KTV was introduced to China in the 1980s and was once an important place for young people to gather and enjoy their time. However, in the evolving landscape of the entertainment industry in China, the traditional dominance of KTV is now being challenged by a wider array of leisure options.

Is it time for people to say goodbye to traditional KTV in China?

KTV with Chinese characteristics

Invented in 1971 by a Japanese musician, Daisuke Inoue, KTV was initially an entertainment for business occasions. By playing the recorded soundtracks on a TV-sized machine, business servers, and clients can sing along to the tune and relax before getting down to their projects.

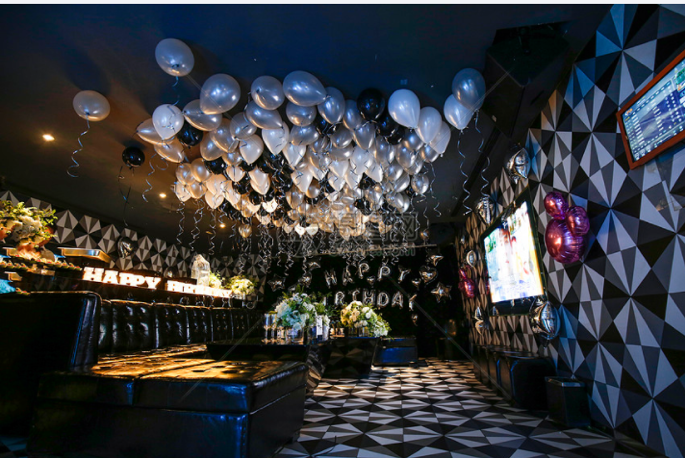

KTV was first introduced to China in the 1980s and instantly became popular, especially among young people. Unlike Western-style karaoke, which often involves singing with a mic in front of a large group, KTV in China consists of booking a personal room for a group of friends, colleagues, or business partners. In China, KTV rooms are decorated to be fancy, glitzy, and over-the-top. There’s a big TV screen in the room playing the music video and lyrics, together with a small screen for song picking, temperature control, and light effect adjusting. KTV places also provide food and beverages, from mini-stores inside to online menus.

Depending on the room size and time slot, the prices can vary (weekend evenings are more expensive than other times). An average KTV party usually costs a few hundred RMB but split between the number of people who go, it’s fairly affordable.

How is China’s KTV industry making money?

The revenue streams in China’s KTV industry predominantly come from private rooms and sales of alcohol, catering, and other services. While song sales serve as the foundational offering, the sale of drinks and snacks within the KTV rooms has emerged as a significant source of profit. Consumers frequently purchase beverages, snacks, and other refreshments, contributing notably to the industry’s overall income.

Pricing within the industry varies based on the time of day and the size of the rooms, with peak periods commanding higher rates. Interestingly, the income from ancillary services such as drinks and catering exceeds the income from room fees. Currently, these services account for 60.4% of total revenue, a figure that is expected to grow further.

This trend points to a shift in consumer behavior, where guests are seeking a complete experience rather than just access to the singing rooms. As a result, KTV establishments have a prime opportunity to innovate their offerings and tailor them to evolving consumer preferences. This could include expanding menu options, introducing themed or immersive experiences, and leveraging partnerships with beverage and food suppliers to enhance the guest experience and drive further revenue growth.

The demise of China’s KTV industry

During the pandemic, many KTV stores shuttered due to overwhelming difficulties. Especially in 2020, the market size of China’s KTV industry plummeted 53.1% year-on-year. Despite this, with the changes in consumer entertainment methods and the implementation of epidemic prevention policies, the KTV industry has not completely disappeared. In the past two years, with the effective suppression and control of the epidemic, the market size has increased, reaching 61.37 billion yuan in 2022, a year-on-year increase of 10%.

Why is the KTV industry in China declining?

1. Banning songs with “illegal” content

According to the Ministry of Culture and Tourism in China, since Oct 1st, 2021, China has established a blacklist of karaoke songs that has banned those containing “illegal content” from karaoke venues across the country. The ministry said banned contents would include those that endanger national unity, sovereignty, or territorial integrity and violate state religious policies. Although it happened previously that songs were being removed from the karaoke music library, this time the scope was much larger and had a heavier impact due to the issue of official documents. For example, songs by famous Chinese singers like Eason Chan (陈奕迅), A-Mei (张惠妹), and Jolin Tsai (蔡依林) were removed for containing only a few lyrics of “illegal” content.

Many old songs have been taken off the shelves, and the copyrights of new songs are in the hands of music software. KTV venues need to pay high fees to buy copyrights, which leads to the fact that people going to KTVs sometimes have almost no songs to sing.

2. KTV is not cost-effective

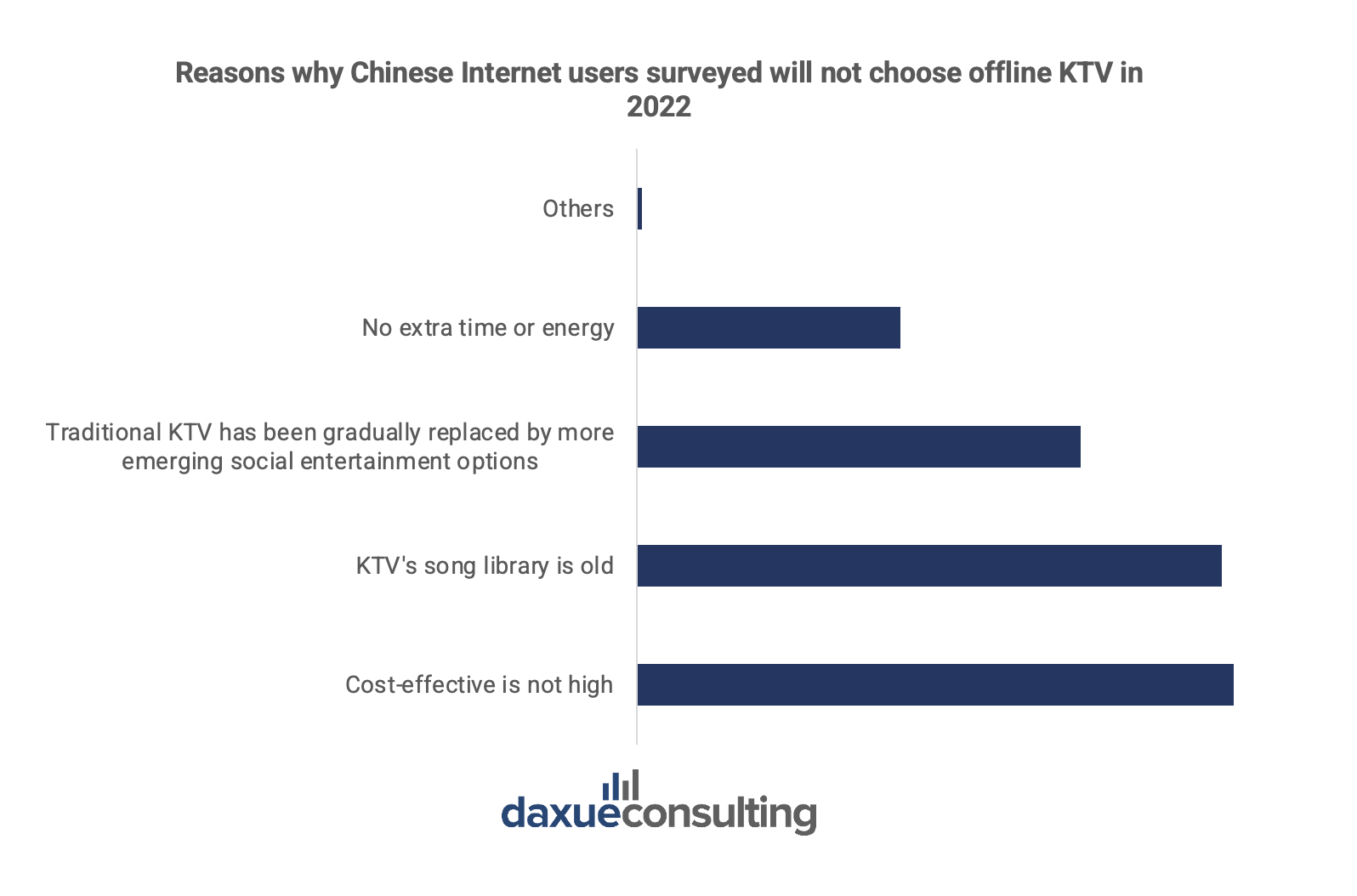

According to data from iiMedia Research, in 2022, among Chinese internet users surveyed, 57.1% of consumers cited expensive prices, average services, and overall low cost-effectiveness as reasons for not choosing offline KTVs.

Source: iiMedia Research, designed by Daxue Consulting, Reasons why Chinese Internet users surveyed would not choose offline KTV

In KTVs, beverages often sell at double the price. For instance, a bottle of Budweiser beer, priced at less than RMB 8 on the JD.com e-commerce platform, sells for RMB 18 per bottle at “Pure K” KTV; a bottle of Camino Real, priced at RMB 89 on the JD.com platform, sells for RMB 388 per bottle at “Pure K” KTV. As a result, individuals are increasingly seeking alternative entertainment options, driven by the desire for more cost-effective and enjoyable leisure experiences.

3. Changing landscape of the entertainment industry in China

Another factor that delivers a fatal blow to the KTV industry in China is the emergence of other forms of entertainment over recent years. The most representative examples are “Script Kill (剧本杀)” and “Quanmin Karaoke (全民k歌)”:

Script Kill

As one of the most popular offline activities with more than 30,000 venues in China, Script Kill is a live-action role-playing game that follows loose scripts of murder mysteries or other fictional settings. The game involves a small group of people and a pre-written script, usually about a murder case. Participants play their respective roles in a story and communicate with each other in the hunt for clues to solve cases. According to Lily Chen, an active user of Script Kill in China, karaoke occasions are highly stressful and awkward for people who cannot sing well, whereas Script Kill doesn’t require any special skills – just a quick brain and some social skills.

Quanmin Karaoke

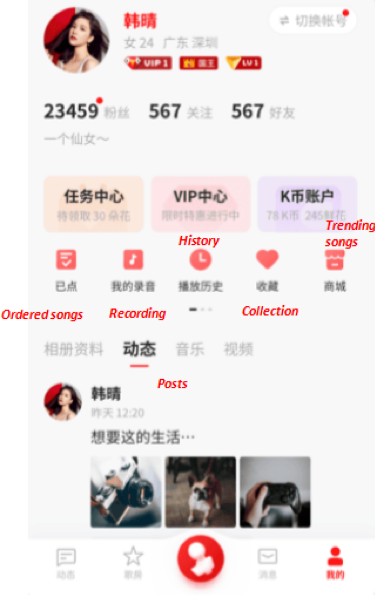

Quanmin Karaoke is a leading karaoke app that has attracted more than 300 million downloads and created an industry value of 7.3 billion RMB in China. According to Cui Yihua, an active user of Quanmin Karaoke, using this app is very convenient since it is free, and versatile, and you can get a music-studio-generated voice effect for an affordable price.

The changing consumer demographics of KTV

KTV was initially strategized as entertainment for younger generations in China. However, the overall decline of the KTV industry and young people adopting alternative entertainment has led the elderly to step in and fill the void. According to Meituan, an online service platform in China, during the first half of 2021, KTV clients aged 60 to 70 rose by nearly 30% compared to the same period in 2019, while those aged between 70 and 80 have doubled. Hence, singing is becoming a source of entertainment in the silver economy.

On the path of decline or looming for another rise?

Under the endless waves of emerging business formats, each industry has a limited lifespan in China. The descending market outlook of the KTV industry in China caused many to wonder whether KTV will disappear soon, the answer, however, is no.

According to the manager of Mei KTV, the Wuxi branch, “social space” is a foothold of the KTV industry in China. KTV, as a social platform, has irreplaceable functions. Indeed, KTV is a common meeting place for business people since singing in a loud environment can help both sides lower their mental guard. Besides, KTV companies are looking for a possible fightback by adopting new business strategies. For example, several KTV venues started incorporating other forms of entertainment into their services, such as Script Kill and board games. The price is cheaper compared to other entertainment values so that customers will not be drawn away. Additionally, KTV parlors are also adding other songs to their music collection as a means to cater to the increasing demand of older generations.

Competition within the industry is also becoming increasingly fierce, most KTV tend to be stationed in large cities shopping centers, but the channel and talent competition has intensified, and the survival space of small brands is gradually shrinking. Although the investment cost of KTV industry is getting lighter and lighter, the industry as a whole is facing huge challenges.

While the future of KTVs may not disappear completely, the increasing challenge of maintaining profitability demands the exploration of potential solutions and innovative initiatives. This could involve exploring the concept of a ‘modern KTV’ model, investigating if such a model exists or could be developed, and considering alternative approaches that some companies may have already attempted.

Key takeaways about China’s KTV market

- The traditional KTV model, once a staple for social gatherings among Chinese youth, is now facing a decline in popularity with the evolving landscape of the entertainment industry in China.

- The revenue model of China’s KTV industry heavily relies on private room rentals and beverage sales. However, factors such as expensive prices and average service quality have contributed to a decline in cost-effectiveness, affecting the overall profitability of KTV establishments.

- The banning of songs with “illegal” content by the Chinese government has further impacted the KTV industry. Restrictions on song selection have led to a reduced music library, diminishing the overall appeal of KTV outings.

- KTVs face increasing competition from alternative entertainment forms such as escape rooms, scripted kills, and online karaoke apps. This, coupled with aggressive pricing strategies to attract customers, has created challenges for KTVs in maintaining their market share.

Contact Daxue Consulting for valuable consumer insights

China’s vibrant KTV market is experiencing shifts driven by changing consumer tastes, technological advancements, and evolving entertainment habits. Daxue Consulting provides in-depth consumer insights into the KTV market, helping businesses understand these trends and their implications for growth opportunities. Whether you are exploring the potential of traditional KTV venues or digital karaoke platforms, our market research can guide your strategic decision-making and product innovation. Reach out to us to discover how our expertise can help you navigate the complexities of China’s dynamic KTV market and position your business.