Chinese insurance market

In recent years, medical and living expenses have gradually increased. A comprehensive security plan is an effective way to cope with high medical expenses and loss of returns. In addition to Mainland Chinese insurance products, more people now prefer Hong Kong insurance products.

According to the statistics of the China Insurance Regulatory Commission, in 2018 the coverage of insurance provided by the insurance industry was 6897.04 trillion yuan, an increase of 66.23% over the same period last year. Among them, the insurance coverage of property insurance companies was 5777.37 trillion yuan, an increase of 90.65%; the cumulative new insurance coverage of life insurance companies was 1119.67 trillion yuan, an increase of 0.10%.

The number of new Insurance policies increased by 66.13% over the same period of last year, to 29.972 billion. Among them, property insurance companies signed 28.263 billion new policies, an increase of 70.10%; life insurance companies added 809 million new policies this year, a decline of 8.46%. In 2018, Chinese insurance depth was 4.22%, while the world’s average insurance depth was 6%, with a difference of about 1.8%.

Insurance coverage and the amount of property insurance are rising, while that of the life insurances are showing a downward trend. The insurance coverage and the amount of Insurance policies in the Chinese market are still large.

Mainland Chinese insurance products: What insurance products are the most popular?

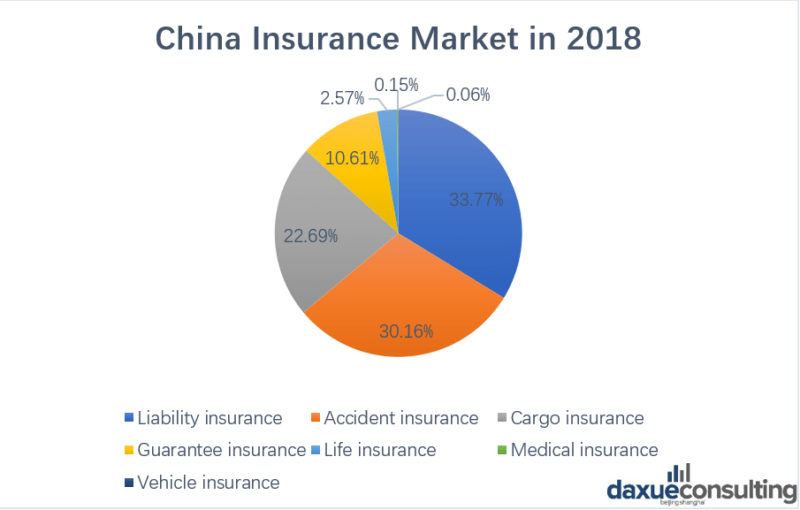

According to the statistics released by the CIRC, the number of cargo Insurance policies in China is 4.89 billion, up 31.91% from the same period last year, while liability Insurance policies are 7.277 billion, up 81.70%. Guarantee Insurance policies in China increased by 35.62% to 2.286 billion, while vehicle Insurance policies increased by 12.09% to 448 million. In this year, there were 89 million new personal Insurance policies in China, down 19.86%; 55.491 million life Insurance policies, down 20.35%; 3.201 billion medical Insurance policies, up 41.7.28%; 6.499 billion accident Insurance policies, up 16.851%.

It can be seen that in the Chinese insurance market in 2018, the number of liability Insurance policies is the largest, accounting for 33.77%, while the number of accident Insurance policies ranks second, accounting for 30.16%. The number of cargo Insurance policies ranked third, accounting for 22.69%, followed by the number of guarantee Insurance policies accounting for 10.61%.

Trend Analysis of Overseas Purchase of Insurance Products in Hong Kong

Hong Kong insurance has only recently become popular, but it has actually been sold for many years, mainly in coastal cities like Beijing, Shanghai, Guangzhou, Shenzhen,.

According to a statistical analysis of the Hong Kong insurance Authority, Mainland Chinese come to Hong Kong to insure. The main Insurance products in Hong Kong Mainland Chinese buying are high-end medical insurance, high-returns savings-dividend products, high-security major disease products, and life products.

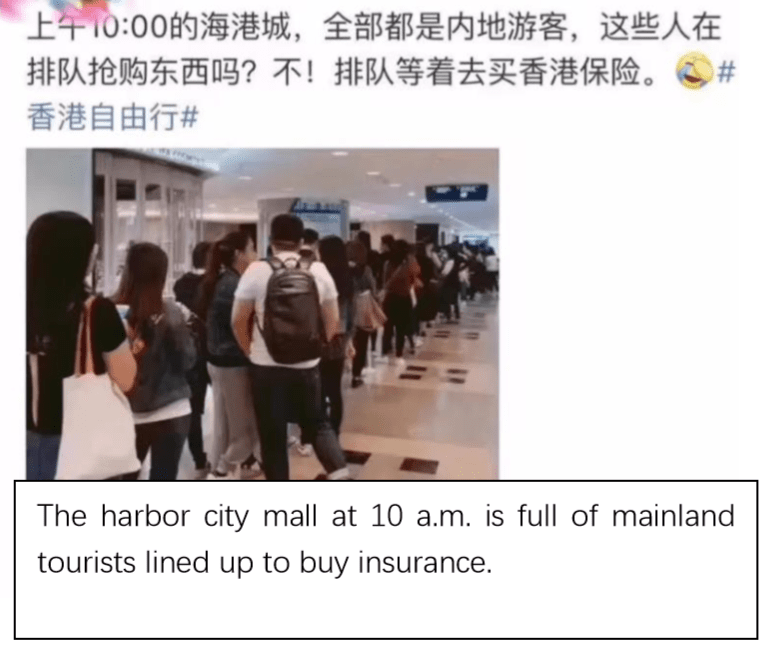

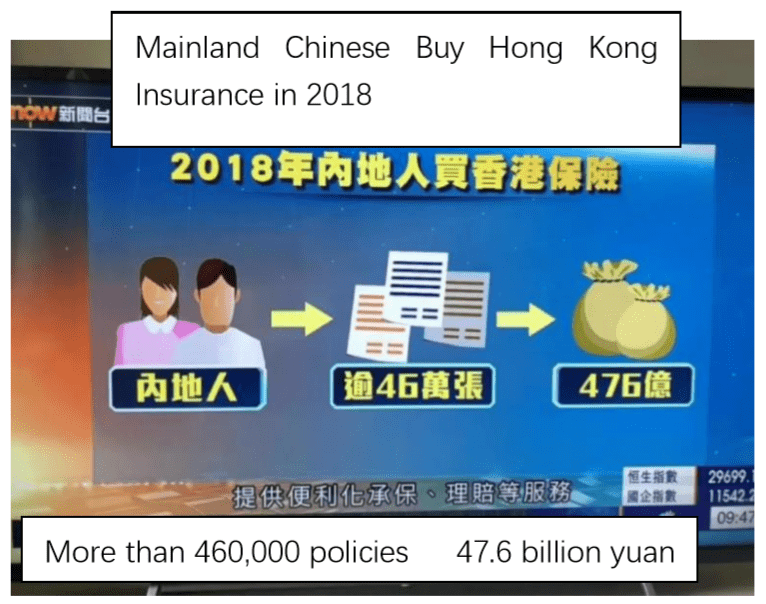

In 2018, Mainland Chinese contributed 460,000 Insurance policies to Hong Kong, averaging about 40,000 policies per month. The annual premium was HK$47.6 billion, averaging about HK$4 billion per month.

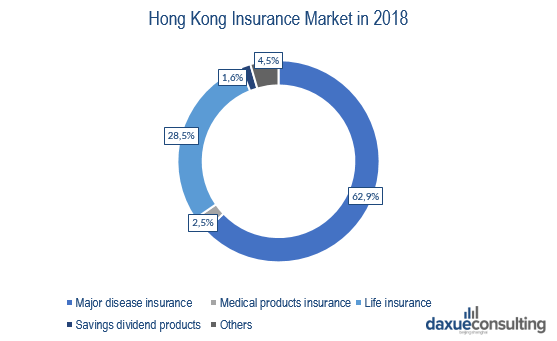

According to data from the Hong Kong insurance Authority. The statistics of new single Insurance policies, the number of major disease insurance purchased by Mainland Chinese is the largest ever, and continues to rise. The first three quarters of 2018 accounted for 62.9%, much higher than the same period in 2017, showing that Hong Kong’s major disease insurance has a strong attraction for Chinese Mainland visitors, followed by life insurance, accounting for 28.5%, which is significantly lower than the same period in 2017.

Why Mainland Chinese prefer to buy insurance in Hong Kong?

A prospering economy upgrades people’s consumption levels: the rapid development of China’s economy, the improvement of people’s living standards and the upgrading of consumption put forward higher requirements for the quality of life and the degree of security.

Pricing advantage of Hong Kong insurance: Pricing is more advantageous because the mortality rate and incidence of major diseases in Hong Kong are lower than in the Chinese Mainland. Similarly, the premiums for major diseases or life insurance are lower than those in the Chinese Mainland. The average price of the same kind is about 30%.

International financial center and mature competitive market: the investment environment of insurance companies in Hong Kong is more mature. As one of the three major financial centers in the world, Hong Kong’s major asset allocation of insurance funds is more biased towards equity products such as stocks and real estate. Therefore, Hong Kong’s savings-dividend products are expected to yield higher returns than Chinese Mainland products.

In September 2015, the CIRC stipulated on ‘Improving Policy Reform of Dividend-based Personal Insurance Premium Rate for Chinese Mainland Insurance Companies’ that all dividend-based insurance should have an expected annual returns rate of no more than 3.5%, otherwise it would need to be submitted for examination and approval. In contrast, the Hong Kong insurance Authority has no revenue-related restrictions, and the yield of Hong Kong insurance products tends to be much higher than 3.5%.

Hong Kong insurance market: The most popular types of insurance in Hong Kong

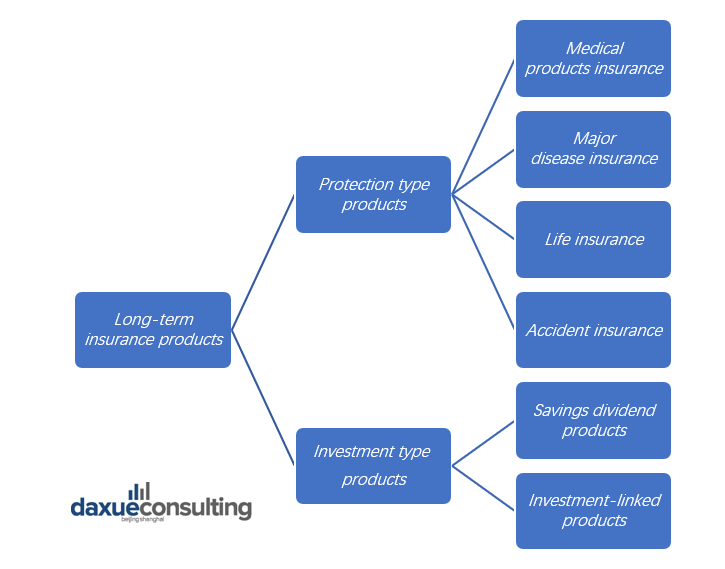

Here is the main product structure of Hong Kong insurance, the long-term insurance products which can be divided into two parts: Protection type products and Investment type products. And among them, protection type products can be divided into medical products insurance, major disease insurance, life insurance and accident insurance, while investment type products are composed of savings-dividend products and investment-linked products.

Among the Chinese Mainland residents, the most popular types of insurance in Hong Kong are major disease insurance and savings-dividend products. Their advantages and functions are described below with specific case.

Insurance in Hong Kong: Major disease insurance

Major disease insurance- there are many kinds of major disease insurance, and their design is more humanized. The majority of Hong Kong’s major disease insurance options cover more than 100 categories, while many in the Chinese Mainland cover around 70 categories. Besides, the dividends are high, the insurance coverage is higher, and the rates are lower. The overwhelming majority of Hong Kong’s major disease insurance have dividend distribution, the dividend rates are generally 3-4%, while those in the Chinese Mainland are relatively low.

Insurance in Hong Kong: Savings-dividend products

Savings-dividend products-the expected dividends of insurance products are higher in Hong Kong. The annual compound dividends rate of Hong Kong products is about 6%, and that of domestic insurance is about 4%. Apart from that, its Dollar insurance policy in Hong Kong, which diversify the exchange rate risk. Hong Kong insurance is denominated in Hong Kong dollars or US dollars, while the Chinese Mainland is settled in RMB.

The contrast between Hong Kong insurance and mainland Chinese Insurance Products

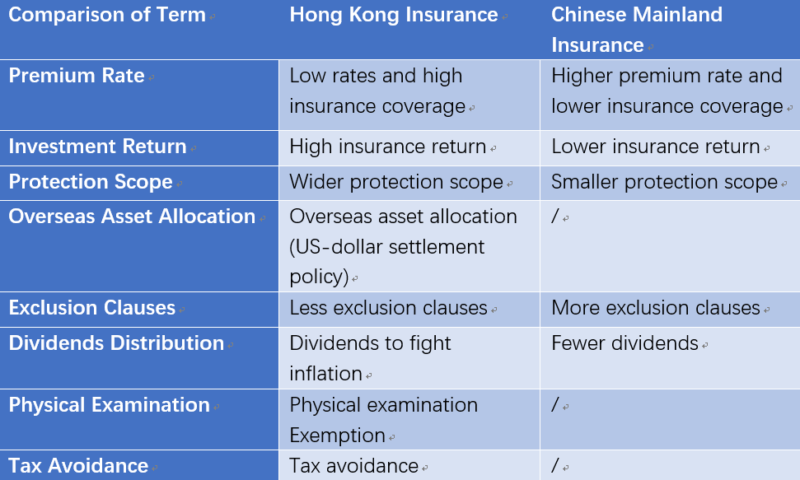

Starting with the advantages of Hong Kong insurance, as the following table shows:

The premium rate is low, and insurance coverage is high: with the same protection content, the premium in Hong Kong is only one-third or even one-second of the premium purchased in the Chinese Mainland. The reason why the price is so much lower than that of the Chinese Mainland is mainly because Hong Kong’s insurance premiums are formulated by the standards of the developed countries. Hong Kong’s health care system is sound, and its basic insurance premiums are very cheap. In addition, Hong Kong insurance Market competition is fierce; the price is relatively cheaper.

Expected returns are higher: in addition to security, Hong Kong insurance also has higher expected returns. Hong Kong’s savings-dividend insurance is indeed about 1.5-2% higher than that of the Chinese Mainland. Especially after the CIRC has imposed restrictions on the pricing rate of the Chinese Mainland, the advantages of Hong Kong’s products are obvious.

Wider protection scope: major disease insurance in Hong Kong usually cover nearly 100 diseases, more than 50 major diseases, and more than 30 mild diseases. The coverage is relatively wide.

Correspondingly, the advantages of Chinese Mainland insurance over Hong Kong insurance are listed below:

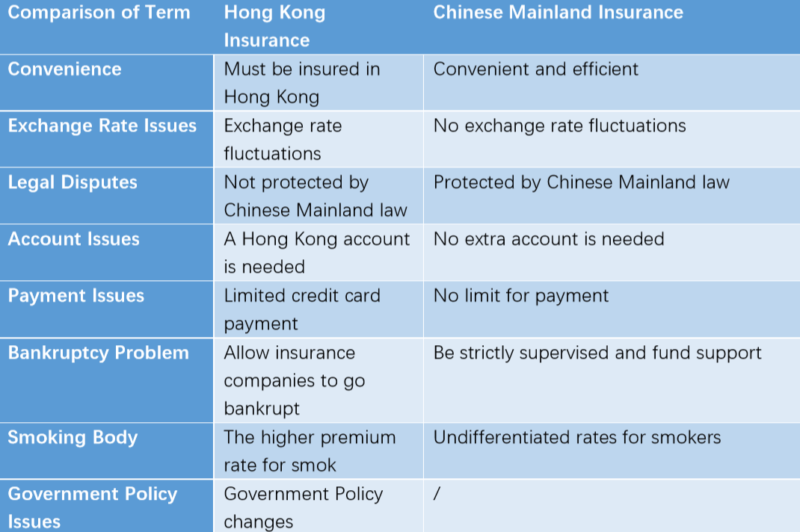

Convenient and efficient: The Hong Kong insurance purchasing process is cumbersome. Not only are you going to Hong Kong personally, but there are also a lot of formalities involved, including the fact that the maximum quota is $5,000 for credit card brushes.

Exchange rate issues: There is a risk of exchange rate fluctuations between RMB and HKD.

Protected by Chinese Mainland law: Insurance products purchased in the Chinese Mainland are protected by the Chinese Mainland law. In the event of problems in insurance purchased in Hong Kong, the Hong Kong insurance Complaints Bureau will accept insurance claims of less than one million yuan, and more than one million yuan case will have to sue in Hong Kong.

Opportunities for foreign enterprises in the Chinese insurance market

The Chinese insurance market is still in its early stages of development and has great potential for future growth. Compared with the penetration rate of 5% to 10% in mature European and American markets, the current Chinese insurance market is only about 4%, belonging to the starting market camp, and there is still much room for development compared with other markets. Looking forward to the future, with the development of economy and the maturity of social structure, the per capita output value and the penetration rate of life insurance will increase simultaneously, which is also the driving force for the vigorous development of life insurance market. Foreign enterprises can seize this opportunity for development.

Author: Zichun LI

Make the new economic China Paradigm positive leverage for your business

Do not hesitate to reach out our project managers at dx@daxue-consulting.com to get all answers to your questions