China’s mattress market is still relatively early in its development. Perceptions regarding the importance of mattresses are evolving. Additionally, the market concentration is relatively low, thus there leaving much room to grow. Yet there are a great number of leading global corporate organizations with significant long-term prospects in the mattress market in China. With consumers’ growing awareness on the importance of mattresses, it provides a high potential for overseas brands to set up and expand their presence.

Mattress market in China overview

The consumption of mattresses in China is relatively low compared to other countries. The brand concentration is also low, with international brands taking the premium spot and domestic brands taking most the market.

China’s mattress market is the largest in the world

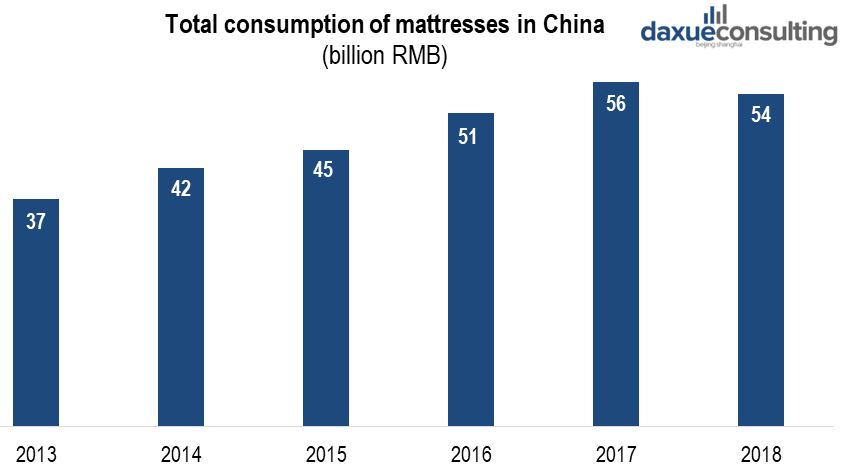

Data Source: Qianzhan, total Consumption of mattresses in China from 2013 to 2018

With the consumption increasing fourteen-fold since 2002, the mattress market in China is now gradually entering a mature stage. With the CAGR of 17.77% for the last decade, China’s mattress market surpassed that of the United States in 2015, becoming the largest in the world.

International mattress brands are premium players in China

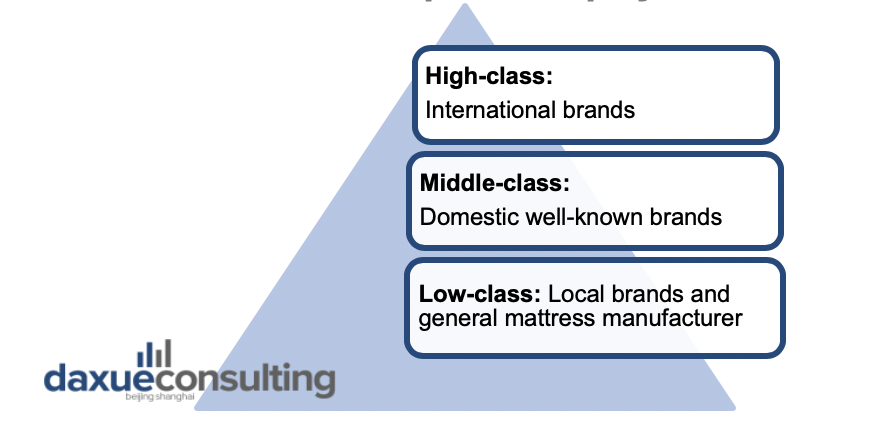

Data Source: Qianzhan, Competitor Overview of the Chinese mattress market

In the Chinese market, consumers generally perceive the imported mattress as premium. Thus, the high-class competitors are represented by international brands. The leading competitors in the Chinese market are the middle-class competitors, which are the domestic brands. The low-class competitors consist of generic brands from local mattress manufacturers.

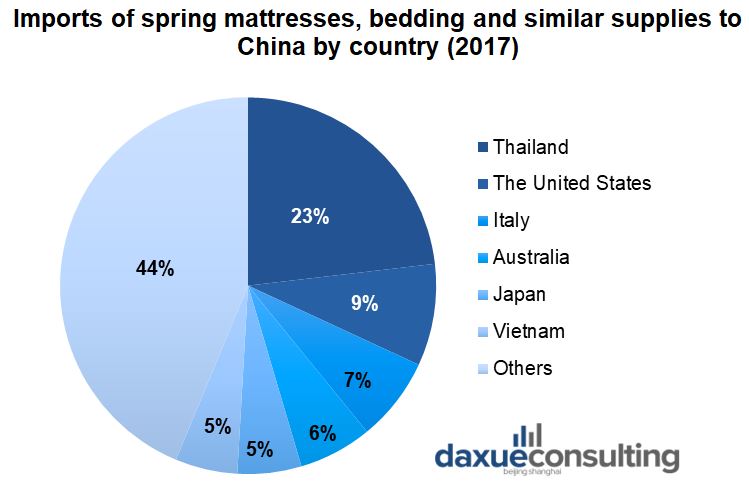

Data Source: Chyxx, Import of spring mattresses, bedding and similar supplies in 2017

The Chinese mattress industry focuses on export instead, the trade surplus between the import and export of mattress reached 1.7 billion dollar in 2019. When it comes to imports, China imported the most bed supplies from Thailand.

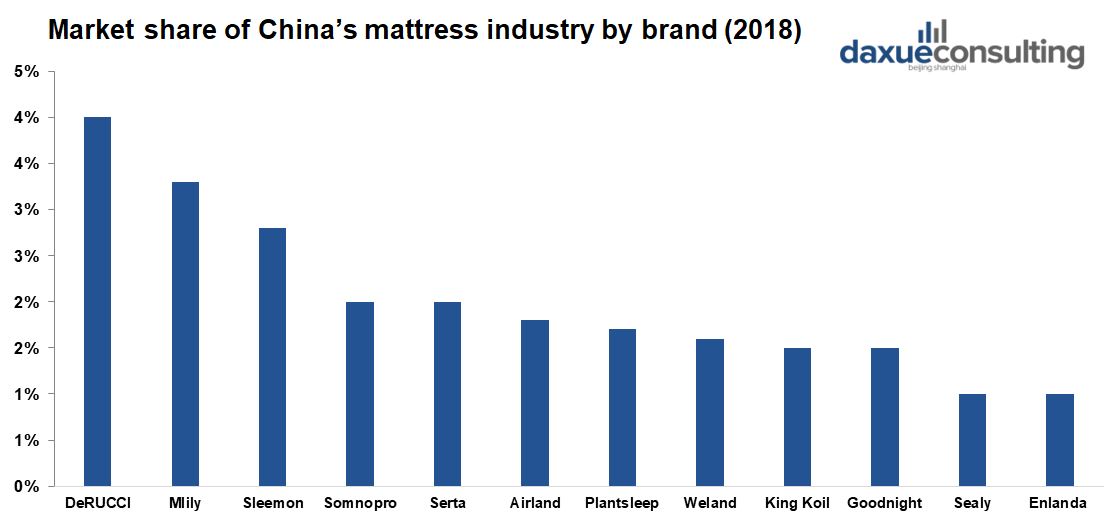

Data Source: Qianzhan, Market share of the mattress industry by brand in 2018

The market concentration is low in this market and there is no obvious leading brand. Based on China’s mattress market share in 2018, half of the top twelve brands, including the top four brands are domestic brands. Foreign brands that are outstanding in the market are from the United States, accounting for five out of the top twelve brands.

What do Chinese consumers look for in a mattress?

China’s economic development head lead consumers to reflect on the quality of regular household items, which is known as the consumption upgrade. Growing awareness on the improvement of living standards has prompted people to have specific requirements for their sleeping environment, mattress quality and appearance. The emergence of mattress production technology can meet the needs of a variety of people. To succeed in this market, it is crucial to understand Chinese consumers’ preferences, spot their needs and provide value adds-on service to win the consumers.

Key factors on mattress purchase decision

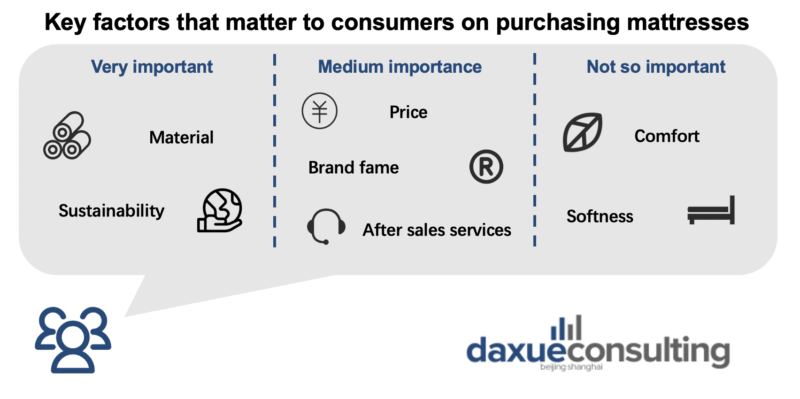

Data Source: Wenjuntech, Key factors that matter to consumers on purchasing mattresses

While purchasing mattresses, consumers mainly focus on the material and sustainability. In China, sustainability is not only an environmental issue, but there is a perception that it has less pollutants. After price, brand name and after sales service, comfort and softness are less important to Chinese consumers.

Data Source: Wenjuntech, Key factors that prevent consumers from purchasing mattresses

About 80% of the respondents stated that the negative review on the mattress brand would affect their purchase decision. This is what brands need to watch out for when it comes to Chinese negative reviews: 40% of the respondents identified ‘air impermeability’ as the main problem, which would lead to skin disease. ‘Low-quality spring’ and ‘formaldehyde’ are the following problem identified by the respondents, accounting 41% of the total responses.

After sales services are important to many Chinese mattress consumers

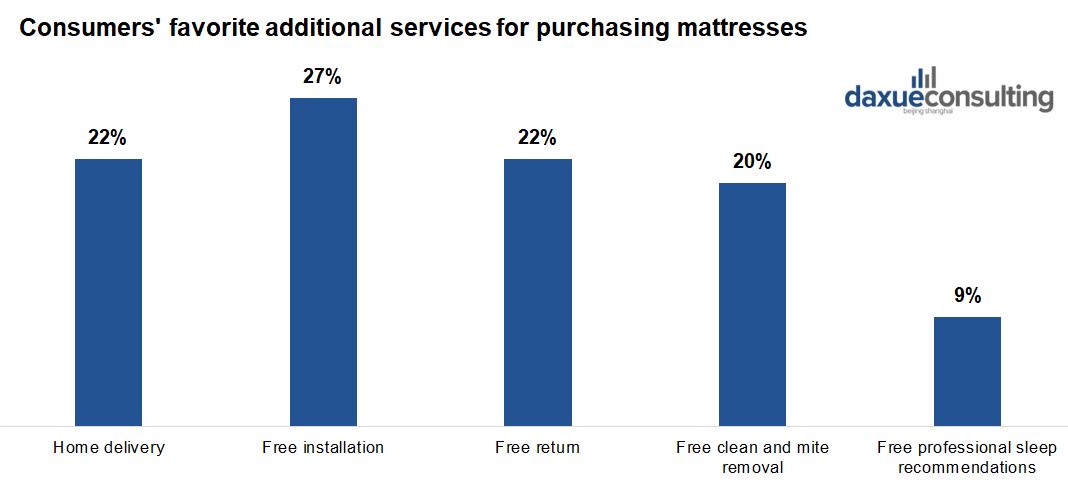

Data Source: Wenjuntech, Consumers’ favorable additional services on purchasing mattresses

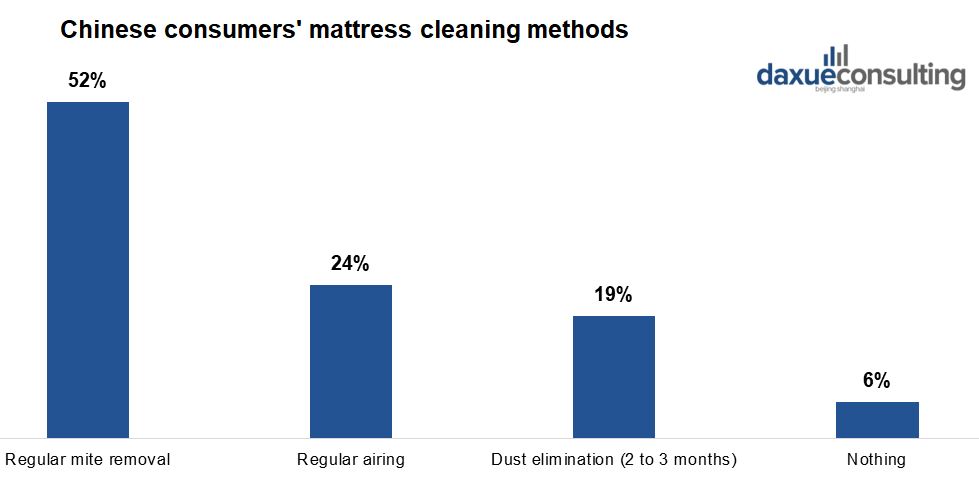

Data Source: Wenjuntech, Consumers’ perception on cleaning mattresses

Products and services are indivisible. Consumers equally prefer home delivery, free installation, free return, free cleaning and removing mites as additional services. Digging deeper, more than a half consumers value regular mite removal. However, the process is too complicated to consumers to do it by themselves. Regular cleaning services would be a powerful selling point in the mattress market in China.

Common mattress materials in China

Latex mattresses are the top selling mattress in China. Consumers appreciate that are porous and have high elasticity, they are highly sought after because of their ability to conform to the curves of the human body and improve sleep quality. In the first half of 2020, latex mattresses made 1.3 billion RMB in sales on Tmall and Taobao.

Palm mattresses are also very popular in China, making over .5 billion RMB in sales on Tmall and Taobao during the same time period. Palm fiber is woven with good flexibility and moderate hardness, but natural materials may have worms or mildew.

Spring mattresses also made around .5 billion RMB in Tmall and Taobao sales during the first half of 2020. However, negative reviews of spring mattresses suggest brands need to watch out for having springs collapse.

Future growth depends on how often consumers replace mattresses

Changing in consumer perception

The results of a study by Kingston University in England showed that a mattress have an average of at least 15,000 bed mites and dust mites. The number of bacteria on a double-bed mattress that has not been cleaned in three years could exceed 1 billion. And experts suggest changing mattresses every five years. It is the frequency of changing the mattress which will lift the market from maturing to mature. As of 2020, a majority of Chinese mattress consumers do not change their mattress as much as recommended as a research shows that 50% of Chinese consumers only change the mattress when it is broken. It is much lower than that of the United States. In the United States, 50% of consumers stated that they generally change mattress once three years and 30% of consumers stated that they won’t use the mattress for more than three years.

China’s mattress market is dynamic due to constantly evolving consumer preferences. With the increasing awareness on living standard and sleeping quality, the frequency of mattress replacement is speeding up and will be a driver of market growth once market penetration is at the max.

Functional mattress: mattresses matter for high quality sleep

In light to the research in 2018, only 25% of post-90s Chinese have acceptable sleeping quality, above 75% respondents stated that they had poor sleeping quality. Around 20% of the respondents chose to change mattresses to improve the quality of sleep, and 27% of them showed interest in intelligent mattresses.

Following that, post-90s are the main consumers in the mattress market in China, the concept of upgrading sleep quality is expected to spark sales. Functional mattresses working on improving sleeping quality would be able to catch this market opportunity.

Rental housing renovation trends

With the increase in home ownership costs and government policy support, the rental industry has entered a new era of development. Data show that the rental population in Chinese service rental market has maintained steady growth since 2017, with 210 million people in 2018, and 220 million people in 2019, 220 million in 2020, and 240 million in 2022.

Renovation of rental housing is trending in China, as demonstrated by frequent hot discussions on Weibo. Mattresses are seen as a key component of improving the living quality. Therefore, purchasing new mattresses for the rental houses is spurring. A question on Zhihu asks about whether it is necessary to buy a new mattress for apartment rentals, the top answer states that people should not settle for uncomfortable mattress and get a new mattress for quality sleep and quality life.

Data Source: Weibo: hot topics related to rental house renovation; Zhihu: Is it necessary to purchase a new mattress for the rental house?

Learning points

The size of mattresses market is growing, and the trend for premiumization is beginning with after sale-services and sustainable material. The Chinese mattress market is lacking an obvious leading brand. Hence there is potential for an existing brand, or even a market entrant, to step up. Companies need to pay attention to the consumers’ needs and find the way to understand and satisfy them.

Author: Dongni He

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast