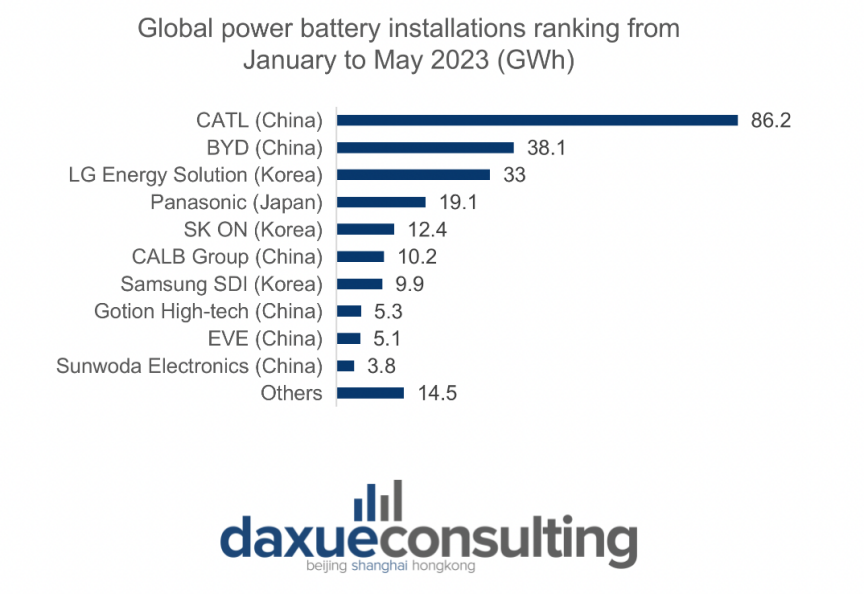

The global battery market size was valued at USD 104.31 billion in 2022. In the same year, the Chinese battery market solidified its dominance, securing a 60.4% market share among the top 10 global companies in vehicle power battery installations and its battery production capacity surpassed that of the rest of the world.

China’s rapid industrialization has led to a near-monopoly on several critical minerals such as cobalt and lithium, enabling it to refine and export approximately 80% of the world’s cobalt supply. This dominant position in raw material mining has propelled China to the forefront of the battery industry.

Global footprint: China’s dominance as a battery export leader

Amidst the thriving global battery market, the lithium-ion battery segment maintains its commanding position. China’s dominance in battery exports is evident through its substantial share in lithium-ion battery exports, which soared by 94.3% year-on-year to RMB 109.79 billion in the first quarter of 2023. China Daily reported that the increase of China’s lithium battery exports can be attributed to the technological advancements in lithium battery manufacturing and an increasing production capacity of lithium batteries.

Download our 10 Mistakes Chinese Brands Make when Going Abroad report

Chinese battery market’s innovative solutions revolutionize the battery industry

CATL unveiled the Shenxing Charging Battery in August 2023, the world’s first 4C superfast charging LFP battery. This innovation offers a 400 km of driving range in a 10-minute charge and over 700 km on a single full charge. Its new silicon-based anode technology has denser energy storage than traditional lithium-ion batteries which will improve EV driving range by more than 15% while reducing battery costs.

BYD is also pioneering battery innovation through its Blade Battery, which addresses safety concerns by exhibiting no smoke or fire and maintaining surface temperatures that range form 30-60°C during nail penetration tests. The unique single-cell design enhances energy capacity per unit volume and boost battery pack space by over 50% compared to conventional batteries.

Diverse markets, diverse needs: Chinese battery brands’ outstanding accomplishments beyond borders

In the rapidly growing market for electric mobility in the United States, a robust demand for EV batteries has emerged, with battery demand for vehicles growing by around 80% in 2022. CATL is one of Tesla’s main battery manufacturers, achieving an impressive energy density of 210 kWh/kg. This allows EVs like the Tesla Model 3 to achieve around 700km on a battery pack comparable size to existing LFP batteries. Furthermore, CATL and BMW Group have teamed up to supply cylindrical battery cells for upcoming German electric models starting in 2025.

Gotion High-tech experienced a notable 112% surge in global battery shipments (14.1 GWh) in 2022, driven by a partnership with Volkswagen Group. Gotion became the designated supplier of lithium iron phosphate battery cells to Volkswagen and embarked on industrializing battery cell production in Germany. It is also establishing business ties with Asian EV manufacturers, supplying batteries to Tata Motors in India. Additionally, Gotion collaborates with VinES Energy Solutions Corporation to create a joint venture for lithium batteries production in Vietnam, targeting an annual production capacity of 5 GWh.

In terms of CALB’s international initiatives, the company has established a supply partnership with Forsee, a French brand specializing in smart battery systems. Collaboratively, they will supply Li-ion batteries for a range of vehicles worldwide, including buses, trucks, specialty vehicles, and ships.

Global ventures: China’s strategic investments in overseas battery manufacturing

In 2022, CATL revealed its plan to invest 7.34 billion euros in constructing a 100 GWh battery facility in Debrecen, Hungary. The strategic location near key automakers like Mercedes-Benz, BMW and Volkswagen, positions the plant to meet Europe’s rising battery needs. This expansion strengthens its global production network and supports the progress of e-mobility in Europe. Moreover, Eve Energy, a prominent Chinese EV battery maker expands its overseas supply capabilities by investing USD 422.3 million in a factory in Malaysia. This facility will primarily specialize in producing cylindrical lithium-ion batteries for power tools and electric two-wheelers in the Southeast Asian region.

Sustainability imperative: How is China’s battery market paving the way for green solutions?

Chinese battery companies demonstrate a holistic commitment to sustainability by implementing green solutions that encompass the entire value chain.

- Recycling – Gotion High-Tech established Feidong Gotion New Materials Co., Ltd. to support China’s dual-carbon goals by focusing on recycling batteries. It can manage 50,000 tons of waste batteries and 10,000 tons of scrap pole pieces annually, achieving high recycling rates for various battery components, ensuring that waste disposal is harmless to the environment.

- Reduce carbon emissions – EVE Energy is actively working towards carbon reduction throughout the entire lifecycle of lithium batteries by using green electricity and embracing sustainable technological innovations. EVE Energy utilizes its BIM technology to offer precise and dependable data for project management, resulting in substantial energy savings equivalent to 2,533 tons of standard coal and an annual reduction of 16,000 tons of CO2 emissions.

- Green production – The chairman of CATL has affirmed the company’s dedication to assisting Indonesia in building an environmentally sustainable battery industry. This includes implementing renewable sources and energy storage systems to support energy-intensive smelting operations in Indonesia. Moreover, CALB‘s facility in Portugal will be strategically located near the Port of Sines, aiming to establish a world-leading green production plant. The project’s objective is to become the foremost highly intelligent, digital, and automated zero-carbon factory on a global scale.

The future ahead: complex realities of the Chinese battery market

China’s dominant position in raw material extraction has prompted other nations like Canada, Australia, and Brazil to replicate its achievements through the utilization of their own resource reserves. Meanwhile, the EU is also taking active measures to reduce reliance on imported raw materials by diversifying its domestic supply. With a current heavy reliance on China for more than 90% of its supply, the EU plans to achieve self-sufficiency in lithium-ion battery cells by 2027 to meet its domestic EV demand.

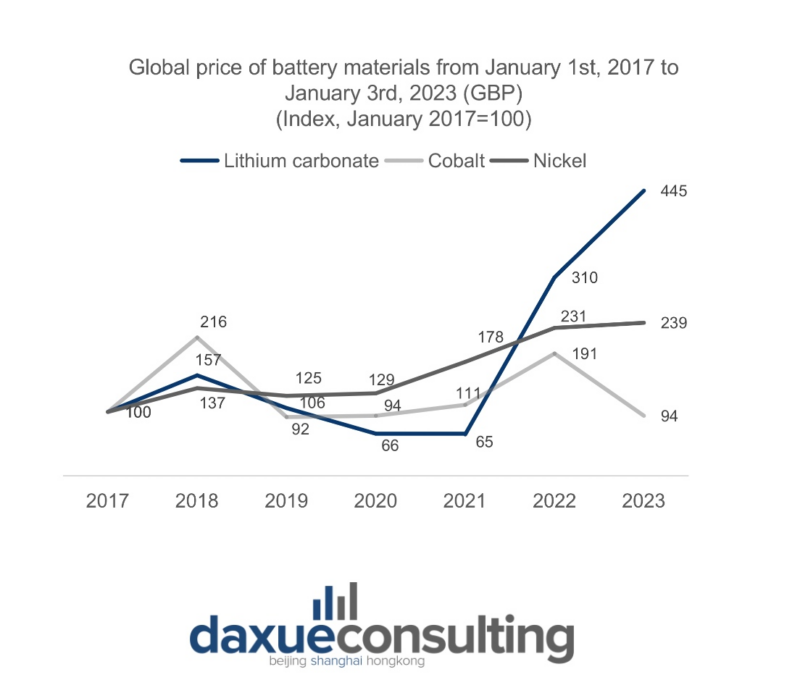

The complexity is also highlighted by critical mineral price fluctuations. Lithium carbonate prices surged, experiencing a four to fivefold increase in 2021 and continuing to rise in 2022. By early 2023, lithium prices were six times their average between 2015 and 2020. This price hike for lithium, nickel, and cobalt was driven by demand outpacing supply in 2021.

However, a shift occurred between January and March 2023 as lithium prices dropped by 20%. Chinese battery-grade also spotted a 10% decline of lithium carbonate’s price in July, reaching 279,000 RMB per tonne. This drop is attributed to decreased demand from cathode producers, which has subsequently impacted the profit margins of recycling companies in China.

Furthermore, well-established global battery manufacturers are driving competition through technological breakthroughs. StoreDot is using nanotechnology and artificial intelligence to upscale its battery technology such as ultra-fast charging battery (XFC) technology for EVs. Tesla, on the other hand, integrates solar system with Powerwall, a home battery storing electricity for self-consumption during low sunlight, enhancing the utility of renewable energy sources.

Benchmarks for access: Barriers for Chinese battery brands to go global

The rising import barriers in Europe also presents challenges for overseas expansion of the Chinese power battery industry. The EU is set to launch a trial of the Carbon Border Adjustment Mechanism (CBAM), a carbon tariff policy, starting from October 1st, 2023. This policy will raise market access standards for entry into the EU. The EU’s “New Battery Regulation,” will assess power battery manufacturers’ carbon footprints, setting specific benchmarks by 2027. Companies surpassing these benchmarks will be prohibited from accessing the EU market.

In recent times, sodium-ion (Na-ion) batteries are emerging as alternatives to Li-ion batteries due to their cost-effective materials. Among battery chemistries, Na-ion is currently the sole viable option not relying on lithium. However, China encounters some obstacles in manufacturing sodium batteries due to the limited access to soda ash, a vital source of sodium for battery production. The United States holds over 90% of the world’s readily mined soda ash reserves, primarily situated beneath southwestern Wyoming. Natron Energy (USA), Tiamat SAS (France), Faradio (United Kingdom) are some of the leading sodium-ion battery manufacturers which could potentially challenge Chinese battery market’s overseas expansion.

Challenges and opportunities in the Chinese battery market’s overseas expansion

- China’ s dominance in the global battery industry is driven by the establishment and expansion of the country’s battery manufacturing facilities, as well as its control over key minerals such as lithium and cobalt.

- The Chinese battery industry’s initiatives such as the exploration of sodium-ion batteries and innovative battery technologies, exemplify consistent advancements aimed at international growth.

- The collaboration between Chinese battery manufacturers and renowned automakers in foreign markets demonstrates the essential role of partnership in achieving global expansion,

- Chinese battery industry’s commitment to recycling, green production, and reducing carbon emissions as part of their strategy to lead the way in providing green solutions on a global scale.

- The complexity in the Chinese battery market is accentuated by the volatility of critical mineral prices and the robust competition with global battery manufacturers.