Nowadays, the world of technological devices is extremely wide, and competition is ruthless. Few brands such as Apple and Samsung lead the global market, however, a new generation of Chinese brands is rising. Oppo is the main example of a brand which had a relatively fast growth over the past few years, conquering the market with its well-priced cell phones and much more.

Oppo’s global success: from Dongguan to the world

Oppo is a telecommunication company registered in China in 2001, officially founded in 2004, and based in Dongguan (Guangdong province). The brand is a subsidiary of the BBK electronics corporation, one of the biggest manufacturers of technological products in China. Such conglomerate was founded in 1995 by the entrepreneur Duan Yongping and owns other famous smartphone companies such as One plus and Vivo.

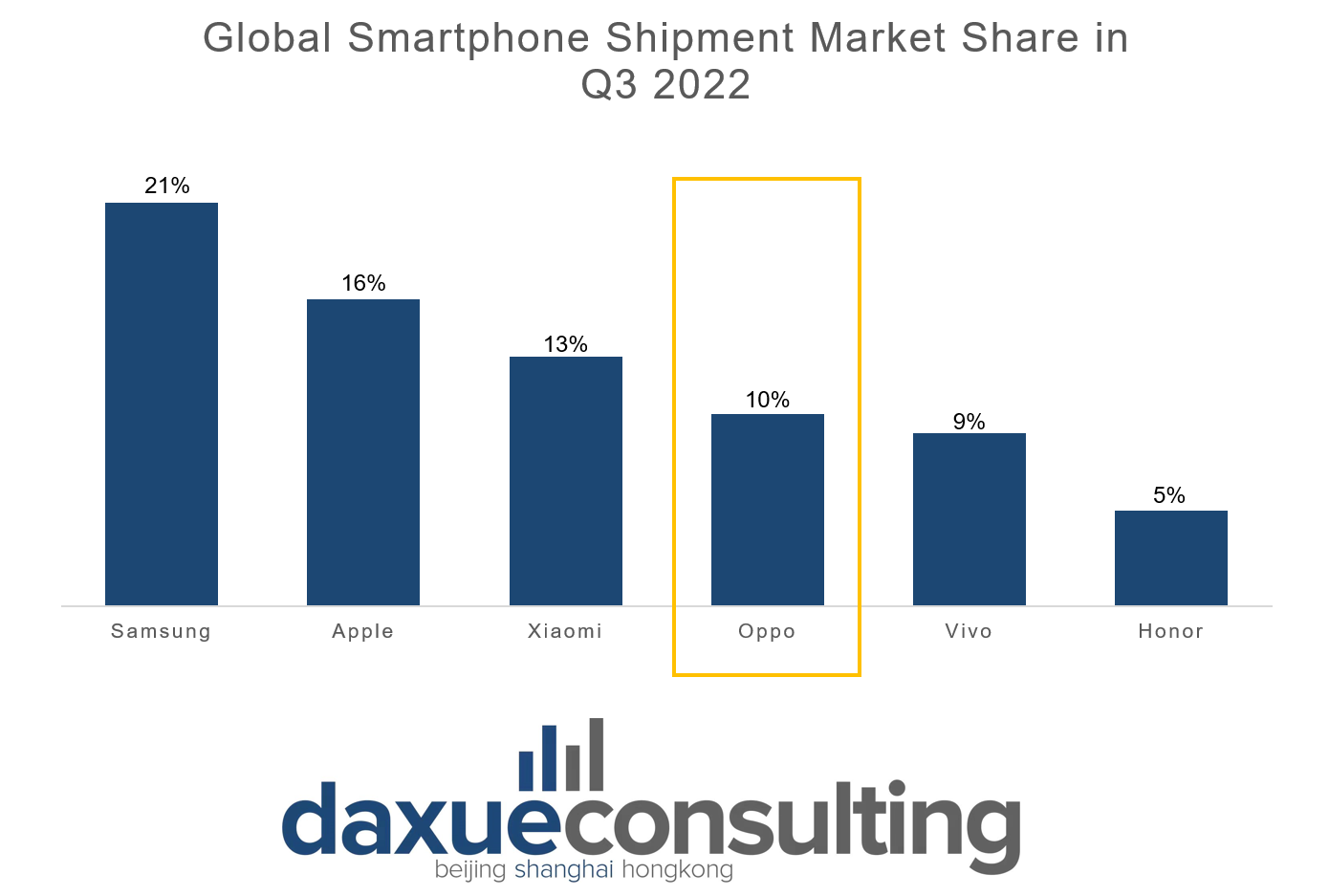

During the past years, Oppo has shown to the Chinese market that it has no reason to envy biggest phone manufacturers. Indeed, the brand detained an 18% of market share in Q2 2022, immediately behind Vivo and Honor. However, the worldwide situation is slightly different, with the Tech giants Apple and Samsung that are still dominating the market. In Q3 2022, Oppo ranked 4th among the largest global smartphones shippers, accounting for a 10% of market share.

Much More Than Smartphones: Oppo bets on Fitness and Augmented Reality

Although Oppo mainly sells smartphones, with 25.8 million units shipped worldwide in Q3 2022, there are also other products to which Oppo marketing strategy is trying to draw the consumer’s attention. First of all, smartwatches, which account for a huge part of the entire electronics market in China and in 2021 there were 39.6 million units across the country. Oppo is successfully following this trend, trying to gain popularity through IoT-related products such as smartwatches and smart headphones. In 2020, Oppo launched its first fitness tracker “Oppo band” also commercialized in the UK, which recorded a 467% growth in Q4 2020.

Another sector in which the company is specializing is the “augmented reality”. During “Oppo inno day 2022”, the brand presented the “air glasses 2”. These glasses do not use a computer-created 3D world, such as the “virtual reality”, but incorporate digital elements into the physical world. They provide real-time translation, instant speech-to-text converter, and data collection, thereby enhancing customer’s shopping experience.

India and Southeast Asia Are the largest Consumers of Oppo Products

Up to day, Oppo operates in more than 60 countries. The Chinese phone brand has exercised a large control especially over India, detaining 71% of the whole Indian telephone market in 2021. Oppo was the 5th biggest brand by shipment volume, taking over 10% of market on the same year.

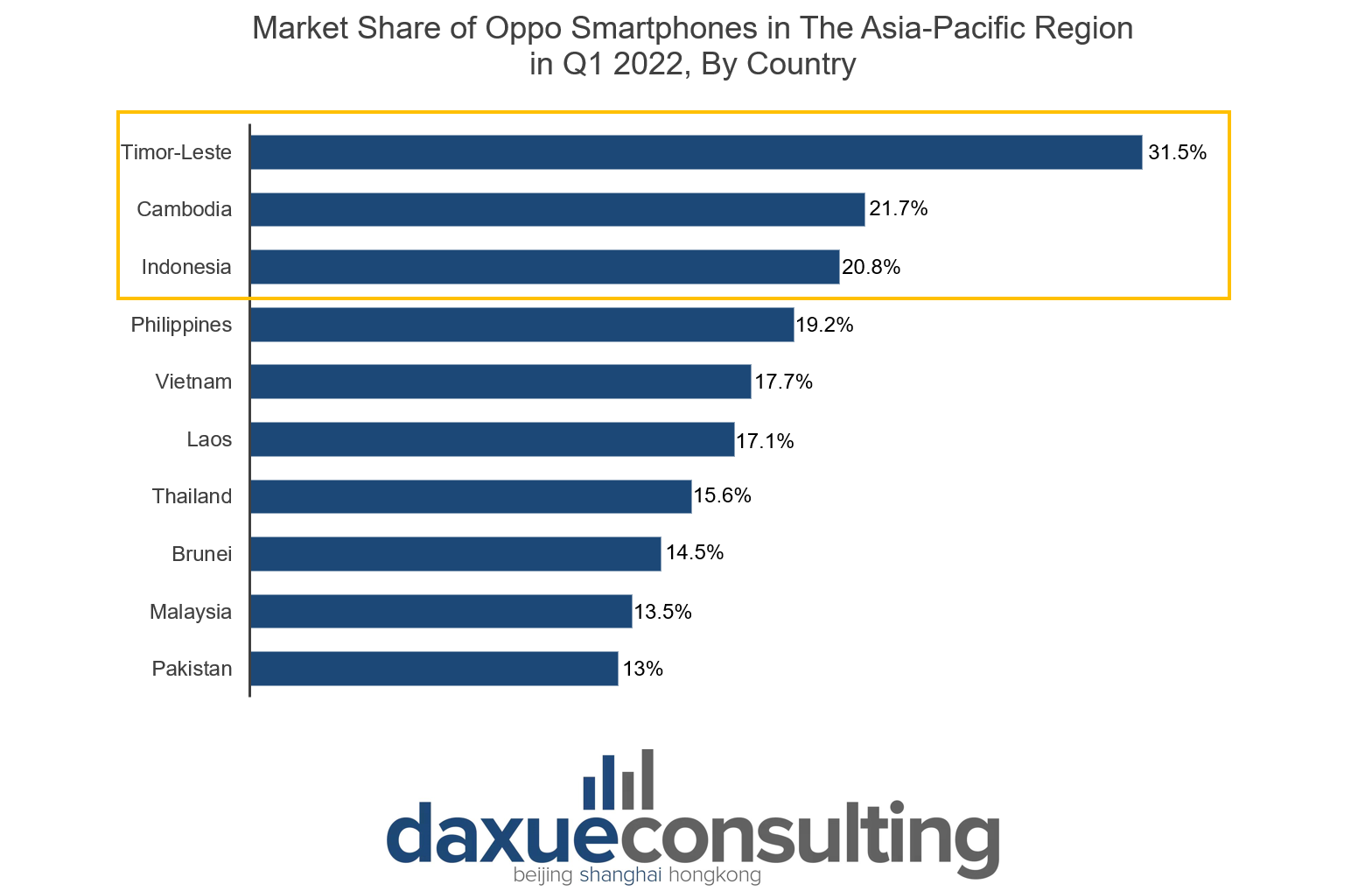

Despite having a big impact on the Indian market, southeast Asia is the area in which Oppo has the most significative influence. Indeed, Timor-Leste is where the brand detains the highest market share, estimated in 31.5% of the market. In 2nd and 3rd place there are Cambodia and Indonesia with approximately 20% of market share in both countries.

Oppo’s influence on the phone market also reached the western part of the world, especially in the UK, where its brand awareness is rising. In April 2022, Strategy Analytics conducted a survey in which 1,000 people aged from 18 to 34 years old shared their opinion about the new wave of Chinese telephones in the English market. Although the interviewed agreed that Apple and Samsung are the undisputed leaders of the sector, half of them believed that Oppo is rapidly gaining popularity. Oppo’s products are also expanding in Europe, in which the percentage of units shipped by the company jumped from 3% in 2019 to 7% in 2021, almost doubling its market share.

Oppo Marketing Strategy and Its Worldwide Collaborations

The main strategy Oppo utilized to stimulate consumers’ curiosity was the “Oppo inno day”, which was firstly held in 2019. It is an annual event organized by the brand to launch its most innovative products, such as the “air glasses 2” presented in 2022, and talk about the objectives accomplished on the previous year. In addition to this event, Oppo also launched the “Oppo Research Institute Innovation Accelerator” which represents an occasion for smaller companies and startups to be recognized and supported. In 2022, there were 536 participants from over than 39 countries who presented their ideas, the top 10 teams received a prize of 46,000 USD along with technology support and global promotions. Oppo created this institute to gather the best ideas concerning technology to improve digitalization in people’s life.

Young people are also another category of consumers which Oppo marketing strategy is trying to reach. In 2021, the brand exploited the trend of manga and anime lovers among the younger generations launching the Oppo Reno 6+ in collaboration with the Japanese anime “Detective Conan”. The limited edition was launched on Valentine’s day and gained 600 million views on Weibo, collecting positive comments by the young anime fans community.

However, the brand is not new to this sort of collaborations, as the Evangelion-themed phone launched in 2020 to commemorate the 25th anniversary of the anime, and the “OPPO reno ace Gundam edition” on the previous year.

The great potential of cross-brand Collaborations

Oppo marketing strategy also includes cobranding initiatives. During the years indeed, the brand announced several collaborations along with other tech giants, such as Huawei. In December 2022, it was announced a license patent agreement between the two Big Techs. The deal mainly concerned the research and development of 5G, Oppo paid Huawei to license its 5G technology, while Huawei obtained the Oppo patent license for technical research in wireless technology.

The Oppo strategy doesn’t end here. The brand also collaborated with some of its sister companies. In 2021, BBK group announced a multi branding marketing strategy involving both Vivo and Oppo. Such strategy was meant to promote different brands in the same category to improve costumers’ awareness in different segments of the market. The multi branding operation makes the two brands compete with one another to increase the market share of the corporation. This economic maneuver allowed the two brands to expand their consumer base and improve their individual innovation. The marketing strategy of Vivo and Oppo revealed especially effective in rural India, where they improved their market share by promoting low-priced cell phones.

Versatility and Cross-brand Collaborations Are Keys for Oppo’s Success

- Oppo is a company owned by BBK group which has been experiencing a significant increase over the past years, ranking 4th among the largest global smartphones shippers.

- Oppo does not only produces smartphones, but also has interests in fitness and augmented reality, selling products like “Oppo band” and “air glasses 2”.

- India and Southeast Asia are the largest consumers of Oppo’s products. Meanwhile, its brand awareness in Europe is increasing.

- Some of the most interesting campaigns in Oppo marketing strategy consist in launching technological products during the “Oppo inno day” and helping startups to gain popularity.

- To increase its influence on young people, since 2019 Oppo started several collaborations with famous Anime and Manga, launching specifically themed phones.

- Oppo collaborated with some of its competitors, like Huawei, with which signed a global-crossing license patent agreement. Moreover, there were also collaborations inside the BBK group, such as the multi branding marketing strategy involving Vivo and Oppo, which allowed the group to enhance their dominance in India.

Author: Lorenzo Linguerri