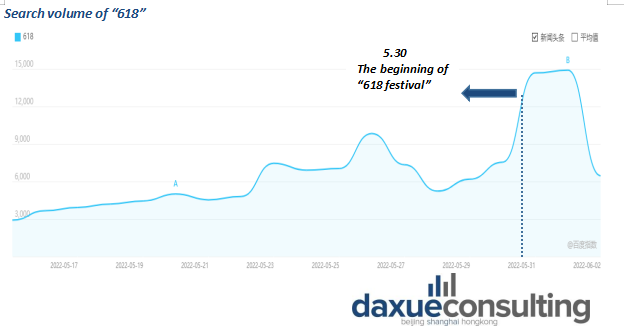

Apart from the end of the citywide lockdown in Shanghai, China’s second-largest e-commerce shopping day, the “618 Festival”, has also been a trending topic on the Chinese internet as it has just begun. On 30th May, China’s major e-commerce platforms including JD and Alibaba’s Tmall officially kicked started this year’s “618 Festival”. Chinese consumers are deeply immersed in the shopping frenzy, which can be seen from the countless shopping-related comments and the soaring search volume of “618” on major Chinese websites. Data from Alibaba showed that its delivery app, Cainiao (菜鸟), recorded a 35% increase in the number of direct signed orders on the first day compared to the same period in 2021.

How the “618 Festival” started from a minor celebration to a nationwide shopping extravagance

Launched in 2010, the “618 Festival” was initially established by JD initially as an internal celebration for the company’s anniversary on June 18th every year, offering a series of small discounts and promotions. However, as e-commerce and online strategies became increasingly prevalent across China, other e-commerce players, such as Alibaba-run Taobao/Tmall, Pinduoduo, and Suning also joined the 618 battle, followed by Chinese social media like Douyin, Little Red Book, WeChat and Weibo that are actively seeking to help brands and merchants drive sales and increase brand awareness. After over ten years in operation, the “618 Festival” has now evolved from an internal celebration to China’s second-largest shopping spree, along with “The Singles Day” on November 11th being the first.

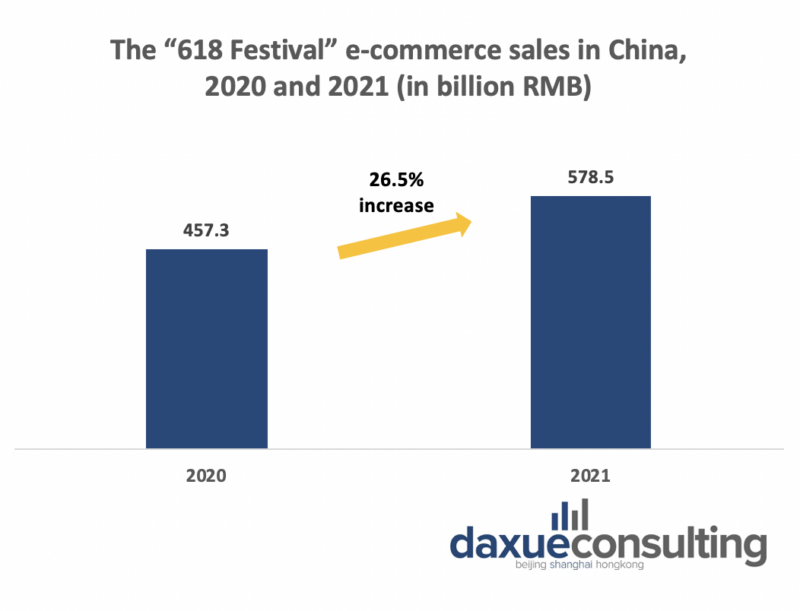

The fast-expanding “618 Festival” is seen as an important sales opportunity by offline retailers both in China and abroad, with household appliances, healthcare products, mobile devices, clothing, and electronic accessories often being the most popular items of the festival, according to a market report from Britain-China Business Council. Based on the market data from Syntun, during 2021’s “618 Festival”, B2C e-commerce sales grew by 26.5% y-o-y, reaching 578.48 billion RMB, with the sales of imported wine and pet care products growing by 20 times on Tmall platform. In 2022 however, the “618 Festival” serves as another crucial function as an economic booster after the extended lockdown in Shanghai and many other Chinese cities. The “618 Festival” is the first shopping event after COVID-19 cases have declined nationwide and will be a significant window to stimulate consumer spending and pave the way for an economic rebound in the second half of the year.

What consumers should expect from the “618 Festival” in 2022

The debut of Jubensha tourism

Jubensha (剧本杀, also known as “The Script Skill”), a mystery-like role-playing board game with participants sitting around a table trying to pick out the pre-designated “murderer”, provided with limited clues in a certain game setting, is one of the most popular go-to pastimes for the younger generation in China. In celebration of this year’s “618 Festival”, Jubensha is leveraged by Fliggy, one of China’s top-ranking travel agencies under Alibaba, to enhance their cruise sailing experience. As the cruise is sailing down the Yangtze River in Chongqing, tourists are invited to participate in Jubensha, obtaining evidence, analyzing the “crime scene”, and tracking down “criminals” in a cruise setting, while enjoying the scenery of the riverbank. This emerging and innovative element of tourism has drawn thousands of applications in just one week.

Tmall’s metaverse mall

Unlike traditional online shopping experiences where consumers drag their desired products into shopping carts on the website, Alibaba’s Taobao has appointed the help of a specialist metaverse project team to create a fully-optimized virtual shopping venue for its consumers this year. Shoppers will be able to guide their avatars through 3D stores and take part in several interactive activities simply on their mobile devices. This example showcases how brands can generate sales and maintain appeals, despite physical stores being remained shut due to the lockdown.

More generous voucher scheme

Another attractive aspect for consumers in this year’s “618 Festival” is the voucher scheme. Tmall platform offers an immediate 50 RMB voucher for every qualified 300 RMB purchase. In addition, consumers who have placed large orders on the website will receive extra discount coupons. In comparison, the discount ratios in previous years ranged between 20 to 30 RMB on average for every qualified 200 RMB purchase.

Health-related products are the most popular category in 2020 and 2021’s “618 Festival”

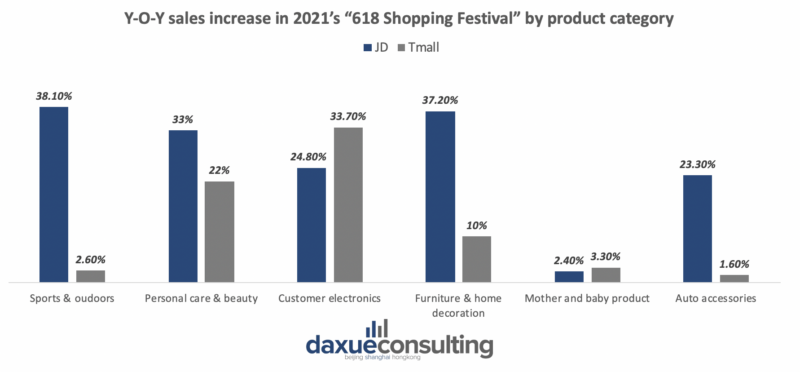

Shopping data from 2020 and 2021’s “618 Festival” revealed the rising awareness of health and personal care from Chinese consumers. Based on the sales data from Alibaba and JD, sports and outdoor products are the most purchased categories, experiencing a 38.1% y-o-y increase from 2020 to 2021, followed by the personal care and beauty category, with a 33% and 22% increase in JD and Tmall platforms respectively. On top of that, consumer electronics was the fastest-growing major product category during the time period, witnessing a 33.7% increase on Tmall platform.

Pre-sale results of the ongoing “618 Shopping Festival”

The pre-sale period, (26th to 31st May), which has now ended, was a short shopping window when consumers can compare prices across different platforms and pre-order their desired products despite in a smaller amount. It is, by experience, a good indicator for brands to forecast their performances of the entire shopping festival. Brands and merchants often draw market insights, estimate the overall sales performance, and optimize the commercial strategies according to the brand’s market dynamics during this initial timeframe.

The top-performing brands today remain in categories like beauty and skincare, home appliances, body care products, and sports shoes, etc. According to Digital Retail Data provider Nint, some brands from those categories had already reached a transaction volume of over 100 million RMB during the first four hours of pre-sale. This result implies the self-satisfaction that Chinese consumers are increasingly looking for when shopping. Whether the purpose of their purchases brings a positive and healthy impact or better quality to their personal life, appears to be a more significant factor in their purchase decisions, instead of buying to show off their social value. On the other hand, the fashion sector such as menswear and the underwear categories recorded a declining trend compared to the previous year. This less-optimistic performance is likely due to the minor but unpredictable COVID outbreaks across Chinese cities every now and then, which results in less demand for outdoor events, thus fashion needs.

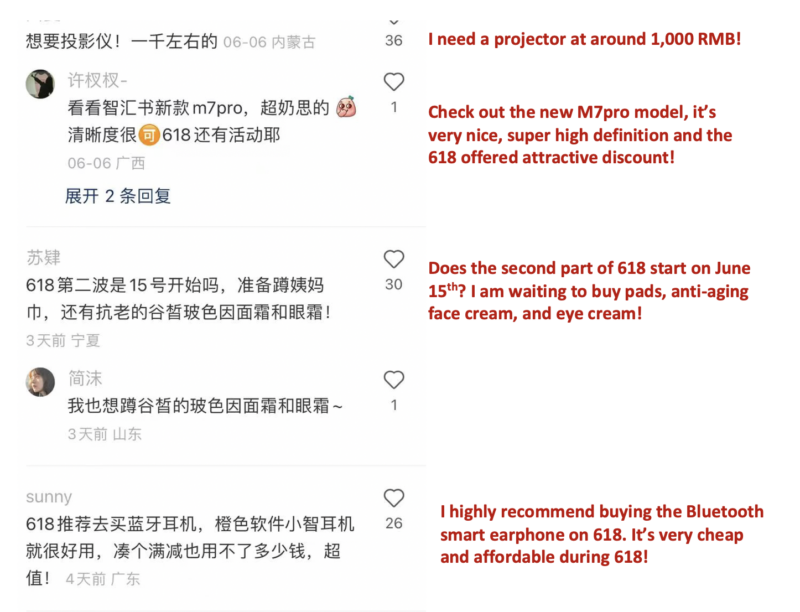

What Chinese Netizens are discussing about the “618 Festival”

Since the start of the “618 Festival”, Chinese social platforms such as Zhihu and Little Red Book have been flooded with posts of netizens commenting about their purchases, 618 budgets, and unique box-opening experiences.

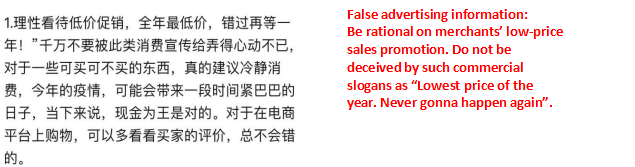

In the meantime, Chinese netizens are also warning each other to “maintain a clear mind” and “keep an eye out for consumption traps that could possibly occur at any time” – the most common traps among which are quality fraud, price tag tricks, and false advertising information.

Key takeaways from the “618 Shopping Festival” in 2022

- The “618 Festival” in China is a shopping extravagance that allows Chinese consumers to shop a vast category of low-priced products.

- With over ten years’ effort, the “618 Festival” has evolved from an internal company celebration into a national shopping spree. In 2022, it plays another essential role as the facilitator for China’s post-lockdown economic rebound.

- Things to expect for this year’s “618 Festival” include the release of the Jubensha tourism and Tmall’s metaverse mall.

- Based on the sales performance from 2022’s pre-sale period, brands that fulfill people’s need for self-satisfaction have performed the best, while fashion apparel brands have been less optimistic, reflecting Chinese consumers’ decline in fashion needs.