Fast-Moving Consumer Goods (FMCG) are typically non-durable products that are sold quickly at a relatively low cost. These products have a short shelf life either due to high consumer demand or their perishable nature. COVID-19 changed consumer purchasing behavior and significantly affected China’s FMCG industry.

What is going on in Chinese FMCG industry

China’s FMCG industry sales have been slowing down even before the pandemic yet throughout that time, the sector had been experiencing five years of premiumization. The continuous increase in China’s overall sales of fast-moving consumer goods, however, was forced to halt after COVID-19 sparked a significant shift in consumer spending habits.

FMCG spending in China saw a significant decline in the first quarter of 2020. The decrease in overall value in 2020 is caused by the lower average selling prices (ASP). During this uncertain period, cautious shoppers stocked up on necessities, searched for lower-priced goods, and delayed purchasing anything nonessential. They waited for discounts to purchase packaged drinks and foods and choose to buy the cheaper variants of home and personal care products, or they shopped in bulk.

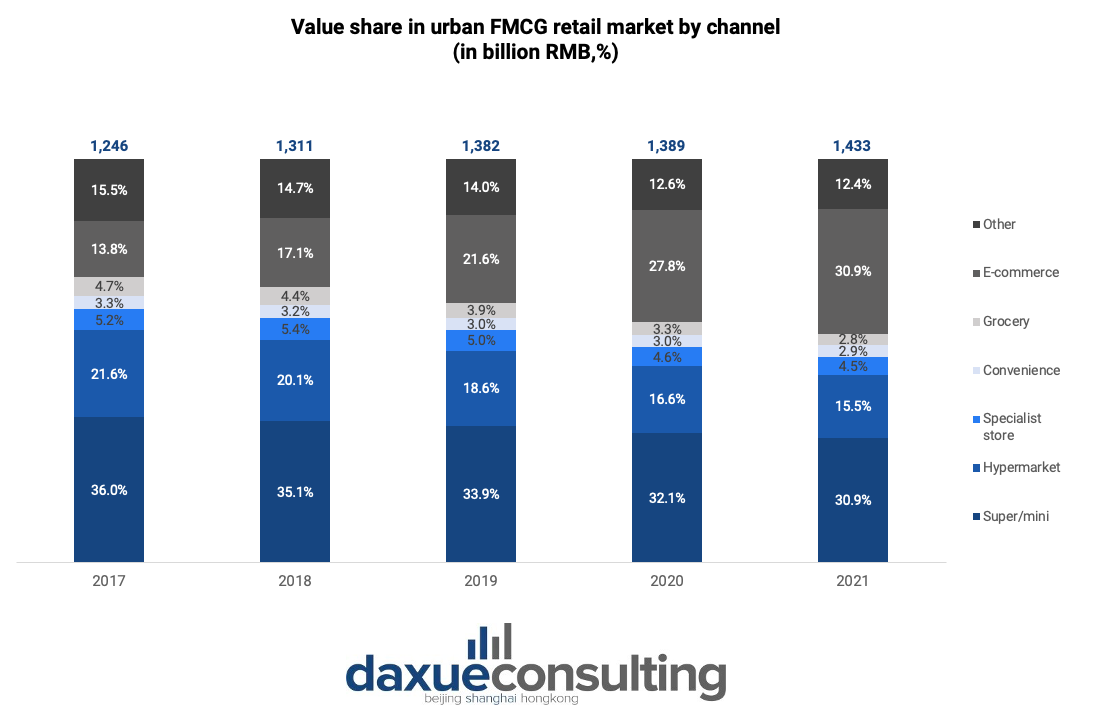

In 2021, the situation started to improve. Last year the sales value totaled around RMB1.43 trillion, increasing from around RMB1.39 trillion in 2020. The overall value of China’s FMCG industry increased by 3.1% in 2021, primarily driven by volume growth while ASP continued to deflate.

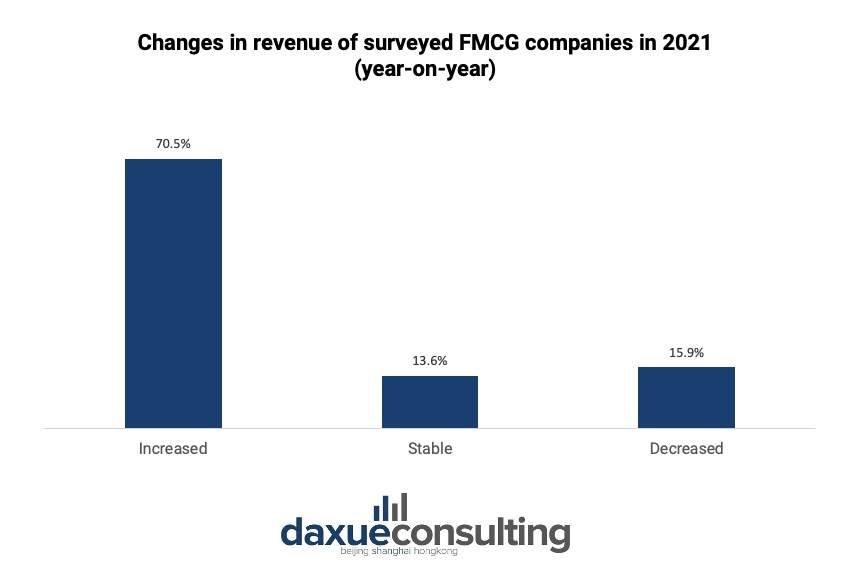

According to a report published by the Oriental FMCG Center, 70.5% of FMCG companies in China experienced an increase in sales in 2021.

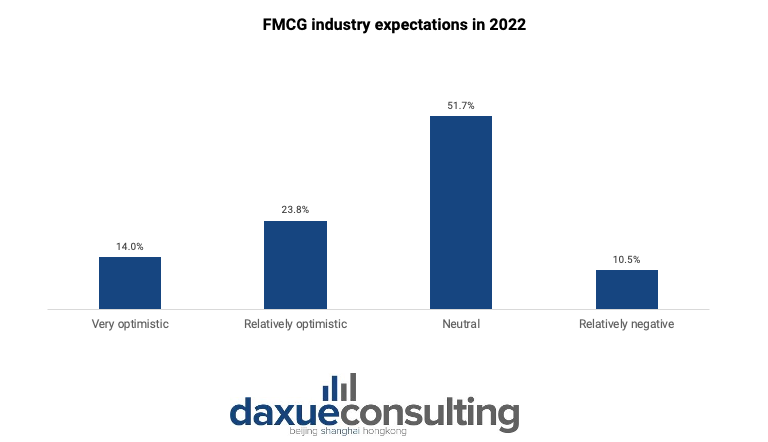

The Chinese FMCG industry’s positive dynamics from 2021 persisted into early 2022. However, its trajectory flipped in March and April this year. Most of FMCG businesses are currently having trouble managing the impact of lockdowns. While volume increased, prices of fast-moving consumer goods fell significantly in March, slowing the total expansion of the FMCG sector.

Breaking down the product category of the FMCG industry in China

There are hundreds of product categories within the FMCG industry, but it can be divided into four consumer goods sectors: packaged food, beverages, personal care, and home care.

Regardless of the sectors, there is a strong trend that Chinese consumers are becoming more health conscious. Therefore, while household consumption categories fell, products that are delivering a higher quality of life grew quickly.

The beverage sector is leading the growth in China’s FMCG industry

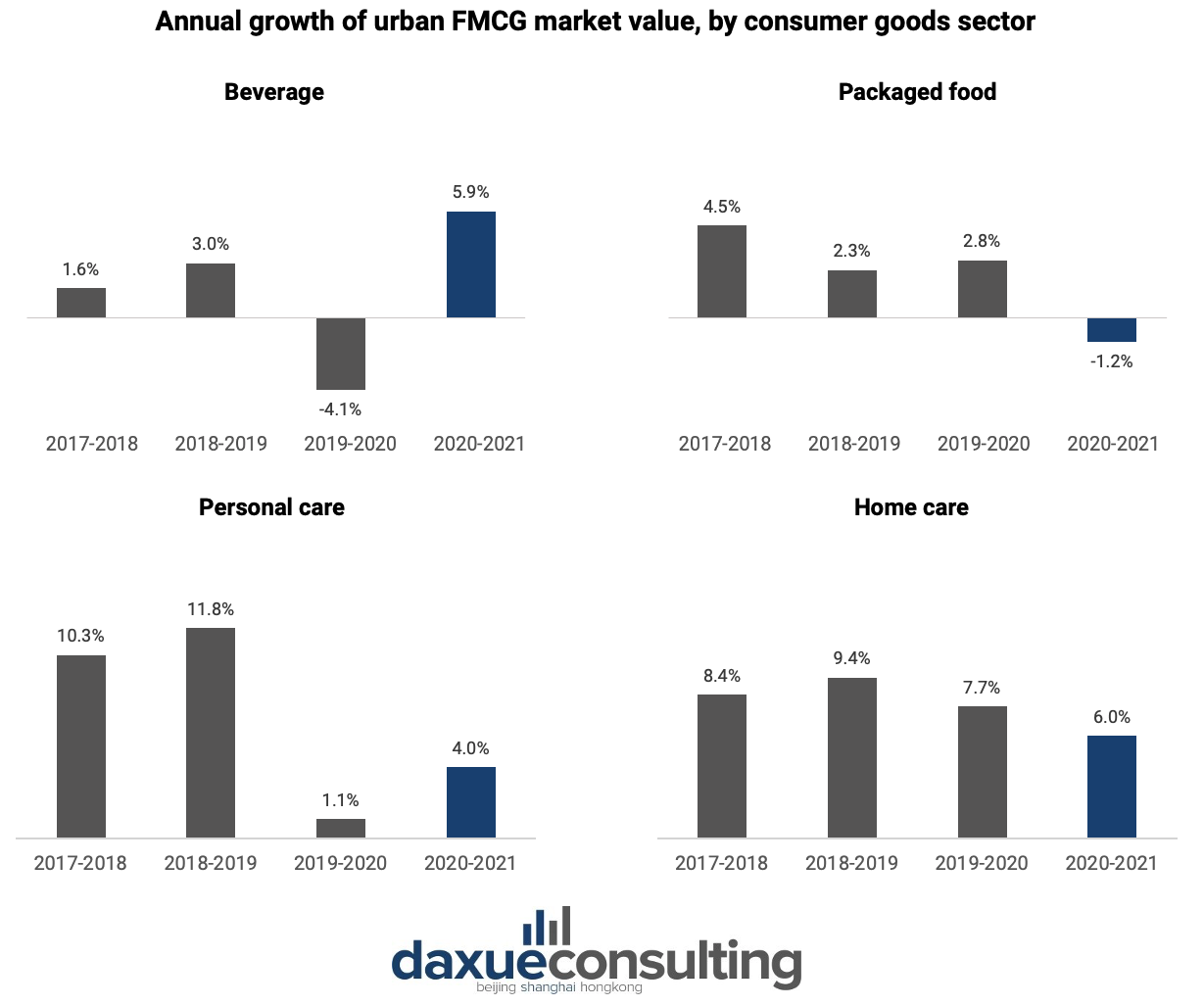

The beverage industry boasted the highest performance among the four main consumer goods sectors in 2021, growing by 5.9%. The value of carbonated soft drinks was the one that increased the most, by 16.7%. This is because beverage companies, such as Genki Forest, significantly increased the market demand with their higher-priced, calorie-free carbonated soft drinks which aligns with the health trend in China.

After Zhang Wenhong, a renowned infectious disease expert, recommended drinking milk for its immunity-boosting properties in April 2020, the milk category’s value still enjoys a rise in popularity and grew by 14.7% in 2021. The dairy sector took advantage of the widespread consumption of milk by putting a strong emphasis on premium milk varieties in its product line.

There are other segments in the beverage industry that keep growing fast. For example, as people got used to stocking up on goods even after the restrictions are relaxed, packaged water grew in 2021. China’s beer market value also increased by 6.7% as companies promote premium and imported varieties. However, demand for wine and foreign spirits decreased with fewer big parties and major events.

Packaged food’s value declined in 2021

China’s packaged food market size fell by 1.2% in 2021 due to a drop in both value and average selling price. Initially, Chinese consumers kept a large stock of instant noodles. However, as people anticipated the end of COVID-19 in 2021, the volume of this category fell by 9% last year. The biscuit category suffered an even bigger loss. The volume fell by 11% as more consumers switched to premium brands but purchased fewer of them.

Personal care and home care continue to grow

In 2021, Chinese personal care and home care market experienced a growth of 4% and 6%, respectively. Shampoo and kitchen cleaner both witnessed an increase in terms of value(5.7% and 10%).

Both skincare and makeup categories were hit at the beginning of the pandemic. However, while skincare demand went back up, the makeup category never reached its pre-pandemic level and kept declining. In response to intense competition, some cosmetics and personal care firms increased sales through promotions. Thus, promotions accounted for close to 30% of all makeup sales in China last year.

Exploring sales channels, city tiers, and key players in China’s FMCG industry

E-commerce is growing

While other channels are declining, e-commerce sales grew rapidly over the years. In 2021, e-commerce accounted for more than 30% of the national fast-moving consumer goods sales in China. All categories across the board saw an increase in online penetration, but their growth pace slowed down. Other than e-commerce, supermarkets and minimarkets are also taking a significant portion of the sales share.

Cities with different tiers have different trends

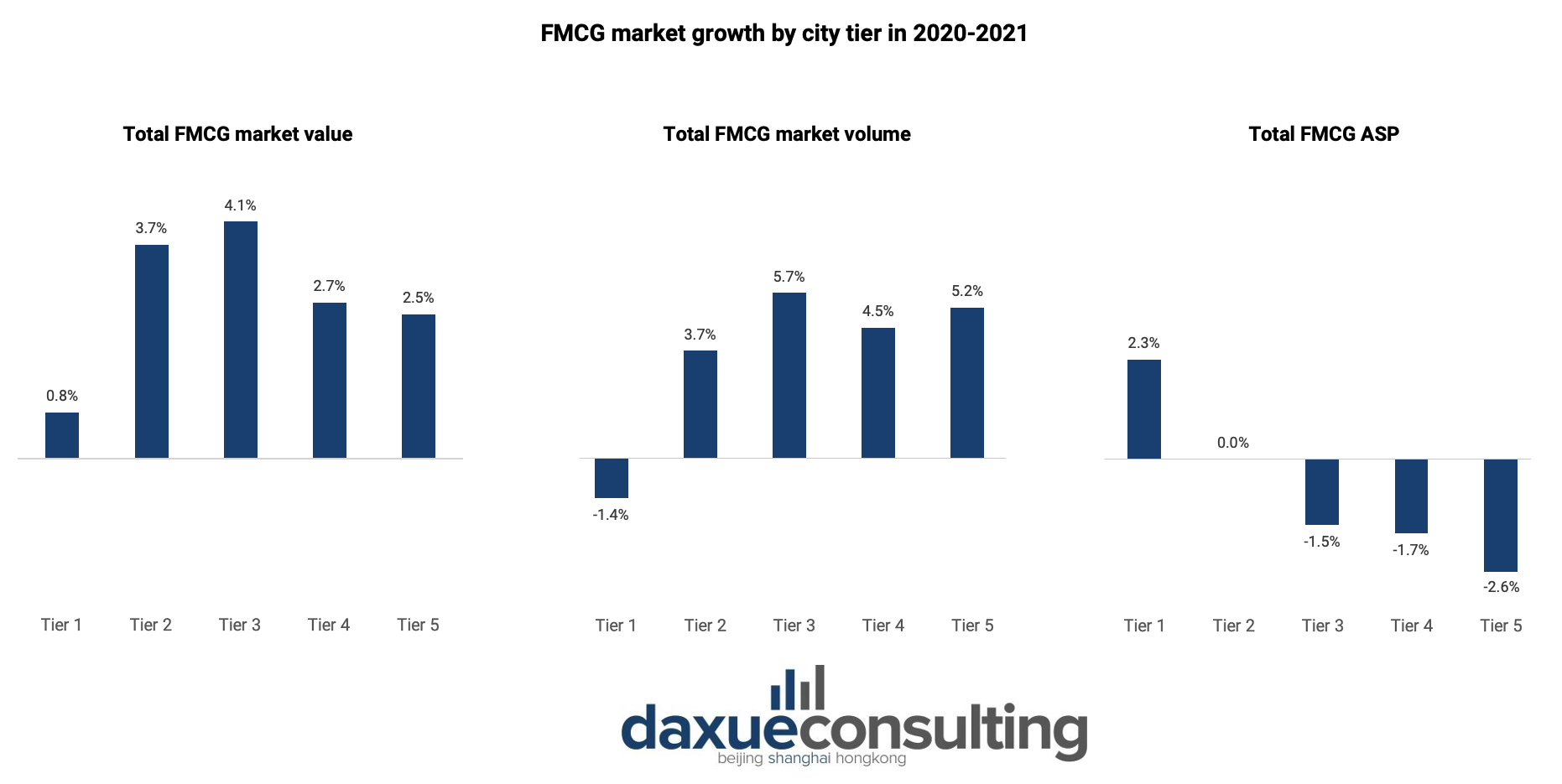

Together, Tier 2 and Tier 3 cities in China make up over 60% of the country’s whole FMCG market value in 2021. Premiumization, however, only applies to Tier 1 cities, while lower-tier cities saw an increase in volume and lower prices.

Looking at the key players

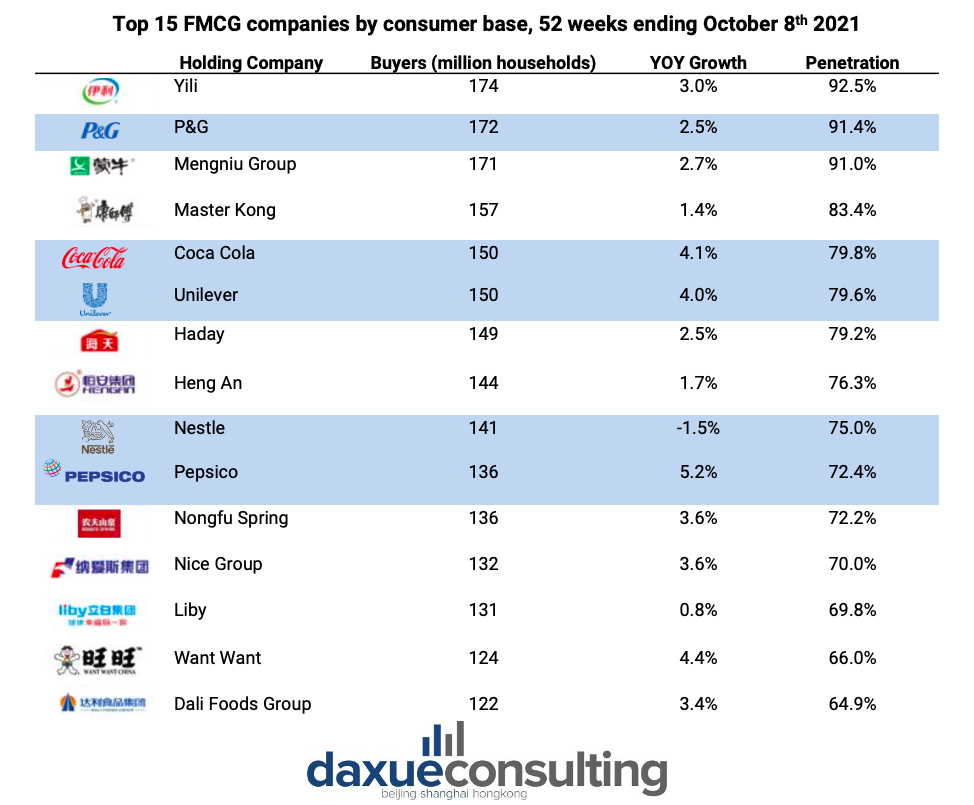

In 2021, most companies boasting the biggest consumer base are local firms. Dairy enterprises like Yili and Mengniu have maintained their top positions. With the help of its dairy product line, Want Want was able to increase its customer base by 4.4% and reach about 9.2 million new households. In contrast, PepsiCo, Coca-Cola, and Unilever gained new customers by drawing people who were searching for comfort and joy during this stressful and unsettling time.

Foreign companies are banking on premiumization. On the contrary, local players are concentrating on growing their volume. This could be an explanation as to why there are more local than international companies on the board.

The marketing landscape of the Chinese FMCG industry

The fast-moving consumer goods market is both very large and highly competitive due to the high turnover rate of their products. Companies in the FMCG industry are constantly competing with each other to lure and attract customers to purchase their products. Therefore, implementing the correct marketing effort is crucial.

As previously mentioned, e-commerce was the only channel to continue to experience strong growth in 2021. However, e-commerce platforms, such as Alibaba, are becoming more and more fragmented as other rising channels started capturing significant market share. Group-buying apps like Pinduoduo and Meituan Select interest-based e-commerce sites such as Douyin and Kuaishou, and live streaming platforms including Taobao Liveare also gaining popularity.

Customers are increasingly making purchases of products they watched on short videos and live streams. Therefore, brands are now opting for omnichannel marketing strategies and enhancing their operational capabilities to reach different consumer segments and satisfy different needs.

Implications for players in the FMCG industry in China

The COVID-19 outbreak made the market more volatile in general. Brands and retailers need to start strategizing and become more agile to react appropriately given the present political and economic climate.

Brands can assess their product portfolio and customize their product propositions based on the city tier and segment while also diversifying into rising channels–live streaming and community group-buying platforms.

Retailers are also remodeling their retail value offer, concentrating on markets with low online penetration, setting competitive prices to set themselves apart from online platforms, and improving the in-store experience.

What to know about the Chinese FMCG industry:

- The growth of the FMCG industry in China slowed down during the COVID-19 pandemic due to the consequent shift in consumer spending behavior.

- China’s FMCG industry’s value decreased in 2020 but improved in 2021, predominantly pushed by volume growth. Yet, the expansion of the industry declined again in 2022.

- Fast-moving consumer goods can be grouped into four consumer goods sectors: beverage, packaged food, personal care, and home care. Consumers in China are now opting for healthier products across all sectors.

- The beverage sector is leading the growth in 2021. The personal care and home care sectors’ value also increased while packaged food sector’s value decreased.

- E-commerce is the only sales channel that grew over the years. However, it is getting more fragmented due to the appearance of emerging platforms such as Pinduoduo and Douyin.

- Tier 2 and Tier 3 cities account for over 60% of China’s whole FMCG market value. However, only Tier 1 cities experienced premiumization.

- Local players are dominating the industry with dairy companies such as Yili and Mengniu taking the lead.

- Businesses should customize their product offerings based on the price segment and city tiers. Diversifying their sales channel to various online platforms is also crucial.

- Retailers should modify their retail value proposition and focuses on products that have a low online penetration such as fresh food.

Author: Regina Sukwanto