Chinese people used to get groundwater from the pump, but nowadays, most people drink boiled tap water. Sometimes consumers also buy mineral water, distilled water or purified water. With the growing demand for bottled water, so many water producers are active in the water industry with specific market strategies and distribution channels. Thus, water becomes not only the closest natural resource Chinese consumers use every day but a new market of industry and an incredible opportunity for business.

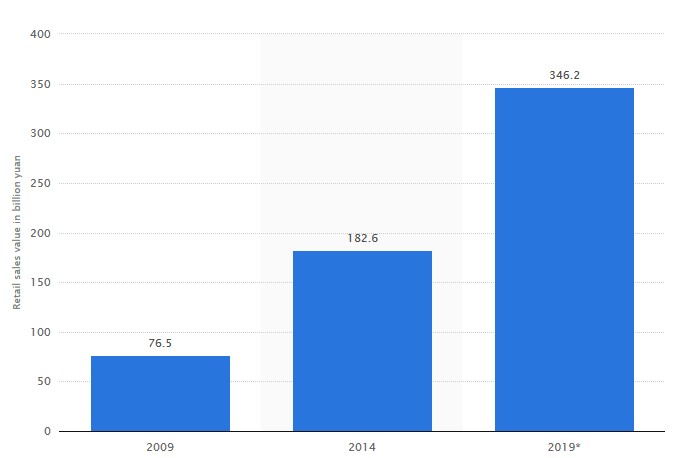

China’s increasing bottled water market is one of the biggest in the world

According to China Daily, the market has steadily grown in the years from 2010 to 2015, from 19 billion to 37 billion liters of bottled water. It is expected to reach 49 million tons of total annual consumption by 2020. In per capita terms, however, the picture is very different. China is running below the global per capita bottled water consumption average of 30 liters per person. With over a billion people to count for, China’s per capita consumption is just around one-fifth of that of the U.S. That means there’s plenty of room for this segment to grow in the future.

Chinese people’s water spending habits

Foreigners often find it strange that Chinese people like to drink hot water or warm water, as most of them always drink cold water. However, with the rapid development of the economy and society, citizens, especially young people, are accepting cold water and in hot seasons, they even prefer to drink ice water or a cold soft drink to cool down. It is reasonable to believe, according to Euromonitor International, the prolonged hot summer in 2017 underpinned dynamic growth of bottled water in China, benefiting carbonated and still bottled waters, experiencing even faster volume growth than in 2016. Mistrust over water safety, besides the hot weather factor, is believed to boost the Chinese bottled water market. The growing awareness of personal wellbeing as well as strengthening purchasing power prompt consumers to trade up to healthier choices such as bottled water, giving rise to continuously burgeoning growth over the review period.

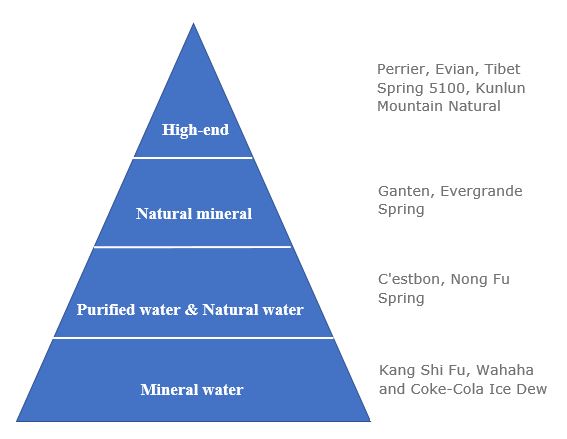

Due to this change, the market for mineral water and distilled water in a plastic bottle is growing as Chinese consumers find it easy to carry and environmental to recycle. Compared to tap water, bottled water is not as economical, but it is also not very expensive so more and more people are beginning to accept it. In addition, Chinese tap water is often full of bacteria and can cause upset stomachs. As a result, more consumers are making the switch to bottled water due to its functionality. Particularly, Chinese consumers’ preference in nutrition drives surging demand for mineral water. As a result, natural mineral bottled water, rich in minerals though much higher in unit price than average, enjoyed the most vigorous volume growth in 2017, outperforming all other bottled water subcategories. Thus, Nongfu Spring, for instance, has expanded its product lines into natural mineral water to remain relevant in the turbulent market, and we could forecast that the future development regarding water consumption is expected to emphasize on more natural and nutritional resources.

Chinese traditional water brands

When it comes to mineral water, it is easy for companies to find a mountain spring with mineral elements. Profiting from inherent natural resources Nong Fu Spring(农夫山泉) with its production facility in Thousand-Island Lake in Zhejiang(浙江) province and Lao Shan Spring(崂山矿泉水) located in Mount Lao in Qingdao(青岛) in the Shandong(山东) province. As for distilled water and purified water, it is even easier for companies to access. Since there is no high hurdle for merchants to get into this business, most soft drink companies have access to this rich market. To make bottled water more convenient to carry for its consumers, companies will spend a lot on logistics, transportation and storage.

The international brand comes into the Chinese water market

The rapid urbanization and the change in lifestyle are leading Chinese preferences towards the premium water and foreign brands, which were jumping onto the moving train.

Since Evian, a famous international brand, came into the Chinese water market with refreshing, high-quality water, it has seen success due to Chinese customers’ obsession with imported goods. However, these international players have also influenced the Chinese domestic market. Though the price of Evian due to transportation cost is extremely high, it expresses a luxury and high-quality lifestyle.

Perrier from Nestlé (China) Ltd extended its product line and launched low-calorie sugar-free Lime Sparkling Natural Mineral Water in 2017. Perrier, though among the highest selling price in the market, enjoys the fastest growth in 2017. In order to lower the production costs and distribution costs, the company employed PET materials to bottle its sparkling natural mineral water.

The marketplace for bottled mineral water in China

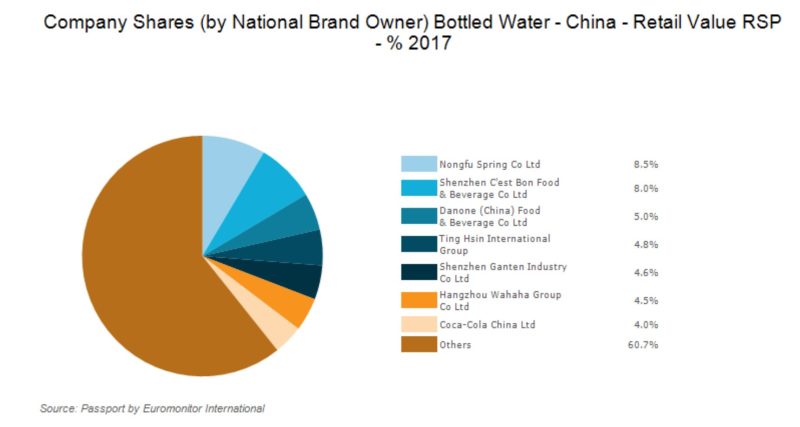

Mineral water sold through the e-commerce channel is mostly in the form of multipacks, and all brands in the first search result page highlight the natural attributes of their products.

Almost all brands of bottled water are presented on the shelf in supermarket, grocery and convenience stores.

|  |

A whole block sells various brands of bottled water [Photo credit: Walmart]

In addition to online e-commerce distribution and offline store retailers, high-end restaurants, bars, clubs, cafes and hotels are also competitive marketplaces. Voss, San Pellegrino, Evian, Acqua Panna and Evergrande Spring among others are used to serve freely as drink water in these places. Water brands vary in various spaces largely due to the correlations between the brand image of certain places and the brand value of water offered. Normally, luxury hotels offer luxury bottled water, expressing their elegant identity. Premium brands guarantee their water quality, as each brand sources from natural places such as the Vergèze spring in which Perrier sources and manufactures bottles with the help of sophisticated skills.

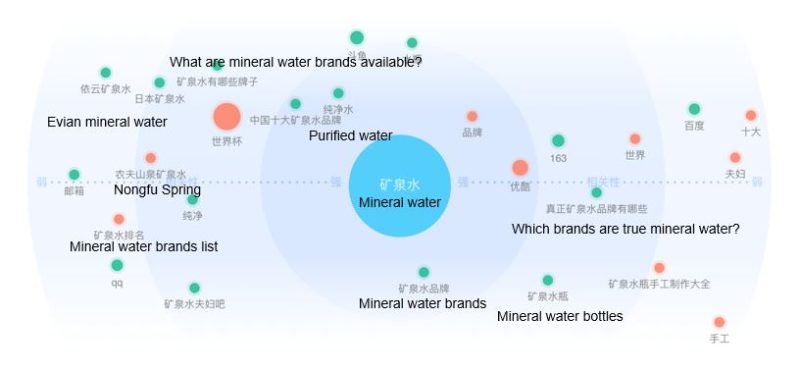

What do Chinese people look about mineral water in China?

Semantic analysis on Baidu Index shows that when Chinese netizens search for “Mineral water” on Baidu search engine, they most care about brands of mineral water in the market. Some are also concerned about the differences between mineral water, purified water and natural mineral water. It is evident that Chinese people are paying more attention to their daily water consumption.

Finding accurate data concerning distribution and supplier in China has become nearly impossible. Daxue Consulting has the capacity of screening in China with the help of our nationwide reach network involving main actors of universities, industries, and cities.

So, to use such a service as Distribution & supplier screening in China and find answers to all questions do not hesitate to contact our project managers at dx@daxueconsulting.com.