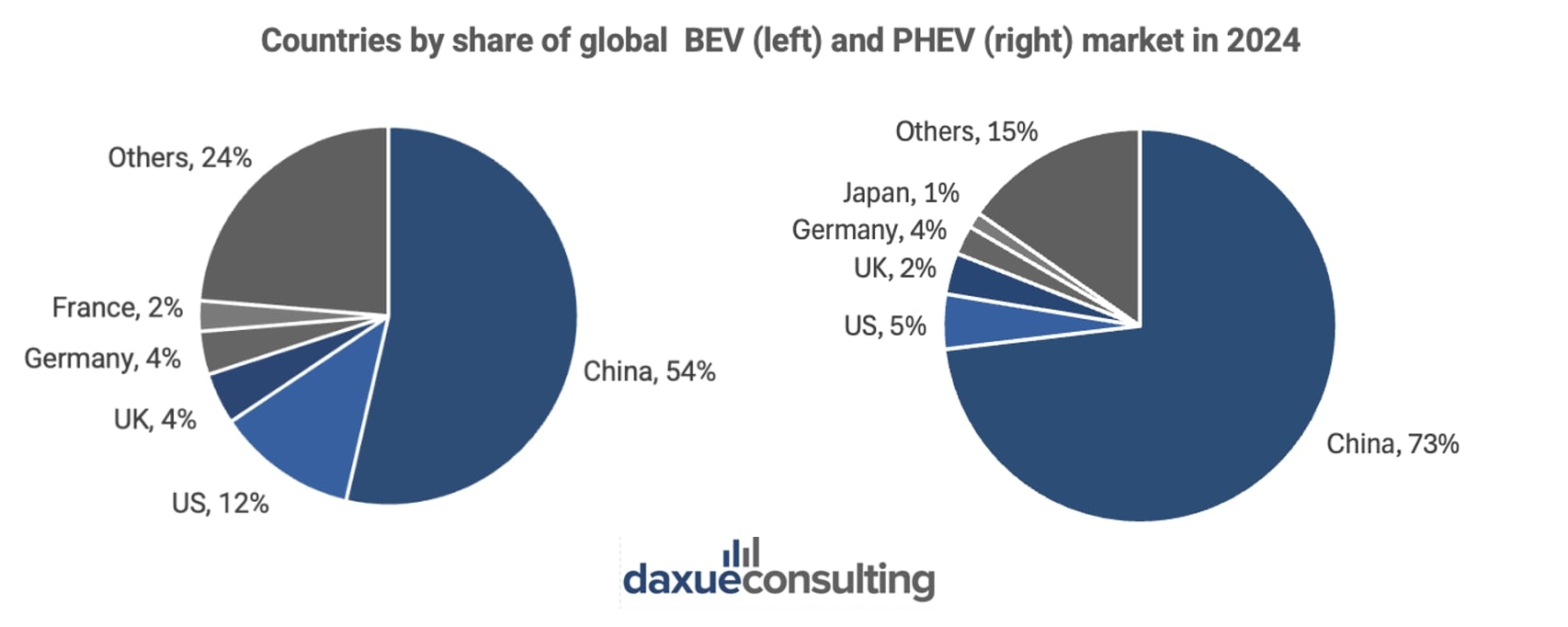

In the last decades, China transformed the global auto industry. In 2024, it sold over 11 million electric vehicles (EVs), marking a nearly 40% year-on-year increase that left the rest of the world scrambling to keep up. Driven by aggressive state support, China claimed 53.6% of all global battery electric vehicle (BEV) sales and a staggering 73.1% of plug-in hybrid vehicle (PHEV) sales. Only now is the world beginning to grasp the full scope of China’s strategic edge, not just in market share, but in supply chains, battery dominance and standard-setting power. As Chinese EVs flood global markets, the geopolitical and economic implications are becoming impossible to ignore.

Download our report on sustainable fashion in China

China’s strategic plan in the global EV industry

A long-term vision rooted in national priorities

China’s leadership identified early that the future of transportation would be electric. Unable to compete with international carmakers on traditional vehicles, China instead invested heavily in EVs to leapfrog the competition. This pivot served multiple purposes: reducing urban air pollution, lowering oil dependence and asserting global leadership in an emerging industry. China’s EV market became a national strategic priority, supported by long-term state planning.

Resource control and technological integration as key enablers

Control over critical raw materials is central to China’s success. The country produces or processes the majority of the world’s lithium, cobalt, graphite, and rare earth elements, materials essential for EV battery production. Beyond mining, China leads in battery cell manufacturing, with companies like CATL and BYD pushing innovation in lithium iron phosphate (LFP) and solid-state batteries. As of early 2025, CATL and BYD together accounted for 55.1% of the global EV battery market share. This vertical integration with the Chinese battery market allows the country to control costs, reduce reliance on foreign suppliers and innovate faster than global competitors.

Technocratic governance and coordinated industrial policy

When Wan Gang, an automotive engineer, was appointed Minister of Science and Technology in 2007, it symbolized the integration of science, industry and policy. The state provided R&D funding, subsidies, and protective policies that allowed companies to grow without immediate profit pressure. To counter the lack of domestic demand, the government promoted contracts between EV firms and public transportation to create artificial demand. Municipal policies also played a role: for example, EV buyers in cities like Beijing and Shanghai are favoured in the strict license plate lotteries. Another notable example is a nationwide policy offering up to RMB 20,000 to drivers who replaced older internal combustion vehicles with new EVs.

Harnessing foreign competition to build domestic strength

China cleverly leveraged foreign expertise to strengthen domestic capability. Tesla’s entry into the Chinese market was promoted but conditional: it had to source its batteries locally. This created demand for Chinese suppliers and accelerated domestic learning. Unlike past eras where foreign firms dominated without transferring knowledge, China’s regulatory frameworks, including joint venture structures and industrial policies, enabled knowledge transfer between Tesla and Chinese firms, creating a unique learning opportunity for China.

Market share through aggressive pricing and scale

With strong support from the government, Chinese automakers accepted early losses to dominate the global market. Most Chinese EV companies are still not making a profit. By pricing aggressively, often below production cost, they expect to drive out international competitors and capture scale. With scale comes manufacturing efficiencies, which further lower costs. This strategy allowed China’s EV market to create vehicles that are now often half the price of Western models, with equivalent or superior features. For example, in 2025, BYD reduced prices on 22 of its electric and hybrid models, including lowering the price of its Seagull EV to just RMB 55,800. As foreign firms lose their advantages, China is quickly gaining global market share.

China’s EV market in 2025: What the industry achieved

Chinese EVs close the gap in tech and quality

Chinese vehicles now come with advanced autonomous driving systems, voice-activated smart dashboards, and high-end digital interfaces, features once exclusive to luxury Western brands or even nonexistent, now common in mid-range Chinese models. On February 10th 2025, BYD announced that all of its new vehicle models will come equipped with the “God’s eye” (天神之眼), an intelligent autonomous driving system. China even saw the rise of self-driving taxis recently. Considered as an experimental and premature industry for many, bright prospects are certainly coming.

Furthermore, at the 2025 Shanghai Auto Show, Chinese companies unveiled charging technologies capable of delivering up to 1,300 kW, the equivalent of 323 miles of range in five minutes. As a comparison, Europe’s fastest-charging EVs, like the Porsche Taycan, fill their batteries at a mere 320 kW.

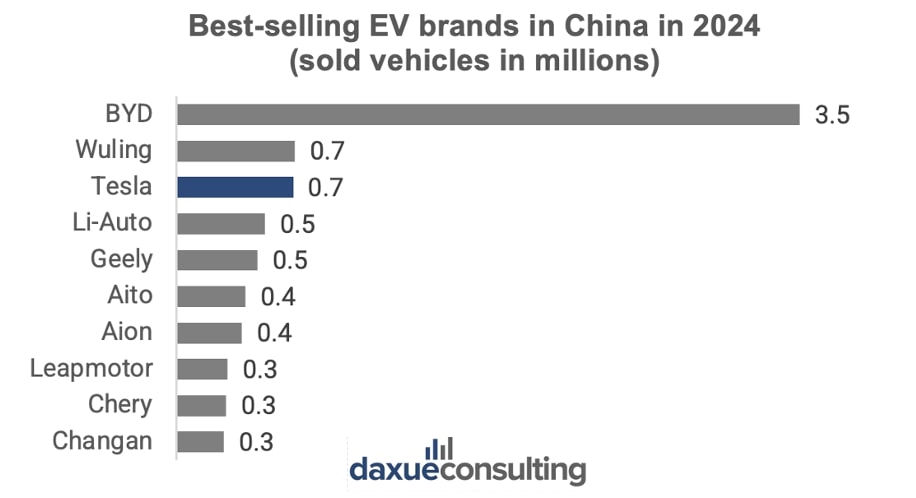

China largely self-produces its domestic market, with the only foreign firm in the top ten best-selling ones being Tesla. BYD widely dominates the domestic market with 3.52 million sold vehicles in 2024 and has become the third most valuable automaker in the world. Its control over the entire supply chain, including battery cells, electric motors and semiconductors, allows it to maintain aggressive pricing while innovating at scale.

Chinese EVs make steady gains in global markets

On the global stage, Chinese EV manufacturers are expanding rapidly. BYD has already overtaken Tesla in Europe in some key markets in terms of monthly sales. The company expects its overseas sales to double in 2025, and other manufacturers are following suit. Chinese EVs are no longer niche imports; they are becoming mainstream choices in markets from Southeast Asia to South America and increasingly across Europe.

Challenges faced by the Chinese EV market

Western responses: reactive and fragmented

Recognising China’s strategy at last, Western governments have responded with tariffs. In 2024, the European Union imposed tariffs of up to 45.3% on Chinese electric vehicles. Similarly, the United States has implemented a 100% tariff on Chinese EV imports, effectively closing its market to Chinese manufacturers. China is bypassing those tariffs by pivoting to hybrids in Europe and building EV plants in places like Mexico to reach the United States, but the market loss is still considerable.

From breakthrough to bottlenecks

China’s EV sector has experienced significant overcapacity. Strong government subsidies and tariffs from foreign countries led to an excess production capacity. This leads to intense competition and a price war among manufacturers. This environment has resulted in the closure of approximately 400 EV companies between 2018 and 2025, with only a few expected to dominate the market by 2030.

The market cannot keep up with China’s pace

China has developed an extensive domestic EV charging network, with over 6 million public charging points as of 2024. However, many of its export markets lack sufficient charging infrastructure. This deficiency hampers the adoption of Chinese EVs abroad. Consumers face limited access to charging facilities, particularly in regions like Southeast Asia and parts of Europe.

The future of China’s EV market

China may be facing current challenges in the EV market, but its long-term vision remains one of its greatest advantages. The nation’s 2060 carbon neutrality plan ensures that electrification and sustainable mobility are embedded in state planning. Forecasts suggest the combined EV and charging infrastructure market in China will grow at a CAGR of 10.9% between 2025 and 2029. It has the potential to reach approximately USD 572.13 billion by the end of the decade.

The road to China’s EV market supremacy

- China’s EV success is the result of long-term state planning, aggressive industrial policy, and strategic investment in battery and supply chain control.

- With 11 million EVs sold in 2024, China claimed over half the global BEV and PHEV market.

- Firms like BYD and CATL lead in production, pricing, and innovation through vertical integration.

- Foreign brands helped build the ecosystem, but now they struggle to compete with cheaper, smarter Chinese EVs.

- While the West reacts with tariffs and challenges appear, China keeps scaling, exporting and setting global EV standards.