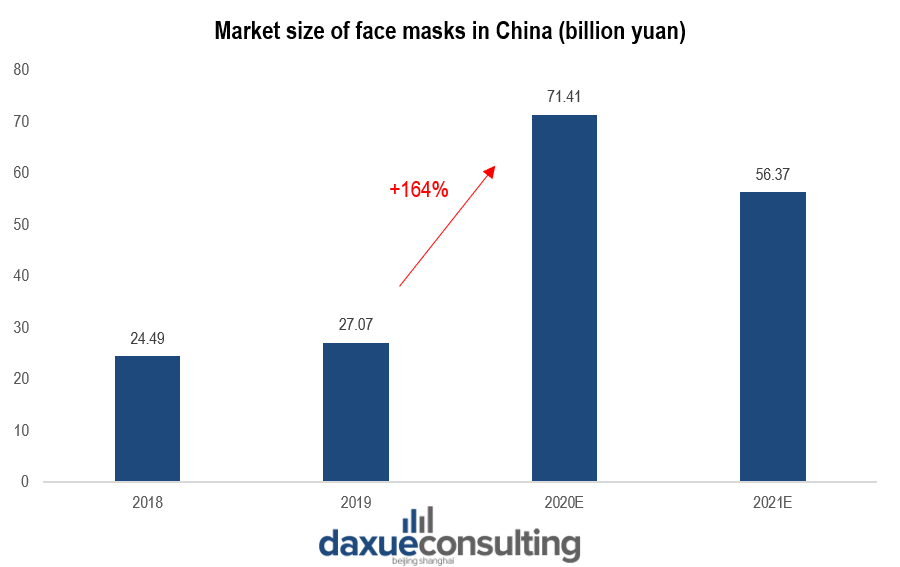

In 2019, the size of the face mask market in China accounted for 27 billion yuan, with a 10.5 percent growth rate compared to 2018. Since December 2019, the spread of the Coronavirus in China has been driving the demand for medical face masks. Updated statistics that include the impact of COVID-19, show the face mask market would exceed 70 billion yuan in 2020, a 165% jump compared to 2019.

[Data Source: Statista, size of the facemask market in China]

2021 estimations after COVID-19 show a slowdown of the trend, but the memory of the pandemic will still account for a significant part of the demand.

Before the outbreak, the face mask market in China was much more driven by pollution concerns than disease. Pollution alerts often led to a surge in demand on the Chinese e-commerce marketplaces. Resulting from COVID-19, an unprecedented surge in national demand for face masks pushed thousands of new manufacturers to start producing face masks, with the support of local authorities. However, the rush for N95 masks with higher filtering capabilities has largely benefited the American brand 3M, which dominates the N95 face mask market in China.

China met global face mask demand with a production boom

Since the re-qualification of the outbreak as a global pandemic, China experienced a mask-making boom. In 2020, More than 38,000 new companies registered to make or trade face masks. China was already the main market for protective masks production in the world, making half of the global output in 2019. In February 2019, the country had already risen its capacity from 20 million to 110 million. Concerns about overcapacity in the offer on the Chinese market have quickly disappeared, with China’s face masks being in urgent demand from other countries.

In April 2020, foreign governments’ ‘wild feeding frenzy’ for Chinese protective face masks brought chaos to the landscape of manufacturers. A medical supplier during the pandemic told the South China Morning Post: “mask machines are like cash printers.” To meet global demand, many factories that were making completely different products like car parts, electronic parts, or plastic toys, therefore turned to mask production. With governments fighting for ramping up their stocks, quality controls at purchase were often completely avoided in favor of shipping speed.

New regulations to prevent face mask scams

The influx of new actors to the market has led to a dilution of the quality and a surge in scams, forcing the Chinese government to change the rules. Mid-April’s new regulations from China’s customs agency require companies manufacturing PPE (Protective Personal Equipment) for export to go through a government-led process. Mask exporters also need to prove that their products meet the relevant regulatory standards of the destination country.

This move comes after a global backlash in which foreign countries were supplied shoddy products, undermining China’s position as ‘the global savior.’

As long as the pandemic doesn’t end, the Chinese face mask market will stay warmly flooded with transactions. However, foreign countries are now ramping up their own productions to be less dependent on Chinese exportations.

Thus, if the pandemic is an instant boon for the Chinese face mask market, the gold rush will soon end, and many actors may be left aside.

National issues supporting the Face Mask Market in China

The face mask market in China is largely driven by external events like epidemics and pollution. Most recently, the Coronavirus outbreak has caused face masks to sell out all over China. Originating in Wuhan late December, the 2019 new Corona Virus (2019-nCoV), has infected over 28,000 people and killed about 570 in Chinese mainland as of February 7th 2020. – The rapid spiral in the number of identified n-CoV cases forced the Chinese government to seal cities and public transport. The Spring Festival holidays had been extended by a week, hoping to curb the spread of the epidemic. Two months before the destructive outbreak, China’s National Health Commission had already called to effectively enhance prevention measures in anticipation of the upcoming flu season, looking for a more standardized process for diagnosis and treatment.

But the 2019-nCoV is by far neither the first nor the last to appear on Chinese soil. China has always been considered by the World Health Organization (WHO) a hot spot for new influenza viruses; there is indeed no other country on earth where so many people have close contact with wild animals. Thus, the n-CoV reminds of the lethal 2002-3 severe acute respiratory syndrome (SARS), but also less widely known avian influenza A(H7N9) virus, which killed 212 people in China according to a 2015 WHO report.

In the meantime, according to the Global Health Observatory, total health expenditure per capita in 2014 in the country reached 731 USD, which is much lower than the 2014 world average of 1041 USD. This report from the OECD shows that China counted 1.8 physicians per 1000 people in 2015, which is slightly more than the World average of 1.5, but almost twice less than the OECD countries.

Pollution drives the functional mask market in China

Flu prevention is not the only health problem that China is facing. Air pollution is another one, which has become one of the most intensely discussed livelihood issues that the Chinese government focused on the 12th National People’s Congress (NPC), held in Beijing on March 5, 2016. Chinese Premier Li Keqiang declared a “war on pollution” at the Communist-controlled NPC parliament in 2014. Three years later, average particulate levels in Chinese cities still do not meet the World Health Organisation (WHO)’s standards, which considers anything over 10 PM2.5 as health hazard (maximum annual average PM 2.5 exposure). According to this infographic, in 2016, Beijing had a yearly average of 7.3 times above the WHO’s recommended safe levels.

N95 masks in China: A shield in a war against the Coronavirus

In January 2020, Chinese President Xi Jinping declared “a people’s war against the [n-CoV] epidemic” over a governmental meeting, stressing that prevention and public awareness remain the most effective measures to fight a pandemic. Since the 2002-3 SARS, people rely on wearing surgical masks. Especially high-filtering specialized N95 masks, during illness as one of the main preventive barriers against propagation. Claimed as an effective way to protect oneself from the virus, face masks have been urgently brought to the fore as a daily necessity and a fast-moving consumer good in China, resulting in a massive gap between market demand and supply. On January 3, 2020, just over a week after the new coronavirus outbreak, China “urgently needs” protective medical equipment while medical masks shortages were reported across the country.

Face masks, also called ‘kouzhao’ (In Chinese口罩) usually cover the nose and mouth and include cotton masks with cute designs, surgical masks, and imported high-end filters. In 2014, officials in Shanghai considered distributing free protective masks to residents after the financial hub of China “suffered one of the worst spells of air pollution on record,” reported The Telegraph. At this time, PM2.5, fine ambient particles less than 2.5 micrometers in diameter causing cardiovascular diseases and lung cancers, rocketed to levels that were more than 20 times those deemed safe by the WHO.

Red alert in Northern China

In December 2016, northern China (including Beijing, Tianjin, and around 70 other northern Chinese cities) had been covered for weeks in thick toxic smog, composed of high concentrations of PM2.5. It is one of the worst episodes of air pollution the country has seen, affecting 460 million people.

The “red alert” was declared in 24 cities, prompting the closing of schools and airports, restricting traffic and asking citizens to stay indoors. In response, online shoppers splurged on filtration masks, and anti-pollution equipment , with e-commerce firms and brands reporting record demand, as explained by Reuters. In December 2016, Internet retailer JD.com Inc sold to domestic consumers about 15 million US-branded filtration masks through its online marketplaces.

Face mask price inflation

The 2016 measures to counter air pollution strangely resemble the drastic measures of early 2020 to stem the spread of the new coronavirus, forcing dozens of Chinese cities to quarantine. As a result, 80 million masks were sold on Taobao over the two days of January 20 and 21. The BBC also reports that the price of a 20-mask box jumped to 1,100 yuan ($158) on Jan. 21, up from 178 yuan in November. Between December 30 and January 24, 3M, the most popular face mask brand in China, added $1.4 billion in market value. Honeywell, the American conglomerate that also sells face masks in China, added $500 million in market value, in the same frame time.

Overall, due to significant health crises, the protective face mask market in China, still dominated by Western brands that control more than half of the Chinese market, is heating up. Many budget manufacturers and low-cost producers from Japan and China are now trying to get a slice of it.

Rising demand for face masks in China

The demand volume of protective masks in China has grown continuously since 2012. State media estimate the protective face mask market in China was worth nearly 4 billion yuan ($600 million) in 2015. Along with the improvement of the living standard of people in urban areas and the rise of the middle-class, people’s awareness of pollution, germs and contaminants protection is increasing all the time, especially for young children, and will maintain rapid growth.

Protective face mask production in China

China’s protective face mask market enterprises are mainly distributed in the eastern region, and Bohai Rim, Yangtze River Delta Region, and Pearl River Delta Region are the major production areas. Shandong province serves as the center of the masks industry in China with another production hub, Dadian, dubbed the “mask village” for producing the cheapest pieces.

There are more than 300 mask processing and supporting enterprises in Dadian village, Jiaozhou City of Shandong with an annual production capacity of nearly 1 billion pieces. Realizing about CNY 1.1 billion ($160 million) of output value, it accounts for more than 80% of market shares nationwide (data based in 2017).

[Source: ABC News ‘Mask production during Coronavirus’]

Currently, common protective masks widely available in every convenient store are priced at CNY less than 1 or 2 ($0.15 to 0.40) to CNY 30 or 40 ($4.5 to 5.8), and they are made from cotton yarn, activated carbon, and other materials. Along with the continuous increase of Chinese residents’ incomes and the improvement of people’s living standard, people have a stronger awareness about the environment and health. As a result, consumers are willing to pay more to protect themselves from health crises’ effects. They look for more comfortable and effective masks, such as Vogmask or Cambridge masks, which generally range in price from CNY 120 to 245 CNY ($19 to 37, based on 2019 Tmall/Taobao prices and currency exchange rates). To meet growing demand in China, new market entrants like Airinum focus on the high-end market, with stylish design and high-quality replaceable filters.

Collectivism and Chinese consumer psychology

“In China, people just pretend or assume that it is useful. It’s a mass behavior,” indicates Wong Chit Ming, a researcher at Hong Kong University’s school of public health. “You may feel a little better…but there’s no real evidence this might help.” This is collective consumer psychology among the Chinese who are entirely concerned about the threat of air pollution and germs during flu season. For him, Chinese people have the impression that this could resolve the problem of air quality and they should, therefore, do something to protect themselves from the harmful air, which will comfort them emotionally regardless the practical effect.

Different style and functions for the Face Mask Market in China

China Textile Commercial Association officially released ‘the community standards of PM2.5 protective masks’. The standards were implemented on March 1, 2016. Before this date, China had no quality standards for face masks for personal use, and the majority masks available claiming to reduce particulate matter by 99% on the market were not protecting against PM2.5.

According to the FDA, “Face masks and N95 respirators protect the wearer from liquid and airborne particles contaminating the face. They are one part of an infection-control strategy.” While face masks like medical and surgical masks are meant to block large-particle droplets, splashes, sprays or splatter that may contain germs from reaching your mouth, they are more loose fitting than N95 masks which are meant to achieve very close facial fit. The ‘N95’ designation means that the mask blocks at least 95 percent of very small (0.3 micron) test particles. Properly fitted, N95 respirators’ filtering capabilities exceed those of face masks, making N95 masks the most popular choice in times of pollution and influenza season. Currently, the N95 mask market in China is dominated by the giant 3M, as it is the only brand to be N95 approved by the Center for Disease Control and Prevention (CDC).

[Source: South China Morning Post ‘3M N95 Masks in China’]

Choosing the most effective mask

At present, the variety of types of anti-dust and anti-contamination masks sold in online shops and outlets have contributed to the disorder of this market. Those most popular kinds of masks are always those masks which have a relatively simple wearing process. Still, the vast majority of Chinese residents use cheap cotton masks that offer little protection. Also, expensive specialized N95 masks aren’t made to fit Chinese faces well, according to a study from Wuhan researchers. Even those benefiting from China’s Kou Zhao boom admit that their masks can only do that much.

Except for the most common cotton masks, active carbon mask which can be recycled and praised for its adsorption force becomes another hot choice in China market. As some researchers analyze, China’s functional mask market has not been arousing general consumption groups’ attention due to its late start. But now it has garnered significant attention.

Division of the Chinese Mask market

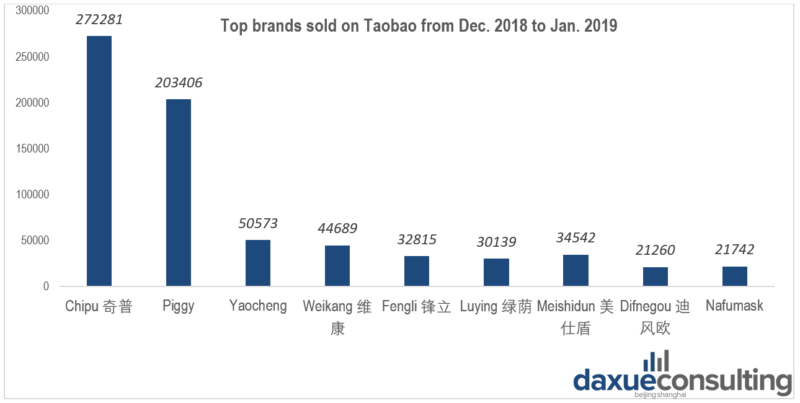

Simple market research shows that on Taobao/Tmall, the top-selling mask brands are replicas of each other. Top brands sold in Dec 2018 to Jan 2019 are listed in the graphic below:

[Data Source: Taobao/Tmall, graph by Daxue Consulting]

Lack of diverse options in China’s mask market

These brands and their products are the same in almost all aspects including materials, designs, promotional strategies, pictures used online and textual description. It is very likely that these masks are produced by the same producer. However, there is no trace showing the actual manufacturer of the products, and thus unable to identify whether the domestic mask product is highly concentrated or not.

Based on Xinhua.net, the overall face mask market in China is mostly controlled by the international giants 3M, which occupies almost 90% of all the market share, followed by Honeywell and Ludun 绿盾 with less than 5% respectively. Other brands such as Uvex and Hakugen have a non-significant market segment of less than 1% respectively.

To be noted that, among all these brands, only Ludun 绿盾 is produced by Chinese domestic company Sinotextiles Corporation Limited, other brands are all international based.

Another market analysis renders different views on the masks industry in China. According to a market report, four major domestic mask producers own 7 major brands. The largest domestic mask manufacturer is Shanghai Dragon Corporation 上海龙头股份 (market share 6.52% with 2 brands) followed by Shanghai MNP Inc 上海美科 (market share 7.14% with 3 brands), Teda Tianjin 天津泰达 (market share 5.90% with 1 brand) and Dongguan Rongxin 东莞容鑫防静电技术 (market share 1.00% with 1 brand) in a descending order.

The future of the Face Mask Market in China

There is an increasing demand for both functional and comfortable masks, so much improvement has been achieved in protective measures, what’s more, these functional masks are equipped with high technological contents. Thus, the additional value increases correspondingly. For example, masks for controlling bacteria and protecting virus should carefully suit with people’s facial form. Obviously, such a malignant environment we are living in is difficult to be improved thoroughly in a short time. Therefore, self-protection measure appears to surge high unprecedentedly, bringing vigor to the protective face mask industry in China.

New market studies in late 2018 found that ‘smart’ masks are now more welcomed than traditional protective face masks. Now major mask buyers in China not only consider the function of filtering but want to buy smarter equipped masks. With some AI microchips implanted into masks, those new products can both monitor the filtering function and other rates affecting human body performances including heart rates, air pressure, humidity and other air-related live data. Some other products even developed a replaceable filter with AI function, and these products are more like sports equipment than simply anti-pollution masks. Their filters can be replaced to imitate different air pressure levels and add on training difficulties when people try to exercise under a thin-air condition and to improve cardio abilities. Most buyers of this new type of AI-based masks are female, and 53% of the buyers are less than 30.

Many investors have seen this opportunity; it is estimated that the production value of China’s functional mask market will grow up to CNY 10 billion in the next five years.

Author: Maxime Bennehard

The ultimate Coronavirus economic impact in China report

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes