China is the world’s first consumer of fish and seafood. In 2023, its revenue is valued to be around USD 88 billion, and it is expected to grow at a CAGR of 8% between 2023 and 2028. However, on August 24, Japan discharged potentially radioactive water in the Pacific Ocean and consequently the Chinese government has banned imports from the country. This action is expected to cause a shortage of products in the seafood market in China, opening new opportunities for other exporting enterprises to try their luck in the country’s expanding economy.

Download the ASEAN x China business relations report

Import and consumption of seafood are increasing

After an initial setback due to the Covid-19 pandemic consequences on the market, imports of seafood are back on the rise. In the first quarter of 2023, the value of imported goods in the sector was more than USD 4.5 billion, with an YoY increase of 58% in volume in the month of March 2023 alone.

The industry had already shown signs of recovery in 2022, when the value of the annual imported goods reached USD 19.13 billion, exceeding the previous pre-pandemic record of USD 15.8 billion of 2019. This year, the industry is expected to bloom once more.

Chinese seafood consumers want it all: health, freshness and taste

China has a rich catering culture and a long food-therapy history, and its people deeply believe that diet and health are deeply correlated. In recent years, Chinese consumers have shown growing concern for environmental pollution and food safety. As a result, imported seafood is often considered more nutritious and safer due to the water quality and stricter quality control. Consumers are becoming more and more aware of the health benefits of seafood, such as the high amount of unsaturated fatty acids.

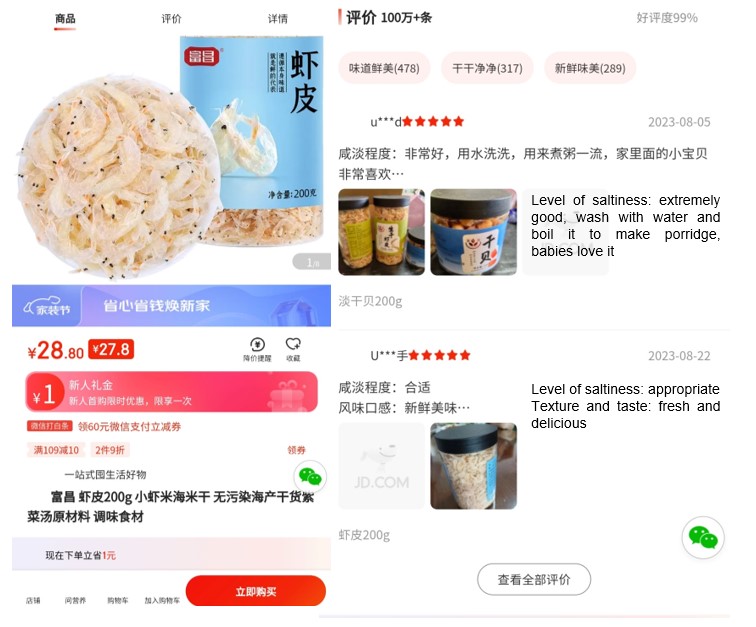

Although the health factor plays an important role of Chinese dining table, taste cannot be compromised. On Chinese e-commerce platforms, positive feedback coming from seafood buyers mainly focuses on deliciousness and freshness, while negative feedback is usually about safety issues.

Chinese consumers are hungry for imported seafood

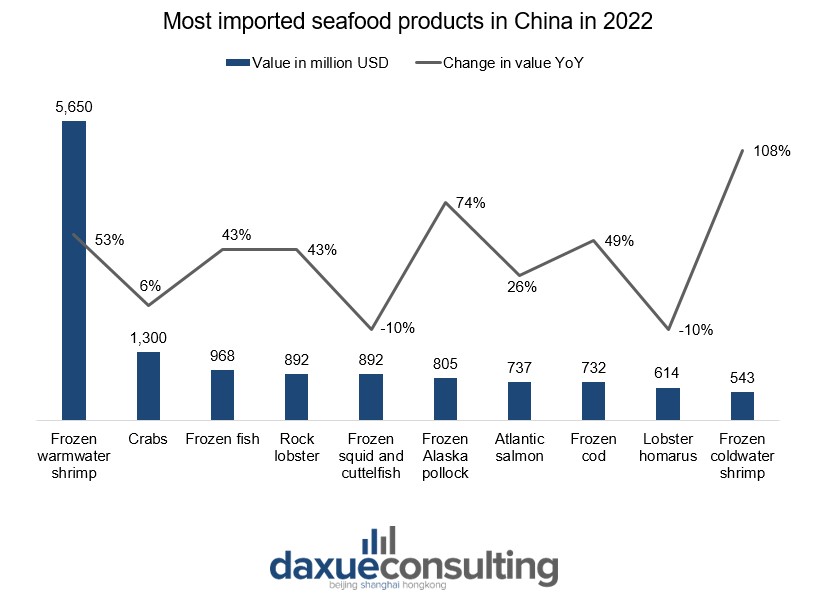

China has been one of the most important seafood markets in the world. In 2022, Ecuador was China’s largest exporter, with a transaction value of USD 3.56 billion, an YoY increase of 63%. Right after Ecuador was Russia, with imports worth USD 2.76 billion, Vietnam (USD 1.7 billion) and India (USD 1.26 billion). Canada, the US, and Norway are also important partners in the sector, ranking fifth, sixth and seventh respectively.

Imported products mainly include shrimp, crab, frozen fish, lobster, frozen squid, and cuttlefish, which mainly originate from the first five importing countries.

China suspends imports of seafood from Japan

Starting from August 24, the General Administration of Customs of People’s Republic of China suspended imports of seafood from Japan, as food safety concerns have emerged following the Japanese government’s decision to discharge radioactive water into the ocean.

Ever since the disastrous earthquake and tsunami of March 11, 2011, the Japanese government has struggled to prevent the release of contaminated water inside three reactors of Fukushima Daiichi’s nuclear power plant. On April 13, 2021, the government revealed its intention to release that water into the ocean and formulated a plan to safely do so.

China has always been a fierce opponent of Japan’s intention, alongside other neighbouring economic powers such as India and Russia. Now that, on August 24, 2023, Japan has officially released 1.34 million tons of treated water into the ocean, China has decided to stop seafood imports from the island.

The International Atomic Energy Agency (IAEA) announced that they will control the levels of radioactivity regularly. As of now, the radiation level is below the target limit, but what concerns scientists the most are the unknown long-term effects. The discharge will take 30 years to be completed, but it is not clear how it will impact the sea wildlife, as well as the life of people living around that area.

How will the market change in the near future?

While there are other import partners in the Chinese seafood market, China is Japan’s second seafood export destination after the US, with an export value of JPY 1.5 trillion (USD 10 billion) as of July 2023. Surely, China’s stop will represent a noteworthy setback for the Japanese fishing industry, as well as an important shortage for the just recovered seafood market in China.

This situation will likely cause an increased demand for fish imported from abroad, leading to a rise of overall prices in the sector. Russia has already voiced its intention to fill in the gap. On Friday 25th, Rosselkhoznadzor, the country’s food security officer, announced: “We hope to increase the number of certified Russian companies and ships, the volume of products and its range”.

As the global demand continues to increase, several scientists have pointed out the need to find an environmental friendly solution. Several start-ups of alternative food have already been put in place worldwide, but none has succeeded in winning Chinese consumers’ hearts.

It is plausible, though, that with the health concerns deriving from seafood originating in the Pacific area, people will tend more toward exploring new trends of the food market, like alternative seafood.

Qualities of the seafood market in China that brands should consider

Since new opportunities for businesses are likely going to open up, it is important for foreign enterprises to understand the features of the seafood market in China.

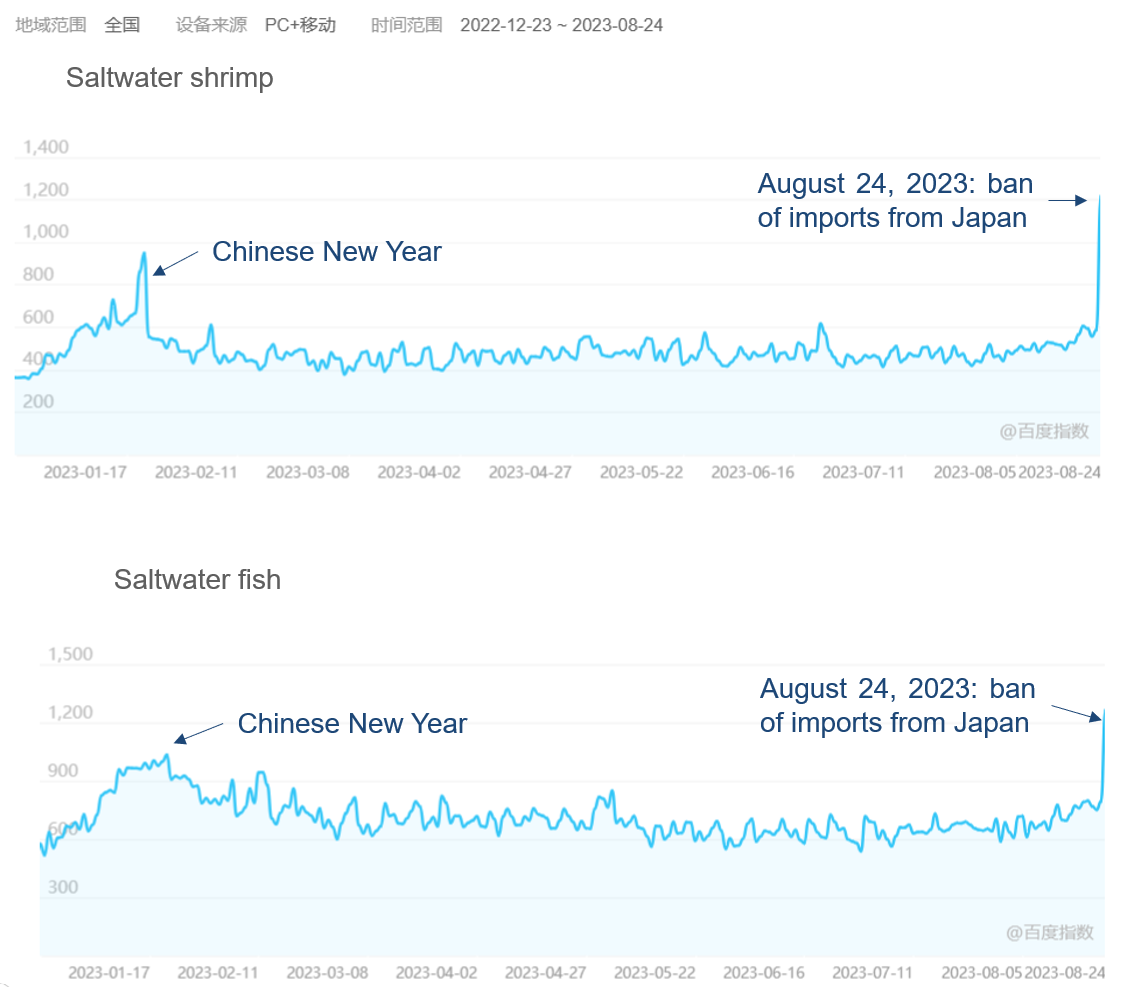

The Chinese seafood market is highly seasonal and festival-dependent

As we can see on Baidu index, the search frequency of “saltwater shrimp” goes significantly high for the Chinese New Year (normally at the end of Jan. to the beginning of Feb.) and China’s National Day, on the 1st of October. And again, search frequency grows every year in the fall season, considered to be a good season to eat fresh fish/shrimps. It is also common for seafood producers to prepare special gift boxes with living or frozen seafood inside so that the Chinese consumers can just grab it in an online or offline shop and bring as a present when visiting their family or friends.

Chinese seafood is peculiar and delicious

Many kinds of seafood which Chinese consumers love are not common in other countries and even considered as peculiar, like sea cucumber, fish balls, turtle, and eel. However, even though consumers from other countries don’t purchase certain kinds of seafood, it is still an opportunity for international seafood exporters. For example, there are lots of dried sea cucumber from the U.S., Canada and New Zealand being sold at relatively high prices, China has a long history eating sea cucumbers and believe they have a lot of health benefits. Also, seafood snacks are quite common in China, e.g. processed dried squids or fish, which suit many Chinese consumers’ taste better and considered as a healthier option compared to other snack options like candy or chocolates.

Seafood has different presentation and distribution channels in China

Chinese consumers attach great importance to the freshness of the seafood. That’s why purchasing living seafood on a Chinese traditional food market is still common, especially for the older generation. Many retailers and restaurants present their seafood in glass tanks or on ice, no matter if it is fish, crabs or turtles, in order to show the freshness of their products.

Nonetheless, key distribution channels for seafood retail sales in China remain hyper- and supermarkets, followed by convenience stores, food & drink specialists and finally e-commerce. Besides well-known platforms like Taobao and JD, many fresh food platforms have been developed and are achieving notable success, like wecook.cn (味库海鲜). For domestics and international seafood brands, dedicated websites are also important distribution channels.

A new blended retail ecosystem offers opportunities for fresh seafood distribution

New retail is a retail ecosystem that blends online and offline channels in a unified way. Since the Chinese market has a strong user base with an increasing purchasing power, the seafood sector could particularly benefit from this new retail model. Hema Xiansheng (盒马鲜生) owned by Alibaba is a combination of a supermarket, restaurant, seafood market, and mobile application. According to Daniel Zhang, Alibaba Group previous CEO: “Hema supermarket is what you get when you imagine a seamless blend of the online and offline shopping experience.” Chinese consumers can order seafood on Hema mobile App, which, in the fastest case, will be delivered in 30 minutes to the wished address. Consumers can also go to Hema supermarket to purchase grocery and pick up fresh seafood, which can be prepared and served directly in the dining area of Hema supermarket.

Now is the ideal time for foreign brands to enter the Chinese seafood market

- China’s is the first seafood and fish consumer in the world. After a temporary setback during the Covid-19 pandemic, the market has recovered and has generated USD 19.13 billion in 2022.

- Following the government’s ban on imported seafood from Japan, new opportunities will open up for foreign enterprises.

- Now that Japanese exports have been suspended, the demand for products coming from the West of the world will likely increase. Additionally, this climate crisis could work as a wake-up-call for consumers to lean more toward alternative seafood options.

- When entering the market, companies should consider that the Chinese seafood market is highly seasonal and festival-dependant and it includes food varieties which are uncommonly seen in the West.

- Both online and offline distribution channels play an important role, but super- and hypermarkets are still the consumers’ first choices. There is also the possibility of a new retail model, blending together both online and offline channels. A successful example of it is Alibaba’s Hema Xiansheng.