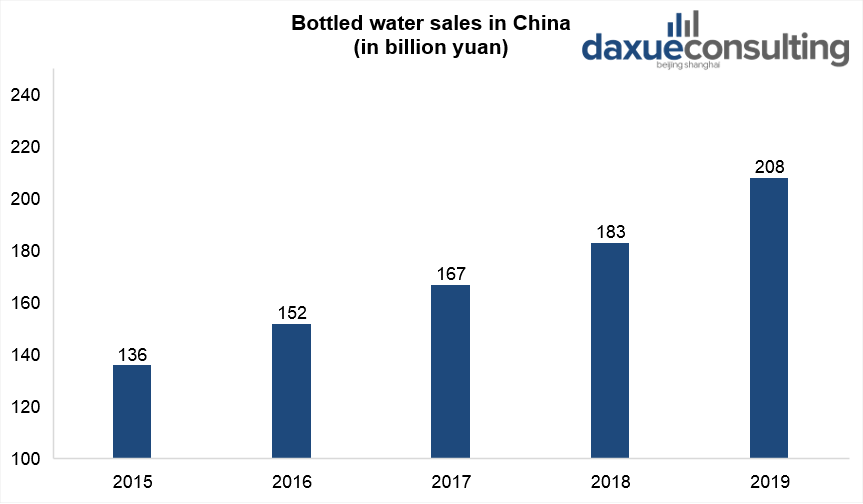

The competition in China’s beverage industry is increasingly fierce. Data show that as of the fourth quarter of 2018, the beverage market sales reached 16 million tons. Forecast shows that the sales volume of China’s beverage market in 2019 will be close to 200 million tons. In 2019, China’s bottled water sales volume reached 208.4 billion yuan, a year-on-year increase of 9.5%. It will maintain a 7-9% growth rate in the next five years. By 2020, the size of bottled water market in China will exceed 200 billion yuan.

[Data Source: qianzhan, ‘Bottled water sales in China’]

From 2018 to 2019, the monthly growth rate of bottled water sales on the Tmall e-commerce platform in China was 130%. The average monthly consumer growth rate was around 180%. The main consumer group is 25 to 34 years old people. Anhui Province’s sales growth rate was 200% year-on-year, surpassing the first-tier regions such as Shanghai, Zhejiang, Guangzhou, and Jiangsu.

China has the biggest revenue in the bottled water segment

The Chinese government has been promoting a healthy lifestyle for years, and has now started to achieve a good result. Chinese consumers are more sensitive to the quality the food and beverages thy consume. This drives the consumption of bottled water over sugary alternatives. Hence, Chinese beverages consumption habits are moving beyond soft drinks and energy drink. The average per capita consumption stands at 84.2 L in 2019. In global comparison, China has the biggest revenue in the bottled water segment. Imported bottled mineral water is one of favorite imported beverages in China market.

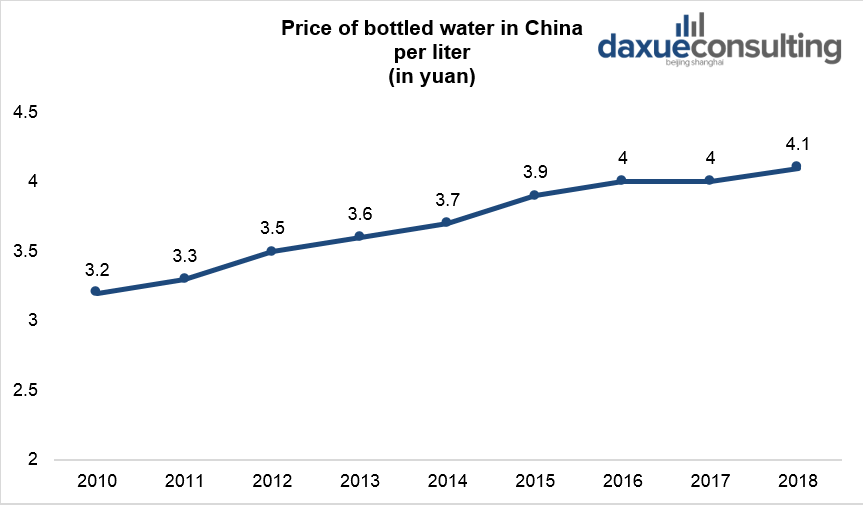

The price for domestic bottled water is increasing

According to Euromonitor data, the unit price of bottled water in China continued to increase from 2010 to 2018. In 2018, the unit price of bottled water in China was 4.1 yuan per liter. It is about 2 yuan per bottle (assuming a single bottle capacity is 500 ml).

[Data Source: Euromonitor, ‘Price of bottled water in China’]

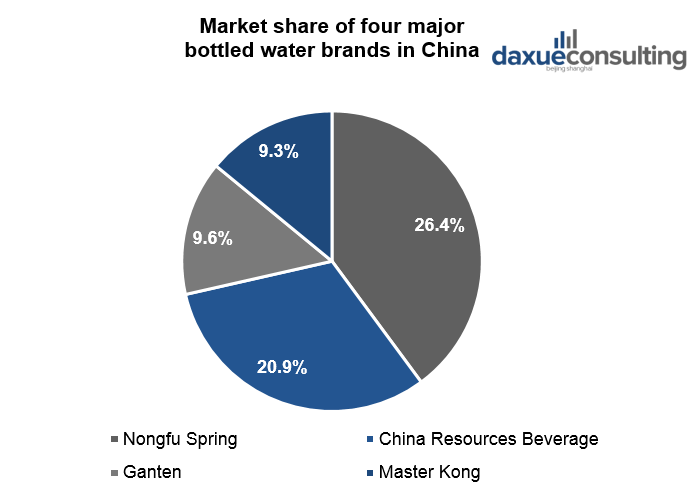

In 2018, the four major brands occupied the bottled water market in China. Nongfu Spring had 26.4% of market share. China Resources Beverage had 20.9%. Ganten and Master Kong had 9.6% and 9.3% respectively. Their share totaled 66.2%. Together with Ice Due and Wahaha they occupy more than 80% of market.

[Data source: China Business Research Institute, ‘Market share of four major bottled water brands in China’]

Sales channels of bottled water in China

In the beverage market in China, 2.4% of total revenue will go through online sales by 2021. However, offline sales still occupy the key sales. Statistics indicates that offline sales were 98% in 2019. It predicts that they will decrease to 97.6% by 2021. The main reason for gradually dipping offline sales is the growing e-commerce in China year by year.

Drivers of the bottled water market in China

As the second largest economy in the world, and a major driver of global economic development, China has paid a high environmental price for its economic increase: polluted air, contaminated land, uninhabitable areas, desertification, and a severe crisis of drinking water. Our focus lies on one of the markets which directly shows the impact of these environmental issues: the bottled water market in China. The country only has about 6.5% of the planet’s renewable water resources to sustain one-fifth of the world’s population. Due to the economic growth, faster than freshwater supply, China’s water shortage has become a much more severe problem.

The WHO (World Health Organization) warned that although China is ranked sixth regarding the total volume of fresh water available worldwide, the amount of fresh water available per-capita in China is only a quarter of the global average. Moreover, the interaction between water resources and agriculture is likely to become increasingly important considering food safety in China. Particularly in Northern China, which holds only 18% of the total fresh water while having 65% of the total fertile land.

Consumers take contamination seriously

Furthermore, consumers take contamination very seriously. In early 2013, 7,500 rotten pig carcasses were found floating in the Huangpu River. The event aroused mass media and people’s attention, as the river supplies 80% of tap water to Shanghai. Although the authorities have guaranteed the quality of the city’s drinking water, residents have remained concerned about water safety, and many of them have stopped drinking tap water and are buying bottled water instead.

In 2016, the Ministry of Water Resources (MWR) in China declared four-fifths of groundwater contaminated, which means it is unfit for drinking or daily use. Thus, the rapid growth in this market results in a mistrust over water safety. A survey conducted by the China Water Supply Services Union in 2014 – with 30,000 urban residents in 100 cities – showed 59% of them drinking (boiled) tap water. The remaining participants prefer bottled water as the first choice over a home water filtration system.

Bottled Water Market in China: The horror of China’s water pollution

Officially, there are five grades for groundwater to categorize ‘drinkability,’ whereas only the first three are acceptable for human consumption, according to The New York Times. 32.9 percent of grade 4 water – which is mainly suitable for industrial use but not for human contact – was found, primarily in Northern and Central China, across the tested wells. Even worse, 47.3 percent was found to be grade 5. The study showed the contaminants included compounds used in fungicides, such as manganese, fluoride, or triazoles. Moreover, in some areas, pollution through heavy metals was found. The MWR clarified the released data was valid mainly for shallow groundwater, while the drinking water comes from deep groundwater. However, even surface water pollution can have an impact on crop contamination and also (an unknown percentage of) deep groundwater is unsuitable for drinking, as the Epoch Times reported.

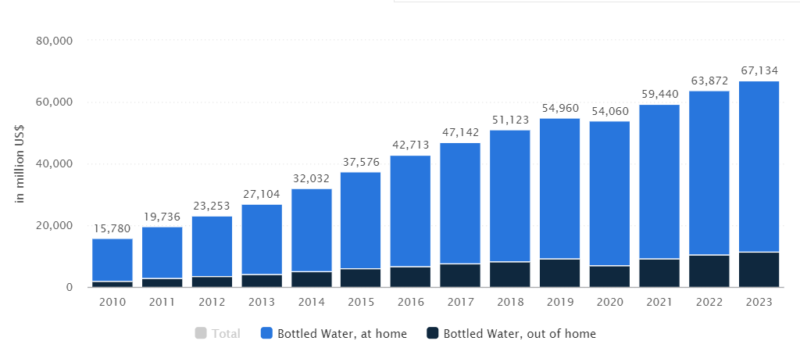

China’s increasing bottled water market is world’s biggest

Research has shown an enormous growth in the bottled water market segment. In 2013, China surpassed America, becoming the world’s biggest bottled water market by volume. The Chinese market is continuously growing, experiencing an increase from 19 billion to 37 billion liters of bottled water in the years from 2010 – 2015 in China, as reported by The Economist, and is expected to reach 49 million tons of total annual consumption by 2020, according to China Daily. Statista forecasts the revenue of bottled water in China will grow by 22% between 2019 and 2023.

Bottled water revenue in China

[Source: Statista, May 2020, bottled water revenue in China, forecast adjusted for COVID-19 2020 impact]

In per capita terms, however, the picture is very different. China is running below the global per capita bottled water consumption average of 30 liters per person. China’s per capita consumption is just around one-fifth of that of the U.S. That means there’s plenty of room for this segment to grow in the future. The emerging upward moving trend in China’s bottled water market also led companies – which compete in other fields besides the beverage market – to participate in the bottled water industry, such as Sinopec Corp, an oil company, as announced by China Daily. However, research shows that businesses that are primarily competing in soft drinks drive the market. These brands include Nongfu Spring, surpassing Ting Hsin in 2015, Wahaha, C’est Bon produced by Hua Run and Ice Dew (China’s biggest foreign-owned brand) produced by Coca-Cola.

Social responsibility: A strategy to sell premium water in China

As the economy becomes larger and stronger and China becomes more and more exposed to western culture, Chinese consumers see expensive consumer goods as trophies for their success. They are embracing new economic ideas and habits, devouring goods that previously were unreachable, were impossible to achieve, or forbidden. The rapid urbanization and the change in lifestyle, as well as the increased health awareness in China, are leading Chinese preferences towards the premium water and foreign brands, which were jumping onto the moving train. For instance, Nestlé and Coca-Cola both associate their branding with social responsibility. Their marketing strategy is turning the consumer to perceive water as a safer alternative, and as a result has bolstered their sales as consumer’s growing worries about risks of contamination continue to rise.

A television ad in China for Nestlé’s Pure Life brand of bottled water showed children making unhappy faces after tasting the water. One child pours his glass into a fish tank instead of drinking it; his face lights up when his mother offers Pure Life instead.

Coca-Cola’s China bottled water strategy

Coca-Cola Co., launched in 2014, is a socially responsible bottled-water brand in China that funds projects to bring clean drinking water to school children in rural China. The name is Ice Dew “Chun Yue,” or Pure Joy, and a single serving bottle costs just slightly more than local products sell for. For the work in rural areas, Coke paired with the prominent local non-governmental aid group ONE Foundation.

Socially conscious brands are not as present in China as in some other markets, and their market share is still small. According to The Economist, Coca-Cola’s waters (including Ice Dew) have 5.6%, Danone of France is close behind with 5.5%. Nestlé of Switzerland has 1.8%.

Bottled Water Market in China: Market potential in China

The market concerning bottled water is highly concentrated in China. National brands control a majority of the volume and value of sales. Nonetheless, international players have established a presence in China, such as Coca-Cola and Nestlé. The increasing consciousness of health among Chinese people and the desire to avoid waterborne diseases has seen the continuous sale increase of bottled water and which will continue in the future; which means high-end bottled water will still play a significant role in the water market.

As of 2017, domestic bottled water brands face threats from foreign water companies due to China’s food security, as national regulators raise concerns about non-compliance with standards. For instance, in December 2014, the Economist reported that authorities in Shanghai found a quarter of the bottled water sold by some of the largest brands was contaminated. However, today existing leading players are more likely to expand their production capacity and develop more high-quality water sources to match their strategic business plans.

How brands increase sustainable production

For example, the Chinese bottled water producer Nongfu Spring has invested in high-speed Sidel bottling (a manufacturing company providing packaging equipment for liquids) – switching from HDPE (High-Density Polyethylene) to PET (Polyethylene terephthalate) – to achieve a more cost-effective and sustainable production process. Since the launch of those PET bottles, Nongfu Spring has seen its sales increase significantly in this market segment. Furthermore, China reasserted and reinforced the 2011 ‘Three red lines Policy’ or also known the ‘Water Ten’ in April 2015, according to China Dialogue 中外对话. The new water management policy discusses the control of water usage, improvement of water efficiency, and limitations to water pollution. Nevertheless, the country’s per capita bottled consumption rate is still 19% below the world’s average which implies an enormous unfilled potential in the Chinese market.

To know more about Bottled Water Market in China, please don’t hesitate to contact us.

Stay Up To Date! Sign up for our Newsletter to Receive the Last Updates or Follow us on LinkedIn

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast