The EU is home to 5.9% of the world’s population, 6.7% if we include the UK. Despite the relatively small proportion, Europe accounted for one-third of the global food service industry in value in 2019. Pre-COVID, Europe remained a stable market with +0.9% compound annual growth rate since 2014. This development is mainly driven by the full-service restaurant segment, suggesting European preference to eat out. Naturally, with such a lucrative restaurant market, Chinese companies expanding abroad turn to Europe.

Though all major European cuisines prevail in the region, consumers are also open to foreign cuisine. For a Chinese company to successfully enter the EU’s restaurant market, understanding the eating out behaviors in Europe is essential.

EU restaurant consumer segmentations

Due to unequal development across the nation, Chinese’s consumer habits are far more different across the regions when compared to Europe. In contrast, EU consumer behaviours are more similar per sub region s there is more equal development.

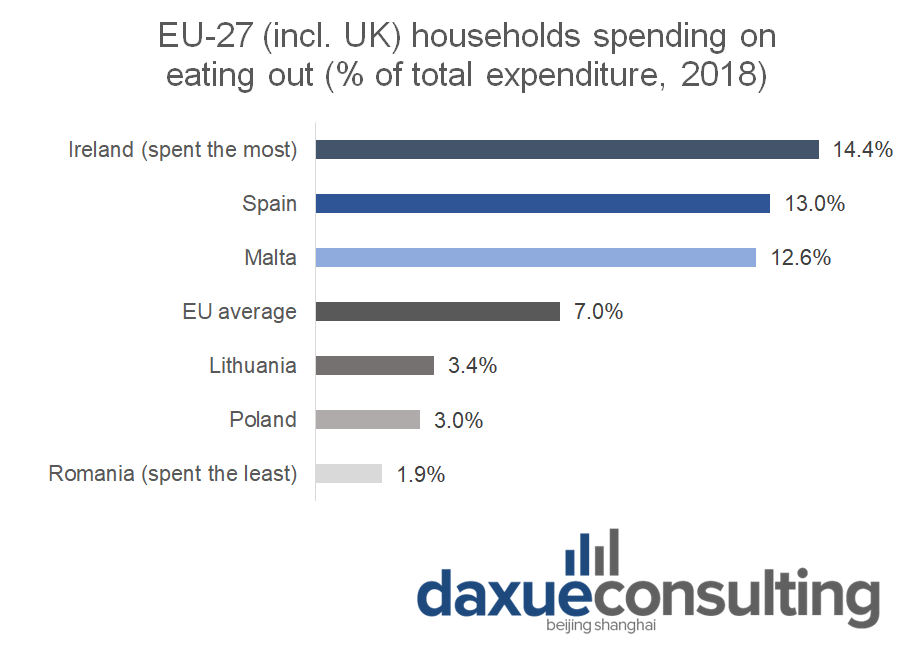

Regional differences in spending on eating out

A recent study from Eurostat found that EU households (incl. UK) spent 7% of their total consumption expenditure on eating out on average. Ireland (14.4%), Spain (13.0%) and Malta (12.6%) devoted the largest share of their household expenditure, while the Eastern and Central EU households spent the least (Germany 4.3%, Poland 3.0% and Romania 1.9). Notably, Romanian households spent the most on food and non-alcoholic beverages (26%), which suggests that they favour home-cooking rather than eating out. On the contrary, the Irish (8.6%) has the lowest share of expenditure.

Italians are the biggest patriots in their national cuisine

For the choice cuisine, countries with strong religious and cultural influence tend to favour their own national cuisine. Patriotically, the Italians are the biggest fan of their own cuisine (99% popularity score), closely followed by Spain (94%) and France (92%). On the contrary, the Chinese (59%) are the least impressed by Italian cuisine. Not to mention that Italy is the most represented cuisine in global the market, as well as the highest market value in the EU food service industry in 2019.

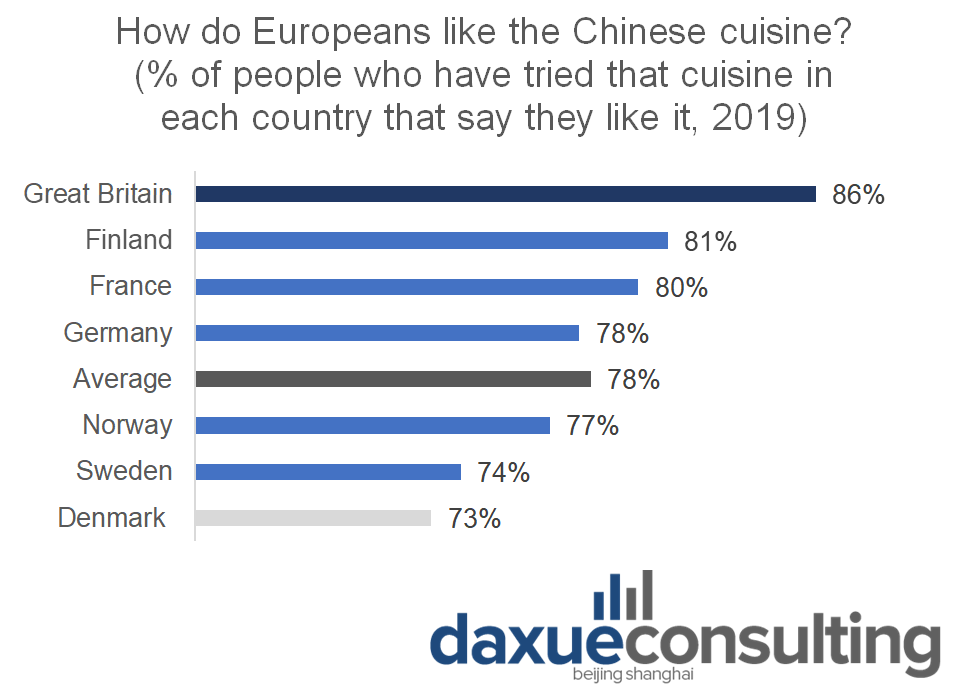

Europe’s appetite for Chinese food

Findings from YouGov also shows a varied appetite for Chinese food amongst the seven survey EU countries. Though Italian cuisine is rated as their favourite foreign cuisine, Chinese food is voted the second favourite, especially favoured by the Brits (86%) and Finland (81%) and France (80%). As opposed to the Europeans, the Chinese favour their own national cuisine (95%) far above any other cuisine. Ironically, their second “favourite” cuisine is from Hong Kong (68%).

The Brits have the most international eating out customs

While the Chinese are less open towards foreign cuisines, the Brits seem to have the most international palate. Latest data from British solicitor firm Bott + Co also shows that London is ranked as Europe’s most diverse city with 89 different national cuisines, with Paris (65) comes as second and Berlin (64) as the third. The firm assessed all major cities worldwide with at least 1 million residents, by means of restaurant listing on Google Maps. Similarly, the UK (14) boasts the biggest recommendations of Chinese restaurants by the Michelin guide, followed by the Netherlands (8), Belgium (7), France (7) and Italy (6).

How do European eating out behaviors differ from Chinese?

Cultural differences influence our dining out behaviors. Shared-dining is widely practised in China, while in western culture separate dining is more common. Research firm Mintel even found that nearly a third of Europeans eat every meal alone in 2019. Despite this difference, full-service-style restaurant still has the highest market value in both China (75%) and EU (41%).

What Europeans value the most when eating out: How to impress European restaurant guests

Although price and quality are the most important factors for diners worldwide, Europeans in particular attach the highest value on price-quality ratio (60%), while consumers at Asia-Pacific (47%) score on the lesser content. McKinsey research firm also found that Europeans will spend less on eating out post-COVID, while an opposite is anticipated for the Chinese consumers. Hence, EU consumer’s cost consciousness will further persist.

How the concept of luxury dining is changing

While the Chinese still view meals at upscale pretentious environment as a status symbol, the consumers in west are shifting towards a more relaxed genuine atmosphere. There is a growing demand for restaurants in offering (Michelin-starred) gourmet experiences, whilst providing laidback and welcoming atmosphere.

Healthy and sustainable restaurants are gaining popularity in the west

While the east has a growing demand for organic food, the EU has by passed this trend and moved onto sustainable and additive free produces. This leads to a rise in restaurant sourcing local and healthier food items for their menus. The circle economy during the pandemic has strengthened this development and is anticipated to stay.

In addition, having vegan menu options available is becoming the norm in the west. Consumers are adopting a (partial) vegan lifestyle and the EU vegan population is rapidly growing. Remarkably, the number of vegans in Britain has risen more than 360% in the past decade. Similar trends are present in Germany, Sweden, Italy and other EU countries.

It’s important to note that these developments are supported by the EU commission, resulting in a set of policies and actions called the European Green Deal, realized through a centralized Farm to Fork Strategy. The main objective is to establish fair, healthy and environmentally-friendly food systems across the EU.

As opposed to the west, the vegan movement in China is still in its infancy due to cultural difference in food.

The success story of Hai Di Lao

Haidilao is China’s largest hotpot brand. The company reached a 2.2% market share in hotpot sector, far above the second largest player at 0.9% in 2017.

Founded in 1994, the group has now successfully expanded to the global market, with a presence in 10 countries and more than 350 restaurants operating outside Greater China. Haidilao is one of the first Chinese restaurant chain to enter the EU, aside from the famous Taiwanese Xiaolongbao-restaurant chain Ding Tai Fung. Both empires operate in London’s most prestigious locations (e.g. Piccadilly Circus and Convent Garden).

Haidilao is positioned as a high-end hotpot restaurant, with a per person spending of around 30 pounds

Haidilao’s unique organizational structure

One of Haidilao’s competitive advantages is its flat company structure. It allows for high level of transparency, and stimulate immediate, effective implementation of the firm’s corporate objectives. According to their official statement for Global offering for IPO, this approach creates optimal balance between control and autonomy, and between standardization and flexibility. Restaurant managers in turn have enough freedom and flexibility while maintain control over the essential aspects of the restaurant operations.

Moreover, the company’s bottom-up growth approach has enabled the group’s rapid expansion. This model aligns the financial interests of their restaurant managers and their ability to cultivate new leaders for future openings. Through their recommendations and Haidilao’s leadership training programs, the group is able to retain and gain new talents internally.

Technology empowerment

Another competitive advantage is their smart adoption of the latest technologies to secure food safety (vertically integrated ecosystem with several partners), improve guests’ dining experience (“Haidilao Super App”) and optimized operations (e.g. site selection). Haidilao was the first in China’s food and beverage industry to open the first AI technology restaurant with fully mechanized service provided by robots. This business model shows lots of potential for future restaurant openings, especially post-pandemic.

One of the pioneers of hotpot delivery

According to Frost & Sullivan, the group was the first in offering delivery service in China in 2010. With the accumulated experience throughout the years, the London-based store is also on the high-end delivery App Deliveroo with an average rating of 4.9/5 from 500+ reviews. The bilingual menu comes with simple cooking instructions and high-quality pictures, making the customer journey in ordering extremely user-friendly and easy-to-understand.

High customer satisfaction rate

Haidilao places guest satisfaction as their primary KPI (above both operational and financial KPIs) for employee appraisal, which results in high customer satisfaction rate. The company’s “above-and-beyond” customer service model is empowered by employee autonomy, the use of technology and regular internal mystery-visits. Data from OpenTable UK reflects high customer satisfaction rate of 4.8/5 on overall experience, while service is rated 4.9/5.

What Chinese brands should know about the Eating out behaviours in Europe?

- Spending on eating out differs per country; however, there is no regional difference within each country.

- Chinese cuisine is the second most popular after Italian, which is hopeful for Chinese restaurants looking to enter the European market.

- The Brits, Finnish and the French considered Chinese cuisine as their second-favourite foreign cuisine.

- The Brits have the most international palate, followed by French and German. The Netherlands, Belgium and Italy also shows potential.

- The EU consumers value the price-quality ratio more than the Chinese consumers, and cost consciousness will further persist post-COVID.

- There is a surge in demand for experiential luxury for the EU consumers, which make them shifting towards restaurant with (Michelin-star level) gourmet experience, whilst providing relaxed and welcoming atmosphere.

- Western consumers have a higher demand in vegan options, healthy and sustainable produces.

- EU consumers are not homogenous, hence tailored market research to your brand’s target group is necessary.

- Understanding the cultural, legal and consumer behavioral differences can provide jumpstart for Chinese ventures to succeed in the West.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

See our report rising Chinese F&B brands

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast