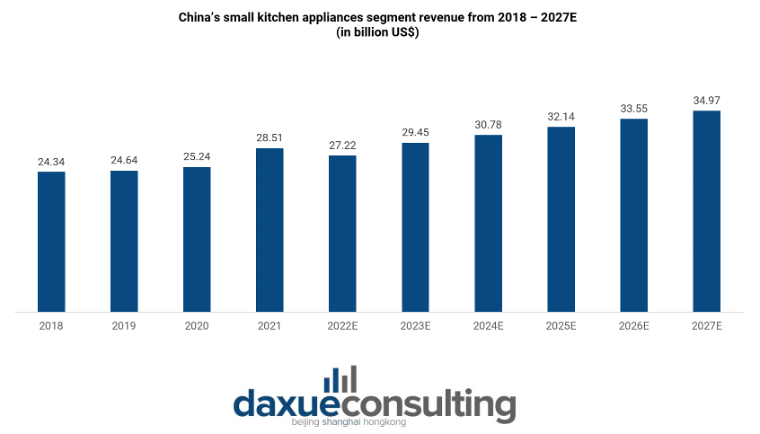

The market of small kitchen appliances in China is expected to generate around USD 29.56 billion (RMB 210.86 billion) in revenue in 2023. The market is anticipated to further grow by a CAGR of 4.24% from 2023 to 2027. It can be encompass any electrical kitchen devices that are not too big to move, such as blenders, rice cookers, microwaves, waffle irons, food processors, egg cookers, and deep fryers that are designed for home use.

Download our guide to Chinese gifting habits

Key players in China include but are not limited to Midea, Haier Joyoung, Laifen and Gree. China hosts specialized small home appliance industrial parks that are primarily located in Guangdong and Zhejiang. These hubs serve as innovation centers, driving advancements in both features and aesthetics.

Evolving trends and pitfalls in Chinese small kitchen appliances on e-commerce platforms

In the realm of small kitchen appliances on e-commerce platforms, some interesting trends have surfaced. Categories like soy milk machines and juice extractors are doing well despite the overall market decline. They are finding success on social e-commerce platforms, like Douyin e-commerce, which made up 44.7% in 2023. However, the average online price for small kitchen appliances dropped to RMB 180 in 2023.

On the other hand, coffee machines saw growth due to returning overseas consumers and improved local user consumption, especially Italian-style fully automatic coffee makers. Meanwhile, the electric steamer market is booming, growing by 25% year-on-year. This is driven by updates, iteration, and increased demand for multifunctional and aesthetically pleasing options.

Yet, false advertisement of certain products on e-commerce platforms can lead to skepticism and disappointment. For instance, the gas energy-gathering ring, once seen as a “kitchen miracle,” got a boost in sales and awareness through social media promotion. However, this exaggerated promotion has led to some products being exposed as lacking real technological features. This situation highlights the importance of rigorous product verification and accurate consumer awareness, calling for careful consideration of how to match the speed of scientific validation and demystification with the rapid popularity of internet-famous products.

Cooling down of internet-famous Chinese small kitchen appliances in domestic market

In recent years, the rise of trends like the “lazy economy,” “stay-at-home economy,” and “single economy” have made small appliances a focal point for generating traction on major social platforms. Users share glimpses of their enhanced lifestyles thanks to small appliances, such as “whipping up morning juice with a high-speed blender,” “cultivating a healthy lifestyle with homemade yogurt,” and “creating gourmet dishes for non-cooks using an air fryer.”

However, by 2023, the allure of small appliances had diminished, with even the previously popular air fryer now topping the list of neglected second-hand items on platforms like Xianyu idle trading. According to relevant statistics, during the “6/18” period in 2023, the retail sales of 14 categories of kitchen small appliances, including rice cookers, electric kettles, grills, electric steamers, and health pots, totaled USD 355 million, marking a year-on-year decrease of 19.3%.

A drop of air fryers in domestic market and and a boost in overseas markets

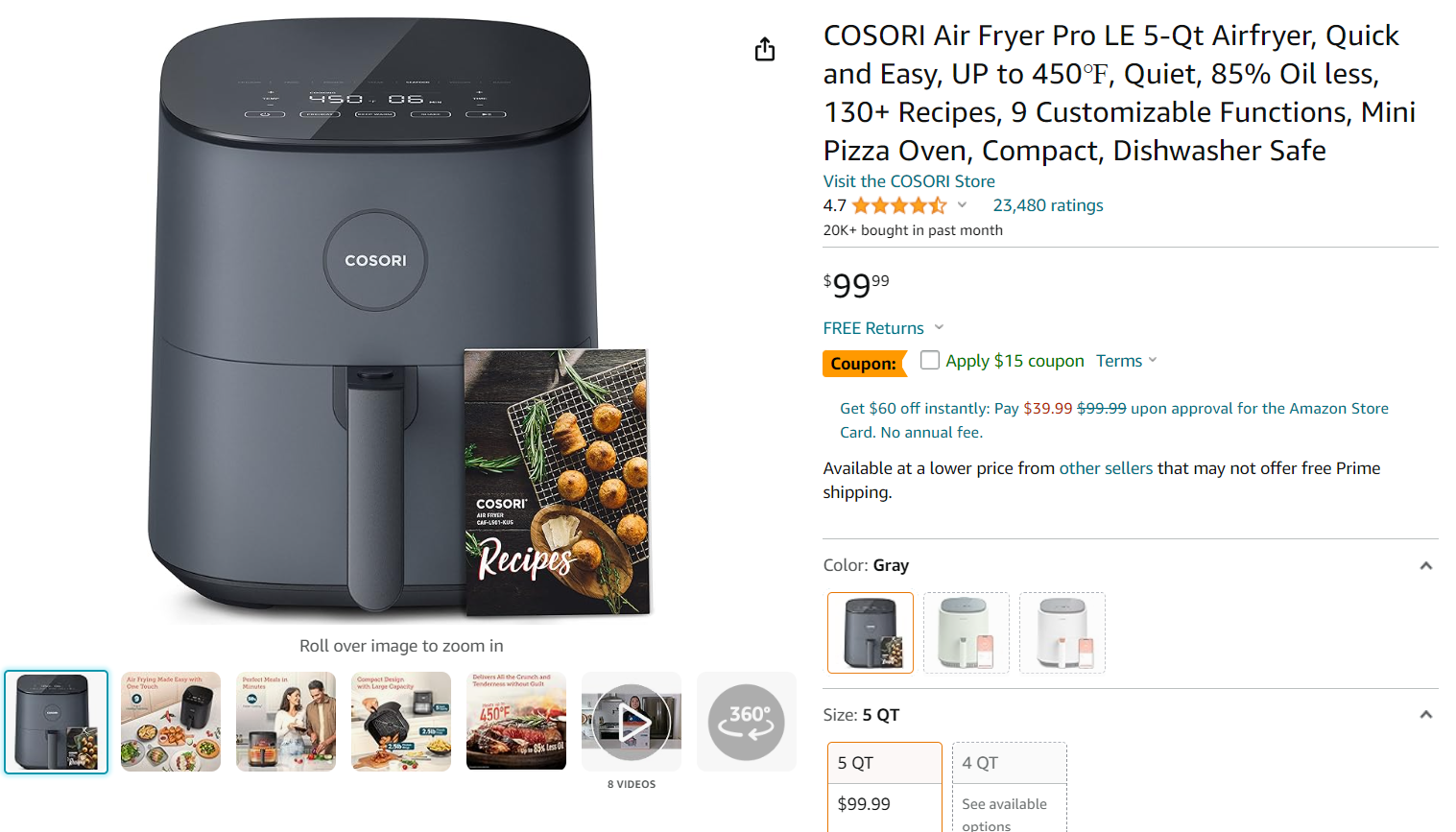

Although the popularity of air fryers has seen a decline in the domestic market, there is a boost in sales in the international market. Due to the preference of Americans for fried and crispy foods, the air fryer has rapidly gained popularity among young consumers. It is sought for its oil-free, healthy, simple operation, and quick smart features, firmly establishing its presence in the European and American markets.

It is reported that 43.1% of American consumers stated that if they plan to purchase small kitchen appliances online in the next 12 months, they are most likely to purchase air fryers. In 2023, the global market size of air fryers exceeded USD 1.7 billion, and it is expected to surpass USD 2.9 billion by 2030.

Seasonal surge in ice-maker demand

In Western countries, the tradition of “drinking ice water” has a rich history, giving ice makers a unique presence in households abroad. Whether it’s enjoying a refreshing sip of iced water during hot moments or indulging in iced beer and coffee during social gatherings, the ice maker plays a crucial role. It is reported that there is a steady annual growth rate of 5.5% in the global ice maker market, projected to reach USD 2.5 billion by 2027. Commercial refrigeration equipment is equally essential for institutions and businesses in the food service sector, with the American Kitchen Industry Association (MASFI) indicating an annual growth rate of 6.1%.

Ice makers are among the fastest-growing kitchen items on U.S. sites this year. While ice makers maintain their importance throughout the year overseas, they exhibit notable seasonal trends. In North America, the search volume for ice makers surges from June to August annually, while in Australia, the peak occurs between November and January of the following year. Presently, numerous Chinese sellers have introduced ice makers that combine functionality and aesthetics, garnering positive reviews from overseas consumers.

Chinese small kitchen appliances turning smart

Small kitchen appliances are undergoing a technological revolution, led by the innovation hubs of the United States, Europe, Japan, and China. Notable examples include smart coffee makers, dishwashers, cookware, cooktops, and ovens.

The rise of smart homes has brought about a surge in smart kitchens. Consumers are increasingly leaning towards sustainable and eco-friendly practices in the kitchen, contributing to the popularity of smart appliances. These devices, such as smart refrigerators, help reduce food wastage, aligning with consumers’ preferences for minimizing environmental impact.

In response to changing dietary habits, especially among health-conscious individuals, smart kitchen appliances offer features that help users track and manage their food consumption. The hospitality sector is also embracing smart kitchen appliances to improve customer service. Additionally, the market is witnessing the integration of IoT and AI technologies into these appliances, making them more advanced and efficient. The inclusion of voice assistants like Alexa and Google Assistant further enhances the user experience, making smart kitchen appliances more accessible and user-friendly in daily life.

The shifting landscape of Chinese small kitchen appliances: trends, pitfalls, and global innovations

- Despite an overall market decline, specific categories thrive on social e-commerce platforms, while false advertising emphasizes the need for accurate consumer awareness.

- Initially popularized by trends like the “lazy economy,” domestic interest in small appliances, including air fryers, waned by 2023 in the domestic market.

- Air fryers declined domestically but saw international success, especially in the US market, reaching a global market size exceeding USD1.7 billion in 2023.

- Ice makers show steady global growth, reaching USD 2.5 billion by 2027.

- Small kitchen appliances globally are embracing smart technology, integrating IoT, AI, and voice assistants for advanced, eco-friendly options.