Douyin is one of the most popular social media platforms in China. Owned by the Chinese tech company Bytedance, this APP allows users to upload and share videos under one minute long, but what makes it so special is its ability to tailor content recommendations on members’ interests and tastes through its sophisticate algorithm. According to data, young people between 19 and 40 years old, living in New-Tier-1, Tier-2, Tier-3 and Tier-4 cities account for about 80% of Douyin users. With this in mind, consumers belonging to such age range are those who made the largest amount of purchases online during the pandemic and that last August the platform reached more than 600 million daily active users, Douyin can be a great tool for brands eager to intercept potential customers and generate new leads.

Moreover, the APP is currently building its own e-commerce ecosystem and this year it joined 618, China’s second most important shopping festival, officially entering into competition with big online retail giants, such as TMall, Taobao and JD. Douyin started its 618 strategy by launching a pre-sales campaign on May 25th, and then provided a wide range of discounts, vouchers and live streaming promotional events for the entire festival period. The platform even created an interactive mini game to engage users and encourage them to don’t miss the offers.

Douyin is a golden goose for all kinds of brands

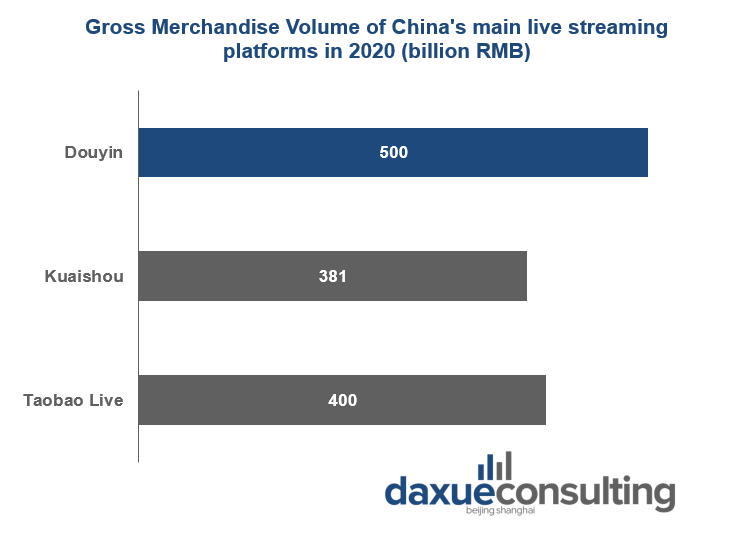

When talking about Bytedance’s short-video platform, the word “livestream” immediately springs to mind. Last year live sessions on Douyin generated more than 500 billion RMB in Gross Merchandise Volume (GMV), therefore it is not surprising that many brands actively recruit KOLs and KOCs for their Douyin marketing strategy. During their livestreams, KOLs usually introduce items that are likely to suit their audience’s tastes, give their viewers the chance to see the products in action and immediately answer their fans’ questions, thereby turning their videos into premium advertising tools.

On the verge of creating its own e-commerce ecosystem

Nevertheless, all that glitters is not gold: about 60% of the platform’s GMV in 2020 came to third parties, while sales on Douyin stores just accounted for around 20% of the total. Indeed, until last year, sellers could add links redirecting to marketplaces, such as TMall and JD, to their videos and livestreams: when KOLs’ fans wanted to buy a product, they actually went to visit another platform to purchase it. Thus, in August 2020, Douyin banned embedding external links on livestreams, in an attempt to cut ties with third-party platforms and encourage both merchants and consumers to utilize its in-house stores. Similar to WeChat, Douyin e-commerce relies on a constellation of mini-programs, which allow users to access several services without ever leaving the APP.

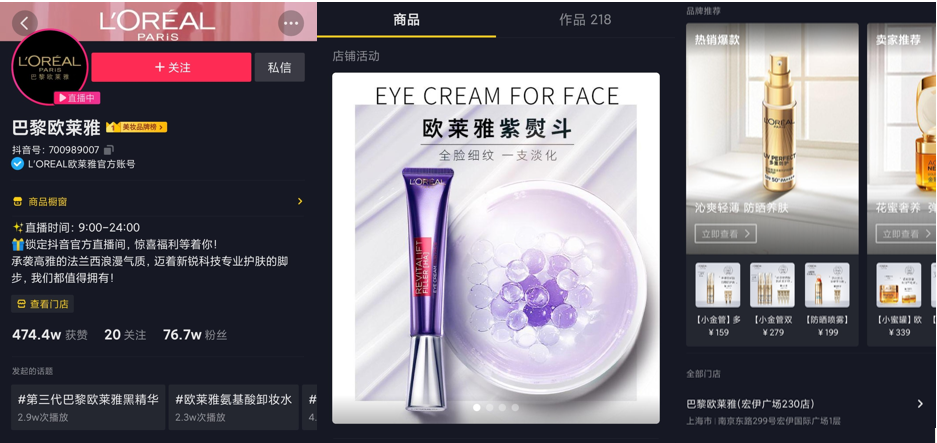

Moreover, aiming to expand its e-commerce capabilities, in March 2021, the short-video platform launched official flagship stores for brand accounts. The new feature provides brands with a large set of powerful tools, including a campaign banner, brand recommendations, vouchers, product recommendations and offline store information. Unlike standard ones, this new category of stores on Douyin is specifically designed for brands selling their own items and requires presenting trademark documents. Compared to the previous framework, flagship stores are expected to increase the ratio of product views from 17% to 80% and improve brands’ click-through rate performance. Big names, such as Huawei, Perfect Diary and L’Oréal are already using this new feature.

Douyin Pay grants independence from other large tech companies

Another significant challenge for Bytedance’s subsidiary consists in cutting expenses resulting from processing fees to other payment service providers. Indeed, WeChat Pay and Alipay currently manage about 90% of all mobile payments in China.

Thus, in an attempt to break the duopoly, in the middle of January 2021 Douyin launched its own payment tool: Douyin. Although during the first two months of 2021 the platform’s in-app payment was listed in the “Other payment methods” submenu, starting from March it moved among recommended payment methods, below Alipay but above WeChat Payment. In addition, Douyin is granting a 2 RMB deduction to all shoppers using its brand new payment solution to make their purchases. Considering that during April 2021 users spent on average 27 RMB on the short-video platform, this is therefore a considerable discount. However, competing with major payment service providers that enjoy a pervasive presence on Chinese consumers’ lives is going to be a very difficult task to achieve.

Defying the titan of China’s gaming industry: Bytedance vs Tencent

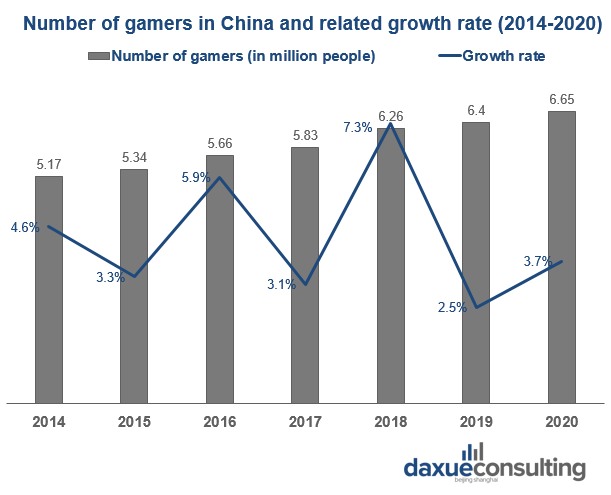

In 2020, China’s mobile gaming vaunted a market value of around 210 billion RMB: compared to 2016, the industry turnover experienced an incredible 45% rise in just four years. As the number of gamers keeps growing, more and more tech companies find such thriving market tempting and Bytedance is one of them.

In line with its desire to expand in the videogames business, in 2019 Douyin’s parent company founded Nuverse, a fully controlled game development and publishing subsidiary. Then, in order to further enhance Bytedance growth in such profitable industry, Nuverse agreed to acquire Shanghai-based gaming studio Moonton Technology on March and the one-man game creator C4games on April. These moves put the Bytedance in direct competition with Tencent, which currently holds the lion share of the market (51.53% in 2019 Q1).

Bytedance’s aspirations in the videogames business couldn’t but involve Douyin as well. After all, gaming-related advertising generate about 50% of the platform’s revenues. Thus, in February 2019 Chinese TikTok launched its first mini game. The game was called Music Jumping Ball and consisted of a ball wearing headphones that had to jump from one building to another to the rhythm of music. When WeChat launched its own mini game Jump Jump, it hit 200 million daily active users, persuading leading international brands to advertise on the game. Probably Douyin hopes for a similar outcome. However, the bid for a piece of the tempting gaming industry has just started, a lot more can still happen.

Douyin’s functionalities beyond short-videos

- Although livestreaming remains a core feature of the APP, Douyin is currently building its own e-commerce ecosystem.

- Third parties absorb most of users’ purchases, thus the platform decided to ban external links during live videos and encouraged both merchants and shoppers to use its own mini-programs.

- Starting from this March, brands accounts are able to set up official flagship stores. Such tool is expected to increase their product exposure and improve their click-through rate performance.

- Processing fees shrink Douyin’s profit margins; thereby the APP is providing incentives aimed to promote its own payment solution, Douyin Pay, at the expenses of Alipay and WeChat Pay.

- Bytedance is eager to expand in the videogames business by creating and acquiring an extensive network of gaming companies and studios. Douyin launched its first mini game hoping to retain users and further attract brands’ advertising bids. However, these moves could bring the tech company into direct conflict with Tencent.