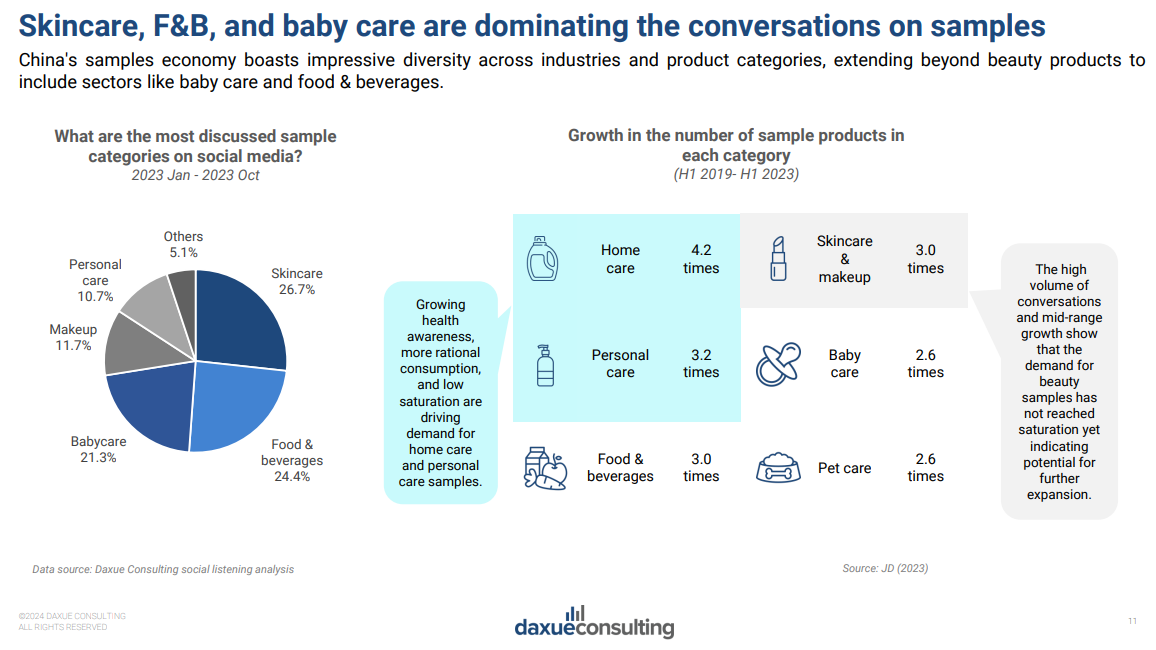

According to JD.com’s data, the sales of sample-size products (小样) in China have grown 4.3-fold between 2019 and 2023. Vending machines distributing sample-size products are popping up around malls, Harmay (話梅), a sample-size retailer born on Taobao has hopped offline to run 11 stores in 8 Chinese cities. Chinese consumers are then going to Xiaohongshu to trade their sample-size products with each other. While China’s samples economy impacts a range of markets, including snacks, coffee, baby products, and pet care products, it is hard to ignore the significant role it plays in beauty (including skincare, cosmetics, perfumes, and self-care).

Download our China’s samples economy report

What’s fueling the demand for samples in China

While testing new products remains the main driver of sample-sized product sales, an emerging trend sees samples being utilized as daily alternatives and sought-after collectibles. Indeed, especially in beauty, perfumes, and personal care, Chinese consumers prefer using sample-sized products as alternatives to purchasing full-sized ones due to their convenience, the ease with which consumers can frequently change products, and the appropriate product volume. Moreover, sample-sized products are practical and convenient for traveling, at the office, at the hospital, and on everyday outings.

The craze for cuteness converts miniature products into sought-after collectibles

Besides being convenient and portable, miniature products are also beloved for their cuteness and attract a pool of consumers eager to collect them. Sometimes, consumers even purchase full-sized products solely to obtain the accompanying gift-for-purchase sample. Cuteness has great marketing potential in China, leading to the rise of the “萌” (cute) economy. Miniature versions of full-size products, especially perfumes, are often referred to as Q “versions” (Q版) because the letter “Q” sounds similar to the English word “cute.” Hence the growing importance of packaging when it comes to samples in China. Consumers tend to prefer miniatures and sample sets over sachets and basic samples due to their convenience and appealing appearance.

Luxury brands do it differently

Chinese consumers’ increasing appetite for samples has led to a market shift from free to purchasable samples. Previously, third parties often distributed them without brand authorization, but now more brands are seizing the opportunity to sell samples directly. However, luxury brands do not completely align with this trend and prioritize giving away samples for free to avoid brand dilution, preserve perceived value, and ensure targeted distribution. Brand activation campaigns, holiday sets, gifts with purchase, VIP gifts, and loyalty programs are the main strategies for distributing luxury beauty samples in China.

What the trend of sample size beauty says about Chinese consumers

The direct purchasing of sample-sized products indicates a need for smaller product volume, and Chinese consumers aren’t shy to express this on social media (an example in the quote below). Beauty brands should take note of this shift when creating their China strategy.

“Wow, I never realized 5ml could be so much! Never buying full-size again. Bought a sample of foundation, picked the wrong shade, so I might as well swatch it all! Turns out 5ml is actually enough. For someone who doesn’t wear makeup often, full-size products are pricey and expire before finishing them. Using samples instead seems like a great idea! Sisters, let’s embrace this mindset.”

– Xiaohongshu user @ D姑娘早安

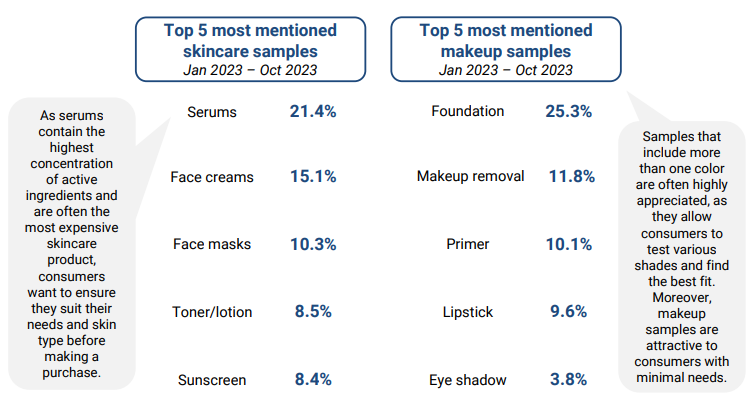

Product size is often mentioned as a pain point for Chinese beauty consumers. However, not all beauty products are equally consumed as samples. When it comes to skincare, serums contain the highest concentration of active ingredients and are often the most expensive skincare products, consumers want to ensure they suit their needs and skin type before making a purchase and therefore are more inclined to buy a sample. As for makeup, foundation is where the most demand lies. Samples that include more than one color are often highly appreciated, as they allow consumers to test various shades and find the best fit.

The rise of China’s sample economy causes us to rethink consumer demand

Whenever a consumer trend takes off it’s important to understand the ‘why’. The traditional uses of sample sizes are promotional, but the fact that Chinese consumers are paying money for these products shows that promotion alone is under-serving the market.

According to our social listening analysis, 45% of sample purchases are driven by testing products, while 21% use them as a daily alternative, and 13% use them for convenience. If the purchase of sample-size products does not lead to full-size product purchases, the question for beauty brands is how to adapt their strategy.

Unraveling China’s beauty sample revolution

- The sales of sample-sized products in China have grown 4.3-fold between 2019 and 2023, driven by their convenience and appeal as collectibles.

- Chinese consumers are in love with sample-sized products due to their portability and practicality in various settings, such as travel, office use, and daily outings.

- The cute economy has amplified the demand for miniature products, with consumers often seeking these items for their aesthetic appeal and collectible nature.

- Luxury brands prioritize giving away samples for free to maintain brand value and ensure targeted distribution through campaigns, holiday sets, gifts with purchase, VIP gifts, and loyalty programs.

- Chinese consumers frequently express their preference for smaller product volumes on social media, highlighting a trend in the beauty market towards smaller product packaging.