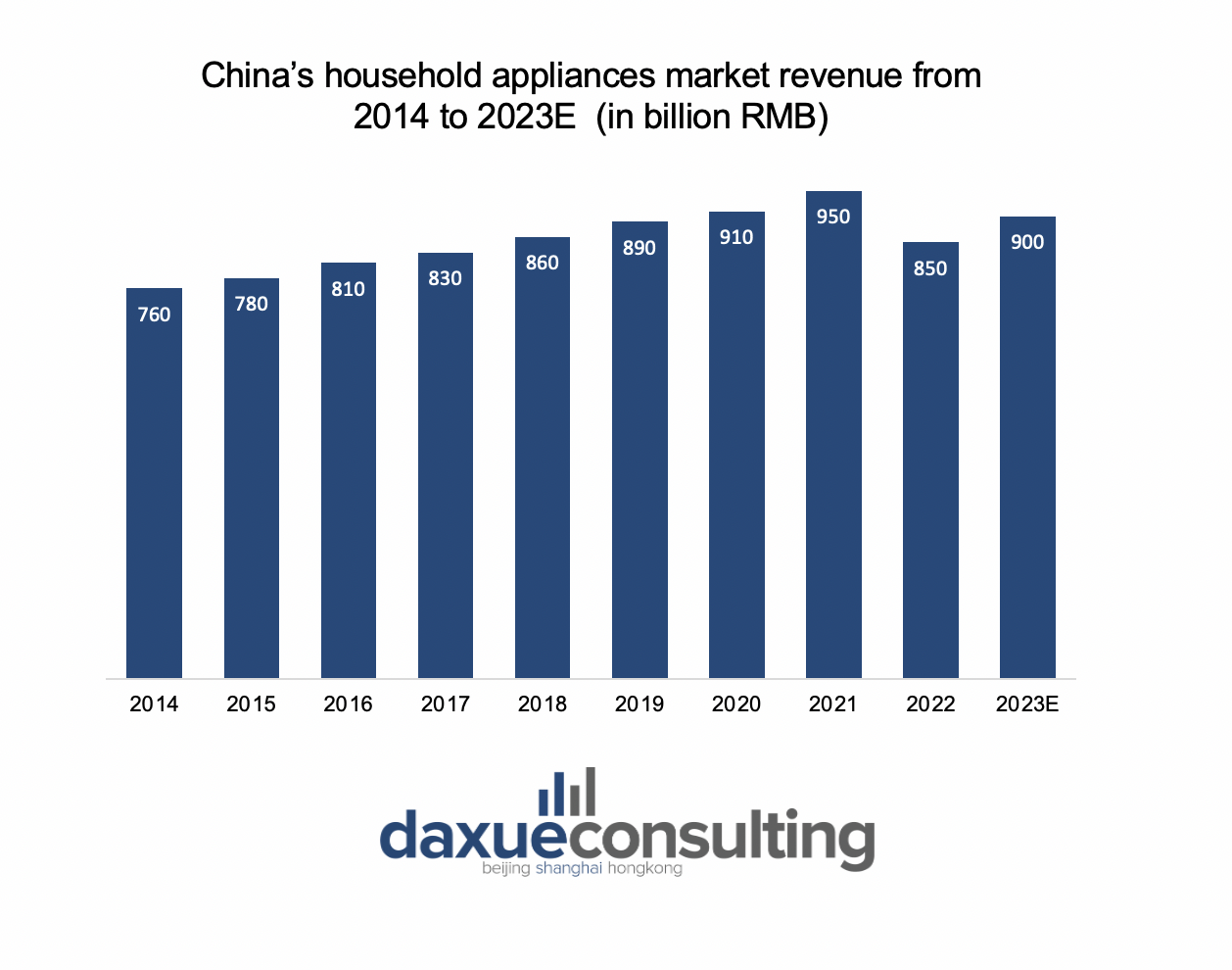

Household appliances are normally categorized into two segments: major appliances and small appliances. Examples of major appliances are air conditioners, refrigerators, and dishwashing machines, while small appliances include small home appliances, personal care appliances, and kitchen appliances. Combining these two sectors together, China’s household appliances market generated 850 billion RMB in revenue in 2022. The number is expected to increase to 900 billion RMB in 2023. China has long been and is expected to continue to be the country with the largest revenue in the global home appliances market.

Despite the current drop in revenue, China’s household appliances market remains optimistic

Although China still outperforms other countries in the global household appliances market, the market revenue dropped by 10.2% in 2021-2022. The current stagnation in the market is caused by the sluggish consumption power and the turbulent real estate sector. After deducting price factors, China’s national per capita consumption expenditure only increased by 1.5% in between 2021 and 2022. Meanwhile, residential sales in 2022 dropped by 28.4% compared to 2021. However, the future of the China’s household appliances market is still considered to be optimistic due to that:

- China’s Zero-Covid lockdown is no longer effective. In December 2022, the central government in Beijing published policies such as scrapping the required testing for domestic travelers and banning local officials from prolonged lockdowns. Also, China’s National Health Commission announced that international travelers would no longer need to quarantine upon arrival starting from January 8th, 2023. The loosening of both the domestic and international Covid-related restrictions suggests that China is on the path to economic recovery.

- China’s Ministry of Commerce issued measures to promote the consumption of green and smart household appliances in July 2022. The measures included promoting green and smart household appliances in townships, expanding online consumption scenarios, and implementing related financial and taxation policies. With the further implementation of these measures, green and smart household appliances market, together with the whole China’s household appliances market, is expected to grow.

Two trends in major appliances: Health awareness and multi-functionality

Affected by the pandemic, Chinese people have an increasing concern for health problems. The net purchase intention toward health-oriented products increased by the largest amount after the outbreak of Covid-19. Accordingly, more companies are incorporating health technology in their product development to address consumers’ concerns. Haier launched anti-bacterial air conditioners in 2021, ensuring the company to occupy over 47% of the market share in the global self-cleaning air conditioners market. Meanwhile, the significant increase in the sales of dryers also proved the growing importance of health in consumers’ criteria for consumption. The sales of dryers were about 1 billion RMB in 2018, while the number is expected to reach 6.5 billion RMB in 2022. Their anti-bacterial and anti-mite properties are some of the driving forces behind the consumers’ rising interest in dryers.

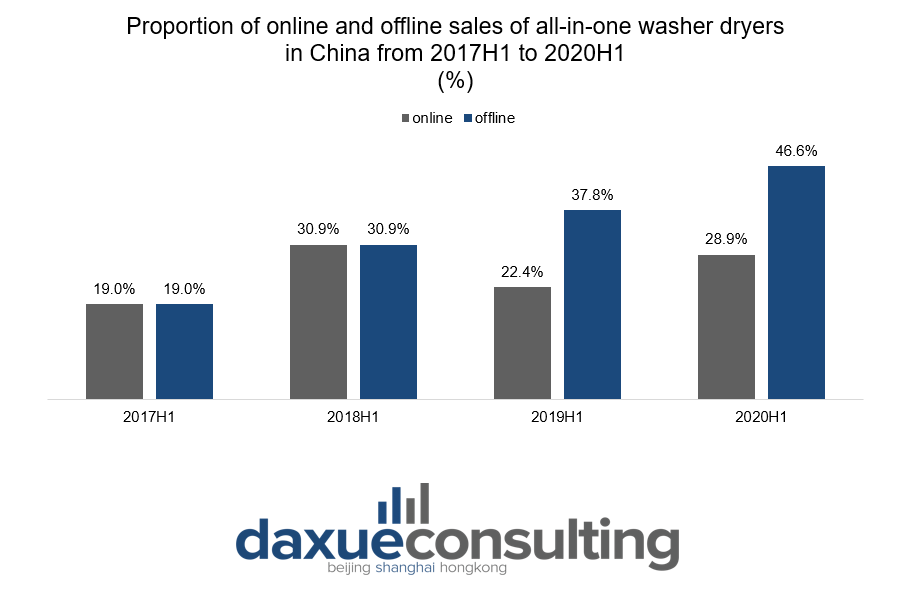

Multi-functionality is another trend in the China’s major appliances market. China’s Ministry of Civil Affairs estimated that there are 92 million single people live alone in China in 2021. Meanwhile, 66.7% of them purchased apartments that were between 30-40 m2. Due to the limited room of their apartments, these consumers preferred multi-functional household appliances, especially when it comes to major appliances. A representative multi-functional major appliance is the all-in-one washer dryer, which experienced a remarkable growth in the past few years. From 2017 to 2020, the proportion of all-in-one washer dryers in the online retail sales of China’s washing machines market increased from 19.0% to 28.9%. At the same time, its proportion in offline retail sales increased from 19.0% to 46.6%.

Automation and Artificial Intelligence: the future of small appliances

Robot vacuum cleaners are increasingly preferred by Chinese consumers. Their market had a year-on-year growth of 29% in retail sales in 2021, thereby illustrating Chinese consumers’ strong interest in home automation. A survey conducted by iiMedia in 2022 revealed that 98.1% of the respondents who were willing to purchase smart small appliances considered automation to be a major product advantage. Additionally, the State Council, Ministry of Industry and Information Technology, and National Development and Reform Commission in China all published supportive policies to promote the development of the smart small appliances market in recent years. Thus, the market size is expected to grow from 62 billion RMB in 2016 to 192.4 billion RMB in 2023. The favorable consumer attitude towards the smart small appliances market and the rapid growth of its market size indicates great market potential and business opportunities.

As a result, companies are continuously renovating and innovating their products to attract consumers’ attention. Artificial intelligence (AI) technology is a common means for major appliances’ renovation and innovation due to its high price. However, some companies now started to not only integrate AI technology with small appliances but also leverage such technology to create new small appliances, such as smart mirrors. FITURE Core is a smart fitness mirror launched by FITURE that can guide users through their home workout, allowing consumers to experience a personal trainer at home. Its market covers more than 300 cities in China while having more than 30 thousand Chinese consumers. FITURE Core is a reflection of Chinese consumers’ interest in AI-enabled small appliances. With AI technology, small appliances can bring traditional out-of-home scenarios into the home while personalizing consumers’ experiences.

Consumers prefer to use online sales channels

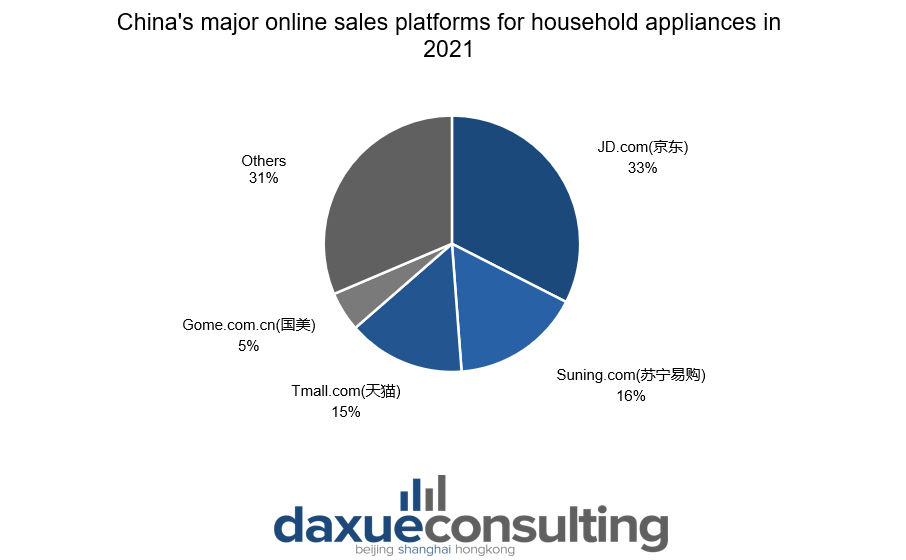

In 2020, 50.4% of the retail sales of the overall China’s household appliances market were generated online. This is the first time that online sales channels generated more than offline sales channels. The share of the online market increased to 52.9% in 2021, and the number is expected to continue growing in the future. After the outbreak of Covid-19, consumers experienced the convenience of online shopping, which led to their increasingly preference and reliance on e-commerce platforms. Currently, the major online sales platforms for household appliances are JD.com(京东), Suning.com(苏宁易购), Tmall.com(天猫), and Gome.com.cn(国美).

Key trends and opportunities in China’s household appliances

- China is currently the country that generates the largest revenue in the global home appliances market.

- The current stagnation in China’s household appliances market is temporary. The loosening of the Covid-related restrictions, together with the measures issued by China’s Ministry of Commerce, is expected to stimulate the growth of the market.

- When purchasing major appliances, Chinese consumers are particularly interested in health-related products due to the Covid-19 outbreak and multi-functional products due to the trend of living alone.

- The smart small appliances market in China experienced rapid growth in recent years. Automation and AI technology are the two trends in the market.

- Starting from 2020, most of the revenue in the household appliances market in China is generated online. JD.com(京东), Suning.com(苏宁易购), Tmall.com(天猫), and Gome.com.cn(国美) are the four main e-commerce platforms for consumers to purchase household appliances.

Author: Sandra Chen