Over the years, the eyewear market in China has witnessed remarkable growth and this trend is set to continue post-pandemic, fueled by factors such as increasing disposable income, changing fashion trends, and rising awareness about eye health. Chinese consumers have developed a strong appreciation for both style and functionality when it comes to eyewear, creating a thriving market for a wide range of products, including prescription glasses, sunglasses, and contact lenses.

China’s optical market outlook post-pandemic

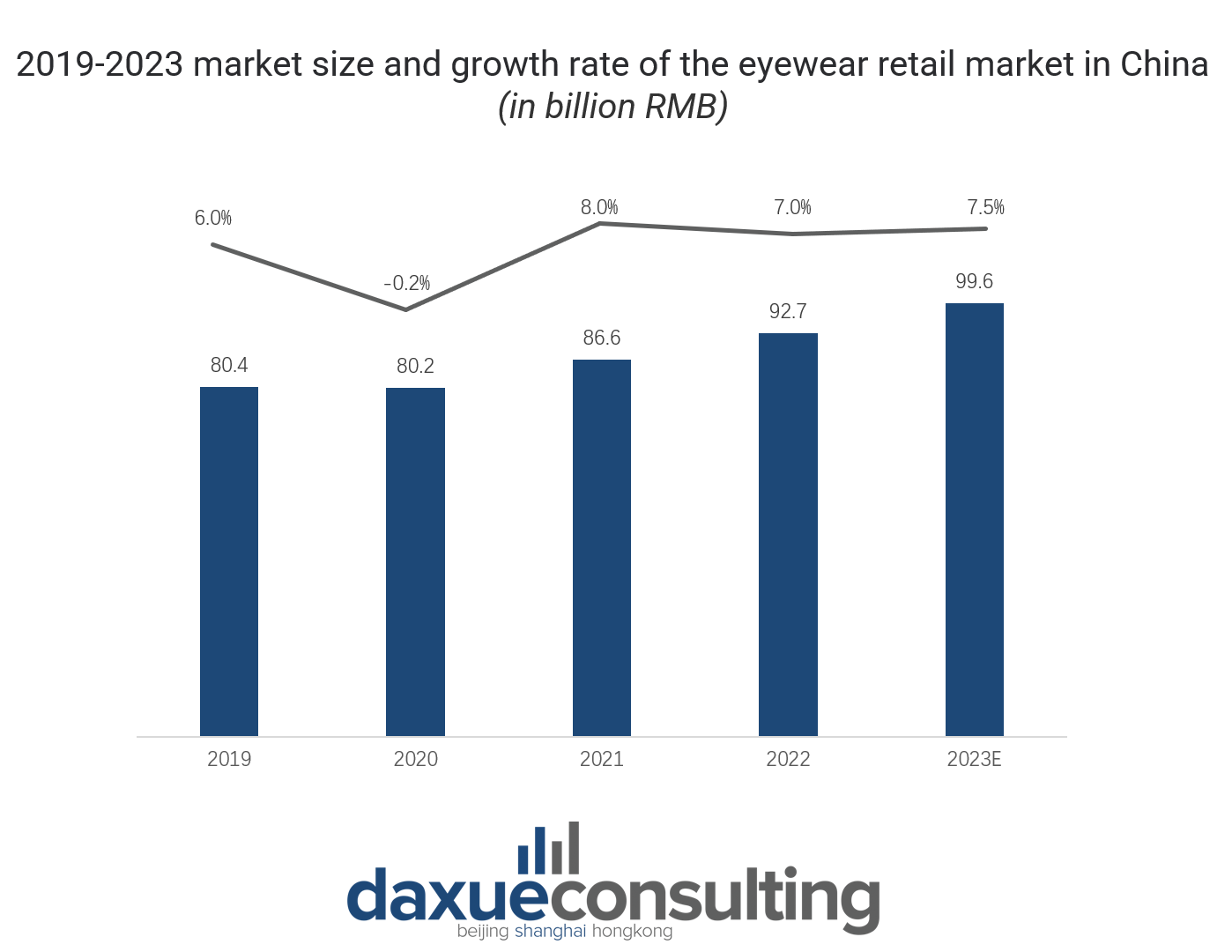

Despite years of development and rapid sales growth up to 2019, China’s eyewear market faced a setback in the first half of 2020 due to the pandemic’s impact on offline retail. While a recovery began in the second half of 2020, the overall market size still declined, reaching RMB 80.2 billion for the year. Nevertheless, in the following two years the market kept growing, and it is expected to exceed RMB 107 billion by 2024.

This resurgence is further fueled by the increased importance of myopia prevention, stemming from students’ long-term online classes during the pandemic, which has contributed to the expansion of the domestic eyewear market.

Changing consumer preferences: prescription eyewear is becoming a fashion accessory

According to the 2022 China Glasses Industry White Paper, in 2022, half of the consumers owned more than two pairs of glasses, up 14% from 2014. This data illustrates a noticeable shift in consumer preferences, where owning multiple pairs of glasses for various occasions became common practice. For example, office workers typically favored black-framed glasses with blue light lenses for everyday use. Yet, for social events or important gatherings, they often turned to contact lenses or opted for more stylish frames in vibrant colors. Likewise, when engaging in sports and outdoor activities, people preferred lightweight frames in lively colors.

Surfing this trend, new eyewear brands such as mujosh (木九十), AOJO (奥玖), and LOHO (乐聚) have emerged in recent years. They strategically positioned themselves as fashion-oriented brands, promoting glasses as stylish accessories right from the start, and quickly gained popularity. According to mujosh official website, it boasted more than 800 stores worldwide in 2021, with annual sales exceeding RMB 1 billion.

China’s booming sunglasses market fueled by health and style

In recent years, there has been a progressive rise in health consciousness among Chinese consumers, leading to an increased focus on eye protection. Currently, the predominant lens materials for sunglasses available in the Chinese market are resin lenses and plastic lenses. These two options offer distinct advantages, including resistance to high temperatures, durability, and improved safety, when compared to alternative lens materials.

Between 2019 and 2022, the sunglasses market in China witnessed a notable expansion leaping from RMB 27.35 billion to RMB 41.08 billion, and exhibiting a compound annual growth rate of 14.52%.

Currently, the distribution of sunglasses in China predominantly relies on offline channels, however, with the increasing popularity of e-commerce platforms in China, the share of eyewear sold through online channels has increased significantly. In 2022, the proportion of sunglasses sales in China through online channels was 34.73%, while offline channels accounted for the remaining 65.27%.

Non-prescription colored contact lenses are considered to be a noteworthy beauty product

In China, contact lenses are mainly used for two purposes: vision correction and cosmetic enhancement. The demand for prescription contact lenses remain stable, while the market for non-prescription colored contact lenses is rapidly expanding. This growth is driven by their alignment with the booming “beauty value” economy in China (颜值经济). Indeed, according to Qingshan Capital, China witnessed an impressive annual compound growth rate of 41% in the colored contact lenses market in 2021. In 2022, nearly 80% of 1,620 surveyed consumers claimed to use colored contact lenses at least once a week, and this trend is believed to continue in the future. This is because the post-90s and post-00s in China are willing to invest more in improving their appearance nowadays. Looking ahead, based on forecasts from the Mob Research Institute, the market size for color contact lenses in China is expected to reach RMB 50 billion by 2025, potentially establishing it as a significant global market.

Foreign brands dominate China’s optical market

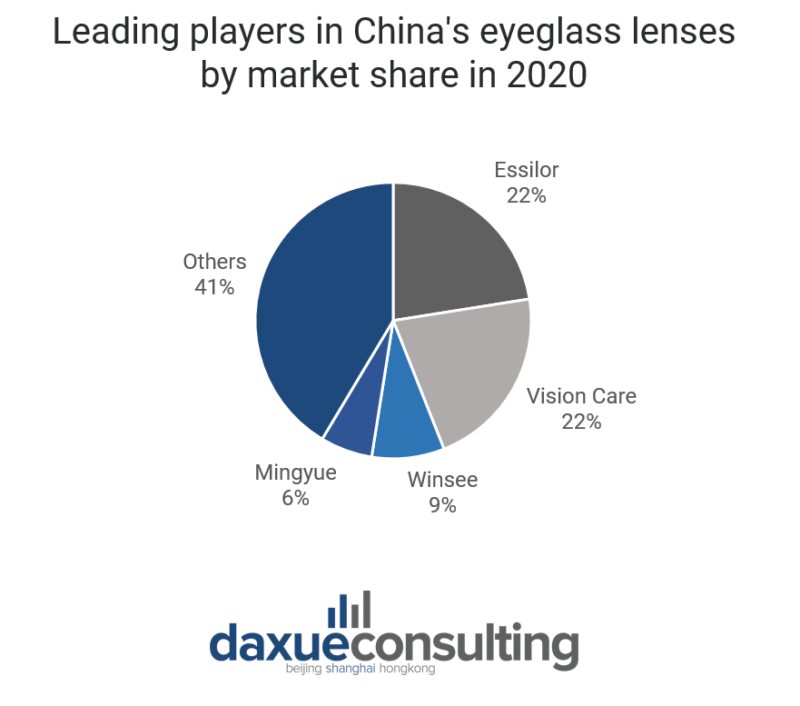

The prominent contenders in China’s eyewear market encompass both foreign and domestic brands. According to iResearch, top enterprises accounted for 85% of the total sales of the industry in 2022. Among them, Essilor and Carl Zeiss (Vision Care) took up over 20% of the market each, ranking top two.

As representatives of domestic lens manufacturers, Winsee and Mingyue lenses ranked third and fourth in terms of sales, with market shares of 8.5% and 6.1%, respectively. At present, in the domestic lens market, well-known international manufacturers still vaunt competitive edge.

Co-branding and influencer marketing are 2 key components of Zeiss’ strategy in China

The brand Carl Zeiss, originating from Germany, boasts a rich history spanning over 175 years. As a globally recognized lens maker, it holds a significant influence within the industry. Carl Zeiss has implemented a localization approach specifically tailored for the Chinese market, with IP collaboration being a key component. Since 2021, Carl Zeiss has been collaborating with IG (Invictus Gaming) esports Club, which is one of China’s most well-known esports clubs. By partnering with IG, Carl Zeiss has gained significant visibility among the esports community and IG’s huge fan base. Additionally, this exposure has helped increase brand recognition and generate positive brand associations with the excitement and competitiveness of esports.

Zeiss has also strategically employed co-branding by collaborating with local celebrities and influencers in 2023.to enhance consumer engagement and trust. This included partnerships with Children’s picture book artist Gui Tuzi, astronomer Liu Boyang, and national women’s football player Ma Piaoliao, aimed at boosting consumer engagement and trust through influencer marketing. In September 2023, Carl Zeiss had over 294 thousand followers on the Weibo platform, outnumbering most other optical brands.

Livestreaming has emerged as a powerful tool in China’s eyewear market

The rise of e-commerce platforms and digital marketing has deeply influenced the way of purchasing eyewear products in China. Online channels have become essential for both established brands and emerging players to reach a wider audience. According to the China Business Industry Research Institute, the number of social commerce consumers in China exceeded 850 million in 2021. In China’s optical market, social commerce is gaining immense popularity, thanks to its cost-effective methods of acquiring traffic. For example, numerous eyewear companies are capitalizing on the livestreaming trend, engaging with their audience in real-time. Through livestreaming sessions, they can demonstrate the features and styles of different eyewear products, answer questions from viewers, and even offer exclusive discounts or limited-time promotions.

6 steps to understand China’s eyewear market

- The pandemic initially hurt offline shopping in China, causing significant eyewear market setbacks in H1 2020. Yet, as the pandemic waned in H2 2020, the eyewear market slowly rebounded.

- The preferences of Chinese consumers are changing, with prescription eyewear turning into a fashion accessory. In recent years, new eyewear brands like mujosh (木九十), AOJO (奥玖), and LOHO (乐聚) have emerged and gained popularity, riding the wave of this trend.

- The sunglasses in the overall eyewear market is growing, driven by Chinese growing consumers’ concern for their eye health and the growing importance of keeping up with the latest fashion trends.

- In China, contact lenses are mainly used for two purposes: vision correction and cosmetic enhancement. Prescription contact lenses have a relatively stable demand, whereas the market for non-prescription colored contact lenses is experiencing rapid growth.

- At the moment, well-established international manufacturers dominate China’s eyewear market, with Zeiss and Essilor accounting together for 44% of the market.

- Livestreaming and social commerce have revolutionized eyewear purchasing in China, enabling brands to connect with a broader audience and showcase products effectively.