China, the world’s second-largest economy, has lately been a focal point of global economic discussions, particularly in the context of consumer spending. As of August 2023, consumer spending in China has shown signs of recovery after a tepid July, with marked increases in sales across various sectors such as apparel, automotive, food, furniture and appliances, and luxury goods. This article aims to provide a comprehensive view of the current state of consumer spending in China, its trends, and the factors influencing it.

Consumer confidence and optimism in China

Consumer confidence in China has been on a roller coaster ride in recent years, with the Consumer Confidence Index (CCI) hitting an all-time low of 85.5 points in November 2022. However, as of March 2023, the CCI has shown signs of recovery, increasing to 94.9 points. Based on a survey of 700 individuals over 15 years old from 20 cities all over the country, this index indicates future developments in households’ consumption and saving.

Despite the economic headwinds and declining consumer confidence, China’s economy continues to exhibit a certain level of resilience. The Chinese consumer sentiment improved in August 2023, snapping several months of decline, though it remains weak compared to earlier in the year. This trend is closely watched as consumption is a key driver of China’s economy, which has slowed in recent months due to waning confidence and a housing market slump.

Long-term projections and cautious optimism

Morning Consult’s China Index of Consumer Sentiment, a measure of consumer confidence, is an important gauge of how optimistic or pessimistic consumers in China are feeling about their economic prospects. This index is on a scale from 0 to 200, where 200 represents extreme optimism, and 100 signifies neutrality. In other words, a score of 100 indicates that consumers are neither particularly optimistic nor pessimistic, while scores above 100 suggest optimism and scores below 100 suggest pessimism.

In June 2023, the index experienced a 2.1% drop, which suggests that consumer sentiment in China was weakening during that month. However, there is a positive outlook on the horizon. Based on Trading Economics’ global macro models and analysts’ expectations, it is anticipated that consumer confidence in China will rebound and reach 100 points by the end of the quarter. This implies that consumers are expected to become more neutral in their sentiment as the year progresses.

Looking further ahead, the long-term projections for China’s Consumer Confidence are optimistic. It is estimated to trend around 108 points in 2024, indicating a more positive outlook, and 111 points in 2025. These projections suggest that, over time, consumer sentiment in China is expected to become increasingly optimistic, as it moves above the neutrality threshold of 100.

Despite the challenges, there is a certain level of optimism due to the vibrant potential of China’s consumer market. However, the term “cautiously optimistic” has been used to describe the current perspective, with an emphasis on “cautious” due to a softer outlook among consumers and companies toward China’s economic recovery.

While consumer confidence in China has been affected by various factors, including the COVID-19 pandemic and economic pressures, there are signs of recovery and a cautiously optimistic outlook for the future.

Factors influencing consumer spending in China

1. COVID-19 pandemic

The country’s strict lockdowns and travel curbs during the pandemic led to a decrease in consumer spending. However, the lifting of these restrictions has seen a resurgence in spending, albeit at a slower pace than expected. For instance, during the Golden Week holiday in October 2023, 826 million trips were made in mainland China, up 4.1% pre-pandemic levels. However, this was lower than the 1.58 million forecast, suggesting that the recovery in the services sector has decelerated.

The pandemic has also led to significant costs for local governments in China, with Guangdong province, the country’s top province by economic output, spending a total of RMB 146.8 billion (USD 22 billion) on pandemic prevention and control over the past three years. These costs may have influenced public spending, as resources were redirected toward pandemic control efforts.

2. State of the economy

The country’s economy has been in a slump since April 2023, with the government introducing a series of measures to reignite growth. However, growth projections for China’s economy for both 2023 and 2024 were downgraded by the International Monetary Fund due to the country’s real estate crisis and weakened consumer and business confidence.

The private sector, once the cornerstone of China’s remarkable growth, has faced challenges due to the sluggish economy, with production and investment falling behind state-owned companies. This situation has likely had a ripple effect on consumer spending, as a struggling private sector can result in job losses and lower wages, which, in turn, can lead to reduced consumer spending. Additionally, exports have also faced challenges, as Western countries continue to grapple with inflation.

3. Economic security concerns and consumer spending

Economic security concerns have been a significant factor inhibiting households in China from spending. Despite the removal of COVID-19 restrictions and the increase in opportunities for consumers to shop and spend, concerns about economic security have restrained Chinese households. According to CEIC data, Chinese household bank deposits increased by 42% since the beginning of 2020, totaling USD 4.8 trillion. This indicates that while the financial means are abundant, the fear of infection, concerns about economic security, and the looming debt from continuous lockdowns have collectively deterred households from spending.

The social safety net in China has been expanding over the past decade, but public social protection expenditure has remained low. This situation leads to precautionary savings, especially for migrant workers, which in turn reduces consumer spending.

4. Youth unemployment and consumer spending

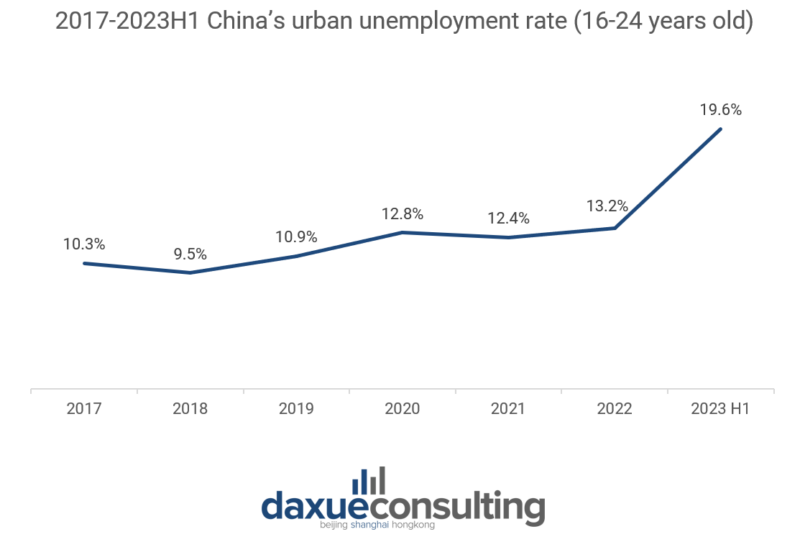

Youth unemployment in China has hit a record high, with the jobless rate for those aged 16 to 24 at 19.6% as of 2023H1. Despite this, China’s Gen Z has continued to spend on travel and leisure, with these categories seeing steady increases in spending among Chinese youth. However, the high youth unemployment rate could potentially have very negative ramifications for the economy, as it reduces the consumption power of the young, a demographic that typically accounts for almost 20% of consumption in China.

5. Real estate crisis and consumer spending

The real estate crisis in China has had a significant impact on consumer spending. For decades, the property boom fueled spending by China’s growing middle class, who kept a great portion of their wealth in real estate and felt confident when their homes increased in value. However, the downturn in the property sector, coupled with the Chinese government’s crackdown on excessive borrowing by the real estate industry, has led to a decrease in consumer spending.

The real estate crisis has also had a knock-on effect on other sectors of the economy. For instance, real estate developers are buying less land, which means that China’s local governments’ revenue has also declined. This situation could potentially lead to a decrease in public spending, which could further impact consumer spending.

Spending patterns and trends in China

Consumer spending in China has been a significant contributor to the country’s economic growth, contributing 65.4% to China’s economic growth in 2021. This growth has been driven by the continuous increase in citizens’ disposable income and retail sales of consumer goods.

China is over-represented in discretionary spending categories such as fashion, accessories, consumer electronics, and electric vehicles. However, consumption in some categories of “mass” consumer packaged goods remains underweighted relative to China’s share of global GDP. For instance, in 2020, China accounts for 10 to 15 % of global consumption of home care, packaged foods, beer, mass beauty and personal care, and consumer health products.

In the first quarter of 2023, the median disposable income of urban residents in China was RMB 12,175 (USD 1,739), up 3.9% from a year ago. Education, health care, and travel were the top three categories for planned spending.

Despite the growth in consumer spending, there are still challenges. Some economists argue that consumption is low in China because its growth is export-led and investment-driven. The resulting low household income and wealth lead to low consumption. However, over the past two decades, China’s household consumption has grown at an average rate of 9.3% per year, more than three times the world average, due to high-income growth.

What’s holding back China’s consumer spending and why hope persists

- Consumer spending in China experienced a recovery in August 2023 after a weak July, with notable increases in various sectors, including apparel, automotive, food, furniture, appliances, and luxury goods.

- Consumer confidence, as measured by the Consumer Confidence Index (CCI), hit an all-time low in November 2022 but showed signs of recovery by March 2023.

- Optimism exists for China’s consumer market, though it is described as “cautiously optimistic,” with uncertainties regarding the economic recovery.

- The factors influencing consumer spending in China include the impact of the COVID-19 pandemic, the state of the economy, economic security concerns, youth unemployment, and the real estate crisis.

- The COVID-19 pandemic led to a slowdown in consumer spending, and the costs incurred by regional governments for pandemic control may have affected spending.

- The state of the economy, including a real estate crisis and reduced private sector growth, has influenced consumer spending.

- Economic security concerns, precautionary savings, and low social protection expenditure have hindered spending.

- High youth unemployment rates are a concern for the economy, despite continued spending by China’s Gen Z on travel and leisure.

- The real estate crisis has had a negative impact on consumer spending due to a downturn in the property sector and government measures to curb borrowing.

- There is a diverse range of spending patterns across income groups in China, with an emphasis on discretionary spending categories and growing interest in education, health care, and travel. Challenges persist due to the export-led and investment-driven growth model.