In mid 2021, the central government’s decision to suspend for-profit tutoring came as a shock to many. Besides provoking fundamental changes in the lives of children and parents, the ban of off-campus education services has destabilized many companies throughout China. Consequently, both families and the country’s education industry need to re-orientate after China’s education crackdown.

Off-campus education market in China: Dimensions & figures

Extra-curricular tutoring classes have become an integral part of many Chinese students’ lives. A 2020 report published by management consulting firm Oliver Wyman highlights the dynamic development of private tutoring in China.

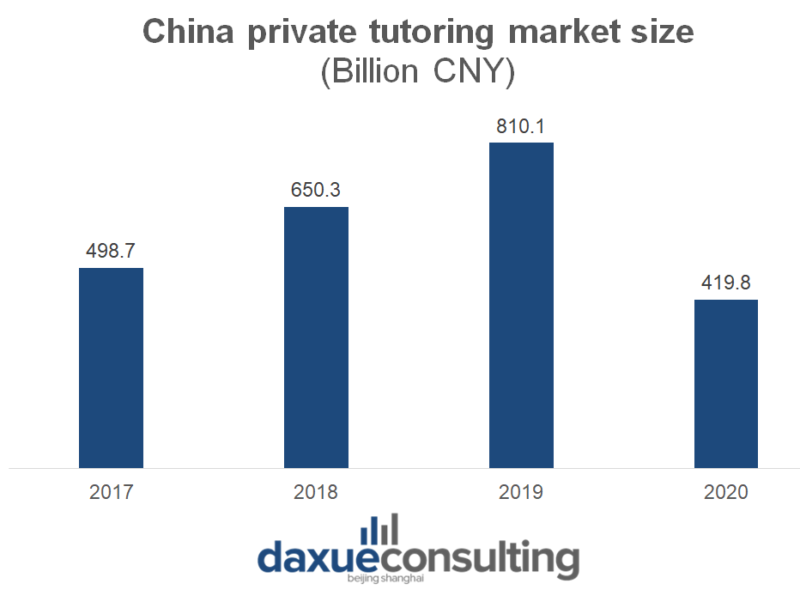

From 2017 to 2019, the market grew from approximately 500 billion CNY ($78 billion) to more than 800 billion CNY ($124 billion), equaling a CAGR of 31.2%. After the steep rise, confinement measures during the pandemic have led to the suspension of many tutoring sessions. Thus, unsurprisingly, tutoring expenditures after the outbreak of the global health crisis got smaller, dropping to approximately 400 billion CNY ($62 billion) in 2020. The latest education policy update will cause another massive disruption of the industry and a further plummeting of the private education sector’s market size. Whether the market will rebound soon remains unclear and will depend predominantly on the China’s Ministry of Education’s course of action after the initial harsh crackdown and the imposed private tutoring ban.

Private tutoring is a widespread phenomenon across China

In February 2021, a survey conducted among 4,000 parents has revealed that 92% enroll their children in extracurricular classes. The financial commitment is considerable, with half of families spending more than 10,000 CNY ($1,500) annually on private tutoring. The high popularity of private tutoring is an attribute of China’s extremely competitive higher education system. Oftentimes, parents feel pushed to send their kids to private tutoring classes. Only by doing so can they ensure that their children stay competitive within their peer group. However, the ironic situation that almost all families dedicate vast financial resources to extra-curricular classes reduces academic disparities, as children will show rather homogeneous academic performance again after the tutoring programmes.

The importance of test scores in China substantially fuels demand for private tutoring

China’s exam-oriented educational culture puts strong emphasis on children’s academic performance. Students in China usually spend months preparing for important exams. Most prominently, the Gaokao builds an academic milestone for Chinese students. The exam often constitutes the only selection criterion for further admission to higher education institutions. Thus, achieving high test scores at centralized exams, such as the Gaokao, is paramount and determines a student’s further academic path. This substantially shapes parents’ view on private tutoring, as children will have to outperform their peers at exams to secure on of the rare places at China’s top institutions.

What has changed and is China’s education crackdown the end to private tutoring?

In essence, the regulatory update requires all private, for-profit education institutions to convert to a non-profit model. Such institutions can no longer pursue IPOs, nor take foreign capital to finance themselves. Listed companies will not be able to issue stock or raise money in capital markets to invest in school-subject tutoring institutions, or acquiring their assets via stock or cash.

In addition, classes cannot take place late in the evening, on weekends and during vacations. Moreover, hiring foreigners to teach will no longer be legally allowed. Finally, the minimum age for tutoring classes was introduced, banning online tutoring and school-curriculum teaching for kids below six years of age.

Motives for China’s education crackdown

President Xi first indicated a potential crackdown on the tutoring industry as early as the beginning of 2021. He voiced serious concerns about the tutoring industry, calling it “a stubborn malady”. He signaled that China must ensure financial security to its citizens. Thus, an effective way to free up financial resources and reduce the financial burden on families, would come from targeting the exorbitantly high expenditures on private tutoring.

What is more, an argument frequently raised with regards to the government’s decision to crack down on private tutoring was the ambition to mitigate academic pressure on Chinese students. This seems relevant as health issues related to overly extensive study hours have increased substantially among Chinese students.

Besides, the rapid expansion of off-campus training institutions has triggered a series of social issues, including parents’ decreased willingness to have children. The new regulation aims at reversing this trend, thus seeking to increase the currently low fertility rates throughout the country. This is understandable as China’s aging population threatens the country’s grow trajectory and is increasingly problematic.

How parents react and what the crackdown implies for children

At least partially, Beijing’s initial plan the reduce the burden on both parents and children seems to work out. However, it is estimated that the private tutoring ban will fuel secret tutoring. Loopholes are currently being found, notably by China’s wealthiest families. To comply with the new regulation, so-called in-home nannies with teaching skills are being increasingly employed by those who can afford it, to provide tutoring to their children as before China’s education crackdown.

Besides, this Beijing’s move might incentivize parents to send their children abroad earlier. By attending international schools and preparing for universities overseas, students can simply circumvent the extremely daunting university admission process in China.

Keep afloat: Edtech companies struggle in times of China’s education crackdown

The change in regulation has deprived many businesses of their core business concept. Above all, the education policy update has had severe consequences for China’s leading edtech companies, such as VIPKid, Yuanfudao, New Oriental Education Technology Group and TAL Education Group. These companies have come close to a complete stillstand and had to suspend operations. Beijing has already shown that it will not refrain from fining companies that do not adhere by the new law.

Given that their main source of income resulted from tutoring children, the crackdown on private tutoring has had disastrous effects on many of these firms. For example, New Oriental Education and Technology Group, China’s largest provider of private educational services, has recorded a 86% hit of its stock. Similarly, TAL Education group was severely hit by the crackdown, resulting in a 93% decrease from its recent all-time peak.

While some argue that the crackdown was in fact a natural, long-overdue course correction of China’s education policy, others believe that the ban is undesirable and the new status quo will hamper children’s academic performance. In any way, families and businesses must search a way forward after China’s education crackdown.

Takeaways of China’s education crackdown

- In July 2021, China’s Ministry of Education issued new regulations that would ban for-profit tutoring throughout China.

- The Chinese government’s motivation behind the private tutoring ban is to mitigate academic pressure on students, free up financial resources of parents, as well as incentivize families to give birth to more children.

- Many companies in the education industry were destabilized, as their main source of revenue came from tutoring children.

- China’s education crackdown is only one of many crackdowns in China this year.

Author: Fabian Haidegger