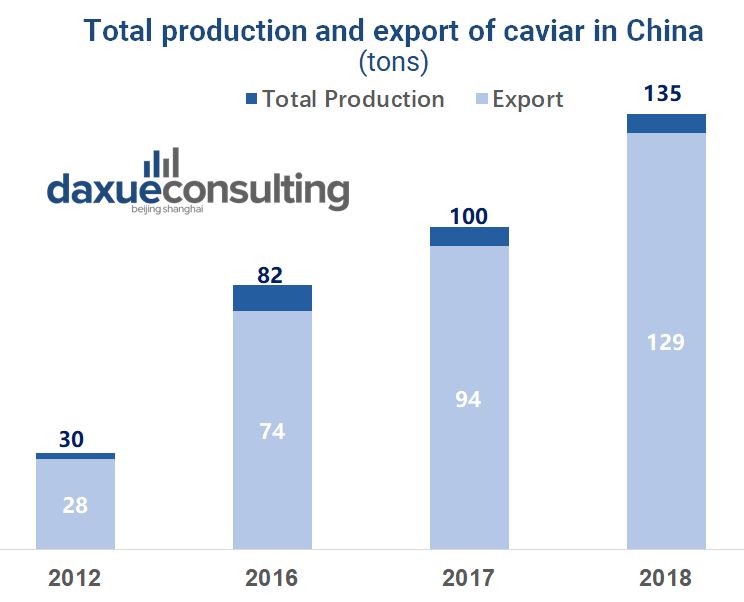

Ever since 2006, the first home-made can of caviar has triggered a hyper-growth of caviar production in China. Within two decades, China’s caviar industry witnessed an incredible escalation from 0.7 tons to 135 tons a year, a nearly 200% growth in the total amount produced. Accredited by United Nations Food and Agriculture Organization (FAO) statistics in 2018, China has become the world’s caviar capital, accounting for 25% of the global caviar supply. However the slow of global demand in 2020 caused suppliers to turn to the caviar market in China.

For centuries, caviar has been a luxury for the rich in the western world. A delicacy that consists of salt-cured fish eggs from various sturgeons aging above 7 years, caviar is crowned as “the black pearl” for the rich nutrients it can provide, including Vitamin A, potassium, and omega-3. Once monopolized by Russia and Iran who took geographic advantage of the nearby Caspian Sea, caviar production enjoyed a high profit margin mostly from mass fishing in the wild. However, in the late 20th century, the Committee on International Trade in Endangered Species of Wild Fauna and Flora (CITES) started to implement a cap on the amount each country could take for wild fishing, opening a new era of artificially propagated caviar from farmed sturgeons.

However, it remains unclear whether such an increase in production correlates with a proportional increment in the caviar market in China. Has the growing knowledge about its beneficiary nature started to work up Chinese consumers’ appetite for this exotic delicacy? If so, how should players in this lucrative domain respond to secure a seat in such an expanding premium seafood market?

Made in China: The birth of Chinese caviar brands

Encouraged by the Chinese Ministry of Agriculture, increasing sturgeon domestication in return gives rise to domestic caviar production in China. Major aquacultural areas including Zhejiang, Hubei, and Sichuan provinces, bring the birth of several Chinese caviar brands. These caviar brands put forth products differing in quality and prices.

Source: Kaluga Queen, Kaluga Queen caviar product collection

Kaluga Queen

Originating in Zhejiang province, Kaluga queen tops the list as the most well-known and profit-making caviar brand. From 2009 to 2019, its total sales rose from around 35 million to over 2 billion RMB . For most Chinese brands, sailing into the foreign market is not easy work. Similarly, it took Kaluga almost a decade to successfully establish itself as a premium brand.

Today, Kaluga is the exclusive supplier for Lufthansa Airlines while serving 22 out of 27 Michelin 3-star restaurants in Paris. Kaluga dominates the caviar market in China with various products of differing quality levels and from bred sturgeons of different ages.

Frosista

Frosista positions itself as not only the supplier but also an educator for the public. Its campaign puts a large emphasis on educating the public on caviar appreciation. Similar to Kaluga, it owns a whole production chain in Sichuan province. Hence, it adopts a well-rounded selling approach by producing both caviar and sturgeon meat. Its niche suggests a future trend in the caviar market in China: developing varied goods for consumers.

Source: Frosista, caviar product collection

Luxcious

Luxcious is another top-of-mind brand, with a straightforward mission to provide luxurious and delicious products. The brand produces caviar from only two types of sturgeons. It also offers a lower price than the other two Chinese caviar brands.

Data source: Taobao and Tmall, collected by Daxue Consulting, top Chinese caviar brands

Demand in the caviar market in China: Emerging from none

In 2019, statistics in a government report about the Chinese Sturgeon Industry revealed that Chinese customers consumed less than 10 tons of caviar. This can be explained due to the fact that Chinese meal courses do not fit with caviar.

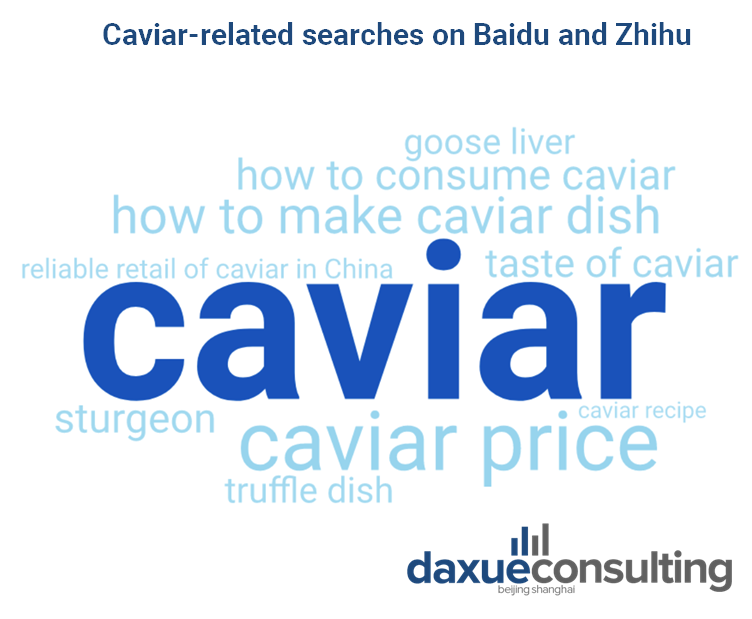

Compounded its shallow history in China, around 99% of domestic customers have little knowledge about how to integrate it into their daily meals, which is further proved by relevant searches on Baidu and Zhihu.

Data source: Baidu and Zhihu, collected by Daxue Consulting, Chinese inquiries about Caviar on social media

For the masses, caviar is still a rare figure on the family table. Continuous economic growth, however, has stirred up a new favor in luxury food consumption. Nearly 4% of the year-over-year growth rate is anticipated in the luxury foods, with a rising interest in rare products such as caviar due to its limited availability along with a high price tag. Consumers aging from 20-40 search the most about caviar, and they are exactly the ones able and willing to afford such luxurious consumption for health benefits.

Chinese caviar consumers are concentrated in first-tier cities

Major domestic consumption comes in first-tier cities, such as Shanghai, Beijing, and Guangzhou. Though caviar consumption in China is still at its infancy stage, high-class restaurants are putting forth more caviar-related dishes. Deluxe hotels, such as The Ritz Carton Hotel, Four Season Hotel, and Hyatt Hotel, and premium restaurants, including Beijing’s Dadong (大董), Shanghai’s Three on the Bund (外滩三号), and Hangzhou’s Xin Rong Ji (新荣记), all have caviar to satisfy consumers’ high-quality needs. Moreover, people may find caviar in cozy bars, choice quality stores, and embassy buildings as well.

Interestingly, as Chinese consumers have become increasingly appreciative of domestic products, fusion courses start to emerge. For instance, Li Xuan (丽轩) in Hangzhou mixes minced crab meat with caviar to create a special flavor, while Sheng Yong xing (晟永兴) in Beijing puts caviar as a side dish for roast duck course. Both elected in the Black Pearl restaurant list, the two top restaurants lead a new inventive trend. Caviar, the once unquestionable star on the table, now helps to set off the flavor of traditional delicacies as well.

Left to Right: caviar with minced crabmeat and caviar with roast duck, Chinese consumers are finding ways to incorporate caviar into cooking

Covid-19 and e-commerce: Changing demographics of Chinese caviar consumers in 2020

Surprisingly, the year 2020 was a critical turning point for the caviar market in China. International requests plummeted as a result of the global pandemic. Such a sudden suspension in foreign trade urged local producers and retailers to turn emphasis on domestic consumers.

With the help of a developed e-commerce environment and marketing methods, caviar makes its presence in multiple advertising channels and becomes a darling among agricultural goods overnight.

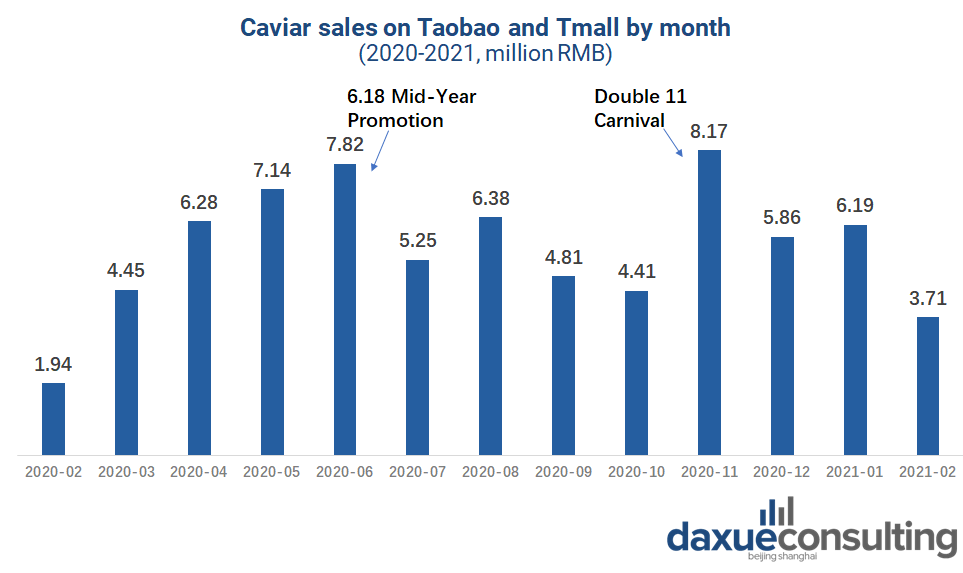

Data source: Taobao and Tmall, designed by daxue consulting, monthly caviar sales on Taobao and Tmall

Sales of caviar on e-commerce platforms vary by month, mostly as a result of various promotions and marketing campaigns across the year. The first peak came in June 2020 with the launch of the “618 Mid-Year Sales Festival”. Kaluga, for instance, generated over 60 thousand RMB sales in just 15 minutes. Similarly, Double 11 shopping carnival also promoted the caviar market in China.

Source: Kaluga Queen, Mid-Autumn Festival gift box

How Caviar brands market to Chinese consumers

To better seize the caviar market in China, each brand rolls out various marketing plans such as leveraging holidays, working with KOLs, and raising public knowledge about caviar consumption.

As caviar is a luxury food item few can afford on a daily basis, brands cater their packaging and marketing to specific holidays where people tend to splurge for others. For example, caviar cans are packaged delicately in premium boxes for Valentine’s Day and Mid-Autumn Day as a unique gift.

Utilizing KOLs is also a “must-have” for advertising campaigns. With celebrities’ endorsement, brands aim to depict the high quality of Chinese caviar. These campaigns appear on TVs, in live-steaming, and user-centric social media.

Left to right: Taobao live stream of an actress promoting Kagula caviar, Xiaohongshu post introducing recipes for Frostista, Zhejiang TV show of idols testing Kaluga’s caviar

Beyond the taste: Caviar ingredients in cosmetics

Rich in nutrition, caviar enjoys extensive applications in not only the food and beverage industry but also in pharmaceuticals, cosmetics, and personal care products. La prairie, the deluxe skincare brand from Switzerland, is the first to adopt caviar ingredients in its products. Its skin cream, one of the top sellers, dwarfs other cream products at an incredible price of around 5,000 RMB/50 ml, a rough double of LAMER’s price level for traditional cream.

Source: La prairie, caviar skin cream

The limited number of products in the arena suggests huge potential. However, new entrants may also find their way in fair-price track as caviar face packs and hair care conditioners start to boom in the market.

The next decade: Diversified goods for consumers

At present, exports account for nearly 90% of the caviar production in China. With a growing internal market, domestic consumption is projected to skyrocket to 100 tons by 2030. Bearing sturgeon is a costly work requiring huge inventory, setting a high entry barrier for caviar production in China. However, huge potentials lie in consumer products.

Data source: FAO, designed by daxue consulting, total production and export in the caviar industry in China

For now, most of the caviar producers rely solely on direct sales while other lucrative sub-markets start to emerge. That said, new players may find unlimited business opportunities if they can differentiate themselves or establish fresh caviar-related product categories.

Meanwhile, as caviar consumption becomes popularized, it will be critical to reach the target audience through multiple channels. Hence, we may see more retailers and offline distributing channels emerge while e-commerce still presides.

Therefore, advertisements and marketing should be diversified if brands aim to communicate with different types of consumers in varying settings. Besides the cheap price for a luxurious taste, there remains a key challenge for the firms to create a one-of-a-kind customer experience and tell a unique story.

Author: Christine Wei

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Some Chinese caviar is imported from Russia, learn more about Russian exports to China

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast