China’s medical device investment sector is fueled by an aging population, rising healthcare demand, technological advancements, and strong government support. From 2012 to 2022, China’s total health expenditure more than tripled to RMB 8.5 trillion, while the medical device market reached RMB 336 billion in 2022, making it the second-largest globally, behind only the US.

Despite the short-term impact of an anti-corruption crackdown initiated in July 2023, which initially deterred investors, the sector is expected to benefit from improved transparency and regulatory oversight in the long run. The campaign targeted hidden kickbacks such as bribes disguised as lecture fees or conference sponsorships. It was aimed to reduce inflated medical device costs and redirect spending towards innovation. As such, projections indicate that China’s medical device market will continue to expand, reaching more than RMB 511 billion by 2027.

Investment trends: How China’s healthcare sector is adapting to global market shifts

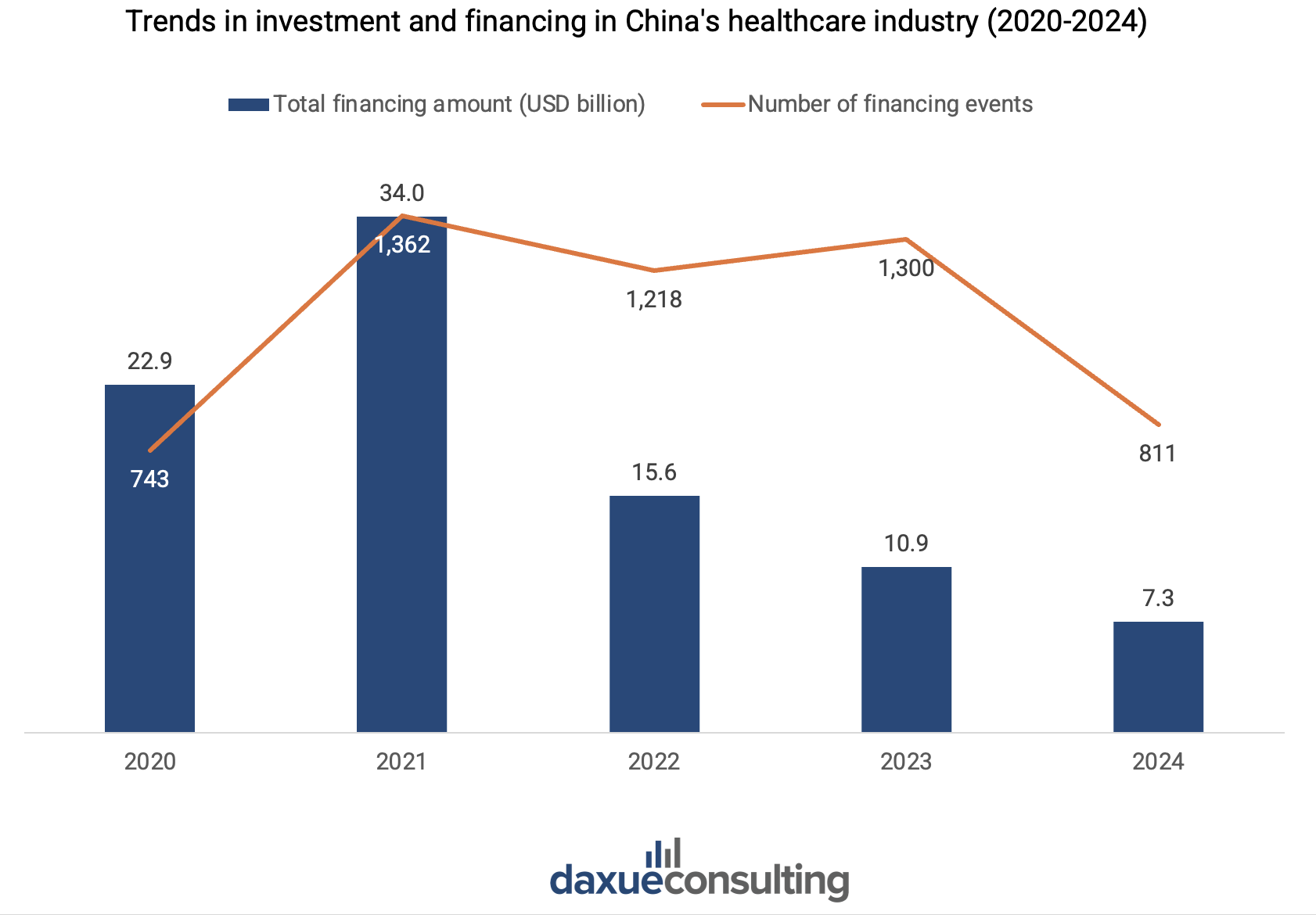

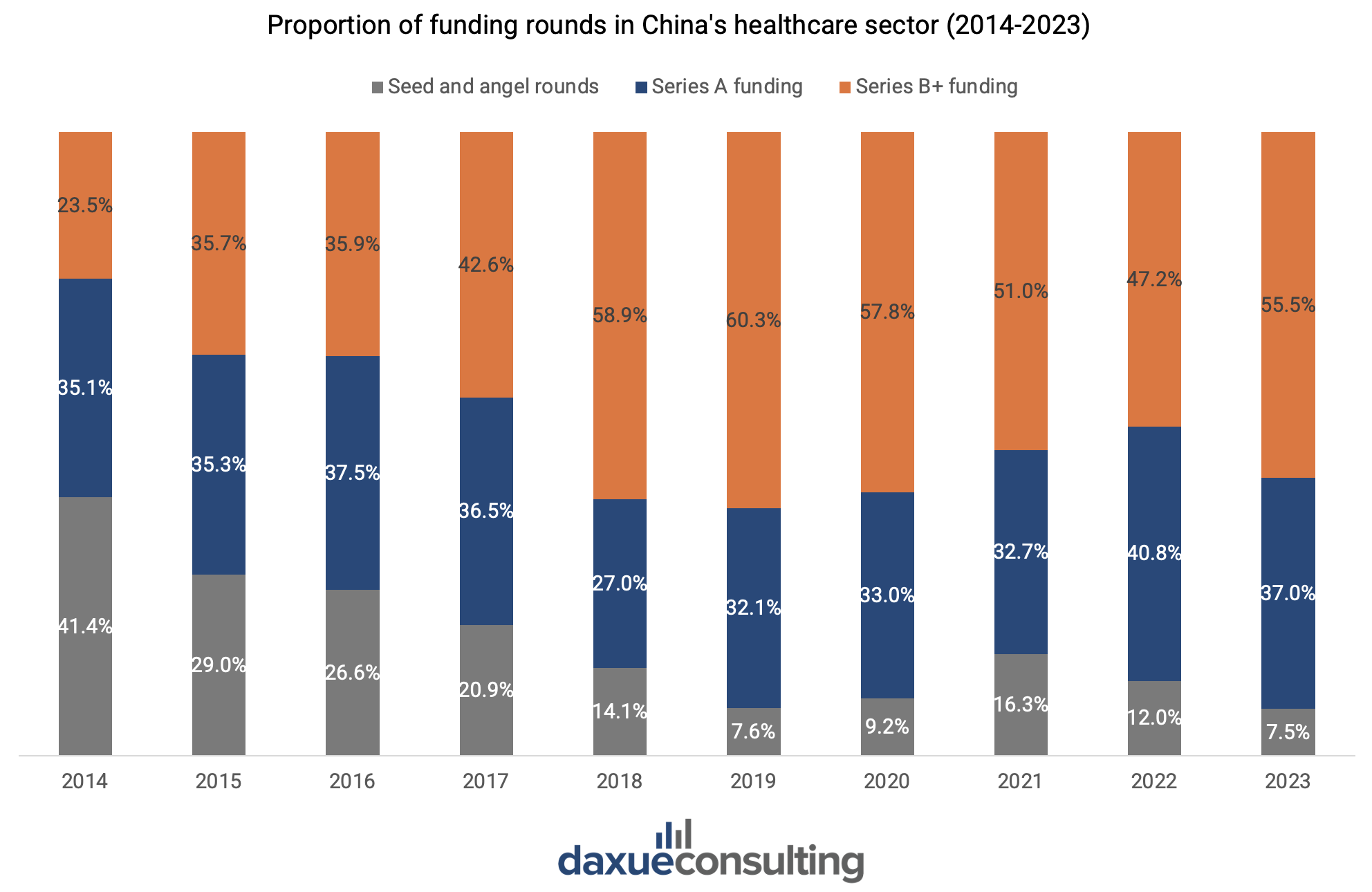

After peaking in 2021 due to the pandemic-driven rapid growth in demand for medical products, China’s healthcare financing declined by 33% in 2024, reaching USD 7.3 billion (RMB 53.3 billion). Deal volume also dropped by 38%, falling to 811 transactions in the primary market. Investors are taking a more cautious approach. This is reflected through a decreased proportion of seed and angel rounds and a shift towards later-stage funding rounds, with preferences for mature and high-certainty projects. Series B funding remains the most common across industries, offering a balanced approach for investors seeking to mitigate risk while still positioning themselves early enough to capitalize on growth potential.

On the other hand, the drop in financing volume is not solely a crisis, it is also a reflection of the China’s healthcare industry’s growing maturity. Unlike early-stage biotechs and medical device manufacturers that rely on VC funding and IPOs, established Chinese biopharma companies turned to outlicensing as a strategic choice. For instance, in 2022, BeiGene outlicensed TIGIT inhibitor ociperlimab to Novartis for USD 300 million up front cash payment with potential royalties of USD 1.9 billion from Novartis whilst gained China rights to five Novartis oncology drugs.

Government-backed funds: Fueling growth in China’s medical device industry

The Chinese government’s proactive approach to fostering healthcare innovation and investment is exemplified by policies like the “17 Measures for Venture Capital” (创投十七条). It encourages international investment institutions to establish RMB funds and expand the openness of venture capital, attracts global capital, and signals a commitment to integrating international expertise and resources into its domestic healthcare innovation landscape.

For example, aligning with the government’s “17 Measures for Venture Capital”, Hillhouse Capital, a globally recognized investment firm with strong ties to international markets, launched the Protection-Oriented Strategy Fund, which integrates equity-debt hybrid investment tools such as preferred shares, convertible bonds, and stock warrants to de-risk investments while expanding into biomedicine, advanced manufacturing, and technology sectors in China.

Local governments, such as Shanghai, are amplifying these efforts through initiatives like the establishment of an RMB 89 billion industrial mother fund, with RMB 21.5 billion allocated for high-end medical devices, as well as innovative drugs, advanced formulations, biotechnology, and pharmaceutical equipment. This targeted funding enables local companies to scale innovative solutions and compete globally while presenting an opportunity for foreign companies to collaborate with local players and leverage government-backed funding mechanisms to accelerate growth. However, challenges such as regulatory hurdles and intellectual property concerns remain.

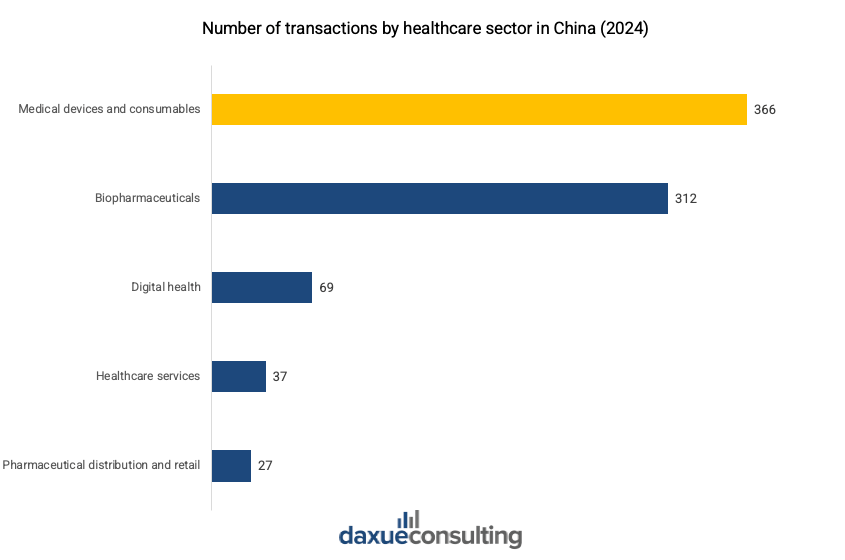

Within this supportive environment, the medical devices and consumables sector has emerged as the most active category, accounting for 45.1% of all healthcare sector transactions, with the highest number of Series A and B deals. This dominance reflects investor confidence in the sector’s growth potential, particularly during the expansion and growth stages.

Why are China’s innovative medical devices attracting investors?

One of the most attractive aspects of China’s medical device investment is the exemption of innovative medical devices from centralized procurement. The policy is designed to foster innovation and support the development of advanced medical technologies. Unlike high-volume medical consumables, which are subject to government-imposed price reductions through volume-based procurement, innovative devices benefit from pricing flexibility and market-driven growth opportunities. This exemption allows manufacturers to recoup R&D investments, maintain profitability, and sustain continuous advancements in medical technology.

The National Healthcare Security Administration supports this policy by refining market access rules, streamlining approval processes, and introducing competitive pricing mechanisms. This regulatory flexibility allows companies to develop high-end medical technologies without immediate pricing pressures, ensuring higher margins and long-term market exclusivity.

From an investment standpoint, this exemption mitigates the price erosion risk that centralized procurement imposes on standard medical devices, which often experience sharp price declines post-procurement. This makes innovative medical devices a more attractive investment, offering a stable and defensible competitive landscape. Their incremental improvements and complex manufacturing processes further reinforce their long-term value. This ensures gradual performance enhancements rather than disruptive market shifts.

A snapshot of the key investment areas of China’s medical device sector

Surgical robots exemplify this trend, securing 55.6% of the RMB 2.6 billion funding in therapeutic equipment. They are also among the innovative medical devices approved by the National Medical Products Administration in 2024. This aligns with China’s strategic push for high-end medical innovation and reduced reliance on imported technologies.

High-value medical consumables—including cardiovascular, ophthalmic, and medical aesthetic applications—represent another category of medical devices with the most funding in 2024. This category received RMB 3.9 billion across 47 financing events in 2024, further highlighting investor confidence in advanced medical technology.

AI-driven healthcare: A rising frontier

The AI health sector is also experiencing an investment boom, driven by the rapid advancement of AI technologies and their transformative impact on healthcare. By 2025, China’s AI healthcare market is projected to exceed RMB 70 billion.

The democratization of AI, exemplified by the release of cost-effective models like DeepSeek, has lowered the barrier for enterprises to adopt AI and created opportunities for companies with access to rare, high-quality, and multi-modal data.

For instance, E-Health Now, a one-stop AI-driven digital healthcare service platform with an AI triage system that quickly analyzes symptoms, recommends suitable hospitals and doctors, improves medical efficiency, and reduces costs, secured nearly RMB 100 million in Series C funding from investors including Ameba Capital, Ventech China, and BeeHive Capital in 2023.

Top investment players: Leading firms shaping China’s medical device market

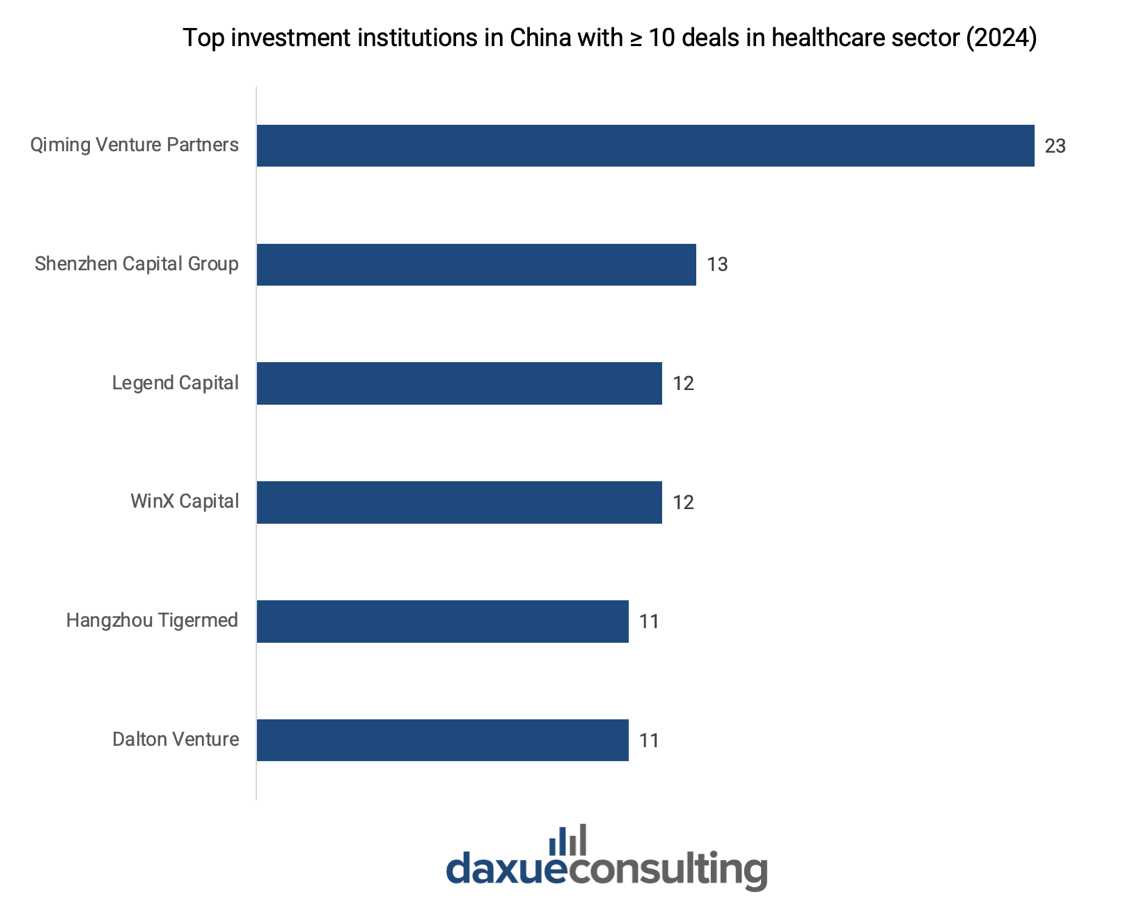

Local venture capital firms have been instrumental in advancing China’s medical device sector. Qiming Venture Partners, among all, led the market with 23 investments in 2024, including both new deals and follow-on funding for existing portfolio companies.

Notably, the company has actively backed companies like Tingsn Technology (medical imaging & interventional devices), Dr. Clear Aligner (orthodontic consumables), Reunion (medical hydrogel), and DK Medical Technology (interventional devices), with funding amounts ranging from RMB 70 million to over RMB 100 million.

Additionally, top-tier domestic investors such as Shenzhen Capital Group, Legend Capital, WinX Capital, Tigermed, and Dalton Venture—each with over 10 deals in 2024—demonstrate a strong appetite for collaboration with innovative companies.

Recently, Sequoia Capital China and EFung Capital co-led a RMB 100 million A+ funding round for MedEdge Innovations – an innovative medical device developer specializing in peripheral vascular intervention, tumor intervention, and hemodialysis access maintenance – showcasing investor confidence in domestic innovation.

What does it mean for foreign investors?

China’s medical device market is shifting from a cost-driven, volume-based model to an innovation-focused ecosystem. Foreign investors and companies, particularly those with cutting-edge technologies and expertise, can leverage their strengths in advanced medical technologies through strategic partnerships, joint ventures (JVs), and co-development initiatives with local players. These collaborations not only provide access to China’s vast capital markets but also offer regulatory expertise, market access, and local networks. For instance, JVs allow foreign companies to share capital costs with local partners, simplifying market entry and reducing financial burdens.

The investment landscape in China is also maturing, with innovative financing models like Hillhouse Capital’s Protection-Oriented Strategy Fund offering structured options that balance risk and return. This diversification lowers barriers for foreign firms expanding or establishing local operations. Given the challenges to accessing capital, foreign companies may benefit from government assistance by locating domestically, while JVs remain a popular strategy for tapping into China’s capital markets via local partners. Additionally, setting up local operations, though requiring more upfront investment, can lower production costs and enhance after-sales service capabilities in the long run.

China’s medical device investment: Key trends shaping the future

- China’s medical device market is growing rapidly and is projected to surpass RMB 511 billion by 2027. It was driven by technological advancements and strong government support.

- Government-backed funds are fueling innovation and supporting high-end medical device development.

- Innovative medical devices are exempt from centralized procurement, ensuring higher profit margins and long-term market exclusivity.

- Surgical robots secured 55.6% of RMB 2.6 billion in funding, reinforcing investor confidence in robot-assisted medical technologies.

- AI-driven healthcare investments are booming, with China’s AI healthcare market projected to exceed RMB 70 billion by 2025.

- Top investment firms like Qiming Venture Partners, Shenzhen Capital Group, and Sequoia Capital China are leading the market with multiple high-value deals.

- Foreign investors can leverage joint ventures, co-developments, and local partnerships to access China’s capital markets, regulatory expertise, and networks. Moreover, innovative financing models and government incentives further lower entry barriers and support long-term growth.