Chinese outbound tourism is on its way back, and brands are making moves to capitalize on the upcoming travel retail opportunities. The 2023 Chinese New Year period already saw a 23.1% bump from 2022 in domestic trips, according to the Chinese travel booking platform Qunar, and outbound trips rise is predicted to follow. A publication recently published by iClick Interactive Asia Group Limited explains how travel retailers are adapting and succeeding post-covid.

Download the report here

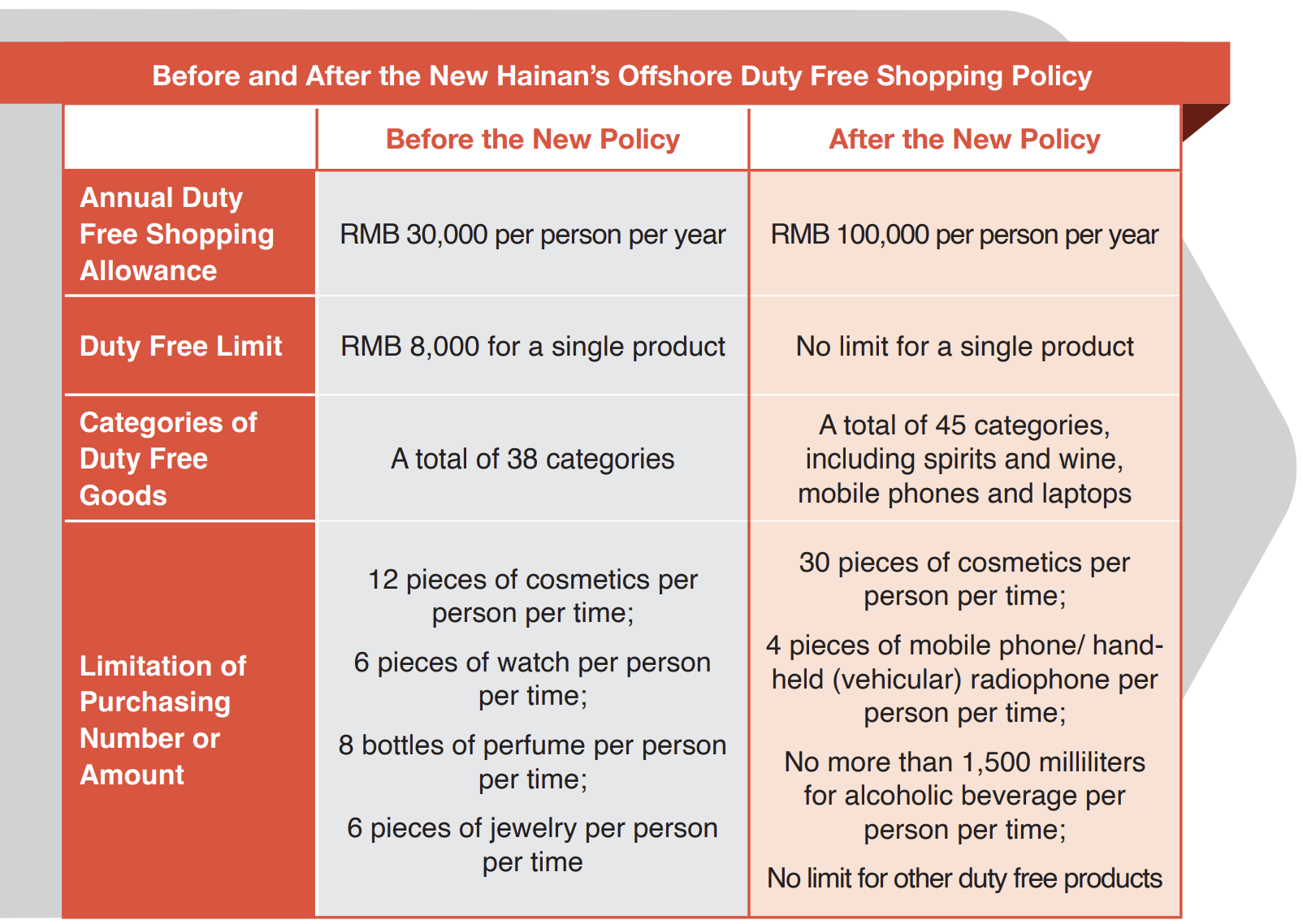

Preferential policies by the Hainan government boost travel retail spending in the province

On July 1st 2020, a policy by the Chinese Ministry of Finance, the General Administration of Customs and the State Administration of Taxation came into effect to boost Hainan’s domestic duty free consumption. The policy included the raising of the annual per-person duty free spending limit from RMB 30,000 to RMB 100,000.

Source: State Taxation Administration of the PRC, 2022

Haikou Customs data shows that from 2012 to 2021, the amount of duty free shopping on the island increased from RMB 2.3 billion (USD 336 million) to RMB 50.5 billion (USD 7.4 million). As of January 2023, there are six duty free business operation entities and 12 off-island duty free stores in Hainan.

China is boosting domestic travel retail

As part of the 14th five-year-plan, starting in 2021, China will spend five to ten years developing several international consumer cities as a way to boost an “internal economic circle” (经濟內循環), including the introduction of incentives for Chinese outbound tourists to shop in the home market.

Chinese duty free spending’s return overseas in 2023

Chinese consumers play a significant role in the global duty free market. In 2019, Chinese contributed 35% of the global personal luxury spending, and also spawned the boom of Korean duty free stores. The proportion of Chinese spending in Korean duty free stores grew from 53.7% in 2015 to over 80% in 2019 (up to RMB 111.4 billion, USD 16.3 billion), with a CAGR of 30.6%.

As Chinese outbound travel bounces back, in early 2023, Southeast Asia was in the spotlight, as Thailand, Vietnam, Indonesia, Singapore, and Cambodia are the most searched-for destinations on Ctrip. However, pre-COVID, data from Ctrip’s travel shopping platform “Global Shopping” showed that the 10 most popular countries for Chinese people to shop were Japan, the United Arab Emirates, the United Kingdom, France, Singapore, the United States, Spain, South Korea, Italy and Australia. Hence, Chinese travel is quicker to return in Asia than elsewhere in the world.

The rise of lower-tier city consumers

Lower-tier cities will be a tremendous source of growth for China’s economy. 70% of Chinese residents live in tier-3 and lower cities where, although incomes and expenses are both smaller, the economic growth is outpacing large cities. The per capita disposable income of rural residents in China had an impressive CAGR of 8.9% over the previous five years, reached RMB 19,000 (USD 2,774) in 2021.

How brands are reaching today’s Chinese travel shoppers

Digitalization is the most important method to reach Chinese consumers. The question is, how and where to implement digital touchpoints.

Digital payments

93% of Chinese tourists say that they would find it more convenient if merchants accepted Chinese mobile payment options, such as Alipay and WeChat Pay. It is standard for travel retailers across to world to implement digital payment systems if they want to sell to Chinese travelers.

Online travel platforms

The top Chinese travel platforms based on active users are Ctrip, Qunar, Fliggy and Mafengwo. Platforms like these are continuously increasing their multi-functionality, which includes content sharing from users, offering promotions and discounts, and even live-streaming. Hence, though they first appear as transport and hotel booking platforms, they can be so much more for travel retailers.

Social media

Platforms like Xiaohongshu, WeChat and Douyin are the first stop for Chinese to research their trips abroad. To have a strong presence on these platforms, brands need to create their own profiles, collaborate with influencers, and also incentivize user-generated content by KOCs. Brands often incentivize user-generated content by having an aesthetically pleasing shopping and user experience, such as pop-up stores.

Continue reading in the 2023 Edition of A Practical Guide to Engage with Chinese Travers