China’s high-tech industry has been witnessing tremendous growth over the past few decades, shifting from its traditional focus as a manufacturing and assembly hub to the role of a leader in the global innovation tech scene. Many factors including favorable government policies, strategic private investments, and the rise of prominent tech giants have caused this evolution. However as China’s tech industry continues to progress toward the frontier of current high-tech research in the global market, it will need to tackle new rising challenges that could pose a long-term threat to its gained competitive edge in the global high-tech landscape.

Beyond the horizon: defining China’s rising high-tech industry

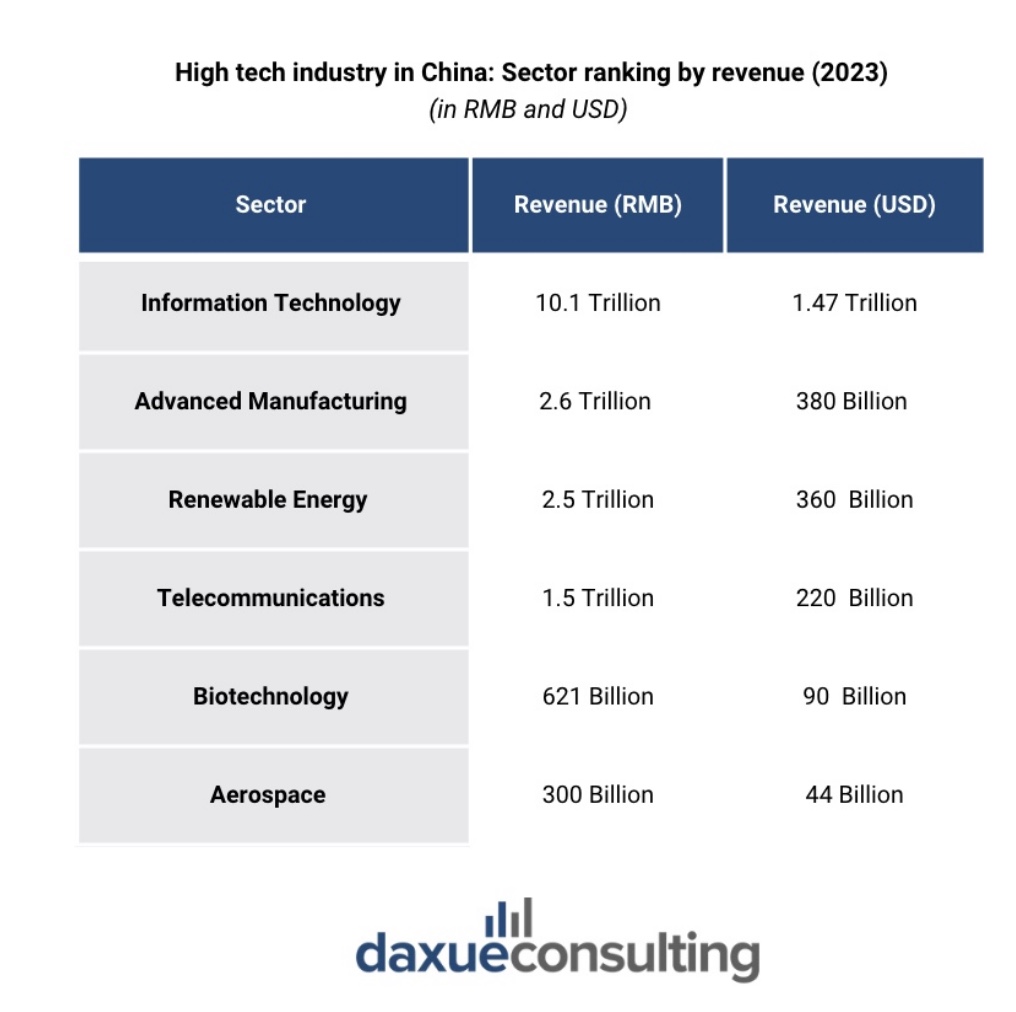

The high-tech industry in China encompasses a wide range of sectors. Some key technological advancement areas include the information technology (IT) sector, which covers software development, hardware manufacturing, and associated IT services. Additionally, telecommunications and biotechnology are both sectors that play a crucial role. Finally aerospace is emerging as a promising niche.

China’s high-tech industry also focuses on advanced manufacturing processes which are becoming increasingly critical to modernizing traditional industrial systems towards a new Industry 4.0 strategy. These processes englobe sectors such as automation and robotics, precision engineering (including nanotechnology), and the development of innovative composite materials.

Data Source: The Diplomat, Global Times and McKinsey, Designed by Daxue Consulting, High tech industry in China: Sector ranking by revenue (2023)

China’s high-tech current landscape: a market snapshot

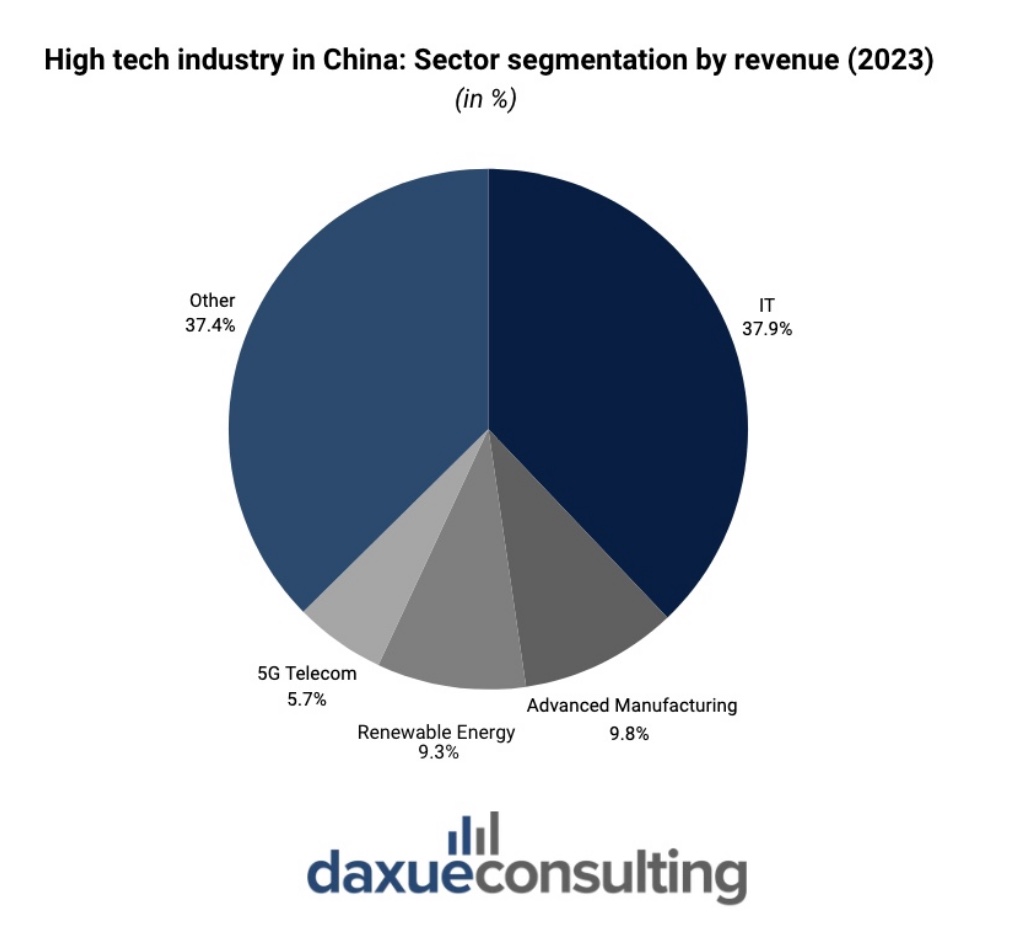

As of 2023, China’s high-tech industry is valued at over RMB 26.6 trillion (USD 3.88 trillion). There has been significant progress within the big data industry. This can be especially witnessed through its average annual rate growth of 10%, expected to last until 2025. This trend will allow China’s high-tech industry to reach approximately RMB 35 trillion (USD 5.11 trillion). In addition, some more positive market analysts expect the sector to reach over RMB 50 trillion (USD 7.30 trillion) of generated value by 2030.

The sector’s overall expansion has benefited from the rapid growth across a diversified range of sectors. The IT sector is the biggest undisputed contributor to the total industry’s value, leading with a revenue of RMB 10.1 trillion (USD 1.47 trillion). On the other advanced manufacturing and renewable energy have been contributing RMB 2.6 trillion (USD 380 billion) and RMB 2.5 trillion (USD 360 billion), respectively, and are quickly gaining traction.

Data Source: The Diplomat, Global Times and McKinsey, Designed by Daxue Consulting, High tech industry in China: Sector segmentation by revenue (2023)

Tracking China’s technological evolution journey over time

There has been remarkable growth within the high-tech industry in China since its inception in the early 80’s. During China’s high-tech early development phases in the 1980s, the industry was intensively bolstered by the introduction of open market reforms, which focused on attracting foreign investment through favorable Special Economic Zones (SEZs) and attractive joint venture agreements between Chinese and foreign high-tech manufacturers. A very prominent example has been the 1985 joint venture agreement made with Finnish mobile provider Nokia and the Chinese government to start manufacturing telecommunications equipment in China.

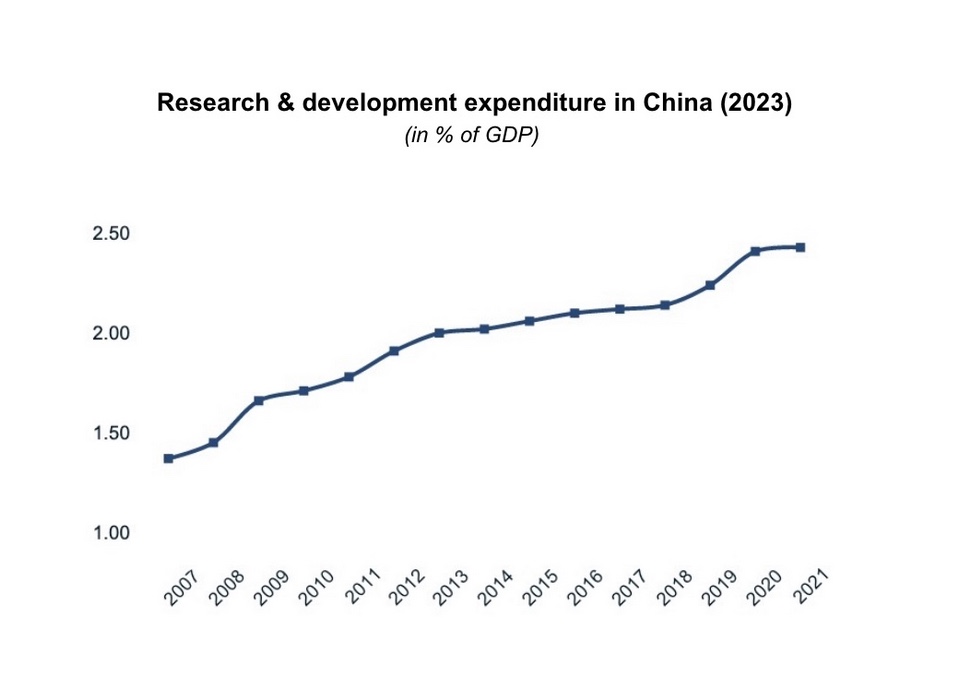

However, it was China’s entry into the WTO in 2001 that truly kick-started its high-tech growth. This can be clearly seen through the continued increase in the amount of funds dedicated to the R&D sector, doubling their relative comparison to China’s national GDP in the last 20 years. The 2010s were marked by an unprecedented e-commerce boom, which bolstered the rise of private tech giants such as Huawei, Tencent, Alibaba, and Baidu. These companies became rapidly the frontrunners, of China’s high-tech industry, both in research output and investments.

Data Source: Great Wall Enterprise Institute, Designed by Daxue Consulting, Research and Development Expenditure in China

Policy blueprint: Government initiatives powering the high-tech sector

China’s high-tech industry development has been constantly promoted by government initiatives aimed at developing nationally strategic high-tech industries and commercializing scientific and technological research. The 863 Program and Torch program, launched in 1986 and 1988 respectively, were the first major policy changes that created China’s initial capabilities in key high-tech fields, like IT and telecommunications.

Today China’s high-tech industry is still driven by supportive government and national bureau policies and strategic initiatives. The “Made in China 2025” plans to build up from its predecessors by continuing to transform China into a global leader in industries that are crucial for reducing its dependence on foreign technology, notably chips, which are essential in many high-tech devices.

Unveiling the pulse of innovation in China’s high-tech industry

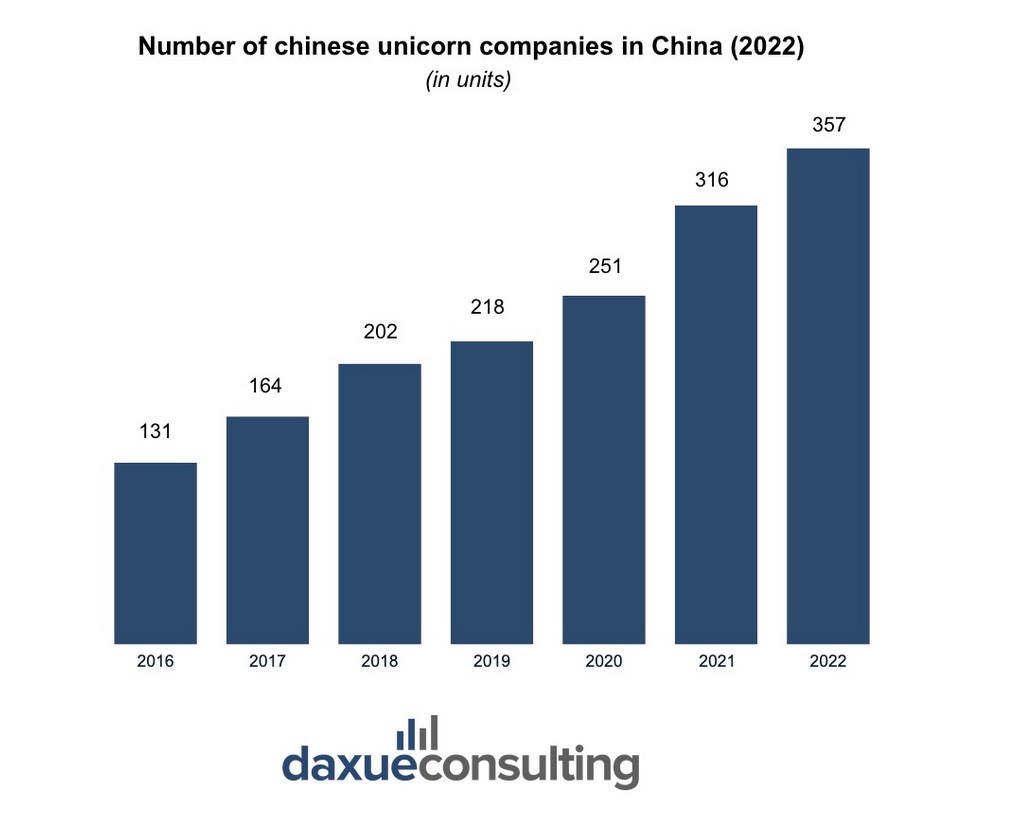

Data Source: Great Wall Enterprise Institute, Designed by Daxue Consulting, Number of Chinese unicorn companies in China (2022)

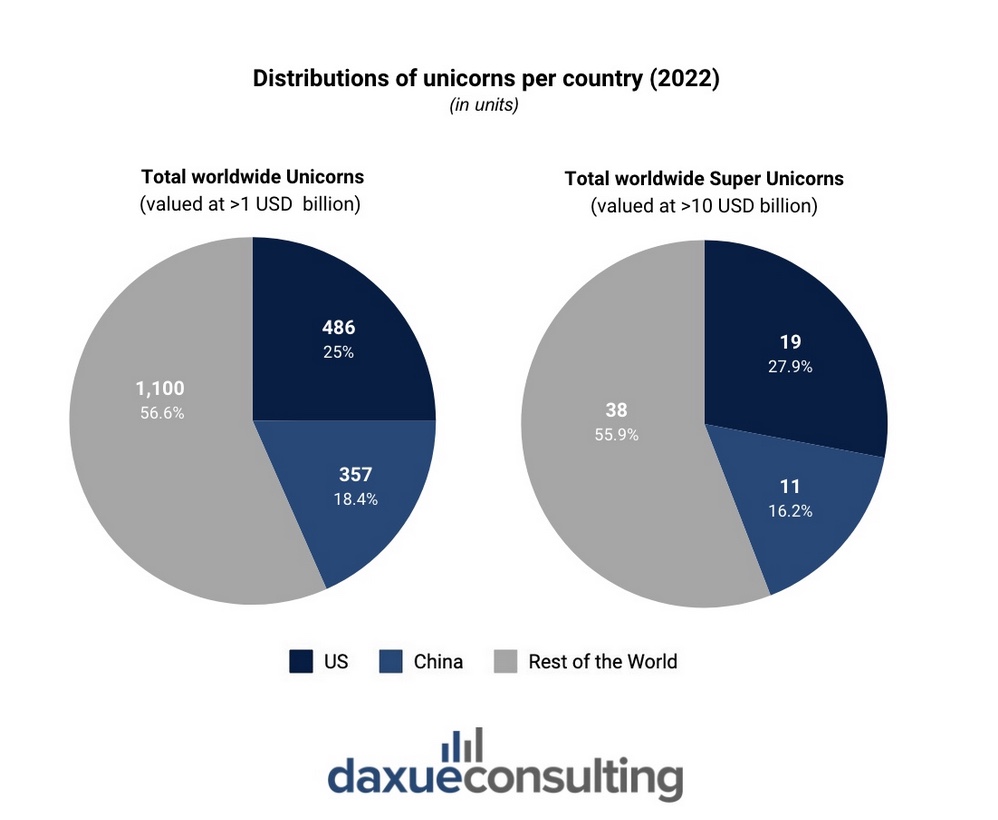

In recent years one way to rank a country’s innovation potential at a global scale has been through the number of unicorns that were born within its high-tech environment. A unicorn refers to private companies recognized as providing highly added value in terms of technological innovation that has surpassed a market valuation of USD 1 billion. They are usually startups and are characterized by extremely high early growth trends.

By the end of 2022, China had 357 unicorn enterprises, witnessing 41 new additions from the previous year. But what is more interesting is the increasing trend of growth. Just between 2016 and 2022, the number of unicorns nearly tripled, going from 131 to 357. Of these, 219, over 60% of the total, are from high-tech sectors, with a focus on chips, AI, digital health, and smart logistics, This allows China to rank second globally, just behind the U.S. which counts 486 unicorns.

Data Source: Great Wall Enterprise Institute, Designed by Daxue Consulting, Distributions of unicorns per country (2022)

An unprecedented surge in patent filings

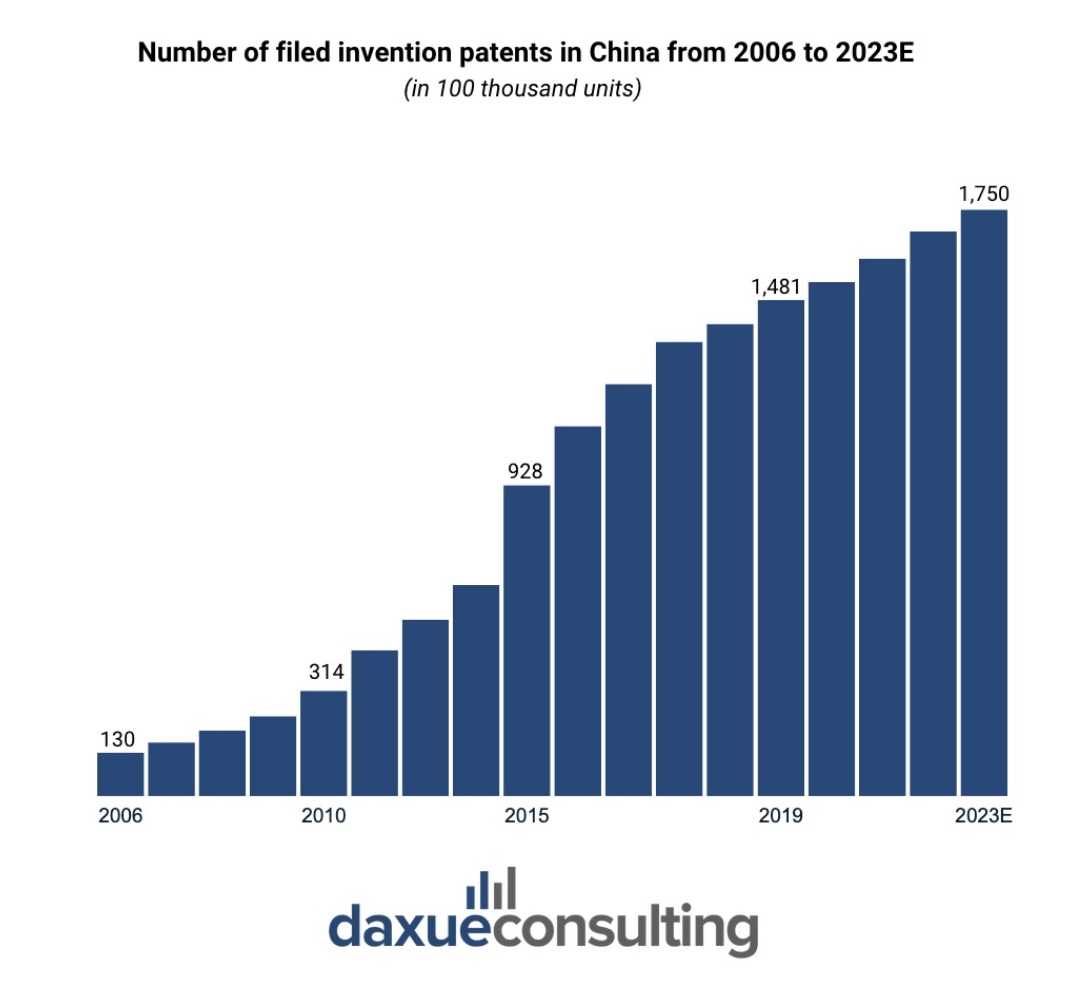

Another way to assess China’s high-tech industry rise in recent years is through the increasing number of invention patents filed since the early 2000s. According to the China National Intellectual Property Administration (CNIPA), invention patents filed by Chinese entities began to increase substantially in the mid-1990s as the government was starting to implement reforms to favor technological innovation. By 2008, Chinese enterprises were already filing 250,000 yearly invention patents, while in 2016, they were surpassing 1 million annually.

2019 was a turning point as China asserted its role as the biggest patent filer globally, reaching over 1.4 million filed patents. This target, which represented more than twice the United States’ filings, accounted for 43.4 % of the world’s total patent applications. In addition, by the end of 2022, foreign entities owned 861,000 valid invention patents in China, further emphasizing the country’s appeal as a hub for technological innovation.

Data Source: China National Intellectual Property Administration (CNIPA), Designed by Daxue Consulting, Number of filed invention patents in China from 2006 to 2023

An extended network of private capital powering the investment of high-tech breakthroughs

Alongside government support, private and venture capital investments have played significantly increasing contributors to the expansion of the high-tech industry in China. At the moment there are over 51 major venture capital firms that focus on providing high-tech startups with a steady flow of capital to support their long-term growth.

China remains the most targeted venture capital ecosystem in the APAC region in 2023. As such Chinese high-tech startups currently account for approximately 22% of the total venture capital funding deals announced in APAC and represent about 24% of the total deal value in the region.

Data Source: Pitchbook – Global private market fundraising report, Designed by Daxue Consulting, Venture capital fundraising activity in China, by quarter, between Q2018 and Q2023

Key players: The titans at the backbone of China’s high-tech scene

Major Chinese companies in China’s high-tech industry

Private tech companies are an essential factor in China’s development of its high-tech industry. Without these companies and their willingness to outcompete themselves in terms of innovative offerings, China would essentially struggle to affirm its competitive edge in global technological innovation. For instance, as of April 2023, Alibaba and Bytedance are currently China’s most highly valued fintech unicorns, with ByteDance having an overall valuation of USD 200 billion, followed by ANT Group at USD 120 billion.

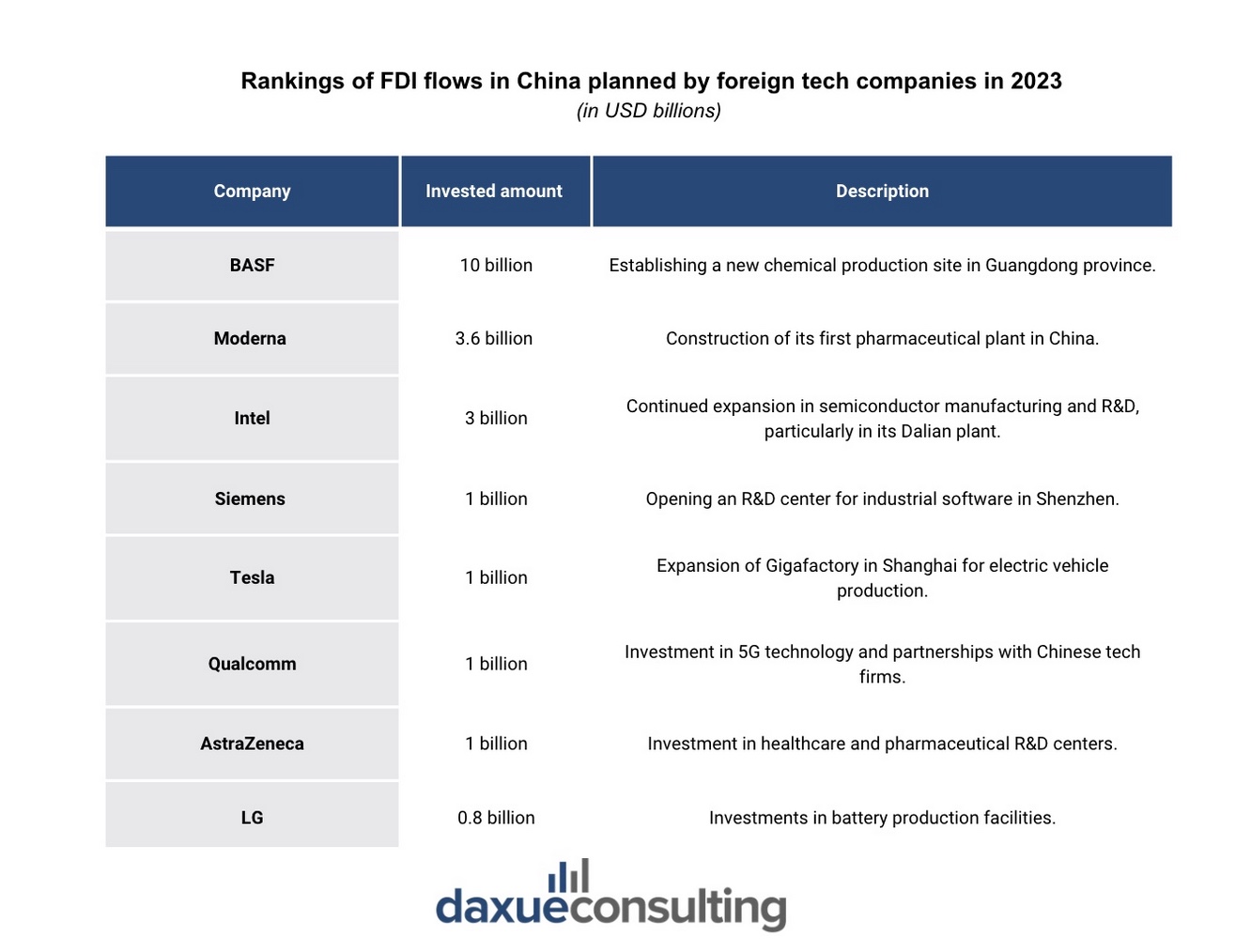

International companies with significant operations in China

Despite China’s witnessing a lower economic pace than before COVID-19, its technology ecosystem remains highly attractive to international tech companies across various segments. In 2023, the healthcare sector will act as a key driver of global FDI investment flows heading towards China. For example, Moderna and AstraZeneca are making significant investments in China’s biotech and healthcare sectors. Moderna is building its pharmaceutical manufacturing plant through a solid USD 3.6 billion investment, while AstraZeneca is investing USD 1 billion to further expand its pharmaceutical R&D centers.

Regarding high-tech manufacturing, Intel is expanding its facilities for semiconductor development and manufacturing in Dalian, through a nearly USD 3 billion investment. On the other hand, Siemens is investing USD 1 billion in an R&D center for industrial software in Shenzhen. Finally, Tesla’s USD 1 billion expansion of its Gigafactory in Shanghai perfectly aligns with China’s increasing push towards green technology and electric vehicles.

Data Source: China Daily, Designed by Daxue Consulting, Rankings of FDI flows in China planned by foreign tech companies in 2023

Key government agencies and research institutions

Aside from the private sector, public and government agencies also play an important role in shaping China’s technological landscape. These entities are empowered by the Chinese public authorities to ensure that China continually remains ahead in terms of global technological development. The Ministry of Science and Technology has an instrumental role, in policy formulation and funding. On the other hand, the Chinese Academy of Sciences is known for its active and extensive participation in pushing the boundaries of current scientific knowledge, by actively collaborating with both domestic and international partners to create new research output. A key example of the influential role of these institutions is their joint projects in quantum computing, which have significantly helped position China as a leader in this cutting-edge field.

A highly active and tech-savvy consumer base

While companies and public institutions are the ones creating a favorable environment of growth for Chinese high-tech industries, it’s eventually the consumers who hold the last word through their consumption choices. Social behavioral studies in China’s consumer population have revealed a very much unique and dynamic landscape that is currently being dominated by young individuals known for their high level of tech savviness and adaptability to technological advancements.

For instance, surveys conducted by McKinsey, have shown that over 70% of Chinese millennials regularly follow tech influencers and participate in online discussions about high-tech products. They usually rely on social media apps like Xiaohongshu and Douyin (Tiktok’s Chinese version) to keep up with the new releases of many technology-related products, including AI applications, new smartphones, or even smart home devices.

China’s leading industries: The trailblazers of technological advancement

5G and telecommunications

China has established itself as a global leader in several key industries, demonstrating remarkable advancements and market dominance. No better example to present China’s technological leadership than by addressing its rising and innovative telecommunication industry. Chinese telecommunication providers like Huawei are market leaders in the realm of 5G technology infrastructure.

According to a report from the China Academy of Information and Communications Technology (CAICT), Chinese companies are responsible for having deployed the largest 5G network in the world, with over 1.5 million 5G base stations and more than 500 million 5G users as of 2023. China’s market share in global 5G technology is significant, and it leads in innovation with over 40% of the global 5G-related patents filed by Chinese companies.

Consumer electronics

China detains a very competitive market share in the development and manufacturing of popular consumer electronics like smartphones and laptops. China’s consumer electronics ecosystem is composed of highly competitive household names such as Xiaomi, Huawei, and Lenovo. As of 2023, these manufacturers are responsible for generating approximately 30% and 25% of all smartphones and laptops sold globally. They are constantly at the forefront of new technical advancements such as the recent introduction of foldable smartphones.

Source: Huawei official online store, Huawei Mate X3, the first innovative foldable smartphone

E-Commerce and fintech

Both the e-commerce and fintech sectors are major areas of focus where many Chinese tech companies excel. In terms of market share, China houses the biggest portion of the global e-commerce market, surpassing USD 2 trillion in total annual sales. For example, mobile payment options are widespread across the market with Platforms like Alipay and WeChat Pay boasting over 1 billion active users each.

Tech pioneers: What are China’s emerging high-tech industries?

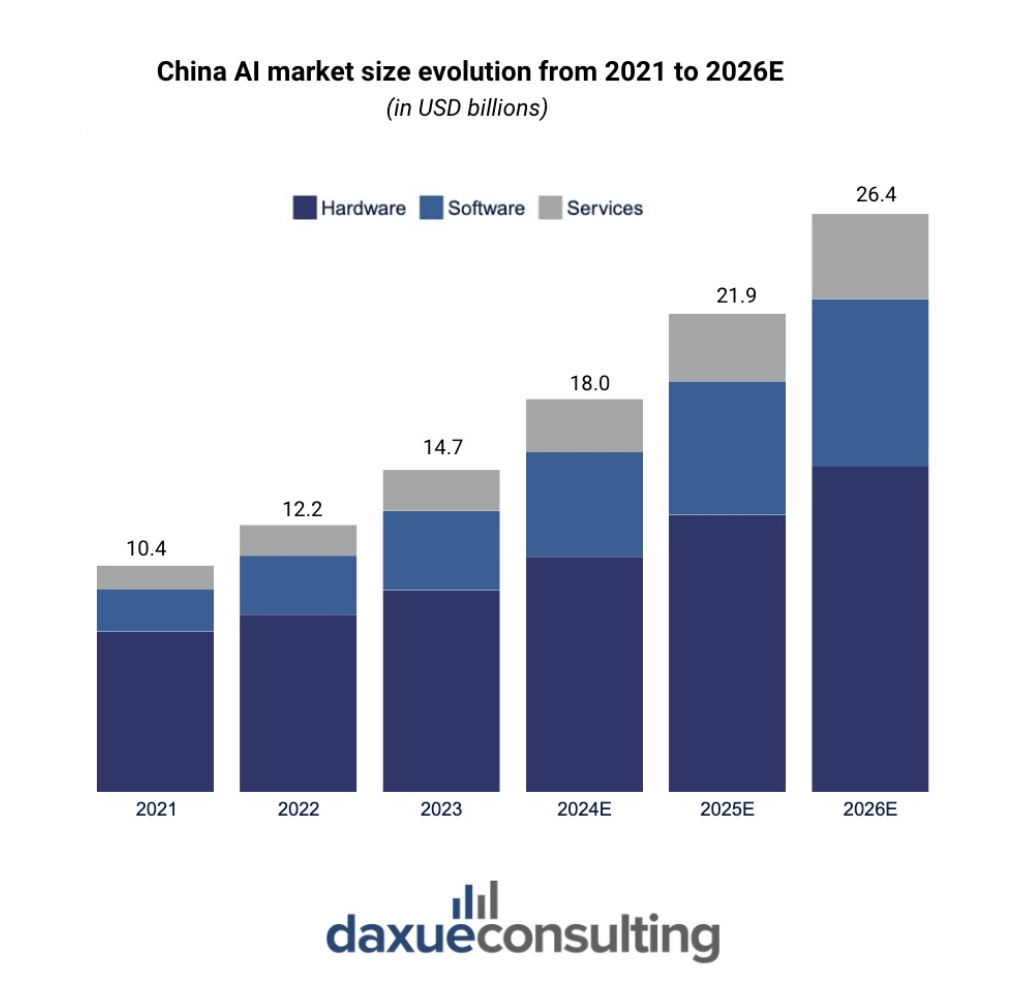

Artificial intelligence (AI)

China’s artificial intelligence (AI) market is expanding rapidly. According to Business Insights consultancy IDC, as of 2023, China’s AI ecosystem was estimated at a value worth approximately USD 14.7 billion, all the while boasting a promising annual growth rate of over 25%, until 2030. This expansion can be felt through the diversification of application options where AI is being used and commercialized.

Companies like SenseTime and iFlytek are some examples of Chinese companies distinguishing themselves as innovation leaders. While SenseTime specializes in facial recognition technology used for security and surveillance, iFlytek focuses on AI-powered speech recognition and natural language processing, which are being widely applied in healthcare and education-based solutions.

Data Source: IDC (2023), Designed by Daxue Consulting, China AI market size evolution from 2021 to 2026E

Biotechnology

Biotechnology research has been classified as one of the government’s 24 most indispensable technological priorities. As such, this government sponsorship has been followed by substantial investment in biotech research which in return has boasted revenue generation in the sector. For instance, as of 2023, it was valued at approximately USD 63.4 billion, with an estimated annual growth rate of 10.4% between 2018 to 2023.

Currently, the healthcare and medical segments represent the largest contribution, accounting for about USD 34.9 billion or 55.1% of the total value generated in the market. Major companies have been leading the way with notable breakthroughs in the development of genomics research. For instance, the BGI Group (Beijing Genomics Institution) has made significant contributions to genomic sequencing and research, by advancing current technical understanding of the CRISPR technology, which is essential in providing advancing personalized cures for rare genetic diseases.

Robotics and automation

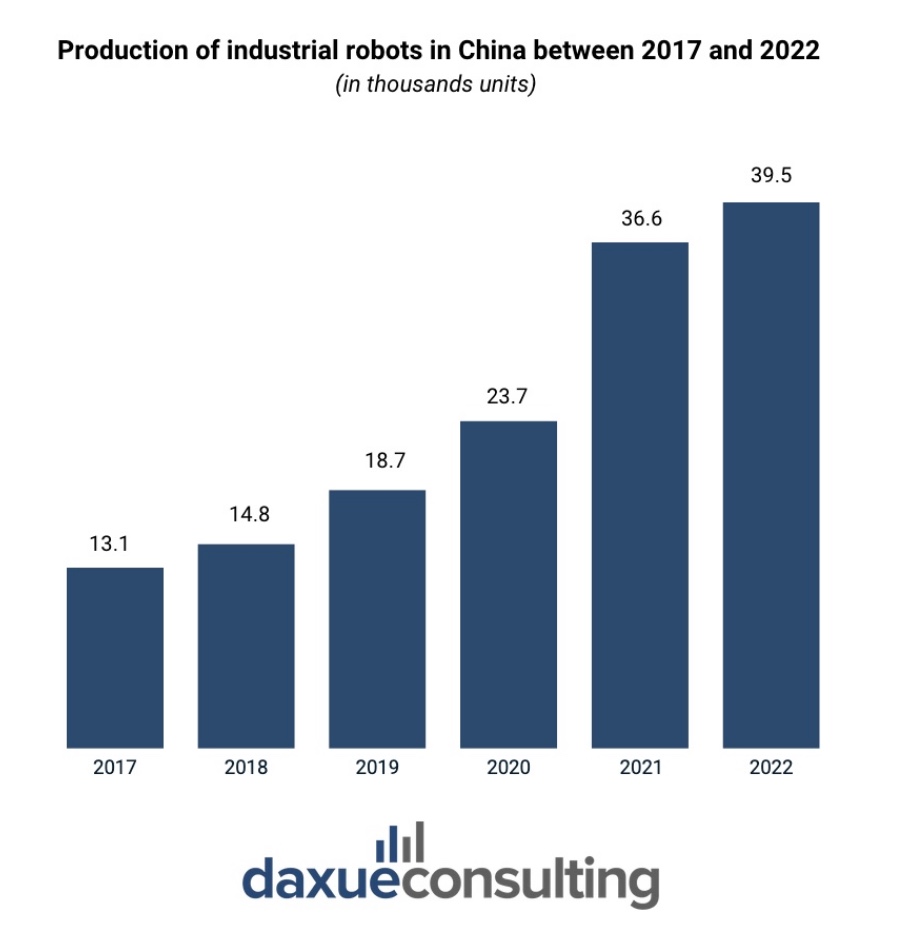

China’s robotics industry has been experiencing a very increased growth pace, mainly driven by major advancements in industrial and service robotics. In 2022, the market size for industrial robots in China was estimated to be around 26.52 billion with an annual growth rate of 10.5% until 2030, reaching an expected value of USD 30.19 billion.

Applications in manufacturing and healthcare are notable, with robots increasingly used for precision tasks and patient care. Significant expansion has also been seen in logistics and healthcare applications, where robots have been increasingly adopted to enhance efficiency and service quality. This adoption trend reflects itself on the constant rise of produced industrial robots which have more than tripled between 2017 and 2022.

Some of the leading companies such as DJI and UBTECH are at the forefront of this growth. DJI is renowned for its advanced drones and robotics used in various industries in agriculture. The company has recently commercialized the DJI Mavic 3 to assist farmers in monitoring the health of the health of their crops, assessing the conditions of their fields, as well as optimizing the usage of resources through a precise mapping and data collection process.

Data Source: Fortune business insights report, Designed by Daxue Consulting, Production of industrial robots in China between 2017 and 2022

Electric vehicles (EVs)

China is a pioneer in electric mobility. The Chinese electric vehicle (EV) market has experienced unprecedented growth, driven by substantial and consistent government backing for EV manufacturing in the last 15 years. In 2023 the Chinese EV market was estimated to have reached a value of USD 292.1 billion.

China dominates global production and sales, accounting for 55% of all EV sales globally in 2022. Leading manufacturers like BYD and NIO are at the forefront, producing innovative and high-quality electric vehicles. The expansion of EV infrastructure, particularly charging stations able to charge simultaneously 20 cars in less than 10 minutes, further supports this growth, making EV adoption more convenient for consumers.

According to McKinsey, China’s EV market is also well positioned to experience continued growth thanks to key breakthroughs expected to be achieved in autonomous mobility. For instance, by 2030, Chinese authorities envision large-scale deployment of autonomous electric vehicle (EV) fleets by 2030, aiming for 1 million robotaxis.

Challenges: Navigating the high-tech frontier

China’s high-tech industry is facing significant regulatory and policy challenges that can potentially hinder the continued growth of the high-tech industry. Intellectual property (IP) protection is a great concern, with ongoing issues related to IP theft and enforcement still being particularly common. Ensuring more strict enforcement of IP laws will be crucial for fostering an environment with a long-term propensity towards innovation. Additionally, data privacy and cybersecurity regulations are becoming increasingly stringent, which if not handled resposively could pose unnecessary compliance challenges for tech companies.

Overcoming current technological barriers to favor homegrown innovation

Most importantly, China’s high-tech industry must overcome its critical need for more homegrown innovation, particularly when dealing with breakthrough innovations that are responsible for driving the next wave of technological advancement. This necessarily requires a substantial amount of investment in R&D initiatives as well as the continued fostering of an environment that encourages creative and pioneering minds to work together. The Chinese high-tech industry also needs to start closing the significant talent gap, particularly regarding graduates from the science, technology, and engineering fields, who still continue to favor other destinations like the US or Europe to work instead of China’s high-tech industry.

Future pathways: shaping tomorrow’s high-tech industry in china

- China’s high-tech industry has rapidly upgraded from a manufacturing hub to an innovation powerhouse, mainly thanks to favorable government policies and tax incentives, strategic private investments, and the rise of tech giants like Huawei, Tencent, and, Alibaba.

- By 2023, the Chinese high-tech industry was valued at an estimated RMB 26.6 trillion and has been projected to grow to RMB 50 trillion by 2030, with significant contributions from IT, advanced manufacturing, and biotechnology sectors.

- China ranks 2nd globally for the number of unicorn companies, with significant growth potential in high-tech startups in sectors like chips, AI, digital health, and smart logistics.

- Key emerging sectors in which China is accumulating competitive advantages include AI, biotechnology, electric vehicles, and robotics.

- Structural challenges to the sustained competitiveness of the Chinese high-tech industry include a weak IP protection scheme, a strong drawback of stringent data privacy and cybersecurity regulations, and bridging the talent gap in STEM fields to foster in grown innovation

Contact us for consumer and market insights into the high-tech industry in China

As China’s high-tech industry continues to grow and innovate at a rapid pace, having a strategic edge is more critical than ever. Daxue Consulting offers in-depth market research and expert insights into the latest trends, technological advancements, and regulatory landscapes shaping this sector. Whether you are seeking to enter the market, expand your operations, or refine your strategy, our team can provide the essential data and analysis you need to succeed.

Partner with Daxue Consulting to navigate the complexities of China’s high-tech industry and position your business at the forefront of innovation. Contact us to explore how we can help you maximize your potential in this dynamic market.