The growing Chinese outdoor equipment market presents potential for future growth

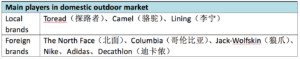

The Chinese outdoor equipment market has seen a lot of growth in the past few years and is expected to steadily increase in the near future. Consumers are turning their attention towards having more outdoor experiences as well as the quality of their equipment. In the current market, foreign brands tend to dominate through higher technical advantages than domestic brands. However, many local brands like Toread (探路者) and Camel (骆驼) also show strong competition power and are gradually seizing more market share with rapidly increasing digital brands. Another factor for this expansion is the shift in sales channels, with the trend shifting from normal shopping malls to dedicated stores and digital channels.

Market overview: Steady growth for the outdoor sports market

In the past years, Chinese people were not considered fans of outdoor sports. However, with rising income and the popularity of adventure sports, more and more millennials are starting to develop an interest in outdoor activities, thus bringing in a lot of business. In 1996, there were only 10 thousand skiers in China. In 2016, this number increased to 11 million.

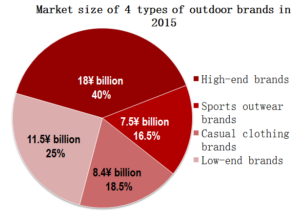

The Chinese outdoor equipment market and its players can be divided into four types:

- High-end technical outdoor equipment which is more professional and tailored for specific sports

- Sports outwear brands who also sell outdoor equipment

- Casual clothing brands who also sell outdoor equipment

Low-end brands which focus on low price market.

Source: Reproduced by Daxue Consulting from COA发布 –《2015年度户外用品市场报告》 Outdoor Company Alliance (COA) report – Analysis of outdoor equipment market in 2015

In 2015, the total volume of outdoor equipment reached ¥45.4 billion, with the high-end market accounting for ¥18 billion (40%).

*Data excludes skiing, fishing, hunting, and mountain cycling.

Source: Reproduced by Daxue Consulting from COA发布 –《2015年度户外用品市场报告》 Outdoor Company Alliance (COA) report – Analysis of outdoor equipment market in 2015

For the high-end market, relevant research forecasts that market size will increase 80% to 32.1 billion from 2015 to 2020. (Data excludes skiing, fishing, hunting, and mountain cycling.)

Chinese outdoor equipment market drivers

Outdoor sports are still very new in China, and as a result, the market will continue to grow for many years to come. Competition on this market in China is less strong than in the US and Europe.

Recently, several microeconomic factors have prompted an increase of consumer’s purchase willingness and power in the Chinese outdoor equipment market. Rising incomes have accelerated the general shift of Chinese people’s emphasis towards health. Take running for example. In the first half year of 2015, there were 302 running activities held by different organizations and the number of people involved in running has increased more than 100% year on end compared with same period in 2014.

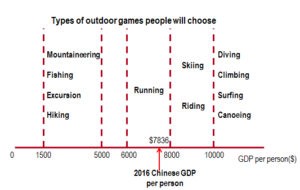

Causality between types of outdoor activities and GDP per person

Source: Reproduced by Daxue Consulting from户外运动2.0时代的中国市场蓄势待发(2.0 time for the development of Chinese outdoor equipment market)

With higher welfare, people are chasing more challenging and exciting sports that diversify outdoor products and increase market size.

As the above graph demonstrates, experts have identified a relationship between the GDP per person and the type of outdoor activity. From the state statistics center, the 2016 Chinese GDP per person as $7836, and in 9 provinces it reached more than $10,000, which presents an enormous opportunity for future growth in market segments of those outdoor games.

Third, outdoor industries’ policies have brought in massive infrastructure for this market. For instance, Beijing and Zhangjiakou, who will hold the 2022 Winter Olympics and one of the officers in the state’s sports association, mentioned they will try to bring in around 300 million people to the winter games.

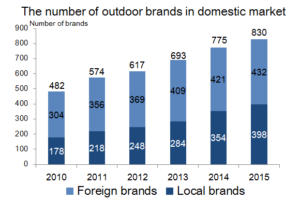

Foreign brands dominant while local brands increase their market share

Before the end of 2015, there were 830 brands in the Chinese outdoor equipment market and as seen from the graph, foreign brands seized the majority of the market.

*Data excludes skiing, fishing, hunting, and mountain cycling.

Source: Reproduced by Daxue Consulting from COA发布 –《2015年度户外用品市场报告》 Outdoor Company Alliance (COA) report – Analysis of outdoor equipment market in 2015

For big market players, foreign brands like The North Face(北面)、 and Columbia (哥伦比亚), lead the high-end outdoor market with key technical advantages. However, the relative advantages are reducing with the rapid increase of domestic brands. This is largely due to the fast development of the Chinese mobile payment system and online shopping. Therefore, lots of digital brands contribute to around 80% of this growth. According to our research, a current trend towards local manufacturers is to launch their own brands after having learned from the large multinationals.

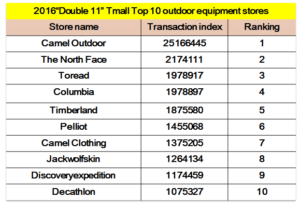

Source: Reproduced by Daxue Consulting from 2016双十一天猫户外用品热销店铺排行榜终极版 (Top list of outdoor stores during Tmall’s Double 11 festival in 2016) & 搜狐体育 Sohu Sports

According to the sales volume from the “Double 11” (“双十一”) festival in 2016, the top 10 outdoor equipment stores are listed as above. 7 of these 10 brands come from abroad, which indicates the popularity of foreign brands within this market. This goes to show that Chinese people are willing to pay more to get a better outdoor sports experience.

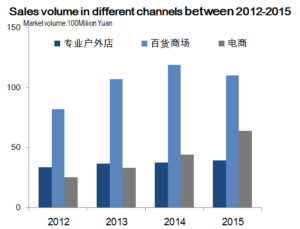

The channels for the outdoor equipment market are changing

Source: Reproduced by Daxue Consulting from COA发布 –《2015年度户外用品市场报告》 Outdoor Company Alliance (COA) report – Analysis of outdoor equipment market in 2015

Source: Reproduced by Daxue Consulting from 2016年中国户外用品市场现状分析及发展趋势预测 – 2016 Chinese outdoor market’s development and predictions

For many markets within China, there are three main distribution channels: dedicated stores, shopping economy, and digital retailers. With the development of outdoor sports, Chinese people, especially in tier-1 cities, are gradually paying more attention to the quality and effectiveness of their equipment. Dedicated stores, which can provide an offline experience and face to face instruction, are expected to maintain a steady growth going forward, although currently the market share for digital sales is only 17%.

Shopping economy is the most important distribution in tier -2 and -3 cities but it has faced a decline of sales volume in 2015, due to the influence of the other two channels.

The digital market for outdoor equipment also shows a strong potential when digital payment and online retailers platform like TaoBao and Tmall have become a part of many people’s daily habits. This channel is likely to combine with offline stores in O2O (Online-to-Offline) to get closer to consumers, which make it easier for people to develop their favorite outdoor games. With the development of Chinese digital shopping, sales of outdoor equipment and clothing bought online will continue to expand quickly in the near future.

The Chinese outdoor sports market is a bedrock of potential

Consumers in Guangdong show strong interest in outdoor sports

Through data obtained from TaoBao’s data platform, the click and purchase index of GuangDong province (广东) ranked the first for purchases of outdoor equipment. This indicates that people there are most interested in outdoor games due to the great purchase power seen from this region. This is largely due to two of the biggest cities: GuangZhou (广州) and ShenZhen (深圳). However, as a big city, the Shanghai market is not so active, only having an index ranking No.14.

With a growing interest from Chinese consumers, an enormous amount of infrastructure being built for upcoming outdoor sports events, and a wide variety of selling channels, the outdoor sports market in China is ripe for continued growth. The numbers speak for themselves, such as the year on end growth of runners in China, as well as the enormous increase in Chinese skiers. Chinese consumers are shifting towards healthier lifestyles and looking towards outdoor activities as a way to achieve this. With many factors aimed towards helping this market grow, as well as support from the Chinese government, getting into the outdoor sports market is a smart move to find future success.

Contact Daxue consulting today by email at dx@daxueconsulting.com for any questions or information regarding this unique and flourishing market.