In recent years, Environmental, Social, and Governance (ESG) considerations have emerged as pivotal elements reshaping the landscape of corporate practices and investment strategies globally. This transformation is notably pronounced in China, which is witnessing a significant surge in ESG awareness and implementation. According to a survey of 262 executives from Chinese listed companies, over half (53%) publicly announced their commitment to ESG. Likewise, two-thirds of these organizations have engaged with key stakeholders to align their ESG plans with strategic objectives. This underscores the escalating significance of ESG in China.

Download our report on the future of sustainable fashion in China

Overview of the landscape of ESG in China

ESG vs CSR

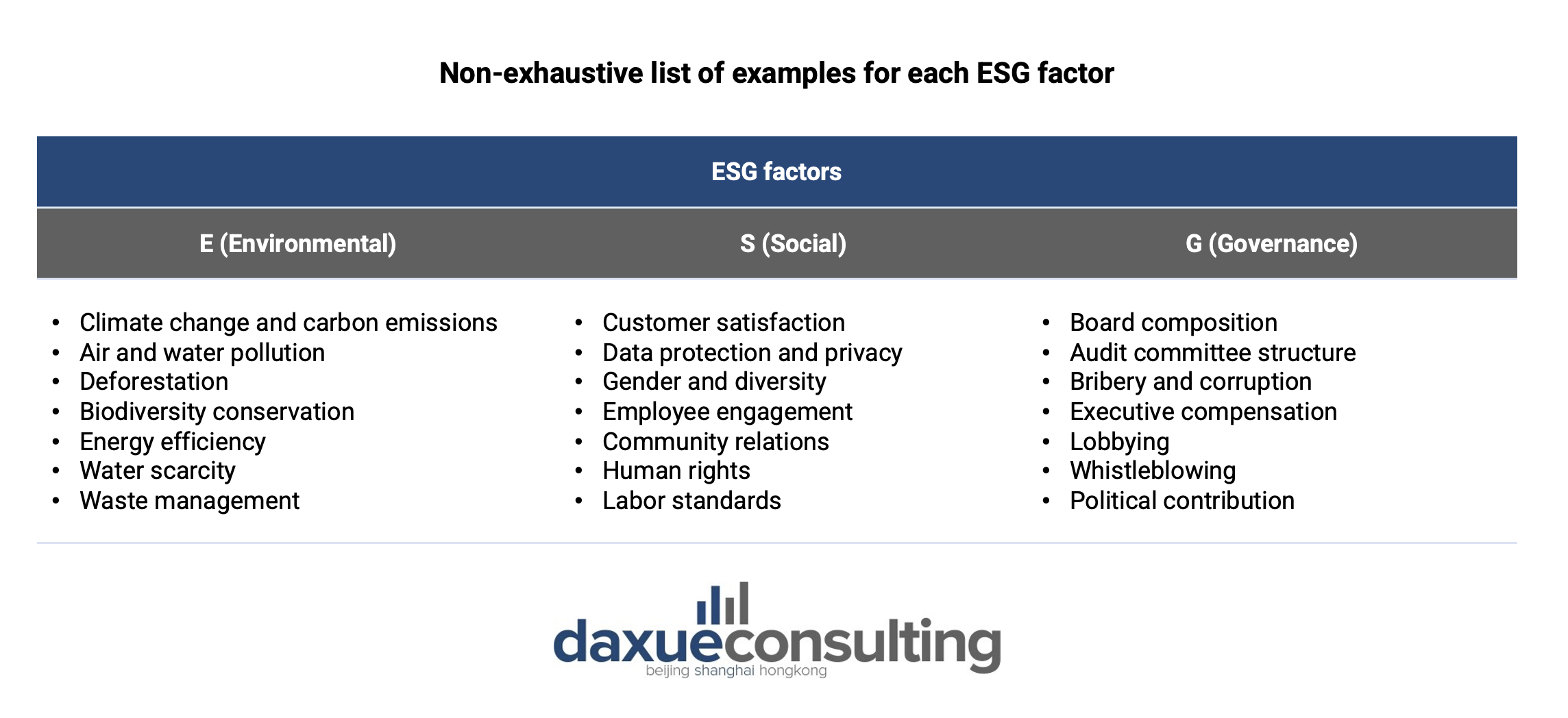

ESG comprises a framework that evaluates a company’s sustainability and ethical impact. The environmental aspect gauges the company’s impact on the environment, the social criteria assess its relationships with employees, communities, and stakeholders, and the governance criteria scrutinize its leadership, ethics, and internal controls. These considerations empower investors and stakeholders to make informed decisions by assessing a company’s dedication to responsible and ethical business practices.

In comparison, Corporate Social Responsibility (CSR) entails specific voluntary initiatives for social and environmental contributions. These efforts are typically implemented as standalone efforts, going beyond regular business operations.

China is at the bottom of the global ESG rankings

Chinese companies are absent in the top 100 ESG companies globally, and they have a lower median ESG score than other nations. Moreover, in 2021, China ranked 47th in terms of median ESG score among 50 measured countries.

However, adopting a purely ratings-based investment strategy in China poses challenges due to the limited disclosure of ESG information and the absence of standardized metrics in the reported data. Despite the emergence of domestic third-party ESG rating providers such as Wind and SynTao Green Finance, the existing ESG ratings fall short of accurately reflecting companies’ true performance. The inadequacy in data availability and reliability presents hurdles in developing a robust ESG evaluation system in China, particularly in comparison with global companies.

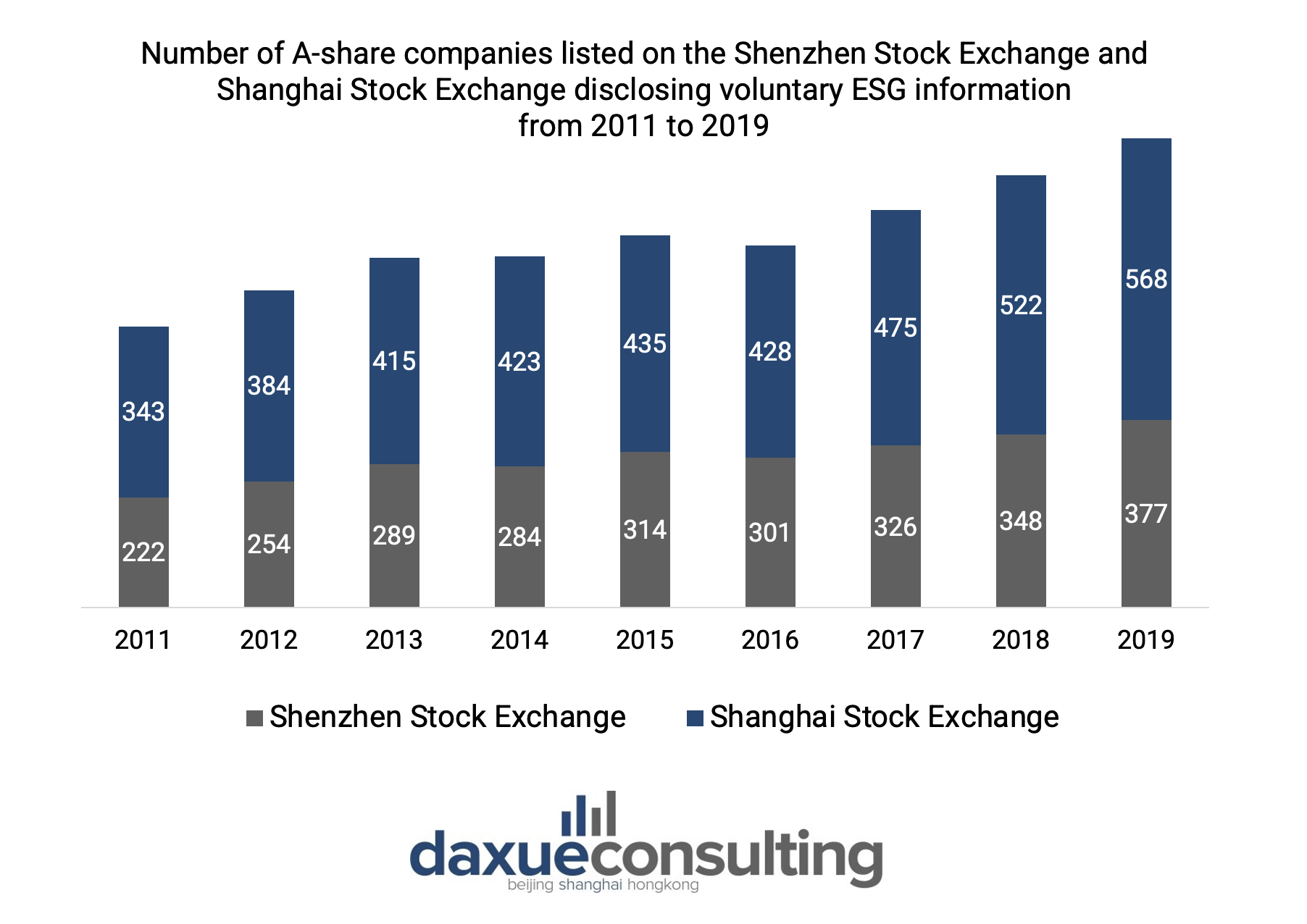

ESG disclosure is on the rise in China

Despite China’s current low rankings, the number of Chinese A-share companies disclosing voluntary ESG information has been consistently rising year by year. From 2011 to 2019, there was a more than 65% increase across companies listed on the Shenzhen Stock Exchange (SZSE) and Shanghai Stock Exchange (SSE).

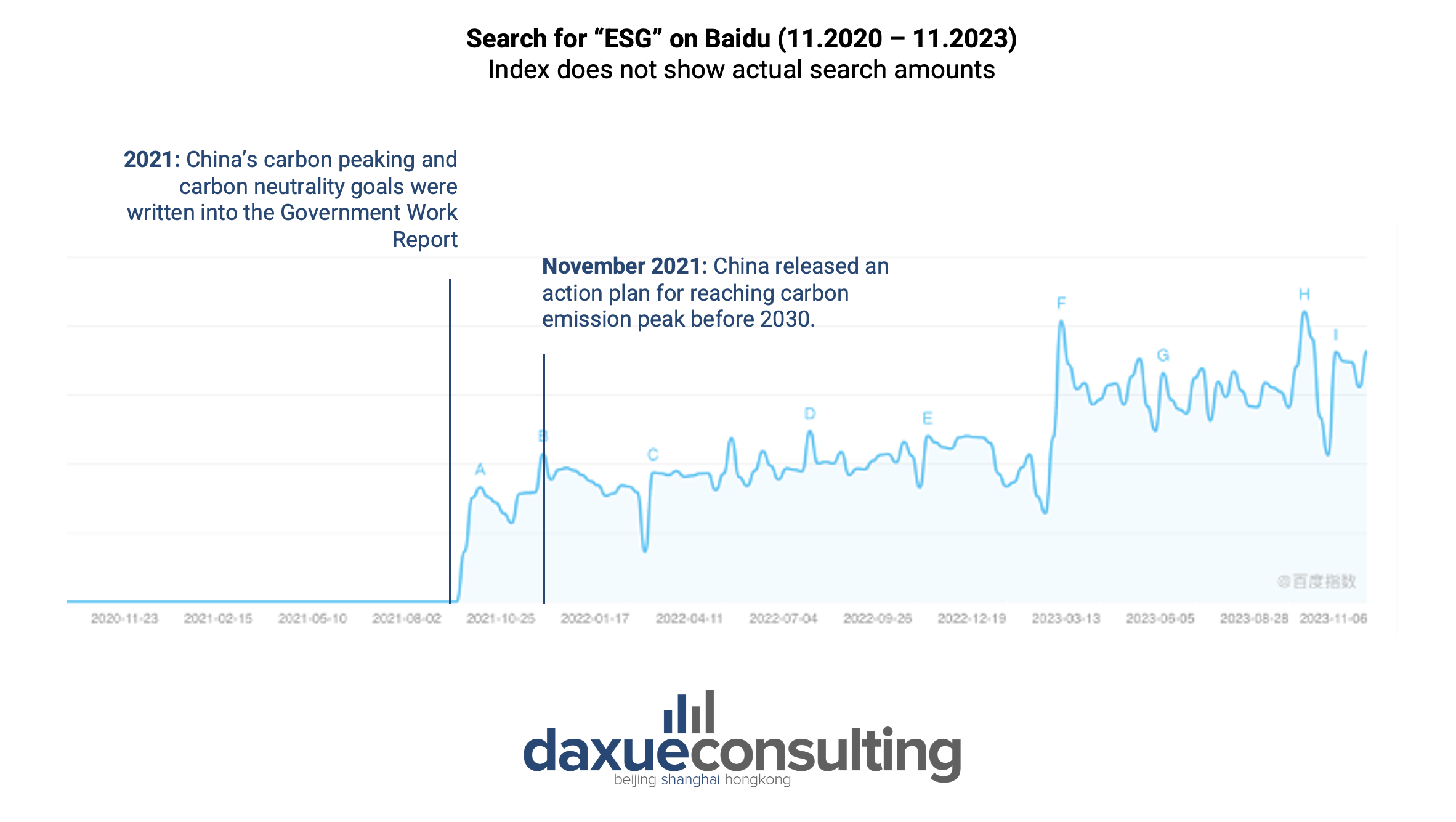

This trend is also visible on Baidu, with a sharp increase in search volume for “ESG” around September 2021. The increase in interest aligns with the period when the country formally incorporated its carbon peaking and carbon neutrality objectives into the Government Work Report. This symbolizes the official commitment of the central government to prioritize and address the reduction of carbon emissions.

Key drivers for companies to embrace ESG in China

Across 262 surveyed listed Chinese companies, the top reasons for developing an ESG strategy were to meet customer expectations (47%), investors’ expectations (44%), and government initiatives (37%). This highlights the importance of aligning with diverse stakeholder interests in ESG decision-making.

Responding to consumers’ expectations

The importance of ESG strategies aligns with the increasing activism of Chinese consumers. Over 80% of consumers in mainland Chinese cities within the Greater Bay Area express expectations for brands to demonstrate enhanced environmental and social responsibility.

Adapting to investors’ influence

Both domestic and international investors are concerned about the disclosure of ESG information, particularly in relation to ESG risk management. The primary obstacles faced by investors when contemplating sustainable investments in China include a lack of reliable ESG information, the absence of comparable ESG data among Chinese companies, and insufficient comparable ESG data with international companies.

Chinese companies, grappling with the aftermath of a prolonged COVID-19 economic crisis, are not only seeking domestic but also foreign capital. In alignment with the global emphasis on ESG, disclosing such information becomes instrumental for companies in securing access to financing and increasing their chance to compete globally.

Local and international ESG guidelines

Government guidelines and emphasis on “Common Prosperity”

Currently, there is no official requirement for companies in China to adhere to specific guidelines when producing ESG reports. The existing reporting standards are set by the China Enterprise Reform and Development Society (CERDS), and adherence to these standards is voluntary.

These standards place a stronger emphasis on domestic social standards rather than global environmental responsibility. The overarching priority is on the common welfare, aligning with China’s focus on social equity and the concept of “Common Prosperity” (共同富). As a result, ESG in China tends to center on issues that directly impact domestic communities and social well-being.

“Common Prosperity” in China represents a people-centric development approach with a distinct focus on the “S”, or social equity, within the ESG framework. Unlike Western counterparts, Chinese firms tend to prioritize on issues, such as product and workplace safety, over aspects like climate change and diversity. Additionally, in light of China’s commitment to achieving “Common Prosperity,” several companies are leveraging their capabilities to foster development in rural regions, promote education, and uplift lower-income groups.

Requirements for Chinese companies exporting overseas

Chinese companies, particularly those exporting to the European Union (EU), face additional compliance requirements with the EU’s ESG reporting standards, which are now one of the most stringent in the world. For example, Chinese businesses exporting to EU markets face a new obligation: reporting emissions for the EU’s Carbon Border Adjustment Mechanism. This mechanism introduces tariffs on carbon-intensive products, adding a layer of compliance for Chinese exporters.

What we can learn from the ESG momentum in China:

- In recent years, China has seen a significant rise in ESG considerations, reflecting a global trend toward sustainable business practices.

- Limited disclosure and the absence of standardized metrics challenge a purely ratings-based investment strategy in China. Over the past decade, ESG disclosure in China has increased, aligning with the country’s commitment to carbon neutrality.

- Key motivations for Chinese companies to embrace ESG include meeting customer expectations, investors’ demands, and government initiatives. Stakeholder expectations, particularly from Chinese consumers and foreign investors, play a crucial role in driving ESG in China.

- Currently, there is no mandatory official requirement for ESG reporting in China; adherence to standards is voluntary. These standards prioritize domestic social issues over environmental responsibility, aligning with the concept of “Common Prosperity.”