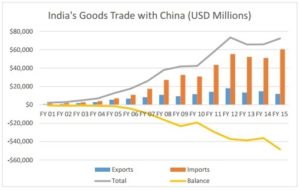

China-India food trade relations enjoyed fast growth as well as global attention the last years. The IPS (Inter Press Service) reported an increase from about $ 3 billion in 2000 up to touch $ 100 billion nowadays. Analysts predict this bilateral relationship to be one of the most important relationships in the world by 2020 and may even surpass US-China trade. The Chinese embassy said on New Delhi Television Limited (NDTV) that China has become India’s largest trading partner, the largest source of imports and fourth largest export market. Moreover, India is China’s primary trading partner in South Asia and ninth largest export market in the world. Consequently, there exists a strong interdependence between the two countries, subsequently, their tier plays a significant role in economics, but also politics and society. However, the rising trade deficit between India and China already amounts to over $ 50 billion according to the Economic Times which results of India having much more imports than exports compared to China.

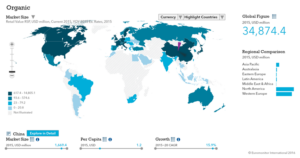

Source: Organic Trade Association (OTA). According to the OTA, the growth of sales of organic packaged food and beverages in China will increase by 15.9 % from 2015 – 2020.

China-India Food Trade: What do India and China trade with each other?

Based on the statistics and categories from the Bureau of Statistics of China, in 2010, the main exports from China to India include rolled steel, various types of fertilizers, telephone sets, medical and health supplies, agricultural products, chemical products, textile products and furniture. Also, due to the backward infrastructure of India, several experienced China companies like China National Machinery Import Export Corporation, China Petroleum Pipeline Bureau, etc., all sent construction teams to India to do contracted projects.

India’s exports to China mainly include iron ore, cotton, plastic products, automobile parts, gemstone, and gold. Most of these commodities are labor-intensive to produce. As can be seen from above, compared to India, China’s exports compared to those of India are mostly finished products with high added value. Some fear that this one-sided trade relation may trigger some unexpected problems in the future.

Latest food trends and consumption habits

As disposable income and health awareness in China is rising, eating and consumer behaviors are changing as well. Ingredients are therefore of more and more important in the Chinese market. According to Nielsen’s Global Health and Ingredient-Sentiment Survey, the satisfaction rate about the supply of healthy food counts only 40 percent. Though, 79 per cent show a greater interest in ingredients. Moreover, 82 percent would accept higher prices for food and drinks to avoid unwelcome ingredients such as food additives, antibiotics in animal products, sweeteners or genetically modified organisms. Chinese consumers’ preferences are increasing towards natural, organic and low-calorie products with regards to fat, carbohydrate, sodium and sugar. Chinese consumers also appreciate packaging and labeling which is showing transparency about the origin of goods, according to the survey. Other evolving trends for Chinese consumers are online shopping as well as the willingness and curiosity to try out new food including international products. Taking a small snack and sports drinks also enjoy higher popularity among Chinese. Consequently, there is growing potential for manufacturers and retailers within the food industry in China.

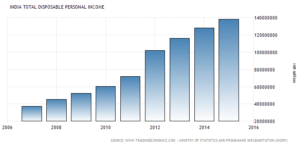

In compliance with China, the Indian eating trend is moving the health and wellness direction as well. Keywords such as natural, organic and not artificial are increasing in India. Mintel’s food and drink analyst Yogmaya Chatterjee stated at the FI (Food Ingredients) fair in India the consciousness about not all fats being bad is playing a significant role, according to William Reed Business Media. Furthermore, she declared a growing number of high fiber food, particularly among the bakery segment, cereals or snacks and a potential to expand this phenomenon to other parts of the food industry. 2016 was the first time that the FI fair exhibited in New Delhi in 2016, showing the increasing relevance of the topic. The next large Asia Health and Food ingredients fare will take place in June 2017 in Shanghai. Every year hundreds and thousands of domestic and overseas enterprises participate in the show. What’s more, India will become the youngest country in the world, as reported by The New York Times. The average age will be 29 by 2020 in comparison with China (37) which could lead India evolving to the biggest consumer market in the world. Besides, the higher disposable income and the lower tendency of saving of the young Indians lead to the opportunity of premium product sales, as stated by Euromonitor.

More of business opportunities

According to The Diplomat, sectors such as agriculture and food processing as well as construction, infrastructure, pharmaceuticals, information technology or logistics are promising options for the two nations. India can concentrate on processed frozen foods as well as dairy products for the Chinese markets while China may focus on agricultural issues for India such as fertilizers and processed chemicals.

India is the largest producer of milk with 16.43 percent share of total milk production in the world as well as it has the largest buffalo population worldwide with 58 percent share, according to the Indian Trade Portal. Furthermore, it ranks second after China with regards to fish, fruit & vegetable production. Also, the food processing sector is the dominating segment in India concerning production growth, export, and consumption, as APEDA (Agricultural & Processed Food Products Export Development Authority) in India reported. It covers fruit and vegetables, spices, meat and poultry, milk and dairy products, alcoholic beverages, fisheries, plantation, grain processing and other consumer product groups like confectionery, chocolates, cocoa products, soy-based products, mineral water, and high protein foods.

The food retail sector in India is, according to APEDA, currently transforming. India has just a small organized retail market and is mainly ruled by small street vendors. As reported by the U.S. Department of Commerce’s International Trade Administration, India’s modern retail sector consists now of about 3000 stores and fast food service restaurants are rising. However, The Ministry of Food Processing Industries (MOFPI) wants to achieve a higher level of processed food in the country, thus takes action to establish 42 mega food parks. Another shift in the agriculture sector, which India is experiencing is moving from traditional farming to horticulture, meat, poultry and dairy products. According to the U.S. Department of Commerce’s International Trade Administration, the poultry industry is evolving rapidly. The report states, India is worldwide the second largest egg and the third largest broiler chicken producer who is gaining importance considering the rapidly growing fast food restaurants.

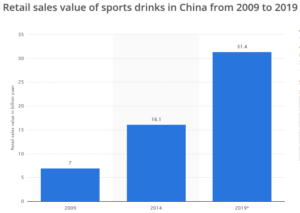

In China, the sports and energy drinks market will further grow quickly, according to Lei Li, a research analyst at Mintel. The rising health consciousness, as well as the government’s support of sports and fitness, led to an explosive growth in that promising sector. Isotonic, protein-based sports drinks and sugar-free energy drinks are of high importance. According to Statista, 31.4 billion Yuan retail sales of sports drinks in China in 2019 were estimated, compared to 16.1 billion CNY in 2014 and only 7 billion in 2009.

As reported by the HKTDC (Hongkong Trade Development Council), targeting the middle-aged and the elderly population in China, has a great potential in the health-food market, as society begins to age. In 2015 seniors at the age of 60 or above had been 222 million. In 2050 however, 400 million within that age group are estimated. Also, females account for major health food consumers. Reasons, therefore, are examples such as beauty or weight loss. Women aged 22-50 are responsible for 60 percent of total sales of all health food. Moreover, one should not underestimate future market opportunities in the rural areas. Though, yet having a weak health awareness, those areas have a quite strong consumption power.

Another business potential is the sales channel Internet retailing. The iResearch’s Fresh Food in E-Commerce in China shows that Fresh food in China e-commerce market has been growing robustly in recent years. Fresh food in China online sales reached 49.71 billion yuan in 2015. Nevertheless, it only accounts for 3.4% of total retail sales of agricultural products, which implies enormous room for growth in the future. The three top reasons for buying fresh food online were to save the time of shopping in supermarkets (65.6%), to save money (59.8 %) –online prices are typically 10 to 20 percent lower than in-store-, and to have access to a more diversified range of products (44%). However, considering the logistics requirements with fresh goods such as their fast delivery may raise difficulties.

Thus, opportunities and challenges arising in different areas within the food industry in India as well as China, not only through the fast-growing populations as well as the demand for more western-style food but also as a result of rising health awareness and changes in consumer behavior.

To know more about China-India food trade relations, contact our dedicated project managers by email at dx@daxueconsulting.com