Homes in Chinese cities are getting smarter and smarter. From fingerprint locks to vacuum robots and smart pet sitters, big data and AI-based smart home assistance system is gradually entering the average Chinese households. Due to the fast-growing loT (internet of things) market, along with government support and the increasing awareness of advanced technology among Chinese people, more and more players are joining the smart home market by launching their own strategic plans to conquer this industry.

According to the big data from AVC, among the national newly built high-end flats from January to July 2020, the penetration rate of household smart home systems has reached 82.2%, recording a 7% increase from the year before. Meanwhile, China’s smart home industry continued to boom because of the rise of the Stay-at-Home Economy during the pandemic, and consumer needs for smart home devices are getting more specific and sophisticated.

China is the second-largest smart home market in the world

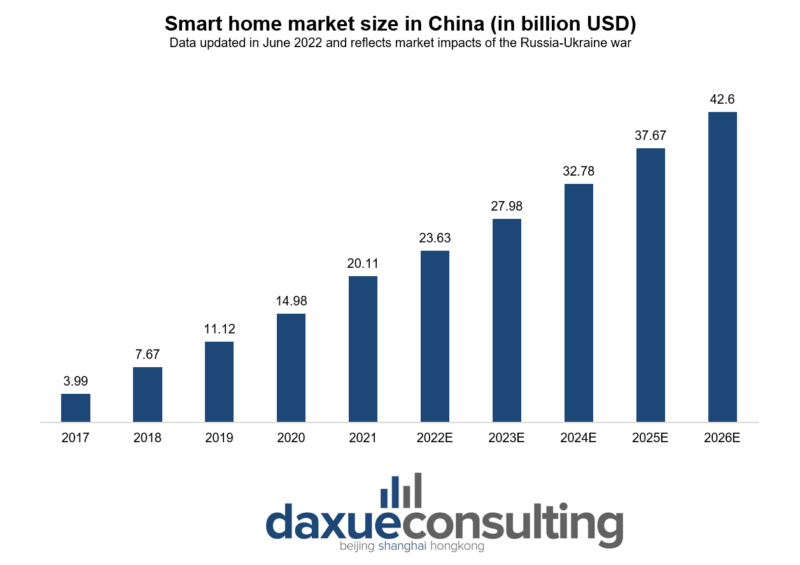

With a current size of around 23.63 billion US dollars, China is the world’s second-biggest smart home market, following the U.S. The smart home revenue in China is expected to reach 42.6 billion US dollars by 2026, with an expected user volume of 142.1 million and an annual growth rate of 15.87% from 2022 to 2026.

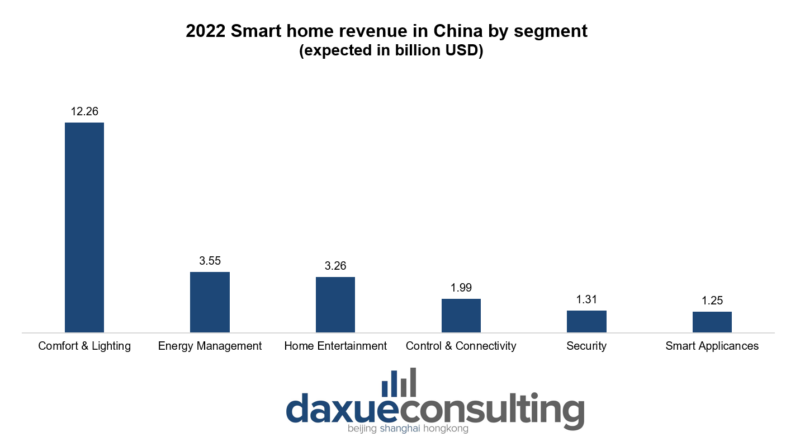

Smart home devices can be divided into six segments depending on their functionalities and intended use, including comfort and lighting, energy management, home entertainment, control and connectivity, security, and smart appliances. The comfort and lighting sector has taken over the most significant sales since 2017. The revenue will reach 12.26 billion US dollars by 2022, indicating that such devices are already commonly applied among Chinese households.

Young married men are the main purchasers of smart home devices in China

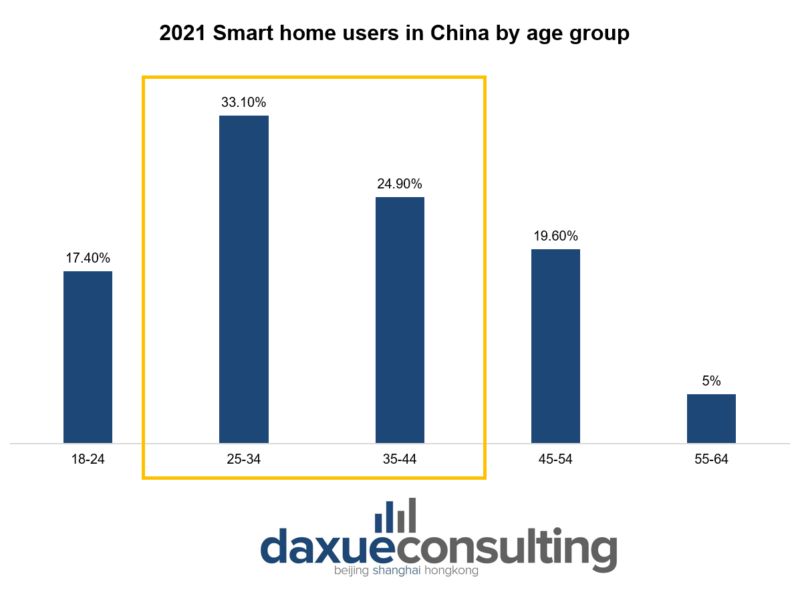

According to the 2021 Statista Global Consumer Survey, more than half of the smart home device users in China are below age 44, with over 33% of the surveyed population aged between 25 and 34, indicating that the Chinese young generation is the main consumer group. The household penetration rate of smart home devices among different income groups, low, medium, and high, are nearly equally distributed. However, around 70% of those owning smart home devices are middle- or high-income urbanites who are mainly located in first- and second-tier cities. Moreover, male consumers tend to purchase more smart home devices than females. Regarding marriage status, 85% of the smart home users are married, and only 15% of the users are single.

Domestic giants and international players fighting for China’s smart home market

China’s smart home market is dominated by large internet and eCommerce companies, home appliance companies, and Chinese mobile operators. Large home appliance companies, including Haier, Midea, and Mitsubishi, have been operating for a long time in the smart home market with their intelligent appliances. While technology giants such as Baidu, Alibaba, Xiaomi, Tencent, and JD are building up their own smart home ecosystem, trying to compete against their well-established players.

The most well-known international smart home product manufacturers in China are Siemens, Schneider Electric, and Honeywell. Each company has its unique product specialization. For example, Honeywell is famous for its smart security products and air conditioners. At the same time, a Legrand has comparative advantage in smart lighting than other product categories.

However, since the lifestyle and living conditions are different in western countries and China, and smart home systems also depend on the specific needs of the consumers, Chinese smart home brands are perceived as more capable of meeting the local needs. According to Maigoo, in 2022, Xiaomi’s MIJIA is the top-level Chinese smart home platform and appliance brand, followed by Haier’s U-home, MSmartLife from Midea, Huawei’s HarmonyOS, and Tmall Genie. As high-tech leader Xiaomi’s sub-brand, MIJIA specializes in smart home gadgets such as sensors and cameras for every budget and need. Most Chinese consumers love the brand because of its high price-performance ratio and captivating design. In September 2022, the brand announced launching new products, including smart door locks, smart cooking equipment, and smart cleaning devices.

What are the most popular smart home products in China?

There are various product segments under the smart home category, including smart home assistants, smart home appliances, smart door locks, smart audio devices, smart electrical panels, and electric curtains. AVC’s data show that, currently, the most single popular product category in China is the smart lock segment, which has reached a sales revenue of around 7 billion RMB in 2021 with a growth rate of 35.5%. The average price of one smart lock was 1,544 RMB in China in 2021, a 3.1% increase year on year. The smart lock market is currently doing well in China, and it is expected to keep on growing fast in the next few years.

Beyond smart locks, Chinese consumers show a great demand of smart lighting, smart curtains, smart switches, and smart toilets as well. Meanwhile, consumers from different cities show different preferences for smart home devices. According to AVC’s 2022 report about newly-build high-end flats between January and March 2022, smart home systems are more popular among consumers residing in new first-tier cities than in other city tiers, with a market share of over 50%. In contrast, second-tier cities are the main markets for smart locks, smart switches, and smart toilets, with a market share of more than 34%.

Chinese consumers’ attitude towards smart home products

According to Lingdonghexin’s research about smart home products consumption in China during the post-Covid period, privacy and safety are the most significant features for Chinese consumers when it comes to purchasing a smart home device, followed by compatibility with other devices, convenience, and price-performance ratio. Moreover, Chinese consumers prefer smart home devices operable by voice command or via mobile apps.

Regarding sales channel distributions, 52% of Chinese consumers prefer purchasing smart home items at large retailing stores after careful research of products’ details. Most of them get to know such products from social media and eCommerce websites.

Lastly, when it comes to the willingness to pay for smart home products, 68.58% of Chinese consumers would spend between 5 thousand RMB and 15 thousand RMB for their smart home devices-

How do Chinese consumers think about smart home products?

During the post-Covid period, most Chinese consumers changed their attitudes toward smart home products and started showing a keener interest on such kind of devices. In fact, 76% of Chinese consumers in 2021 declared being willing to purchase smart home devices because they believe such products can make their lives more convenient and comfortable.

Most Chinese consumers are quite optimistic about the smart home industry: smart home owners love sharing their knowledge and experience in particular categories and discuss products’ specific functions with other users on Chinese social media like Xiaohongshu.

China’s smart home market in a nutshell

- China’s smart home market is the world’s second-largest, following the U.S.

- Regarding functionality and intended use, the comfort and lighting sector has taken over the most significant sales since 2017.

- Most smart home users in China are male, below the age of 44, and are mainly located in first- and second-tier cities.

- Siemens, Schneider Electric, and Honeywell are China’s most well-known international smart home product suppliers.

- Xiaomi’s MIJIA is recognized as China’s most renowned smart home brand in 2022, followed by Haier’s U-home, MSmartLife from Midea, Huawei’s HarmonyOS, and Tmall Genie.

- The smart lock segment is the most popular product category in China.

- Chinese consumers prefer voice commands for smart home devices and like to connect them with their mobile apps.

- 76% of Chinese consumers are willing to purchase smart home devices after the pandemic due to the convenience and comfortability these products can bring.

Author: Ariel Wu