China’s baby formula market has faced several challenges over the past two decades, leading to a decline in consumer trust. One of the most significant incidents that rocked the industry occurred in 2008, when melamine was found in contaminated baby formula products. Because the toxin was identified in a Chinese brand, the situation scared families away from domestic producers and resulted in a market that was welcoming for foreign firms.

Download our report on how young Chinese Consumers are Finding Themselves

The second shock was a scandal that happened in 2014, when toxic bacteria was found in imported dairy products from New Zealand. At the time, the demand for baby formula was rising in China, and the event instantly led to a drop in imports and created a situation where supply could not meet demand. With the government’s efforts to promote Chinese producers, the industry began to shift its focus back towards local companies. By 2020, baby formula makers accounted for 53% of the China market, and the market is expected to grow at a CAGR of more than 7% during the period 2021-2027.

Is the market growing as strongly as expected?

There were many expectations for China’s baby formula market to show substantial growth in the past few years, driven by the Chinese government’s efforts to increase birth rates as a response to demographic challenges. Authorities aimed at easing the country’s child policy, with the significant move in 2021 allowing families to have up to three children. However, due to the large changes in people’s priorities and lifestyles, the policy did not result in the expected growth of population.

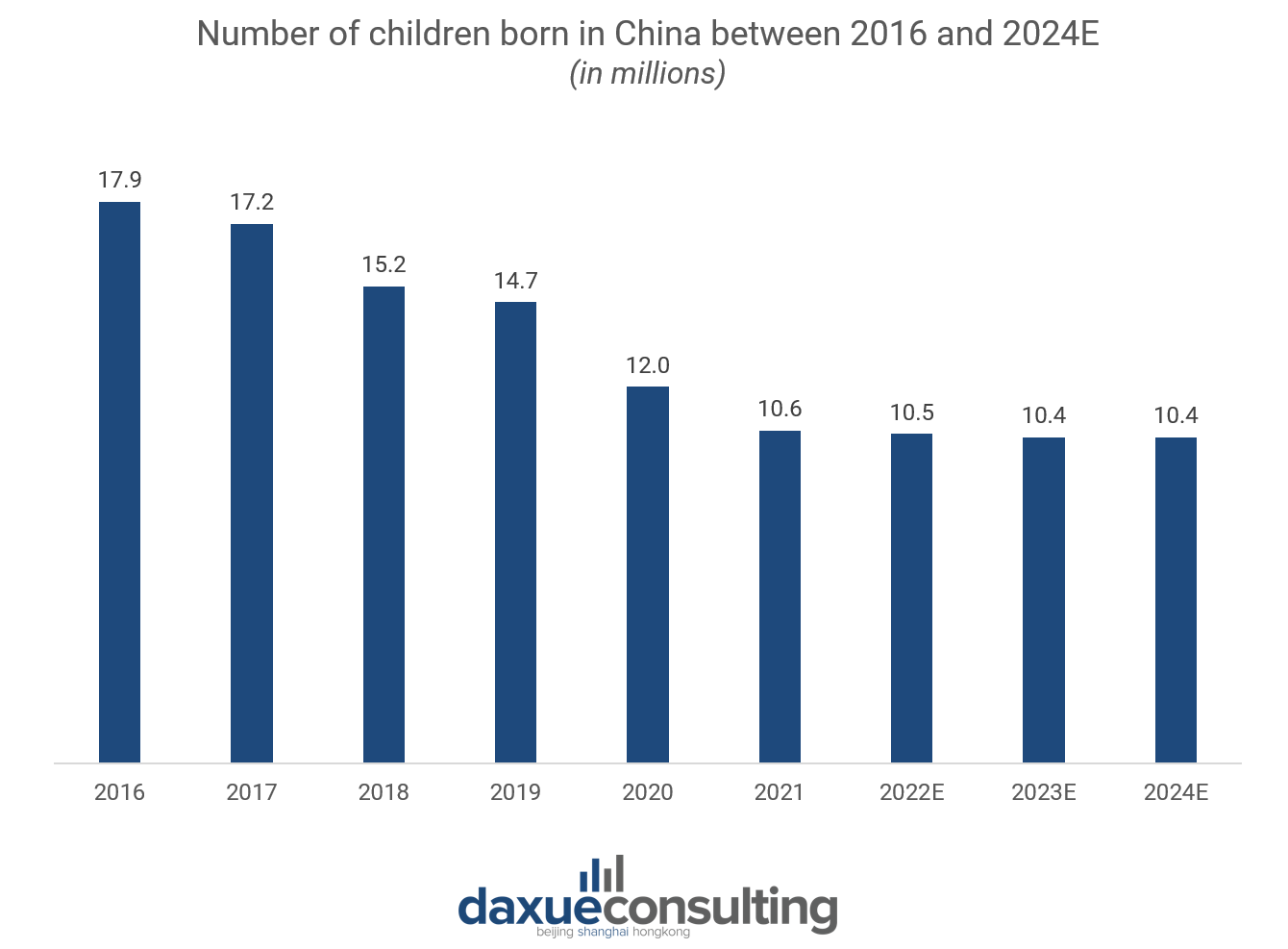

Indeed, China’s demographic landscape is undergoing significant changes. The country’s births have been declining in the past decades, seeing a sharp drop of almost 2% in 2019-2020, followed by similar decreases in the following years. Fewer women and couples desire to create large families, with some opting to have no children at all because of high prices and value changes. According to Guoyuan Securities, in 2023, the proportion of one-person households across the country has reached 25.4% of total households, representing an increase of 11.4% compared to 2011.

These demographic changes will inevitably affect China’s baby formula market. However, there is hope that the market will continue growing due to premiumization and higher prices.

Safety is a priority for both consumers and officials

With a growing focus on quality and safety, Chinese customers in the baby formula market are becoming more discerning. In general, consumers in China are preferring to purchase fewer, higher-quality, but more expensive goods. The recent food safety scandals, shifting health priorities due to the pandemic, and growing disposable wealth all contributed to this change in choice.

The Chinese government concentrated its efforts on tightening industry safety controls in order to support families. To improve the safety and quality of infant formula, strict rules were implemented in February 2023. These regulations require producers to spend a lot of money on product reformulation, testing, certification, and re-registration before initiating new marketing campaigns. Most importantly, the standards have changed the requirements for nutrient levels and lactose content, as well as banned certain elements, in an effort to match infant formula as closely as possible to breast milk.

This policy will affect the constitution of the market. As a result of these changes, smaller or foreign players are likely to exit the market due to the resource-intensive registration process, which can last up to one year. The government’s aim is to reduce the number of players in the market and strengthen the safety standards this way.

Will the governmental policies boost domestic baby formula producers?

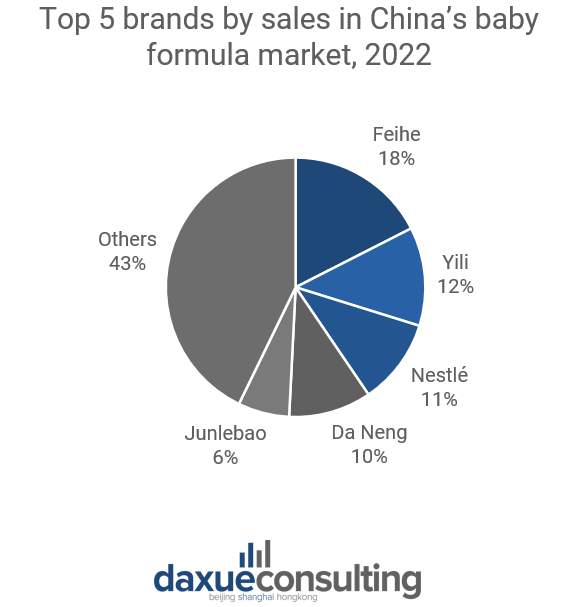

China has been seeing consumer interest in domestic companies rise in the past few years, not least owing to the Guochao trend. Now, the newly implemented regulations may help local producers gain even more market share. In 2021, the leader in the industry was Feihe, a Chinese brand, with a market share of 19%. The same year, domestic brands already accounted for 60% of the market. However, even though some growth is seen, Chinese companies remain pessimistic about the future of the market: even if their market share grows, the total sales are likely to be reduced.

It has yet to be seen whether the enacted policy will further boost local companies. However, as of September 2023, a number of foreign brands were struggling with re-registration and considering turning away from the market. In 2022, the top five brands in sales were Feihe, Yili, Nestlé, Da Neng, Junlebao. Respectively, the brands accounted for 17.5%, 12.3%, 10.7%, 10.3%, 6.4% of market share. This shows the dominance of large Chinese players in the industry.

The current state of the troubled China’s baby formula market

- China’s baby formula market underwent problematic times, and is now shifting from foreign to local producers.

- The government is attempting to boost the market through eased child policies, but it is unlikely to lead to the expected growth due to declining birth rates.

- The government is tightening regulations to prioritize safety and quality, which is a response to family’s concerns over product quality.

- The efforts may further boost domestic brands, but the overall market size is likely to reduce.