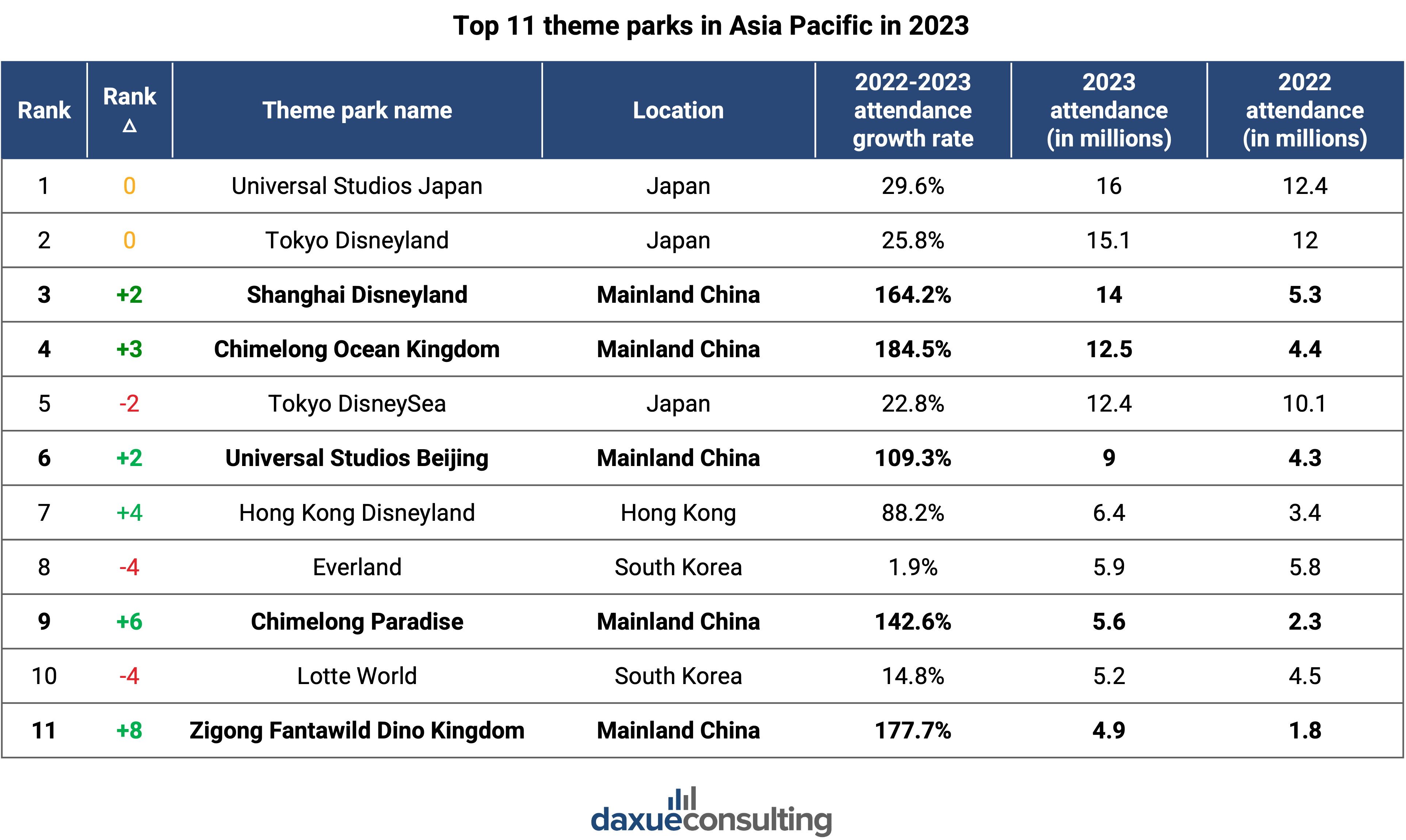

China has the second-largest theme park market in the world after the United States, receiving 130 million visitors in 2023, a 72% year-over-year increase. As cultural entertainment and leisure travel continues to grow, theme parks in China are attracting a broader audience, including solo travelers and the elderly.

Download our report on young Chinese consumers

How theme parks have developed in China

The development of theme parks in China can be divided into three phases: inception, proliferation, and transformation.

The inception stage, from 1989 to 1995, started with the establishment of China’s first theme park, Splendid China. This park sparked initial interest, attracting consumers and encouraging the development of other theme parks. Early theme parks focused on miniature cultural landscapes and performances, such as Window of the World Shenzhen, which features iconic landmarks from China and the world and historical sites.

From 1996 to 2015, theme parks experienced the proliferation stage. Many theme parks developed, focusing on differentiation and diversification through the incorporation of Intellectual Property (IP).

In 2016, the theme parks entered the transformation stage and competition intensified. International parks, such as Shanghai Disneyland in 2016 and Beijing Universal Studios in 2021, opened. They quickly gain attention for their strong IP resources, immersive and technological experiences, and integration with surrounding industries, such as dining, hotels, animations, and video games.

International theme parks are industry leaders

Shanghai Disneyland remains the top theme park in China. Despite its late entry, its strong story and immersive experience is unparalleled compared to those of local theme parks. It continuously introduces new attractions and consistently delivers high-quality experiences, from rides, parades, themed dining options, and marathons.

Successful localization to the Chinese market

Many international theme parks have localized successfully to the Chinese market. A notable example is Disneyland and its iconic castle. Unlike other Disney parks that dedicate a castle to a single process, Shanghai Disney’s Enchanted Storybook Castle represents all Disney princesses, which allows its to appeal to a broader audience, especially for audiences less familiar with princesses than those in the West. Moreover, it offers a wide range of cuisines, from Western to Chinese food inspired by Disney characters. With increasing health awareness, there are more tasty and healthy options.

Capitalizing on strong IPs that do resonate with Chinese consumers

International theme parks in China capitalize on their globally recognized IPs, though not all of them are introduced. For example, they did not open a theme land inspired by Star Wars and India Jones because they are not popular in China. Zootopia, on the other hand, has been well received in China. In response, in December 2023, Disneyland opened the first Zootopia-themed land in Shanghai.

According to Walt Disney Company CEO Bob Iger at the opening ceremony, they chose Zootopia because of its “enduring popularity.” The animated film, which was released in theaters in 2016, became the highest grossing animation in China at the time. Its popularity is evident in the theme park’s visitors trends. According to Shanghai Disneyland’s 2024 report, 97% of surveyed guests were aware of Zootopia-themed land before arriving and 33% of them said it was a key reason for their visit.

Additionally, with the sequel expected to premiere in November 2025, it is expected to have return visits to Shanghai Disneyland.

Local theme parks leveraging their own or foreign IPs

While local theme parks’ IPs are not as strong as the international ones, they are slowly narrowing the gap by developing their own IPs, licensing globally recognized ones, or engaging in joint ventures with foreign brands. For example, Fantawild’s Boonie Bears and Chimelong’s Panda Triplets have become widely recognized characters. Moreover, Jinjing Amusement Park announced the signing of a joint venture framework agreement with Warner Bros. Discovery to co-develop Harry Potter Studio Tour, the first in China and the third in the world. The studio tour, covering about 53,000 square meters and taking about half a day to take a full tour, will provide an immersive behind-the-scenes experience of Harry Potter.

Theme parks target a broader audience beyond families and young adults

Families and young adults remain the main consumer groups for theme parks in China. However, niche groups, particularly the elderly and solo travelers, are emerging.

Shanghai Disney Resort reported that in 2023, compared to 2019, the number of senior visitors purchasing one-day and two-day tickets increased by 75%.

On Baidu Baijiahao, solo visitors have shared their experiences at Shanghai Disney. Overall, they express positive sentiment, as there are many things they can do, such as taking photos, enjoying fireworks, and doing what they want instead of having to discuss plans with someone else. They can also sometimes take the single rider lines, speeding up their wait time.

Visiting theme parks as part of their “urban travel” (城市旅行)

As young Chinese consumers seek to reconnect with the cities they live in, they engage in citywalk, visits to theme parks, and other city-related experiences. According to a 2024 theme park development report, the annual pass holders visited Shanghai Disneyland 12 times per year on average, suggesting that theme parks have become lifestyle destinations. This is possible because Disney continues to offer fresh and limited-time experiences.

Theme parks in China: a playground, a travel hotspot, and a place to unwind

- China has the second largest theme parks market in the world, with 130 million visitors in 2023. As China’s traveler market grows and theme marks develop stronger IPs and fresh experiences, it is expected to continue growing.

- Foreign brands like Disney remain the top of mind for Chinese consumers due to their strong localization efforts, IP characters, and storytelling.

- Local parks have struggled to develop strong IPs. However, they are turning to develop IP characters that resonate with Chinese culture or leverage globally renowned IPs.

- Solo travelers and seniors in China are emerging niche groups.