It took less than 5 years for Xiaomi to skyrocket from a nascent startup to a Chinese tech titan and global top-4 smartphone maker worldwide. Founded in 2010 by visionary Lei Jun, Xiaomi shattered the myth that high-quality technology is a privilege for the affluent. Championing the belief that premium tech should be accessible to all, Xiaomi launched affordable smartphones with top-notch hardware and built-in quality, able to displace offerings from rivaling giants like Apple and Samsung.

Download our China luxury market report

Xiaomi’s meteoric rise: a story of unprecedented growth

Xiaomi’s exponential rise in the tech industry is credited to its unique approach of combining affordability with high quality in its smartphone offerings since its inception. This approach resonated well with consumers across China, enabling Xiaomi to quickly capture a substantial market share and become a key market leader by 2014. A pivotal moment in Xiaomi’s history was the 2011 launch of the Mi 1, which emerged as one of the company’s most successful products. The overwhelming demand for the Mi 1 was evident when Xiaomi received over 300,000 preorders within the first 34 hours of its announcement.

In 2013, Xiaomi drastically grew its sales with the release of its e-commerce platform Mi Market. This allowed the company to become China’s third-largest e-commerce company. By 2014, Xiaomi also started to expand globally, particularly into South Asian markets like India, becoming the world’s fourth-largest consumer electronics company.

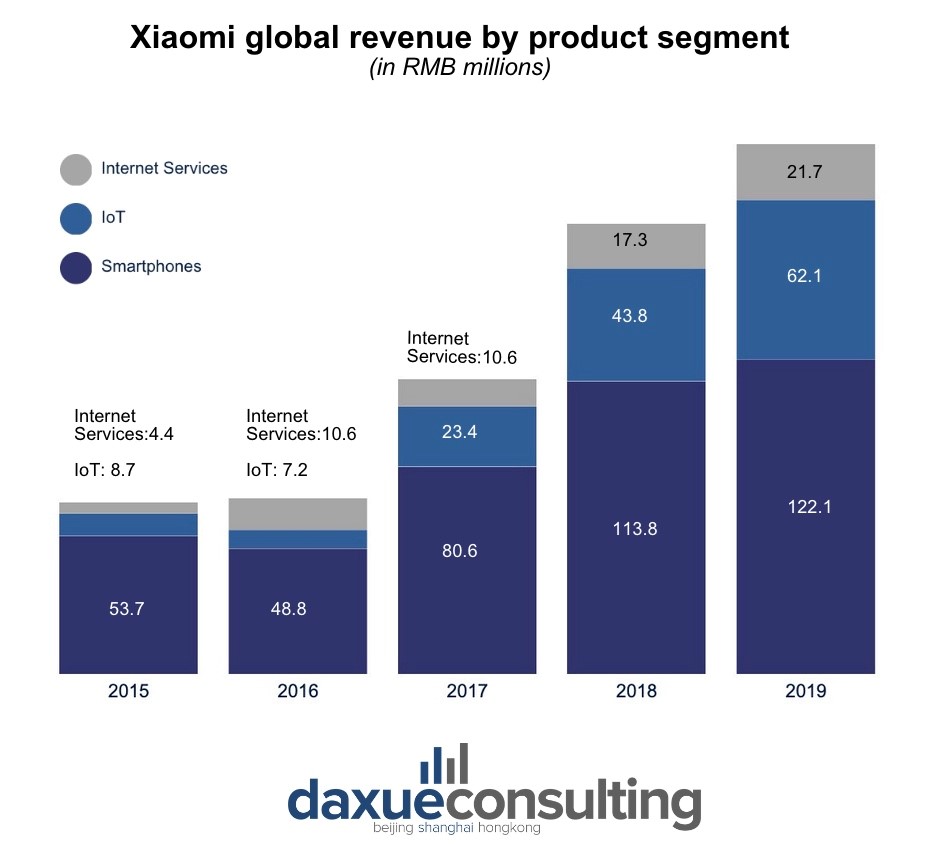

From 2015 onwards, Xiaomi began to capitalize on its smartphone success and implement a diversification strategy that could allow Xiaomi to broaden its reach into other segments of consumer electronics and further open up new avenues for revenue. The company has since significantly expanded its product line, reaching over 80 different items offerings including laptops, TVs, wearables, speakers, and other lifestyle products.

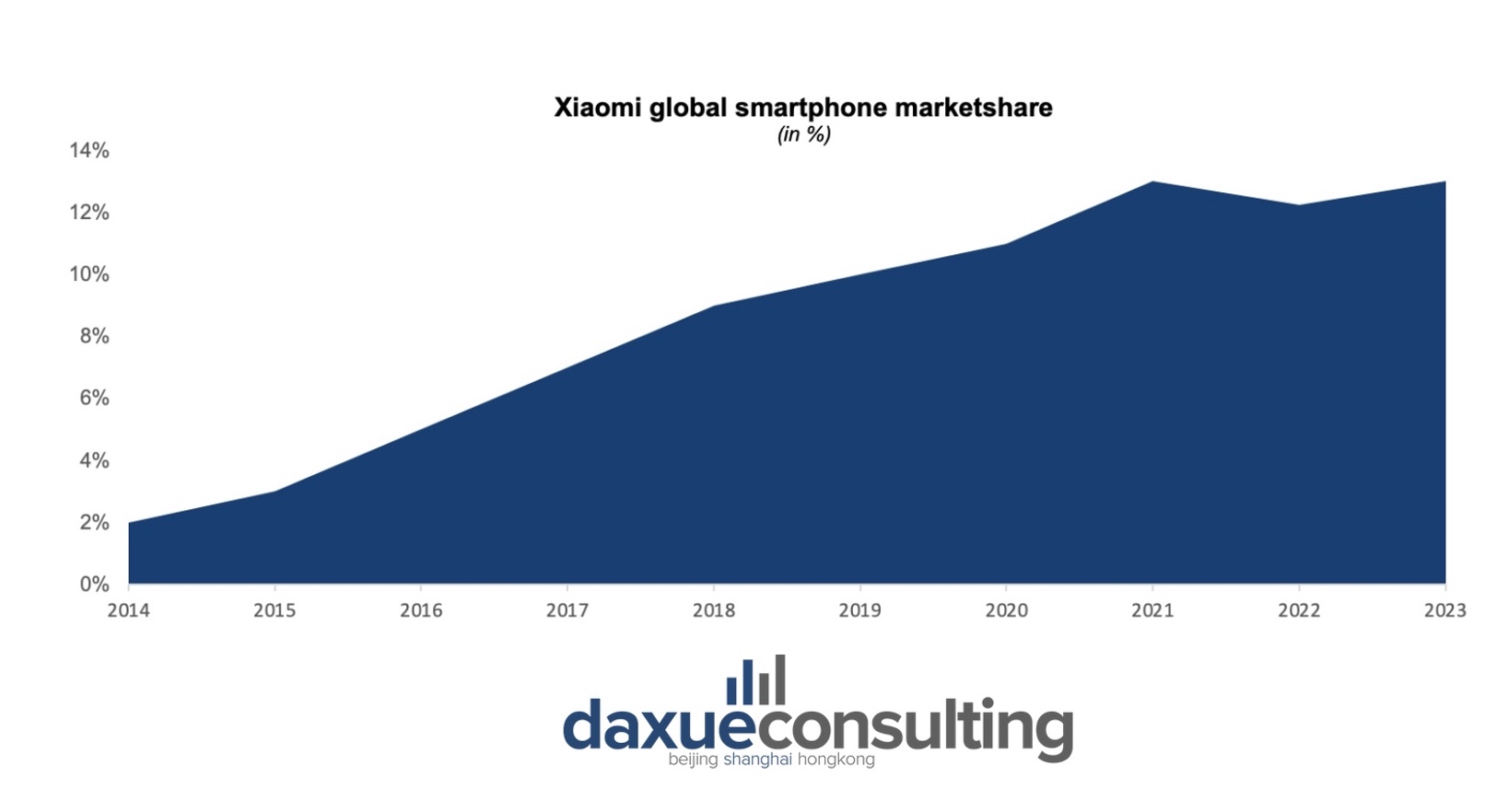

As of June 2021, according to Counterpoint Research, Xiaomi has reached a significant milestone by achieving the biggest share of monthly smartphone sales, joining Samsung and Apple as a leading player in the global smartphone market. However, with rising competition within the Chinese market, Xiaomi’s share has stagnated at around 9% while globally Xiaomi’s presence has stabilized at around 14% of global sales.

Xiaomi’s game-changing business approach

Revolutionizing affordability as part of Xiaomi’s strategy

The first crucial aspect of Xiaomi’s business model is its commitment to affordability. By streamlining their supply chain and manufacturing processes, Xiaomi manages to keep costs low without sacrificing quality. This also allows them to constantly be up to date with the most technologically advanced products at more affordable prices for a broader demographic. Xiaomi also saves considerable costs by overwhelmingly selling its phones online via its platform, Mi Market.

Putting customers first: Xiaomi’s secret to continuous improvement

The company is famous for actively engaging with its customers and listening to their feedback, to understand their needs and preferences better. Xiaomi currently operates a consumer-centric business model which is very similar to that of Amazon. The company heavily relies on feedback gathered from its online user community, named MI, which it then integrates into its product development efforts. This practice is a winning strategy not only because it constantly improves the delivery and quality of the product but also because it helps Xiaomi keep a loyal and engaged user base.

Cutting-edge pricing: Xiaomi’s innovative razor-blade model

Xiaomi’s pricing strategy is also a cornerstone of its success. It revolves around a “razor-razor blade” model. This involves selling certain products, like smartphones, at low profit margins or even at a loss, to attract customers into their ecosystem. Once customers are integrated, Xiaomi then markets profitable complementary products to them in bundle deals. This strategy not only boosts sales of Xiaomi’s affordable hardware but also draws consumers into Xiaomi’s broader ecosystem. In this context, customers can be encouraged to buy additional products that generate revenue, such as smart home devices equipped with XiaoAi (小爱) voice recognition technology.

Building a tech empire: the strength of Xiaomi’s ecosystem

Finally, Xiaomi’s ecosystem strategy is a key part of its business model, involving investments in or partnerships with various companies to create a wide range of products. This approach allows Xiaomi to expand beyond smartphones into other technology sectors, maintaining a diverse portfolio of products and services. One prominent example is the Mi Band, a fitness tracker developed in collaboration with Huami. This product has been highly successful, offering features like heart rate monitoring, step counting, and sleep tracking at a very competitive price point. Another example is Xiaomi’s investment in Ninebot, a company known for its electric scooters, enabling it to expand its product range in the electric transportation segment.

Marketing genius: crafting Xiaomi’s global brand image

Xiaomi has crafted a cost-effective marketing strategy largely inspired by Apple’s handbook. Instead of investing huge sums of money in launching advertising campaigns, Xiaomi showcases its new products mainly through its social media accounts including WeChat and Xiahongshu. For instance, Xiaomi’s focus on digital content, like user-generated reviews and unboxing videos, has traditionally played a significant role in its advertising strategy, bolstering strong user engagement.

However, Xiaomi’s advertisement efforts peak through its dynamic public events that resemble more tech festivals than standard conferences. These vibrant gatherings are not just product reveals; they are experiences designed to generate excitement and build a community spirit among users. A distinctive element of these events is the ‘flash sale’ model, where products are sold online in limited quantities for a short time.

But Xiaomi’s wide notoriety couldn’t have reached such high profiles in so little time if it wasn’t for the unique identity and charismatic profile of its founder and CEO, Lei Jun. Lei Jun has rapidly elevated the company’s profile to great heights, drawing frequent comparisons to Steve Jobs for his visionary leadership style. Under his guidance, Xiaomi has embraced the philosophy of ‘innovation for everyone,’ targeting tech-savvy yet budget-conscious consumers. He constantly makes the headlines, pushing Xiaomi brand awareness alongside his public image.

Conquering new markets: Xiaomi’s strategy in the Indian market

Since its first overseas expansion into Singapore in 2014, the company has rapidly expanded internationally by launching in more than 80 markets. However, Xiaomi’s entry into the Indian market in 2014 is the most notable textbook example of a well-executed international strategy. In less than 4 years, Xiaomi made a remarkable ascent to the top of India’s smartphone market, surpassing Samsung as the market leader in 2018, and reaching in 2021 a peak of 27,3% of India’s s total smartphone market. This strategy was especially successful in 3 aspects:

Pricing was the first. Even though price competitivity is naturally engrained in Xiaomi’s value proposition, no other company has been better at recognizing the particular price sensitivity of Indian consumers. For instance, Xiaomi astutely focused on offering high-quality smartphones specifically at selling prices below USD 200 device, like the widely popular Mi11 series.

Additionally, Xiaomi’s commitment to localizing its production played a crucial role in minimizing costs associated with import duties. A significant milestone in Xiaomi’s local integration was its ability to source 65% of its components domestically.

But beyond pricing strategies, Xiaomi differentiated itself by customizing products to align with local preferences. Collaborative efforts with e-commerce platforms such as Flipkart for exclusive launches, coupled with the creation of India-specific products like the Redmi Note 4, solidified Xiaomi’s position as the preferred choice for Indian consumers, making it their top go-to brand.

Future-proofing Xiaomi’s strategy: Adapting to tomorrow’s tech trends

Although Xiaomi’s business model has been able to generate unprecedented levels of success, the company has to contend now with new competitors like Oppo and Vivo, which have perfectly reproduced its low-cost and high-value model and are quickly gaining ground. Xiaomi’s future relevance will strongly rely on its ability to adapt to this new scenario.

Further internationalization

First of all, Xiaomi’s response should focus on a continued emphasis on international expansion, a strategy that has already shifted its revenue sources significantly. In 2015, 6% of Xiaomi’s revenue came from outside Mainland China. By 2018, this figure had already risen to 40%. Some of Xiaomi’s biggest successful market entries in its international expansion have been in the Indian and European Markets. The short-term goal for Xiaomi was to reach half of its total revenue from international markets, which it achieved at the closing of 2022 with 49.2% of its revenue being generated overseas.

A pivot toward premiumization as part of Xiaomi’s strategy

Moreover, Xiaomi needs to pivot towards high-end smartphones, to cater towards markets where there’s a growing demand for premium devices above USD 540. Despite being a traditionally price-sensitive market, India is showing a trend towards premiumization. This shift is evident as competitors like Apple are projected to capture a 6% market share by the end of 2023, marking a 34% year-on-year growth. Recognizing this, Xiaomi’s CEO Lei announced on Weibo the company’s plan to enter the high-end market, aiming to outdo Apple in China within three years. To this end, Xiaomi is investing USD 15.7 billion in R&D over the next 5 years, focusing on launching premium products like the Xiaomi 13 Ultra and Xiaomi 13T Pro, and directly positioning them against Apple’s offerings.

Product segment diversification

Finally, Xiaomi should continue to diversify its product line by expanding into promising consumer electronics segments. Its venture into IoT and smart home technology is a key example. As a leading IoT brand with over 230 million devices worldwide, Xiaomi is ambitiously positioning itself as a hub for IoT technology. It offers a range of interconnected smart home products, like Smart LEDs, fitness trackers, and smart TVs, all controlled via WiFi and managed through its voice recognition assistant, XiaoAi (小爱). Another key area of expansion for Xiaomi is the smart electric vehicle (EV) market. The company has announced plans to invest RMB 3.3 billion in this sector, aiming to become an industry leader in Smart EVs by 2024. team of 500 professionals has already been assembled to deploy 140 testing vehicles for this initiative.

What can be learned from Xiaomi’s strategies?

- Xiaomi rapidly evolved from a startup to a global tech leader and smartphone manufacturer by relentlessly following its motto consisting of offering high-quality and yet affordable technology.

- The company diversified its product line beyond smartphones, achieving success in various consumer electronics and through its Mi Market e-commerce platform.

- Xiaomi’s business model emphasizes cost-effective manufacturing, customer engagement, and a unique pricing strategy to bolster sales and ecosystem integration.

- The strategic leveraging of social media and CEO Lei Jun’s leadership played a crucial role in Xiaomi’s brand development and customer loyalty.

- Facing competition, Xiaomi’s future adaptation needs to rest on further international expansion, entering the high-end smartphone market, and investing in new ventures like IoT and electric vehicles.