For Huawei’s smartphone business, 2020 was particularly difficult. On the one hand, under the trade ban signed by the United States in 2019, Huawei’s smartphones sold overseas cannot be equipped with Google’s GMS (Google Mobile Service), which has seriously affected their overseas sales of smartphones. Even though the Chinese smartphone brand launched HMS (Huawei Mobile Service) in time, and it is difficult to make up for the huge loss of sales caused by the disable of GMS. Will Huawei’s market strategy pull the brand through these challenges?

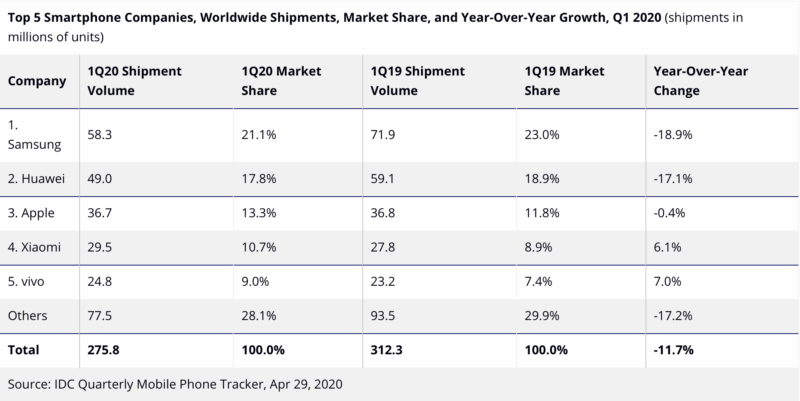

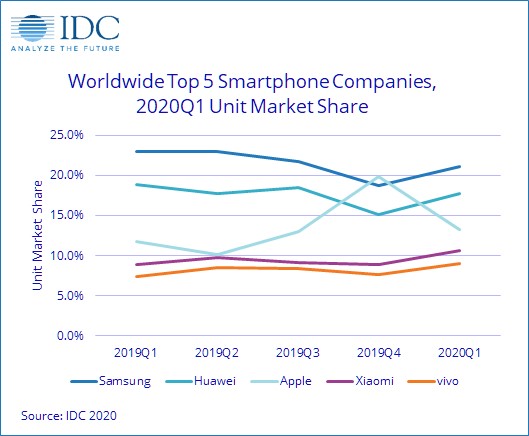

According to the research reports of 2020, worldwide smartphone shipments decreased by 11.7% (year on year) in the first quarter of 2020 due to the COVID-19 pandemic. The sales has decreased to 1.26 billion units, but the 11.7% YoY decrease is actually less than original estimations of 15.6%. Hence, the pandemic impact was lower than expected.

However, of these smartphone brands, Huawei’s sales had decreased 17.1% YoY.

Source: IDC, Smartphone sales units

Source: IDC 2020, Smartphone market share in China by brand

The COVID-19 pandemic hit Huawei’s global smartphone business

In 2019, Huawei was the world’s second-largest mobile phone supplier. However, due to the sanctions implemented by the United States, the company’s operating prospects are full of uncertainties. In 2020, the shipment of smartphones is estimated to drop to 190 million units, with a market share of 15.1%. This pushes the ranking from second to third. According to the research and judgment of Strategy Analytics, the Chinese smartphone brand may run out of semiconductor wafer inventory in 2021, and its market share may collapse, shrinking to 4.3%. Under this circumstance, other Chinese smartphone brands such as Xiaomi, OPPO and vivo will be benefit and are expected to grab more market share.

On the other hand , the US upgraded the sanctions and began to affect Huawei’s semiconductor business and supply chain. Thus, people began to worry about the supply of Huawei’s Kirin mobile phone processor wafers in the second half of the year.

Source: andriodauthority, Kirin chip

Huawei’s search app

Huawei officially launches independent search app “Petal Search (花瓣搜寻)” in HMS (Huawei Mobile Services)” after the ban from Google mobile service.

Recently, a search app launched by the Chinese smartphone brand has attracted a lot of attention. This app was actually launched as early as February in 2020. It was called “Huawai Search” (华为搜寻) at the time and it has been in beta examination before. But in May of 2020, Huawei Search has been renamed “Petal Research” (花瓣搜寻), and officially launched in the AppGallery of Huawei Mobile Services.

Considering that Huawei’s logo itself is the figure of petals, this change of name is actually not misleading. But in terms of function, Petal Search not only provides general information search services, such as weather forecasts, news, videos, images, music, financial information, but also some new features such as the ability to directly download and obtain recommended applications program.

Petal Search is more like the combination of previous Huawei Search and AppSearch. Of course, the most important reason why Petal Search has received a lot of media attention is that it is a mobile search engine for overseas users, and its main competitor is Google. It means that through the application ecology construction of Huawei Mobile Services and AppGallery, the gap between Huawei and GMS are gradually getting bigger, and it formed a competitive relationship between the two as well. Of course, this may not be what the smartphone brand expected, but under the pressure of the United States, this is one of the limited choices.

Source: xda, Petal Search, Huawei’s search engine in the foreign market

Huawei contends against iOS and GMS (Google Mobile Services) with HMS (Huawei Mobile Services)

In fact, apart from Petal Search, Huawei Mobile Services replaces GMS in many aspects. For example, “Here WeGo” was previously listed in the AppGallery app store. It can support navigation and positioning in more than 1,300 cities of 100+ countries. This is considered to be Huawei’s replacement of Google Maps.

Source: HuaweiCentral, Here WeGo

In addition, combined with maps, GPS, gravity sensors, electronic compasses, photographic lenses, the Chinese smartphone brand has launched the “Huawei Cyberverse (华为河图)”, which achieves 4 billion 3D information points per square kilometer, 1:1 restoration of the real world, and AI 3D object recognition and light and shadow tracking capabilities. These can be regarded as Huawei AR maps. On May 22, Huawei’s “Fellow Cyberverse” chief engineer and “Camera” chief engineer announced that the Huawei Cyberverse trademark has been successfully registered.

Source: ifanr, Huawei Cyberverse

It is worth mentioning that at the Huawei Consumer Business Summit which was held in August 2020, Huawei announced that latest developments in the Huawei Mobile Services ecosystem, including:

- Huawei Terminal Cloud Service (HMS) now has 650 million monthly active users worldwide, an increase of 25% from last year

- The global total number of registered developers has exceeded 1.4 million (increased to 1.5 million in May this year), an increase of 115% from last year.

- The number of applications connected to Huawei Mobile Services Core exceeds 60,000 an increase of 66.7% from last year.

In the next few years, in the global mobile application ecosystem, we will see if Huawei’s own mobile services can successfully take a big share of the market against iOS and GMS.

Source: HuaweiCentral, Huawei Mobile Service (HMS)

The influence on the next generation of Huawei Kirin SoC (System on a Chip)

For Huawei’s mobile phone business, except the ban of GMS, there is another concern that Huawei’s next Kirin SoC will be affected. On May 15th, 2020, the U.S. Department of Commerce announced that it would restrict Huawei from using American technology software to design and produce semiconductors. Huawei Kirin, which was manufactured by TSMC SoC processors may also be affected. To be precise, it is the supply issue of the next Huawei flagship SoC processor Kirin 1020.

However, although people generally believe that TSMC will also be subject to the US ban, there is still some reports say the Kirin 1020 processor can still be mass-produced within the specified time, and this processor will be used in the upcoming Huawei Mate 40 series.

The new U.S. regulations will affect future orders, but not the orders that are already placed. In addition, TSMC also stated that it currently has no plans to lower its annual capital expenditures-this proves from the side that at present TSMC does not consider Huawei’s supply issue as a variable in its annual budget.

“This matter is not so pessimistic; in fact, TSMC is not completely banned. It can internally review and apply for a license from the US. Huawei itself has made a lot of efforts. For example, it is actively stocking, and there is at least half a year of inventory on core components”.

Fang Jing, Chief analyst of electronics industry of Cinda Securities

Huawei is surviving in a really rough year

For Huawei, the biggest theme in 2020 is “to survive”, and the smartphone business is no exception. At present, although Huawei is vigorously promoting the development of HMS, it still needs more time to grow. Of course, Huawei Mobile Services and AppGallery are not breaking away from the Android ecosystem, but just starting a new life outside of Google, and the application ecological problems faced by Huawei mobile phones overseas are not completely unsolvable.

As for the chip issue, although there is great uncertainty, this Chinese smartphone brand still has many cards to play. From the perspective of Huawei’s overall development, although the smartphone business is not the absolute core, it has also lost a lot of blood for Huawei’s operator business and core technology research and development. It also constitutes Huawei’s future development support from the terminal level.

Author: Shannon Yeh

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast