Intellectual Property (IP) refers to creations of the mind such as designs and symbols that are protected in law. Creators who own IP can obtain recognition or financial benefit accordingly. In the current context, IP can also be extended to film and literature, games and animation that are suitable for multi-dimensional development. With the upgrading of China’s cultural and entertainment consumption, the IP industry has begun to accelerate its prosperity. According to Guosen Securities Economic Research Institute, the size of China’s IP industry will reach 168.6 billion CNY by 2024. However, China’s IP industry still has two core pain points to reach consumers:

1. How does IP generate effective business ideas and apply them to licensing?

2. How to form a benign closed loop between the authorised parties and the consumers in the channel?

In response to these issues, Alibaba launched a new Chinese IP trading platform Alifish in 2016 to transform virtual IP into tangible commodities.

Alifish: A cooperative platform between copyright owners and Ali merchants

One-stop Internet licensing solution

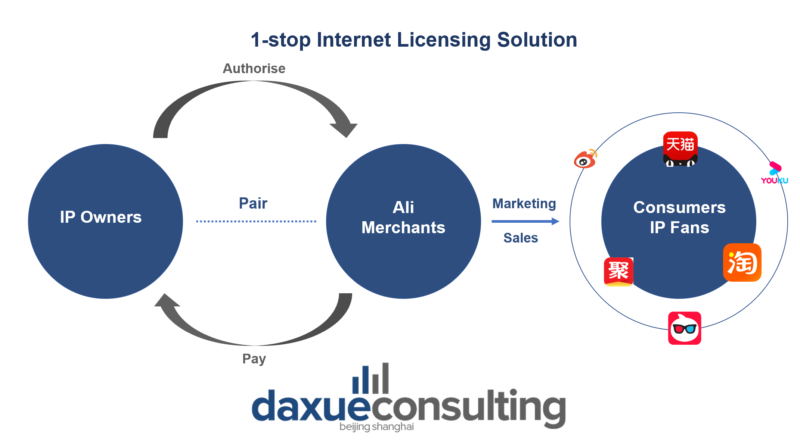

Alifish is an IP trading and entertainment business unit of Alibaba. Comparing with traditional licensing, the unique selling point of Alifish is the “IP2B2C” full process model, which is a bridge among IP owners, Ali merchants and end-users. Alifish integrates Alibaba’s big data resources and capabilities on the IP2B side, assisting the dual-end (IP owners and merchants) in IP index evaluating, IP merchant matching, marketing and much more services. On the IP2C side, to help authorised products reach end consumers, Alifish uses derivatives as a resonance medium for the ecological linkage. By selling derivatives, Alifish can not only increase the life cycle and exposure of IP but also attract target customer groups and maintain the marketing vitality of e-commerce stores.

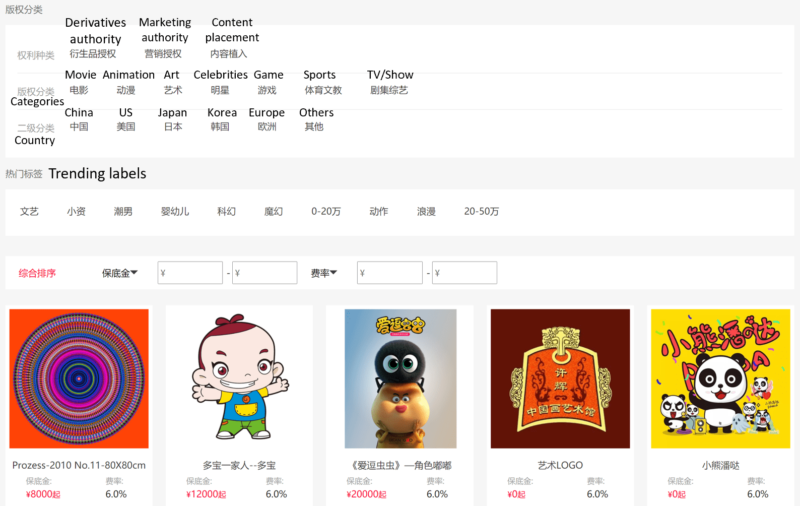

3 types of authorities in Alifish

Alifish mainly consists of 3 kinds of authorities, which are derivatives authority, marketing authority and content placement. Derivatives usually refer to the financial authorisation of a well-known brand or role to a new product or service. For example, movies, games, model figures and clothing accessories derived from the Harry Potter series. Marketing authority applies IP elements to marketing promotions, such as marketing posters and online shop decoration. Film or animation placement and variety show titles are also common modes of licensing cooperation between brands and IP parties. For instance, as a popular Chinese soft drink brand, Genki Forest has sponsored 4 popular variety shows to raise public awareness and interest in its brand.

7 Copyright categories in Alifish

Alifish mainly divides the available IPs into 7 broad segments, including movie, dramas/shows, art, animation, game, celebrities and sports/education. Businesses can easily search IP by filtering these categories.

How can copyright owners get involved in Alifish?

It is worth noting that Alifish firstly investigates the qualifications of copyright owners during the internal test period. Only well-known and high-quality domestic and international copyright parties will be invited to join in. Copyright holders can be either enterprise, individuals or other organisations.

Once businesses upload the required files successfully, they can publish the IP and set the licencing price on the platform. Alifish will charge IP owners a technological service fee, which refers to a certain percentage of the authorised amount (including the authorisation deposit and licence fee) of the copyright party operating on the platform (referred to as the “rate”). The current range of the service fee is from 0% to 6%.

Finally, IP owners can start finding merchants to cooperate with. Alifish owned 100 thousand high-quality merchants coming from Taobao and Tmall E-commerce platforms. According to the graph shown below, IP owners can directly pair and trade with proper Ali merchants without a middleman. When Ali merchants complete the payment of IP, Alibaba’s ecological system will provide omnichannel joint marketing solutions and deliver 400 million IP fans and end consumers to them.

Opportunities in China’s IP industry

A large market with a relatively low concentration

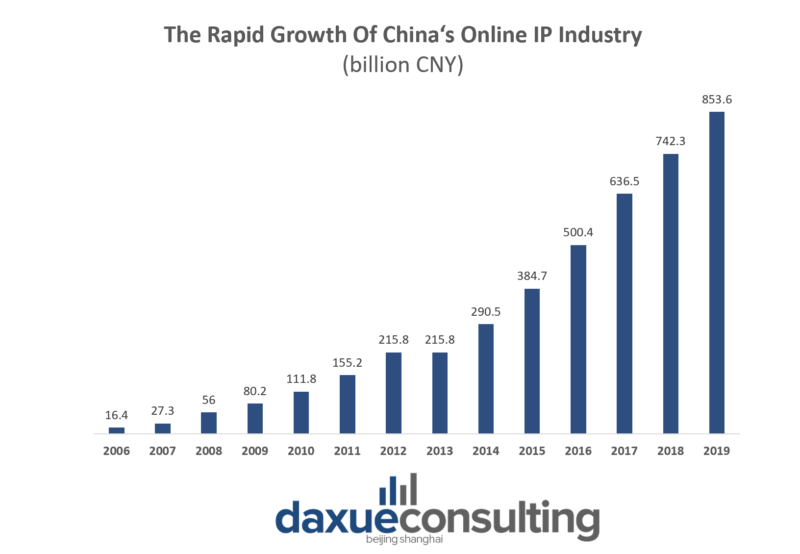

According to Huaxi Securities, the size of China’s online IP industry is close to 1 trillion CNY, growing from 16.4 billion CNY to 742.3 billion CNY from 2006-2018, with a compound growth rate of 37%. Moreover, IP-branded goods and Chinese IP trading platform are becoming new consumer growth points.

IP co-branding is becoming more trendy

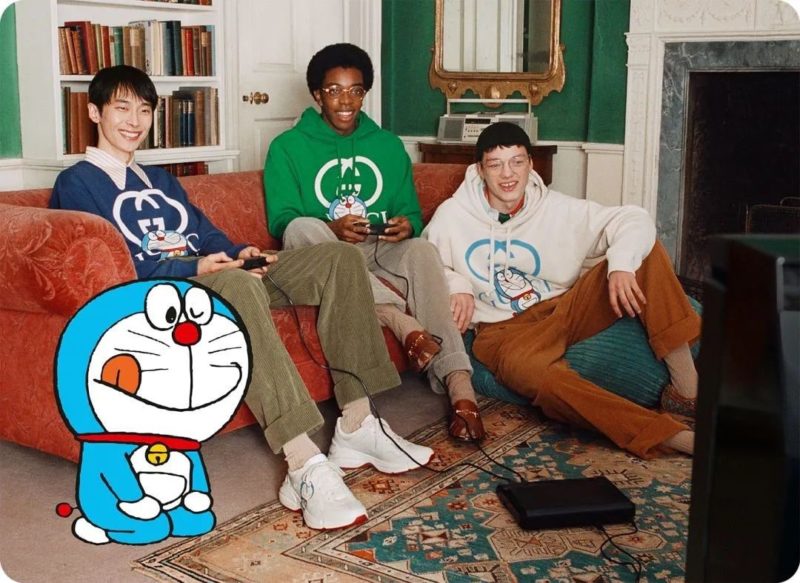

The 2021 Tmall Apparel White Paper shows that the growth rate of Tmall Apparel IP co-branded models exceeded 60% in 2020, giving birth to many single products with sales of over 10 million. For example, Gucci’s special Doraemon capsule collection for the Chinese Lunar New Year comes just half a month after the last joint collection with The North Face, and the Mickey Mouse co-branded products launched a year ago continue to be a hit with Chinese consumers.

One of the competitive advantages of businesses applying IP co-branding strategy is that brands can achieve win-win cooperation and reach more potential consumers. For example, Uniqlo released its fashion collaboration with KAWS in China in 2019. As a hip brand known for its street graffiti, KAWS combined its creative and fashionable design with Uniqlo’s visibility and comfort. As a result, the search index of both Uniqlo and KAWS has risen rapidly on WeChat since the series was launched. The products in Uniqlo’s Tmall flagship store were also sold out in three seconds, which generated high levels of buzz for the brand and effectively increased its sales volume.

However, for brands that want to establish their own style, it is also important to think through their brand positioning before using IP co-branding. An unsuitable partner will lead to a serious public relations crisis for the brand, such as Hey Tea launched their unsuccessful co-branding campaign with Durex in 2019. At a time when IP co-branding is no longer a novel marketing technique, it is crucial to be more creative and cautious with your brand to attract attention.

Governance of network IP infringements

China started its copyright legislation in 2001, and after nearly 20 years of changes, the policy has continued to strengthen the scope and intensity of copyright protection. At present, in the context of the new international environment and industrial upgrading, the IP industry is included in the “13th Five-Year Plan”, and China has made the industry a key strategic direction.

Threats to China’s IP trading industry

Rare high-quality IP

There may seem to be a wide range of IPs nowadays, but there are very few super IPs that can become a “ratings leader” in China. Moreover, since 2014, the price of high-quality IP is even comparable to the wildly rising real-estate market. Among them, novels, animation, film and television category the most popular. For instance, the IP of a popular novel rises to a range of 2 to 5 million CNY, with some of the most popular novels’ IP even selling for up to 10 million.

Piracy squeezes out the genuine IP trading market

Compared to the more comprehensive copyright protection systems in western countries, domestic copyright protection is still in its infancy, and the long-term prevalence of piracy has significantly crowded out the development of the legitimate market. The main reasons include deficiencies in regulations and supervision, small penalties, and relatively weak domestic consumers’ copyright awareness. The low prices of counterfeit products are attractive to some groups.

Key takeaways about the China’s IP industry

- With the gradual improvement of the IP industry chain and increasing market, the IP trading platforms led by Alifish brought more convenience and comprehensive authorisation experience for IP owners and Ali merchants.

- IP co-branding is becoming a popular way for businesses to increase sales in China. The traditional brand image, transformed into a highly empathetic, interactive IP role, in cognition beyond the traditional is the trend.

- Although China has promulgated a number of laws and regulations on IP copyright in recent years, the general public’s awareness still needs to be improved and there are relatively light penalties for plagiarism. Therefore, merchants who want to enter the Chinese IP market need to bear certain risks.

Author: Yifan Ma