China’s fertility market is undergoing rapid transformation as declining birth rates become a critical issue. With policies supporting childbirth and advancements in Assisted Reproductive Technology (ART), the market shows potential for steady growth.

Download our 2024 China Summer Sports Market report

Shrinking population: A new reality for China

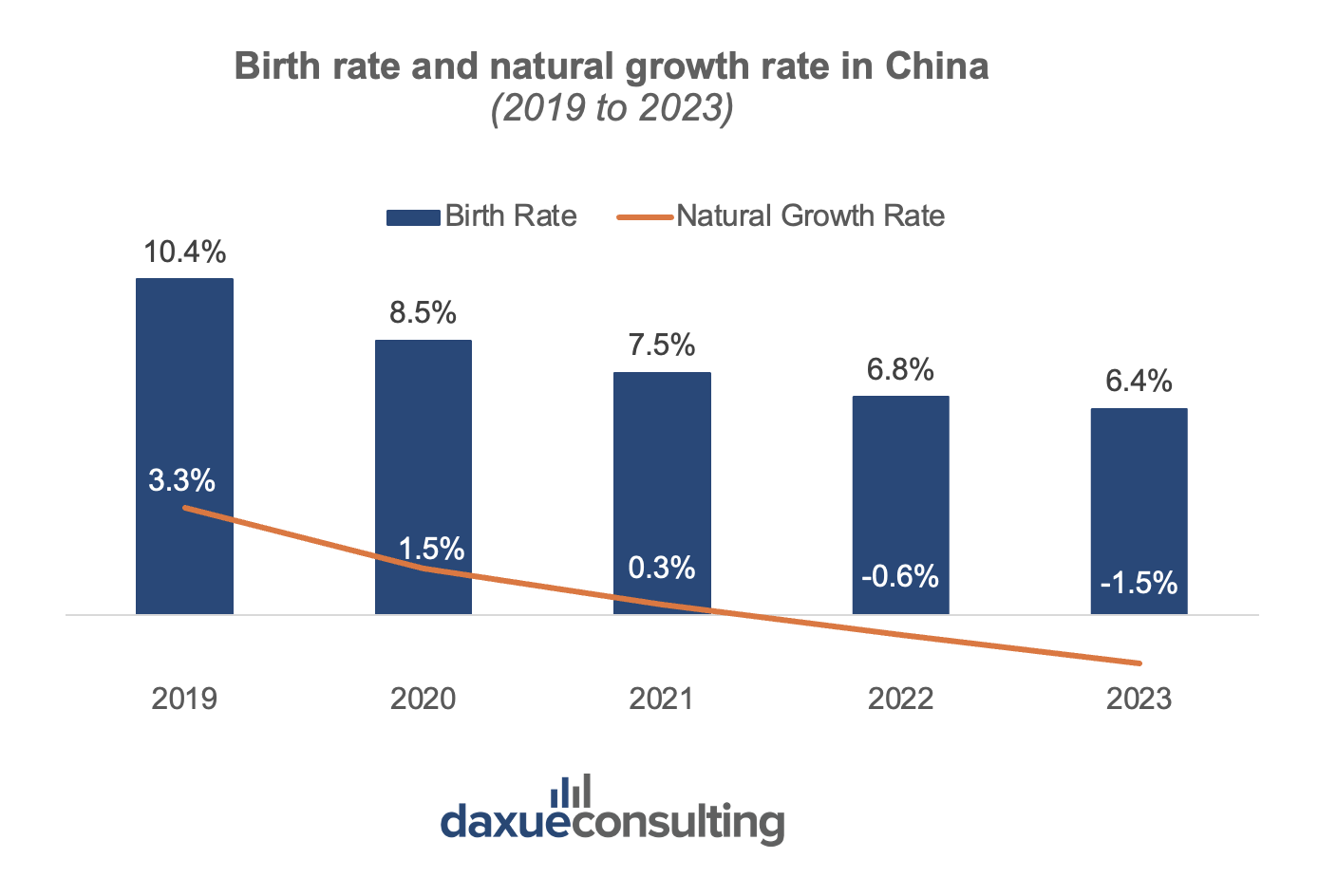

China’s birth rates declined continuously from 10.41 to 6.39 births per 1,000 residents from 2019 to 2023. The natural growth rate, which reflects the difference between birth and death rates, is also shrinking. In 2023, China’s population declined by 1.48 per 1,000 residents, indicating China’s vulnerability to the “low-fertility trap”.

This persistent decline in birth rates can be largely attributed to a combination of factors such as rising living costs, shifting societal attitudes toward marriage and family, and the increasing pressures of career development. However, another significant and often overlooked contributor is the increasing prevalence of infertility.

Infertility on the rise

Assisted Reproductive Technology (ART) to the rescue in China’s fertility market

China’s fertility market has seen a significant increase in demand. The infertility rate among couples of childbearing age rose from 11.9% to 18.2% between 2007 and 2023. This means approximately 1 in 6 couples in China faces difficulties conceiving. Factors driving this rising infertility include later marriage and lifestyle factors such as stress and diet. From 1990 to 2020, the average age of first childbirth was postponed from 24 to 28 years old. Additionally, by 2030, the number of women aged 20-35 is projected to decrease by 27% compared to 2022.

To address concerns of families struggling to conceive, the National Healthcare Security Administration recently consolidated Assisted Reproductive Technology (ART) services into 12 categories, such as oocyte retrieval and embryo cultivation. By 2024, 27 provinces had included ART in medical insurance. This development benefited 1.03 million patients and reached a total expenditure of RMB 1.96 billion.

IVF subsidies: Easing the financial burden and expanding access

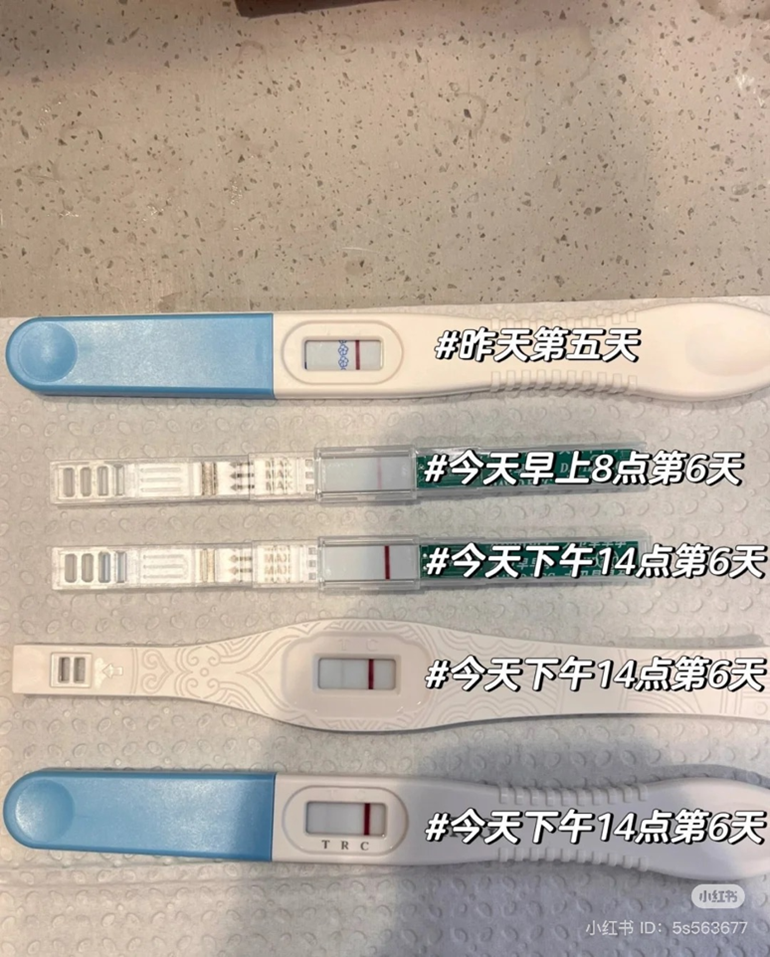

China’s fertility market is seeing growing attention towards In Vitro Fertilization (IVF) – as of January 2025, hashtags like #The IVF Journey (试管之路) garnered 1.05 billion views and over 8 million discussions on XHS. To help reduce the financial burden, regions are actively promoting the implementation of assisted reproductive subsidies. For example, commercial medical insurance in Hangzhou includes IVF costs in its reimbursement scope, with insured citizens eligible for a maximum reimbursement of RMB 3,000. For families who have lost their only child, Liaoning Province offers a free IVF treatment cycle. Meanwhile, Shaanxi Province provides a complete IVF treatment free of charge.

Egg freezing: Rising popularity in fertility preservation

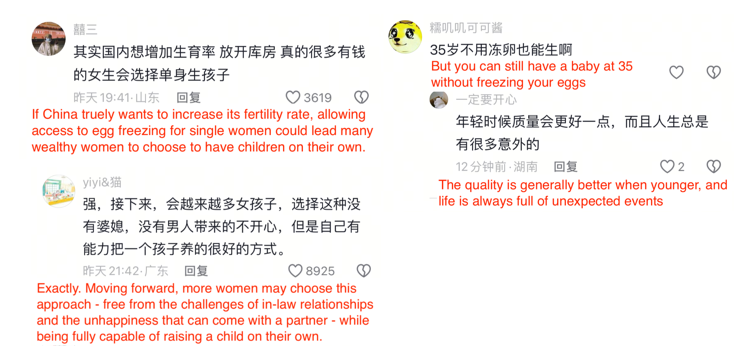

In a survey based on 1,683 current and potential ART patients conducted by Yuwa Population Research and Jinxin Fertility – the largest private assisted reproductive enterprise in China, more than 60% of the respondents expressed a desire to preserve their fertility through egg freezing. The 30-34-year-olds and those with higher education levels expressed the highest intention. Due to the domestic ban on single women accessing ART, some had to pay high costs to freeze their eggs abroad. Considering that egg-freezing technology has been developed for over 20 years and has gradually matured, many voices on social media are advocating for the liberalization of egg-freezing for single women to safeguard their reproductive rights.

This conversation has been amplified by actress Gui Gui, who shared the news about giving birth to a girl via egg-freezing technology in Taiwan. Her story ignited widespread debate in China. Supporters advocate for greater reproductive autonomy and expanded access to these services, while critics raise concerns about health risks. Feminist voices have also called for policy reforms to allow single women access to egg freezing. It is estimated that if the reproductive rights of single women are guaranteed, the fertility rate would be increased by about 2%, translating to an additional 200,000 births per year.

China’s fertility market: Growth and competition

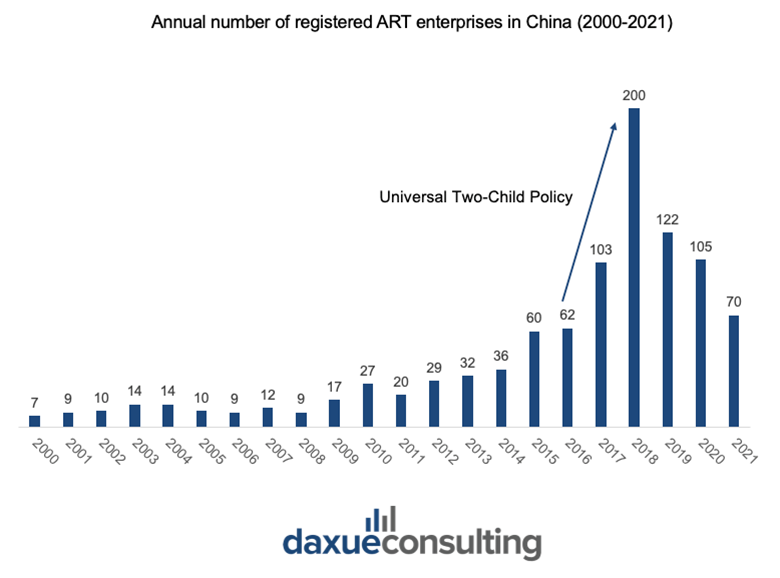

As the “Two-Child Policy” was fully implemented in 2016, the family planning certificate was no longer required for accessing ART treatment. This leads to a broader range of people who could benefit from infertility treatments. This regulatory relaxation significantly expanded the market demand for ART services, encouraging new businesses to enter the field. In 2018, there was a spike in the annual number of registered ART enterprises in China, reflecting the growing interest and investment in this sector. By 2026, the ART market is projected to reach RMB 48.4 billion.

Nonetheless, challenges remain, including heavy reliance on imported high-end reproductive drugs and medical devices. While this gives international brands a competitive edge, domestic companies have gained ground in areas like diagnostic reagents and medical consumables, with shorter R&D cycles and lower technical barriers. The reliance on imported upstream materials, however, still exceeds 50%, limiting the industry’s independence.

Complex approval processes and high development costs further constrain local innovation. Therefore, simplifying regulatory hurdles, encouraging investment, and promoting resource-sharing can help domestic brands compete more effectively, reduce costs, and improve technical capabilities.

Highlights of China’s fertility market

- China’s birth rate and natural growth rate are declining, with the country now facing a shrinking population.

- Infertility rates have risen from 11.9% to 18.2% since 2007, leading to growing demand for ART. ART services are now included in medical insurance in 27 provinces, benefiting over a million patients.

- IVF is becoming more accessible as subsidies ease financial burden. Moreover, some regions provide free or reimbursed treatment cycles to support families in need. Egg freezing is also gaining popularity, though restrictive policies push many women to seek these services abroad.

- The ART market is projected to reach RMB 48.4 billion by 2026, driven by policy shifts and growing demand. Domestic brands are making strides in diagnostics and consumables but remain reliant on imported high-end materials.