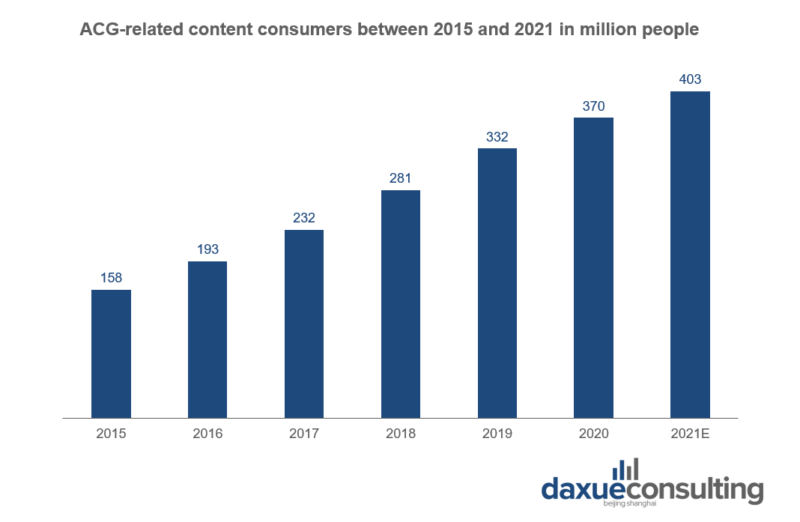

The Anime, Comics and Games (ACG) market in China attracts a great number of enthusiasts, especially among the youth. According to iiMedia, in 2019 there were about 332 million ACG fans in China, and the number is expected to exceed 400 million by the end of 2021. Cartoons and anime series represent the most successful category in China’s ACG market, thus enabling hosting websites to capture a high stream of traffic.

Growing investments promoted the development of the Chinese animation industry, leading to the emergence of a wide array of ACG-related platforms: in 2021 H1, ten of such companies were able to collect over 17.5 billion RMB in total during their funding bid. Among these, Kuaikan Manhua stands out, succeeding in raising about 240 million USD. The platform is renowned for its Made in China mangas, which is one of the fastest growing segments in China’s ACG market, partly because of the Chinese young consumers’ Guochao fever.

However, Chinese domestic animation industry is still in its the early stage of development compared to the Japanese and the US one, high-quality content is rare, and its penetration remains uneven across the different age groups.

Chinese Gen-Z goes crazy for the ACG universe

Gen-Zers are the main engine of growth for the ACG market in China, accounting for 52.4% of cartoons and anime watchers and for 40.4% of manga readers in China. According to a report jointly published by AdMaster and Mining Lamp, people born after 2000 declare consuming ACG-related content in order to cheer themselves up, stimulate their own imagination as well as to better express their personality and taste. Pixiv, Donghua Zhijia and Bilibili Manga are the platforms boasting the highest proportion of Gen-Zers among their user bases.

Cartoons and anime dominate Chinese social media

According to iiMedia survey, 53.6% and 50.4% of Chinese manga and anime lovers mentioned Bilibili and AcFun respectively as their favorite platforms. Due to the expansion of its audience, ACG content is no longer confined to vertical websites and spread on mainstream platforms. At the same time, technological advance, along with users’ higher willingness to pay, led to higher quality and more diverse works. Currently, advertising and membership plans are ACG platforms’ main sources of revenue; nevertheless, growing competition, poor user experience and users’ abandonment rate are hampering companies’ efforts to generate positive cash flow.

Tencent is attempting to dethrone Bilibili

Bilibili is one of the fastest-growing video streaming platforms in China, vaunting an impressive 68% increase in total net revenues and experiencing an astonishing 53% rise in average monthly paying users during 2021 Q1. Founded in 2009 drawing inspiration from Japan’s largest video-sharing website Niconico, Bilibili gradually expanded its business from anime’s pictures and videos to a wider array of fields, such as advertising, mobile gaming, e-commerce, live streaming, imposing itself as one of the most beloved apps by Chinese Gen-Z.

In an attempt to curb its unstoppable growth, this summer Tencent, iQiyi and Youku gathered together to join forces and counterattack. Soon after their meeting, Tencent registered the expression “Q站” (Site Q) as a trademark. Many netizens considered it as part of a counteroffensive against Bilibili, also known as “B站”. So far, Bilbili’s competitors have all lost their bid for hegemony: Dilidili, “D站”, designed as a copycat of Bilibili, was shut down after its founder was arrested for copyright infringement; while Acfun, “A站”, the pioneer of ACG in China, suffered continuous loss of users because of issues linked to its homoerotic content, internal conflicts, and site crashes.

China’s Cosplay fever

As an offshoot of the ACG universe, the world of cosplay in China is extremely popular. Although Japanese and US characters enjoy discreet fame among Chinese cosplayers, China built a conducive environment for local creations. Cosplaying is a group activity in China and enthusiasts like either reproducing scenes or creating original ones. Indeed, cosplaying in China is not just about imitating fictional characters, as local cosers enjoy adding their own creative touch and personalizing the creature they interpret: dressing up as their favorite ACG characters allows Chinese Gen-Zers to better express their own personality and imagination.

On Weibo, the topic #cos# boasts about 6.5 billion people views and 7.3 million discussions. @G44不会受伤 is a lab tech who likes cosplaying in her spare time and sharing cos-related content on social media. About 182 thousand people follow her Weibo account and one of her latest posts received over 851 likes as well as 690 reposts. Douyin teems with Cosplayers as well. @蛋黄mayo_ vaunts approximately 570 thousand fans enjoying her cosplay-themed short-videos and her posts caught nearly 6 million interactions.

ACG characters are the Trojan horse for capturing Chinese Gen-Z

Chinese young people are eager to purchase ACG-related items, indeed, taken together, people born after 90s and 95s spent on average over 1,300 RMB for such kind of goods in 2019. According to iResearch survey, ACG fans consider manga and anime characters as their favorite spokespersons since purchasing goods endorsed by their beloved heroes can deepen their bond with them, make them feel closer to the kind of person they want to be, create a sense of belonging and make them feel happy. However, the marketing power of animated characters goes beyond the circle of anime and manga connoisseurs, and brands can actually utilize ACG elements to address a wider audience. Co-branding operations involving ACG creatures are currently widespread in a wide range of industries, from F&B to cosmetics, including also NEVs and e-commerce. Even banks launched new credit cards in collaboration with manga and anime platforms.

Beyond surfing the Guochao tide and riding Chinese young consumers’ growing attachment to the past through co-branding with famous animated characters of their childhood, cooperating with manga and anime characters allows leveraging Chinese audience’ love for cute creatures. Indeed, as the great success of kidfluencers and pet KOLs has shown, cuteness is a powerful marketing tool in China and cute creatures can significantly boost sales. Last but not least, fictional characters are a safer and cheaper alternative to flesh-and-blood brand ambassadors, capable of shielding companies from risks related to celebrity endorsements in China.

How luxury brands utilize ACG characters to win the hearts of Chinese consumers

International luxury brands decided to tap into the ACG world in order to look more appealing for Chinese Millennials and Gen-Zers. Pokemon are among the most popular virtual characters collaborating with luxury brands. In 2020, French accessory house Longchamp partnered with The Pokemon Company to launch its new collection: shoppers could choose within a wide selection of leather goods, including handbags, mini backpacks, travel bags, silk scarves, and cell phone cases, all debossed with Pikachu. It is not the first time that Pokemon paraded on the catwalk: in the past, Dior, Valentino and Kenzo decided to cooperate with the famous cute creatures by Nintendo as well.

Instead, on occasion of the 2019 League of Legends World Championship Finals, Louis Vuitton collaborated with the gaming studio Riot Games to design exclusive skins for Qiyana and Senna, the main characters of the famous videogame. In addition, the French maison created a capsule collection inspired to the universe of the League of Legends, including camouflage streetwear trousers in blue and white, limited-edition Archlight sneakers, and a Monogram silver leather biker.

Takeaways: the power of the ACG world in China

- Chinese Gen-Z is crazy for the ACG universe since it piques their imagination, and allows them to express their personality and taste.

- Bilibili is Chinese ACG fans’ favorite platform, vaunting an unstoppable growth. So far, none of its competitors managed to dethrone it.

- The world of cosplay is very popular in China and Chinese social media teems with cosplayers.

- Chinese Millennials and Gen-Zers are the main consumers of ACG-related items. However, owing to the power of cuteness in China, along with the Guochao wave and Chinese young consumers’ nostalgia for an idyllic past, manga and anime characters reveal an impressive marketing tool in a wide array of industries.

- Such marketing potential did not go unnoticed and several international luxury brands established ties with ACG companies. That is the case of French brands Longchamp and Louis Vuitton which launched capsule collections collaborating with The Pokemon Company and Riot Games respectively.