised presence for the company’. It is no surprise that they have now integrated their app with Chinese social networks, such as Weibo and WeChat. They also now use a localised version of google maps, which is blocked in China, so that their customers can navigate effectively. Their interface is becoming increasingly localised and adapted.

Whilst patient in researching their customer, Airbnb are also taking the time to obtain a positive brand reputation in China. To achieve this, they are targeting China’s outbound tourist market. To date, they have roughly just 1.5% of their listings on the Chinese mainland. Nevertheless, they want to return Chinese travellers to speak highly of their experiences abroad and use Airbnb to replicate their travel memories in China. This appears also as a logical strategy as China’s outbound tourism is increasing. According to China Tourism Research Institute, there were 120 000 000 outbound Chinese tourists in 2015, an increase of 12% on the previous year. Meanwhile, Daxue Consulting predicts that there will be 200 000 000 Chinese overseas travellers by 2020. If Airbnb access this market successfully their brand reputation across China could soar and allow them to scale rapidly, rather than fighting Tujia as an unknown service. Before scaling in the Chinese mainland, Airbnb is building their brand reputation and researching Chinese consumer behaviour. They are not entering the Chinese mainland explosively. Instead, they are preparing so that it will be easier to scale when they feel sufficiently organised.

By contrast, Uber took to the Chinese market aggressively. It did, however, encounter immediate difficulties. When it officially launched in February of 2014 in Shanghai, Guangzhou and Shenzhen, it quickly had to redesign its software as google map is blocked by the Chinese government. The app was dysfunctional as users could not locate taxis or vice versa. This is a problem Airbnb will not encounter with their more reserved strategy. Moreover, Uber’s expansive approach has not shattered competition. Whilst Uber operates in 50 locations across China, DidiChuxing has amassed 400. Despite being the world’s most valuable start-up, Apple Inc. chose to invest $1 000 000 000 inDidiChuxing. This is symbolic of Uber’s struggles in China. They have not eradicated competition and have had trouble adapting their services to the demands of Chinese society. They are even using their profits from other regions in the world to support their efforts in China. Indeed, the calendar year of 2015 witnessed Uber loses $1 000 000 000. Nevertheless, it should be mentioned that this does not demonstrate that Uber has failed. Their push into the Chinese market might end up profitable. Only time will tell.

In summation, many foreign companies face competition from their Chinese equivalents upon entry into China’s markets. They do not, however, adopt identical market strategies. One can see that Airbnb has been patient before scaling in the Chinese market. They want to understand their customer sufficiently and build their brand reputation. The expansion, therefore, could be demand led. Contrastingly, Uber have pursued a supply led strategy as they entered the market aggressively. Whilst they have struggled to generate profit, it is unclear whether this will continue. It is equally uncertain whether Airbnb’s strategy will prove effective. Their differing strategies are worth following though as it could provide insights into the effective means to successfully enter China’s markets.

Case Study: Usability Testing in China

A multinational company for household goods wanted to test its App features for China and explore how Chinese consumers respond to the App’s first version. After a long development time, the client had built the first version for the European market. The client contacted Daxue to conduct some exploratory research with the user testing methodology in China. The client received real feedback from potential users of the App on how well the App served the customers’ needs and preferences.

The client obtained rich and qualitative insights about their target demographic, as well as the right tools to turn their App users into store customers.

See also:

- Airbnb in China and its competition

- Daxue’s latest Twitter post:

Tujia Beats Airbnb with Tailor-Made Services. More at https://t.co/mCzcjqymgf #marketresearch #hotel #China pic.twitter.com/lKnLlZR1cy

— Daxue Consulting (@DaxueConsulting) July 22, 2016

Image source from https://goingawesomeplaces.com/