Over the last decades, China has become one of the world’s major economic powers in the technology sector. When it comes to apps, the country’s market is undisputedly ranking first in the globe for size and revenues.

However, China’s mobile app market has developed differently than in the West and foreign companies might find it challenging to adapt to the local market features.

China has the largest mobile app market in the world

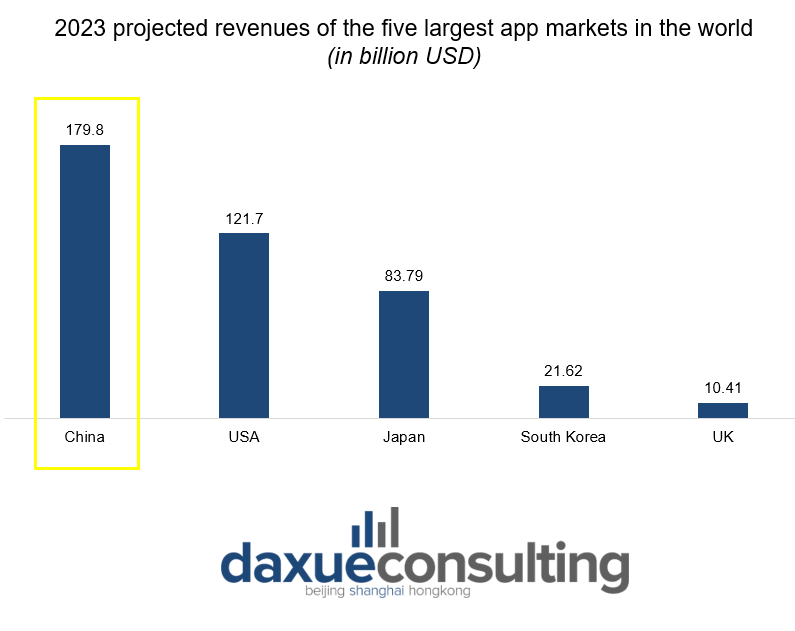

The Chinese app market is the most profitable one in the world. It is estimated that it will produce USD 179.8 billion in 2023, largely surpassing the other major economic superpower, the US, by more than USD 50 billion. It is forecasted that this sector will maintain a Compound Annual Growth Rate (CAGR) of 6.98% for the five-year period from 2022 to 2027.

In the mobile app sector, China is expected to grow with a CAGR of 5.1% in the next ten years, reaching a market value of USD 21.3 billion in 2033. This outstanding growth can be attributed to the expected surge in production of high technologies in the field of Artificial Intelligence (AI), Augmented Reality (AR), and Virtual Reality (VR).

Short-form videos and instant messaging rule China’s mobile app market

In 2022, China had 1.04 billion smartphone users, accounting for 15% of the world’s users, and this number is expected to reach 1.18 billion by 2026.

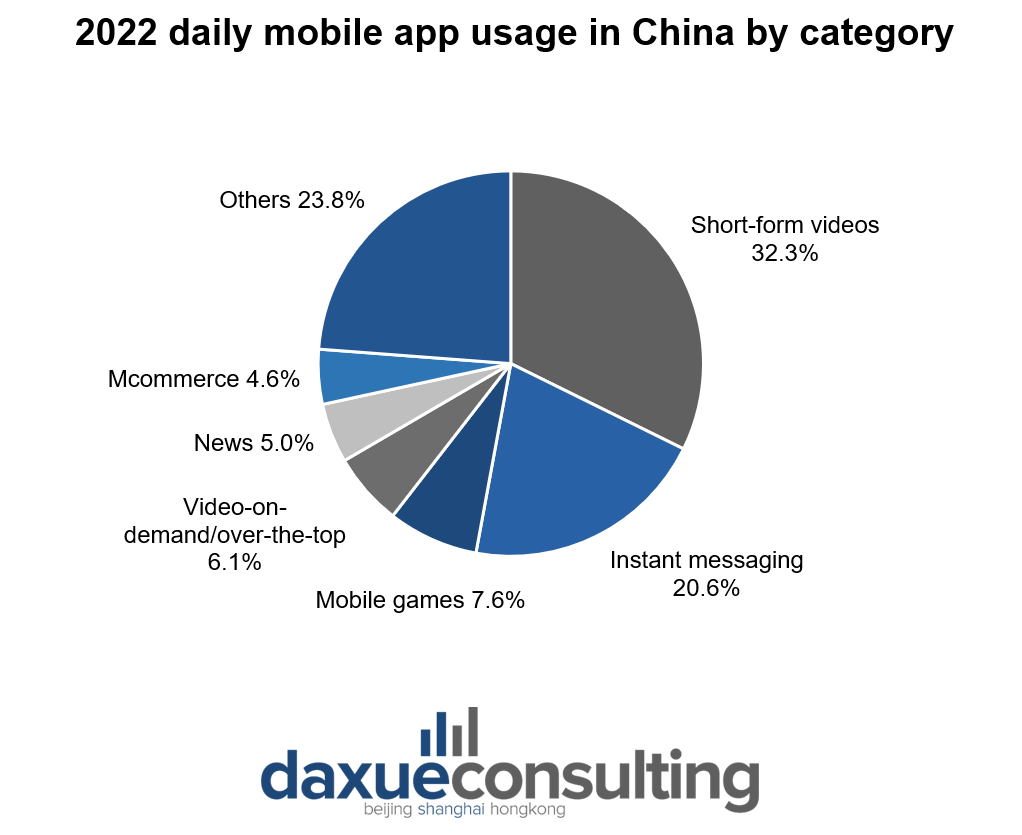

According to a research by MoonFox, in 2022 Chinese netizens had an average of 73 apps installed in their phones and their app usage time per capita amounted to around 5.4 hours a day. Among the most popular app categories that Chinese netizens use on a daily basis are short-form video and instant messaging platforms.

Android and iOS are the main mobile operating systems in China

Just like in the rest of the world, the mobile app market in China is dominated by mainly two operating systems, Android and iOS. As of February 2023, Android leads the market with 77.6% of the share, while iOS follows with 21.9%. However, both these systems present differences with their Western counterparts.

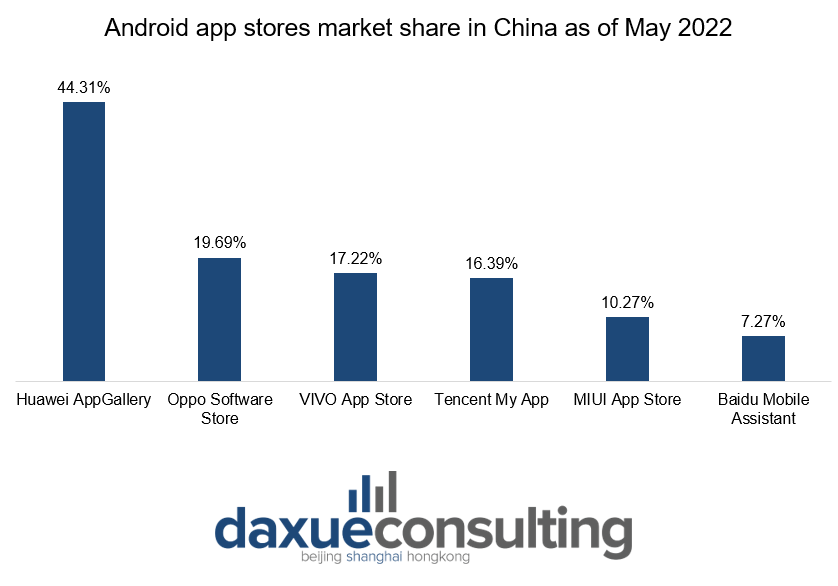

Due to the Huawei’s trade ban and local producers’ decision to forgo Google Services, Android users rely on third-party app stores to replace Google Play.

The most popular app store on Android as of May 2022 is Huawei AppGallery, with 44% of the market share, followed by OPPO Software Store (19%) and VIVO App Store (17%). However, there are also many other options, such as Xiaomi App Store (小米应用商店), Tencent App Store (应用宝), Baidu Mobile Assistant (百度手机助手), and Samsung App Store.

When it comes to iOS devices, instead, Apple Store is still the main option. However, the Apple Store in China is different from the Western counterpart, as its regulations have to comply with the strict Chinese laws on cyber security.

China’s big three: Baidu, Alibaba, Tencent

China has always preferred to support local companies over well-affirmed international multinationals, particularly in certain sectors of the market. This trend is evident in the mobile app market in China, as it gave the three giants Baidu, Alibaba and Tencent (BAT) the chance to become the driving force of China’s online markets.

Baidu

Baidu is a Chinese multinational company offering digital technology, internet, and AI services. As an app publisher, it released a total of 420 apps, 210 for Android and 210 for the iOS operating system, which generated an overall revenue of USD 13 million in February alone.

Alibaba

Alibaba is a Chinese multinational operating across various sectors of the market, including e-commerce, online services, retail, and app publishing. It published 528 apps, 316 for iOS systems and 212 for Android. Among these, the most downloaded product in February 2023 was the mobile app version of the online-shopping platform Alibaba.com, while the most profitable product in terms of revenue was the game Romance of the Three Kingdoms (三国志·战略版). In the same month, Alibaba mobile app revenue amounted to USD 64 million.

Tencent

Tencent is one of the major Chinese multinational app publishers. As of February 2023, it had a portfolio of 1,139 apps, 834 of them being for the iOS system and the remaining 305 for Android. In the month of February alone, its total revenue amounted to USD 509 million, with USD 478 million generated from iOS apps and USD 32 million from Android apps. Its most popular apps include the mobile games Honour of Kings (王者荣耀) and Game of Peace (和平精英), the social network Qzone (QQ空间) and the instant messaging apps WeChat and QQ.

The most popular apps in China’s mobile app market

According to QiMai (七麦), the most downloaded apps in China as of March 14th are:

- The short-video platform Douyin (抖音), ranking second.

- The mobile game apps Honour of Kings, Game of Peace, and Romance of the Three Kingdoms ranking first, third and sixth respectively.

- The on-demand video platforms iQIYI and Tencent Video (腾讯视频) in fourth and fifth place.

- The music streaming app QQMusic (QQ音乐) in seventh position.

The challenges of uploading apps to the Chinese Market

Uploading an app on the Chinese market is not as easy as in the West. This is mainly due to the lack of a centralised app store such as Google Play on the Android operating system, which makes the publishing process remarkably longer and more complex.

However, the restrictions to Google Services are not the only factor that differentiate the Western and China’s mobile app market.

The Chinese government’s role: The Great Firewall

The Chinese government keeps a tight grip on China’s access to internet. Commonly known as the ‘Great Firewall’, the web censorship system is endowed with measures that can cut off cross-border information flow and shut down the functions of applications located outside the country. To access China’s market, all foreign providers must register to Gateway operators and respect the government rules regarding cyber security. The Ministry of Industry and Information Technology (MIIT) is responsible for supervising and ensuring compliance with rules and policies in the mobile app market.

In accordance with the 2016 Cyber Security Law, all internet data flow must remain within the country and private enterprises are required to share their data with local authorities.

Important steps to consider before launching an app in China

Foreign companies are not yet allowed to publish apps independently on Android systems in China. To enter the Chinese mobile app market, it is necessary to be officially registered as a Chinese company or as a Wholly Foreign-Owned Enterprise (WFOE). Furthermore, the app’s data should not depend on any cloud services, APIs, or SDKs to be accessible behind the Great Firewall. Another option would be to entrust the app to an authorised local distributor.

The following section will try to give an overview of what to consider before launching an app in China.

Create an app version that is appropriate for the Chinese market

Changing the app’s name to Chinese characters is not enough. The interface, icon, language, and functionalities should be formatted to meet Chinese standards. As much as it might sound logical to do, this is – in practice – complex to attain, as it requires knowledge of local culture and consumers’ tastes.

Prepare the documents

Launching an app in China is a long bureaucratic process that requires several documents. Some of these are:

- proof of registration as a Chinese company or affiliation with a local distributor;

- user’s manual that explains in details how the app works;

- Security Assessment Form;

- if the company intends to launch a game app, a Game License from the National Administration of Press and Publication (NAPP) is also needed.

Consider investing in a Software Copyright Certificate (SCC)

SCCs are not required to enjoy legal copyright protection, but all the major app stores in China demand it, as it is very helpful to enforce IP ownership. The company’s documents need to be translated in Chinese and notarised by China’s Ministry of Foreign Affairs and your home country’s Chinese embassy. For foreign companies, the process to get SCCs is long and the chances of being rejected are high. It is advisable to work with a Chinese partner that better knows this environment to increase the chances of getting the SCC approved.

Choose the right app store

It might be natural to think that, to reach the widest audience possible, publishing on Android app stores is the quickest option. However, due to the great variety of app stores available, it might be hard for an app publisher to reach the entirety of the Android users, if not impossible. Moreover, each app store’s regulations are different from one another and the range of fees they demand on the app’s revenues can vary greatly. Certain app stores require even a 50% cut of the app revenues. Launching on Apple Store may result to be easier for foreign companies.

Ongoing trends and opportunities in the mobile app market in China

- The Chinese mobile app market is the largest in the world and is expected to grow at a CAGR of 5.1% for the next ten years.

- Chinese netizens installed an average of 73 apps on their smartphones, on which they spend around 5.4 hours a day.

- Android and iOS are the main mobile operating systems, with Android leading the market with 77.6% of the share. Due to the ban on Google Services, the Android system needs other app stores to substitute Google Play. Huawei AppGallery is the most popular app store in the country.

- The mobile app market in China is dominated by three digital technology giants, Baidu, Alibaba, and Tencent.

- The most popular apps in China include short-form video and instant messaging platforms, as well as mobile games.

- Launching an app in China is more complicated than in the West. The government plays an important role in the market and keeps a tight control over internet access.

- To enter the Chinese mobile app market, foreign companies must be officially registered as Chinese companies or as WFOEs, or entrust the app to an authorized local distributor.

- Before the launch, the company should format the app to meet Chinese standards, prepare the necessary documents, and carefully choose an app store to maximize reach.

Author: Chiara M. Barbera