Many people know China as the world’s largest toy exporter. It has a solid manufacturing reputation, especially in the southeastern provinces. Indeed, China’s toys market has consistently exhibited positive growth over the last ten years. In 2023, the size of China’s toy market stood at a substantial RMB 159.8 billion, indicating that the demand for toys in China remains robust. However, while manufacturing products remains the focus in the industry, more local companies are focusing on Intellectual Property (IP) development even though they fall behind compared to foreign companies.

Download our 2024 China Summer Sports Market report

China’s toys market structure

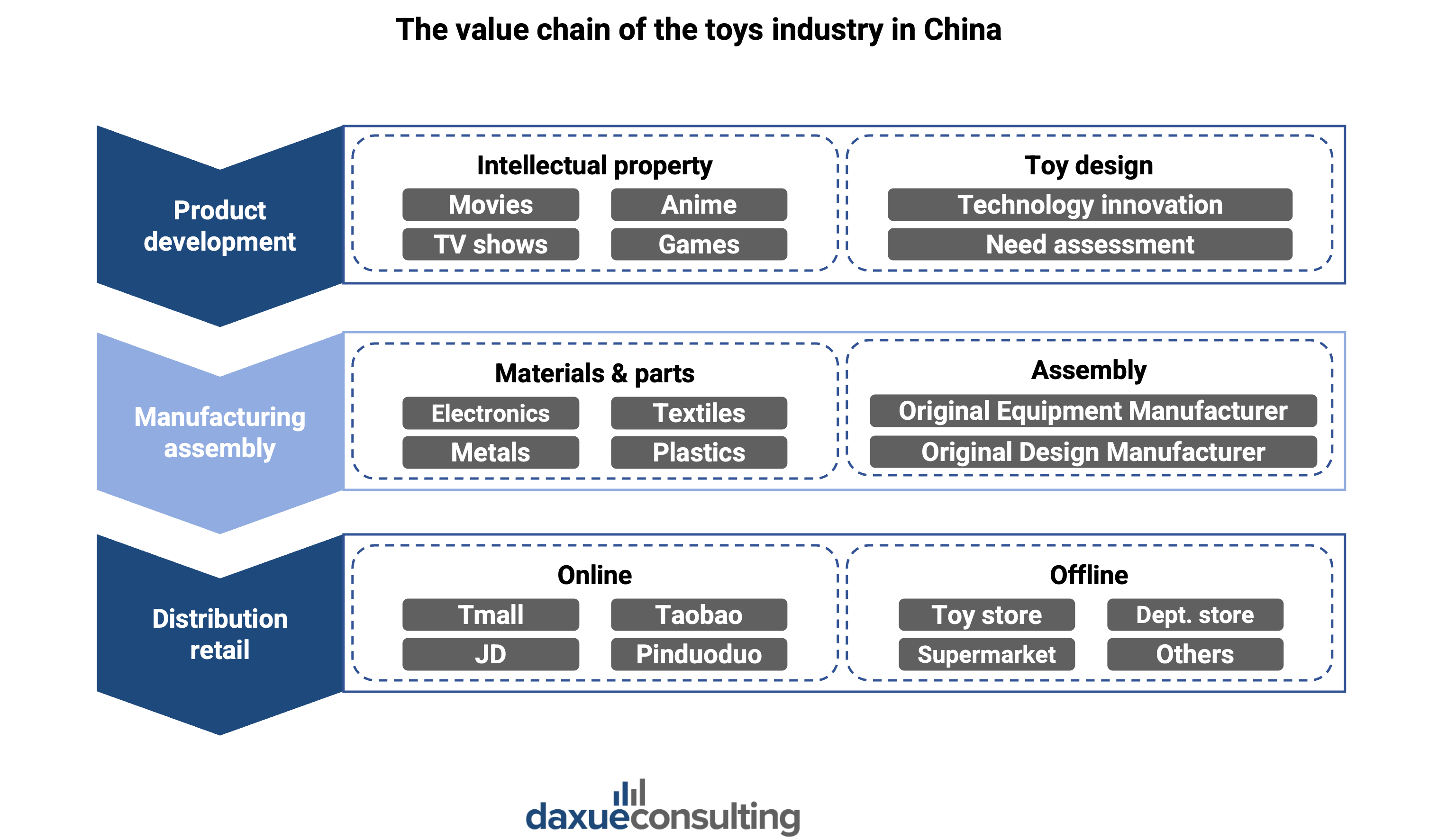

The value chain of the toy industry in China can be categorized into three segments: product research and development, manufacturing assembly, and distribution retail.

China’s toy industry chain focuses on manufacturing and toy production. Factories are mainly concentrated in the coastal areas of Guangdong, Jiangsu, Zhejiang, Shandong, Shanghai and Fujian, where reform and opening-up took place earlier and the economy is more developed. China’s toy production was 7,111,600 tonnes in 2023, a year-over-year increase of 0.7%. However, despite the large output of toys and the large number of enterprises in China, the level of R&D and design of Chinese toy manufacturers and brand awareness is not high. 80% of cartoon and animation IPs in China is foreign characters.

Chinese toy consumers: once the only child, forever the toy lovers

The major consumers in the toys market in China in 2022 are Millennial parents who were born in the 80s and 90s. These generations are the ‘only-child’ generations as China implemented the one-child policy from 1980 to 2015. At first, many people were curious or worried whether these generations would make good parents due to the negative stereotypes associated with being the only child: spoiled, selfish, or “little emperors”.

It turns out that the “only child” generations are indeed different, and in some ways better than the previous generations when it comes to parenting. According a research by The Chinese Academy of Social Sciences, about 30% of 90s parents pay with their children more than three hours per day, compared to 24% for 80s parents and 12% for 70s parents.

Why are Chinese parents becoming more willing to play with kids? Parents believe that playing together is a form of education, not of traditional STEM knowledge but rather soft skills such as working together, making decisions together, developing artistic sense, and bonding emotionally. Another key reason is that Millennial parents use playtime with kids as a means of destressing themselves and having fun. 97% of the parents expressed that fun time is very important to them.

Defining pop toys and traditional toys

Traditional toys are items that are often crafted from familiar imagery to educate and entertain. They are often affordable and commonly used by children. In contrast, pop toys are inspired by pop culture, and they are meticulously designed and tend to be more expensive. They primarily appeal to young adults who seek them for appreciation, collection, and fulfilling emotional desires.

Traditional toys

In 2023, the total retail sales of traditional toys in China amounted to RMB 90.7 billion, reflecting a year-on-year growth of 2.7%. It is expected to reach RMB 119.5 billion in 2026. Such sustained positive growth is uncommon in a mature industry, indicating that there are still promising prospects for the market’s future.

The traditional toys industry in China originated in the early 1960s and has now reached a mature phase. These toys can be classified into five primary categories: educational toys, dolls, wheeled toys, blocks, and model toys. They hold market shares of 54%, 26%, 9%, 8%, and 3%, respectively. Educational toys hold the largest market share, reflecting the continued interest in toys that that are not only fun but help children learn. It is followed by wheeled toys with a market share of 26% and wheeled vehicles with 9%.

China’s toys market competitive landscape is segmented

China boasts a significant number of toy companies with a low level of market concentration. Consequently, individual toy companies in China hold a minimal market share, leading to fierce competition within the industry. In 2023, the leading ten firms in China’s traditional toy sector collectively represented merely 5.6% of the total market share. Furthermore, the market share of publicly listed companies within the traditional toy industry is very limited. This indicates that the toy industry in China presents a relatively low barrier to entry, and the existing market for traditional toys continues to expand, rendering it appealing to external stakeholders.

Pop toys

The pop toy industry has been gaining traction in China since 2016 and is currently experiencing significant expansion. As reported by Statista, the market size for pop toys is projected to reach RMB 76.4 billion by 2024, with a year-over-year growth rate of 20% over the next two years. In terms of categories, blind boxes, assembled toys, and clutch toys are the key segments, representing 36.6%, 19.6%, and 14.5% of the total market size in 2024, respectively.

In the context of technological advancements and the regulatory landscape, this upward trajectory is expected to persist. On one side, advancements in 3D printing technology are reducing production costs and enhancing efficiency, while virtual reality (VR) and augmented reality (AR) technologies are facilitating more engaging interactions with toys and enriching the shopping experience.

Moreover, approximately 85% of China’s pop toys are manufactured in Dongguan, where the government has established policies encompassing production equipment and financial assistance. These initiatives effectively consolidate regional resources for pop toy production in Dongguan, create economies of scale, and foster collaboration and innovation.

Young adults buy toys for themselves

The Generation Z, those born between 1995 and 2005, represents the primary demographic for pop toy consumption. They comprise 38.4% of the market in 2020, according to iiMedia. A significant portion of this group consists of children, who often experience heightened feelings of confidence and individuality when purchasing well-crafted and limited-edition toys. Additionally, they exhibit a pronounced desire for social interaction beyond their home environment, prompting them to acquire pop toys as conversation starters. Social engagement and personal gratification serve as pivotal drivers for Gen Z’s purchasing behavior. Consequently, 46.78% of consumers attribute their spending on pop toys to the element of surprise.

Generation Z tends to maintain an optimistic outlook regarding their financial prospects, possesses a heightened sense of curiosity, and places considerable importance on the shopping experience. While 62.4% of this group opts to purchase pop toys through e-commerce platforms, 51% also frequent physical retail locations. These offline channels include vending machines and animation exhibitions. They allow consumers to privately view and occasionally handle the products they intend to buy. Furthermore, they can engage with cosplayers representing the pop toys within the store and meet customers with similar interests.

Trendiest brands in three categories and case analysis

The current landscape of popular pop toys companies can be categorized into three distinct segments based on their core operations. POP MART stands out as the sole entity that engages in the entire process. It encompasses product image design, production, and sales, to create a pop toy empire. The second category includes companies primarily focused on the design and development of toy imagery. Some notable examples are Twelve Culture, Muna Studio, Wakurai, and 52 Toys. Lastly, the third category comprises firms specializing in sales, including Nine Woods Miscellaneous Goods Society, Kulo Chiu Play, and MINISO.

POP MART, known for its blind boxes, stands as the frontrunner in China’s toy sector. The company reported a revenue of RMB 6.3 billion in 2023. This is nearly six times that of its closest competitor, Alpha Group. It also boasts a substantial audience and a remarkable level of customer loyalty. It has over 30 million members and a repurchase rate of 44.5% as of June 30, 2023. Many of its consumers are females who are urban white-collar professionals or students aged 16 to 28.

The brand has demonstrated that effective co-branding in China can serve as a vital marketing strategy. In the fiercely competitive landscape of China, collaborating with established brands is essential for attracting new customers and piquing their interest.

To differentiate itself and engage younger consumers, POP MART has successfully collaborated with globally recognized brands, such as Lenovo Xiaoxin and KFC. However, KFC’s promotional efforts and the perceived low quality of blind box toys in China have led to some criticism of the brand.

We offer consulting services for China’s toys industry

Our comprehensive consumer understanding helps businesses refine their offerings and craft effective marketing strategies to resonate with toy companies. Through our consulting services, we guide you to leverage emerging opportunities and navigate the competitive landscape. Reach out to us to discover how our expertise can drive your toys business’ success in China.