The COVID-19 pandemic has caused not only a public health crisis, but also an economic crisis across the globe. According to the International Monetary Fund, the median global GDP dropped by 12% from 2019 to 2020. When Omicron became the dominant variant, most countries started loosening their restrictions as the new variant is less deadly, and more people are vaccinated. While the rest of the world has been lifting COVID restrictions, China has continued its Zero-COVID policy.

Before the Omicron outbreak in China, stay-at-home orders have proven to lower transmission rate, with a 90% decline in the number of new cases from the 2020 lockdowns. However, the Omicron variant is the most contagious strain so far, and is often asymptomatic, making it harder to control. For example, in March 2022, Shanghai experienced the most severe pandemic in China since 2019 – around 60 thousand people were infected. The entire city has been under strict lockdown for more than two months and around 20 million people were prohibited from leaving their homes or communities. This wide-scale lockdown not only affected the regional economy but also disrupted the national economy performance and the entire supply chain. Beyond that, the shift in consumer behaviors, such as increase in digital activities and decline in shopping for non-essential goods, have created new challenges and opportunities.

Zero-COVID has disrupted China’s GDP growth

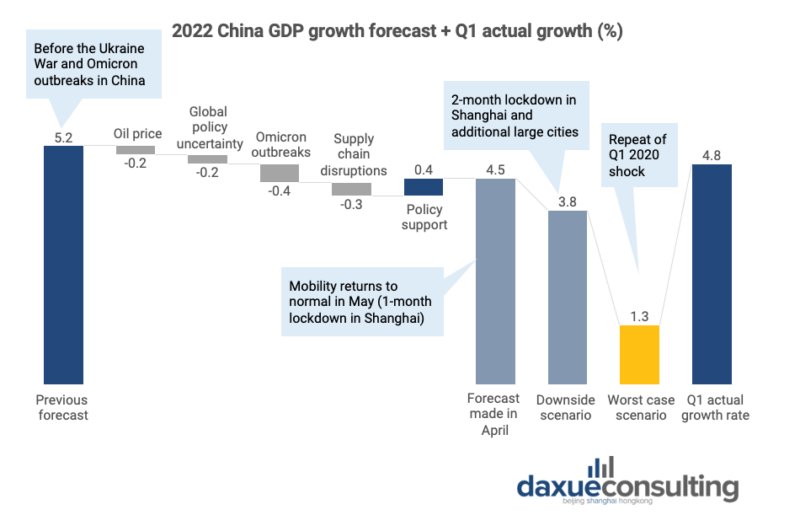

As China attempts to curb the spread of the virus, restrictions such as quarantines, lockdowns, and border controls have caused a slowdown in manufacturing, infrastructure, and production. It is estimated that a strict lockdown in Shanghai alone could reduce China’s real GDP by 4%, and if China’s four largest cities all underwent a strict lockdown together, national inflation-adjusted GDP would drop by 12%. The recent lockdown in Shanghai officially began on March 27th, 2022, lasting for almost two months, with restrictions loosening from the week of May 16th, 2022. In 2022 Q1, the Chinese economy expanded 4.8% year-on-year, which was above the market consensus of 4.4% and faster than the 4.0% growth from the previous period. However, the larger-than-expected Omicron outbreak makes it impossible for China to meet its 5.5% GDP target growth rate this year.

The rising uncertainty amid COVID-19 lockdowns and slowdowns in the economy could result in a slower growth in the following months. In addition, the economy will likely keep on suffering during 2022 Q2, which has yet to be seen. Considering that the government will only gradually end its “dynamic Zero-COVID” policy over the course of the following year, the Fitch Ratings raised its China 2023 GDP growth prediction from 5.1% to 5.2% in May 2022.

The Zero-COVID lockdowns slow down China’s Dual Circulation Strategy

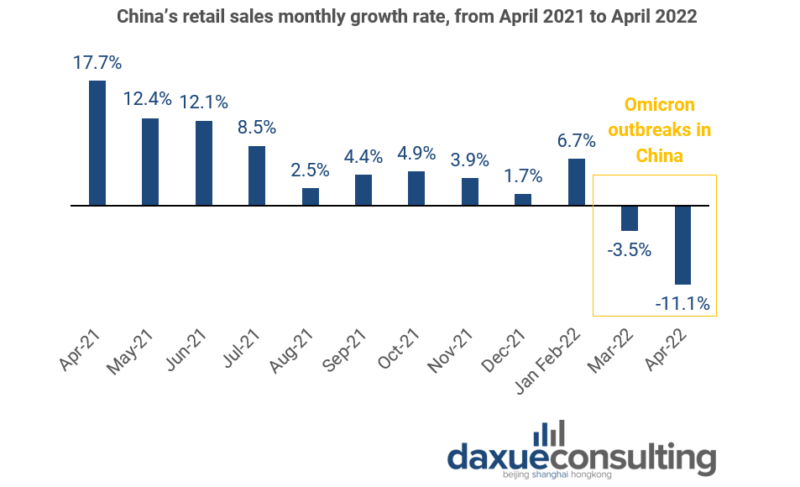

The Dual Circulation Strategy, China’s new economic model, aims to shield China from global volatility and pivot the Chinese economy toward greater self-reliance. However, the Omicron outbreak has disrupted the implementation of the strategy. On the one hand, domestic consumption has dropped dramatically – the retail sales declined by 11.1% year-over-year in April 2022. This was the sharpest slump recorded since the 15.8% drop in March 2020 due to the first wave of the COVID-19 pandemic. Decline in domestic consumption is likely to drive domestic companies to potentially look overseas for revenue.

On the other hand, the country’s export growth in April 2022 was the slowest in nearly 2 years. And imports are declining faster than exports, reinforcing the idea that the decline in Chinese domestic consumption will push companies to sell their products abroad.

Weakened demand in retail, offline entertainment is suffering

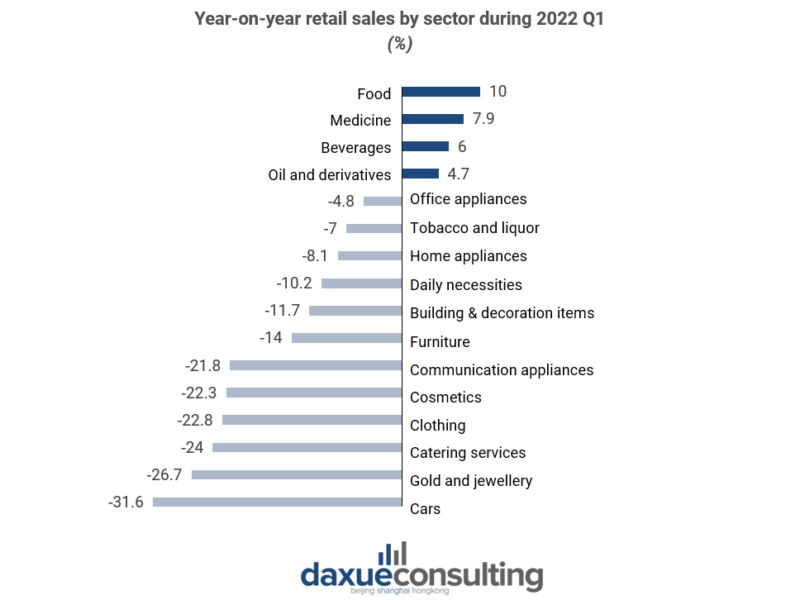

While the macroeconomic performance is still haunted by the uncertainty of COVID, consumer behaviors is also changing. The prolonged pandemic and the recent waves of lockdowns are discouraging consumers from purchasing certain categories of goods. One of the most obvious consequences was the decrease in retail sales during 2022 Q1, except for daily essentials, such as food and medicine, whereas other categories of goods have borne the brunt of the downturn.

The entertainment industry has been one of the most vulnerable categories. Under the Zero-COVID policy, regions with sporadic cases have prohibited most indoor venues for dining and activities, including cinemas. This restriction directly caused profound disruptions in the entertainment industry in China. Chinese box-office revenue in 2022 Q1 amounted to just RMB 16.1 billion, thus recording a 28% drop year-on-year. During the same period, less than half (47.4%) of all the cinemas in China were opened due to the Omicron outbreaks across the country. In addition to the movie industry, live performances were facing the same hardship. Between mid-February and mid-March of 2022, over 4,000 live performances were canceled or postponed nationwide. As a result, Chinese theaters are projected to witness a further decrease in revenues by 35% compared to 2022 Q1, thus pushing major theaters to move their shows online.

Hotels adapt to providing staycations and ‘studycations’ to stay afloat

On the other hand, the continuous waves of lockdowns as well as the change in consumers’ travel habits and preferences are putting a strain on the Chinese tourism and hospitality industry. For example, the required COVID testing before travel and the risk of new outbreaks have discouraged people from long travels. During Labor Day holidays in 2022, the number of domestic tourists equaled to just 160 million, a decrease of 30% year-on-year.

In such hard times, some hotels had to reinvent themselves to compensate the decrease of tourist flows. As new Omicron cases mushroomed across the country, some large hotel chains decided to broaden their offers to mitigate the impact of the pandemic. In March 2022, Mandarin Oriental Pudong launched a “studycation” package including in-room online schooling, 3 meals per day, and daily supervision from the hotel staff.

Nevertheless, a declining demand of tourism and hospitality doesn’t apply to all cities. Tourism in Fujian and Sichuan (where the pandemic was mostly kept under control) during the first days of May generated more than RMB 10 billion, proving Chinese consumers’ willingness to travel again once things return to normal. In other words, people’s consumption willingness is likely to increase as long as the pandemic is under control.

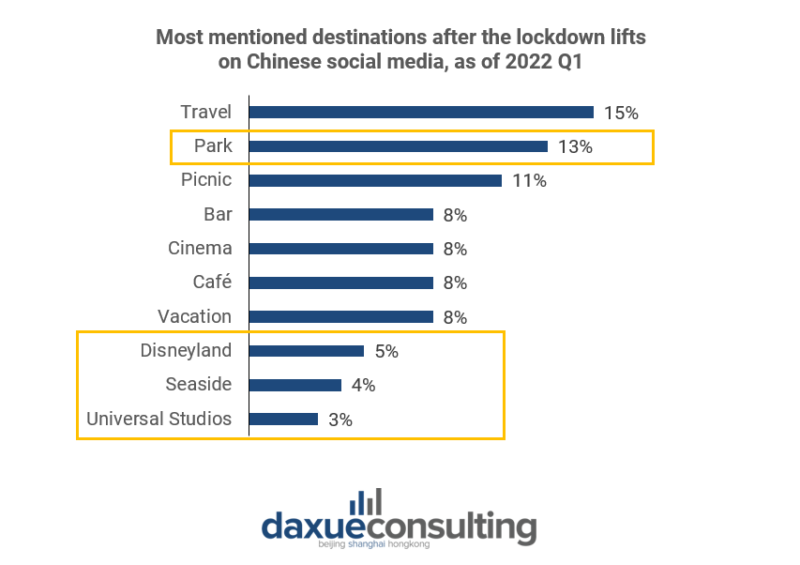

Netizens show clear intent on revenge shopping and travel once lockdowns lift

Although the current consumption level is still low, shopping and traveling intentions are just temporarily repressed during the lockdown period. According to a social listening analysis by Publicis Groupe, people in locked down cities are looking forward to traveling and shopping again. Indeed, 35% of people in locked down cities expressed on social media their intention to spend on tourism after the lockdown is lifted, and 48% of Chinese netizens revealed their desire for normality. Moreover, conversations about the 618 festival have suddenly spiked, surpassing those in 2020, showing that shopping is back on consumers’ agenda. People’s optimistic expectation about the future and growing online sales give hopes for a recovery in consumption.

Government policies to boost economy after the first COVID outbreak

Recently, the Politburo meeting and the Central Finance and Economics Committee chaired by President Xi Jinping emphasized that the government would introduce macro support policies to resist the downward pressure on the economy. The Chinese government is likely to prioritize measures for stabilizing the economy by boosting investment and increasing public spending.

In fact, the government increased infrastructure spending by 8.8% in March from 8.1% in February 2022. The Government Work Report (GWR) also announced that transfer payments from the central government to local governments will increase by about RMB 1.5 trillion, reaching a total of nearly RMB 9.8 trillion and recording an increase of 18% year-on-year.

Moreover, the 2022 GWR announced its intention to allocate RMB 640 billion of the central budget to investment. The report also emphasized the importance of stabilizing imports and exports in 2022. There are several supportive measures for foreign trade companies proposed, including expanding the coverage of export credit insurance, strengthening export credit support, leveraging cross-border e-commerce, and the overseas warehouses, etc.

Simulating domestic consumption is instead a long-term strategy for economic growth. For example, the GWR called for increasing disposable income and improving income distribution, as well as providing better social infrastructure at a community level, such as community pensions and childcare. Furthermore, to promote service consumption, the GWR called for the expansion of the service sector, the construction of county-level commercial systems, and development of rural e-commerce and express logistics and distribution.

Lockdowns are going to accelerate the China+1 strategy while giving China the opportunity to move up the value chain

International companies were already coupling their investments in China with investments in other countries in the region due to rising wages in China and the gradual appreciation of the yuan. Academicians and experts labeled this phenomenon as “China+1 strategy”. However, as the Omicron outbreaks in China forced factories to shut down and restricted mobility of goods, thus strongly disrupting the supply chains, more and more foreign investors are going to follow this path. Indeed, over 180 global companies including Tesla, Sony, and LG claimed they were affected by China’s lockdowns in their first-quarter earnings calls or financial statements in 2022. As a result, Southeast Asian countries are going to be the most popular destinations of Foreign Direct Investments diverted from China. For instance, Apple moved some of its iPad production to Vietnam in an attempt to diversify its supply chain after months of disruptions due to the lockdown in Shanghai.

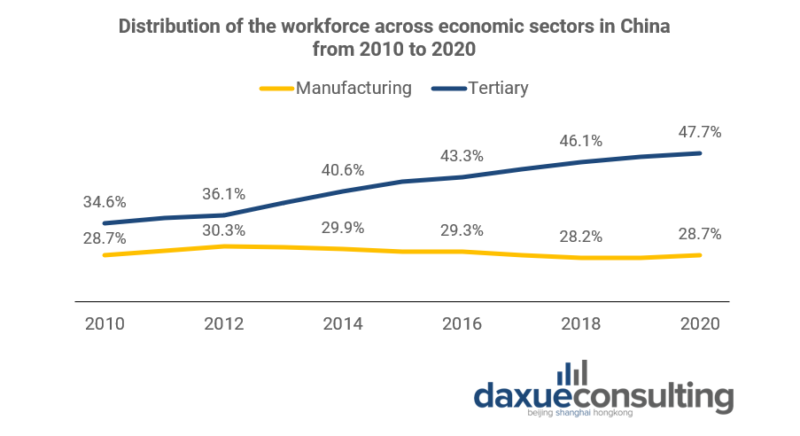

After foreign companies leave the country, unemployment is bound to increase in the short run, but this could provide China with the opportunity to move up the value chain in the long run. Indeed, as foreign companies outsourcing low value-added operations in China exit the country looking for cheaper labor and more stable conditions, the Middle Kingdom can seize this opportunity to capture higher value-added activities in the downstream and the upstream of the chain, thereby boosting the shift towards a capital- and knowledge-intensive economy. Since 2011, most of China’s labor force has been employed in the service sector and the proportion of people working in the tertiary sector in China has been steadily growing.

The economic cost of the Zero-COVID strategy in China

- Zero-COVID has disrupted China’s GDP growth and the economy is likely to keep suffering in the following months because the government will only gradually end its “dynamic Zero-COVID” policy.

- The Zero-COVID lockdowns is posing a threat to China’s Dual Circulation Strategy as domestic consumption declines and export growth slows down.

- The continuous waves of lockdowns as well as the change in consumers’ travel habits and preferences are putting a strain on the Chinese tourism and hospitality industry.

- The prolonged pandemic and the recent waves of lockdowns are discouraging consumers from purchasing non-essentials. As a result, the retail sale declined by 11.1% year-over-year in April 2022, which was the sharpest slump recorded since the 15.8% drop in March 2020.

- Netizens have shown clear intent on revenge shopping and travel once lockdowns are lifted but consumption recovery is unlikely to be as strong as in 2021.

- Restrictions of indoor venues directly caused profound disruptions in the entertainment industry in China, pushing major theaters to move their shows online.

- Lockdowns are going to accelerate the China+1 strategy as the supply chains have been strongly disrupted and foreign investors want to diversify their portfolio to mitigate the risk.