The gardening tools market in China has grown substantially in the past 5 years. According to a report by ASKCI, the market size for gardening tools in China has grown from less than 600 million RMB in 2014 to more than 850 billion RMB in 2019, at a CAGR of 7.6%.

The market is expected to expand to reach the market size of 1.2 billion RMB in 2024. The growth is driven by expansions in both commercial and household segments, with household segments growing at a higher speed.

Leisure gardening is rising in China

In China, the demand for landscaping and gardening activities has increased considerably in recent years. Aesthetics and environmentalism are the primary driving desire for this change in consumer preferences. As the economy is moving towards environmentally-friendly industries, the concept of gardening is also changing among Chinese consumers.

Now, Asia-Pacific cultures incorporate gardening activities into their lifestyles as it becomes recognized as a leisure activity. In China, people are gradually accepting the idea of horticulture as a therapy for daily life getaways. Small gardening tasks are not only a hobby but a ‘medicine’ to reduce stress.

The increasing popularity of ‘Do It Yourself’ (DIY) in gardening also brings a fresh approach to Chinese middle-class consumers. Rising disposable income affects leisure choices, and small gardening and horticultural activities are being widely recognized as a relaxing and worth-trying way to maintain the peace of life.

Competition in the gardening tools market in China

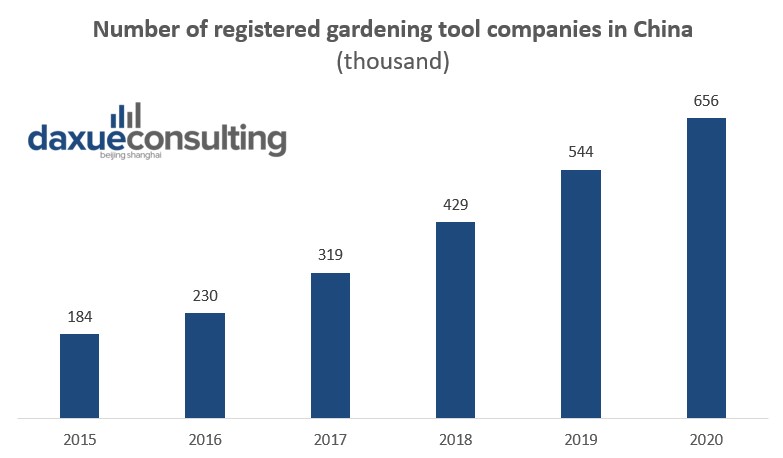

According to a report by Intelligence Research Group, The number of enterprises engaged in the production of gardening tools in China has grown from less than 185 thousand in 2015 to more than 650 thousdand in 2020.

The vast majority of these enterprises are small and medium-sized enterprises with small production scales. Only 9,280, less than 2% of all the enterprises in the industry, have market values exceeding 10 million USD. Currently, the leading actors in the gardening tools market in China are large foreign brands like Gardena, STIHL and ARS, followed by large Chinese home-grown brands such as Worth and Kafka.

Data source: Intelligence Research Group, graph designed by Daxue Consulting, number of registered companies in the gardening tool industry in China

The gardening tools manufacturing industry in China, however, is not developed to scale. So far, the main competitors in this market are all small-to-medium sized enterprises with fewer specialties and a broad range of products. Thought highly competitive, the market specification is not precise and there exist no major market players in the domestic production.

Seasonal fluctuations in China’s demand for gardening tools

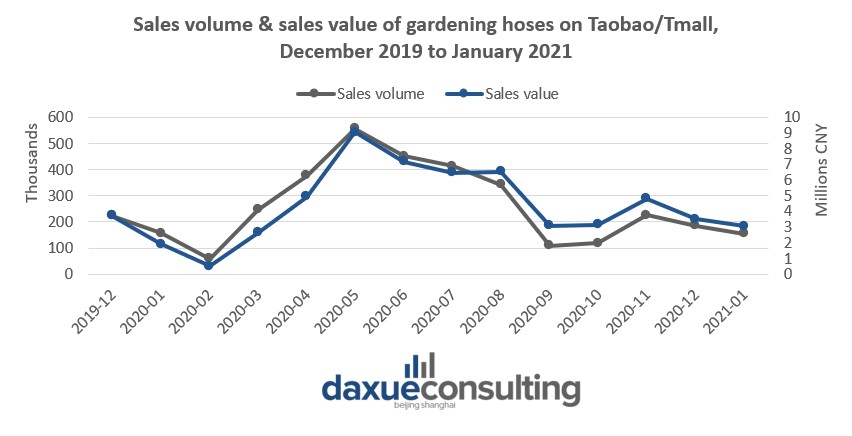

Unsurprisingly, consumption in the gardening hoses market in China shows a strong annual-seasonal pattern. According to Tmall/Taobao data from December 2019 to January 2021 the sales pattern of gardening hoses is mainly concentrated in the spring and summer. The demand for hoses usually start rising after the Chinese New Year. Peak season is May, and demand stays high through the rest of summer. This strong seasonal pattern can be understood by the hose’s private users’ purposes of purchasing. Most consumers purchase them for car washing and gardening. The second annual sales peak is correlated with the 11.11 (双十一) shopping festival and the aggressive discounts implemented by brands.

Data source: Taobao data, graph designed by Daxue Consulting, Sales volume & sales value of gardening hoses on Taobao/Tmall

Key players in gardening tools market in China

GARDENA: Foreign brand with high quality products

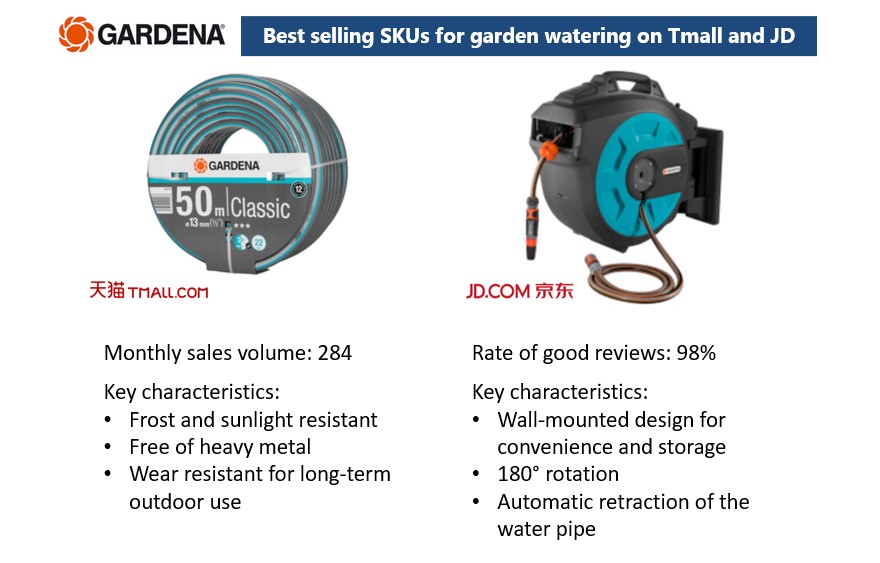

GARDENA was founded in 1961 in Germany and is specialized in the design, development and manufacturing of high-quality gardening equipment and tools. It has both Tmall and JD flagship stores.

Source: JD, Bestselling SKUs of GARDENA in China, Tmall and JD

Customers give overwhelmingly positively reviews to GARDENA’s products; most products have positive review rates higher than 95%. Many reviews demonstrate consumer’s positive mentality towards foreign brands. For example, one customer states that “while hoses bought from Chinese brand have already frozen into ice lollies, this imported hose are still flexible.”

On the online channels, customers generally purchased them mostly for private use such as watering gardens and car washing. However, apartments are much more common than houses, and some customers comment that the products are not really suitable for those in apartments. One of the reviews states “the material is very good, but it is also very heavy. This makes it exhausting to move it. My opinion is that if you are in an apartment, it might not suit you. The hose is better for houses and gardens.”

Although GARDENA’s prices are generally higher than domestic counterparts, many customers still prefer it along with other foreign brands due to their trust in products’ quality. One customer said, “I’ve been using it for a few days, and it works well. The hoses can be pulled out and retracted smoothly; it’s perfect for watering plants and washing cars in the garden. It’s quite expensive, I hope it lasts.”

At the same time, GARDENA China’s target consumers are wealthy people who are more likely purchasing the hoses for their personal gardens, and are not price sensitive. For example, a user in the review posts an image of a fancy garden and commented “the hose works really well, both for watering the flowers and cleaning the garden. My friend also bought a set after my recommendation.”

Source: JD, positive review of GARDENA’s gardening hose

WORTH: Listed Chinese brand trusted by consumers

WORTH is a Chinese gardening tools brand, and a leading environmentally friendly enterprise, specializing in the research and development, production, marketing, service and retail operations of gardening tools.

Source: JD, Bestselling SKUs of Worth in China, Tmall and JD

The brand relies on its good quality and high price-performance ratio to build its brand recognition. One customer wrote “the outside color is beautiful. It has a good texture and there are no leaks in the joints. The hose pulls out and retracts smoothly, and the spray is also fully functional. I chose Worth because it is a large brand and the quality is reliable.” In addition, as an established brand, many customers are not first-time buyers and their positive reviews of the brand help it to build its brand value. A customer says “The previous hose I use is also from Worth. I have used it for more than two years and it has been left outside in the open like this. Very good quality. This time I bought another one with 20-metre length, so I can pull it to the door and wash my car.”

In addition, the company’s status as a listed company also distinguishes itself from its other domestic competitors and gains customer’s trust. A customer wrote that “The quality of the hose is quite good. It has three layers so it is very thick. I feel that it can be used for a long time. The hose is also very flexible, I can use it to water flowers and wash the car. I’ve looked at many brands, and finally chose this listed brand.”

Consumer preferences revealed by Social Media

Consumers of gardening tools in China utilize different social media platforms to ask, gather, evaluate and make decisions on different gardening tool products.

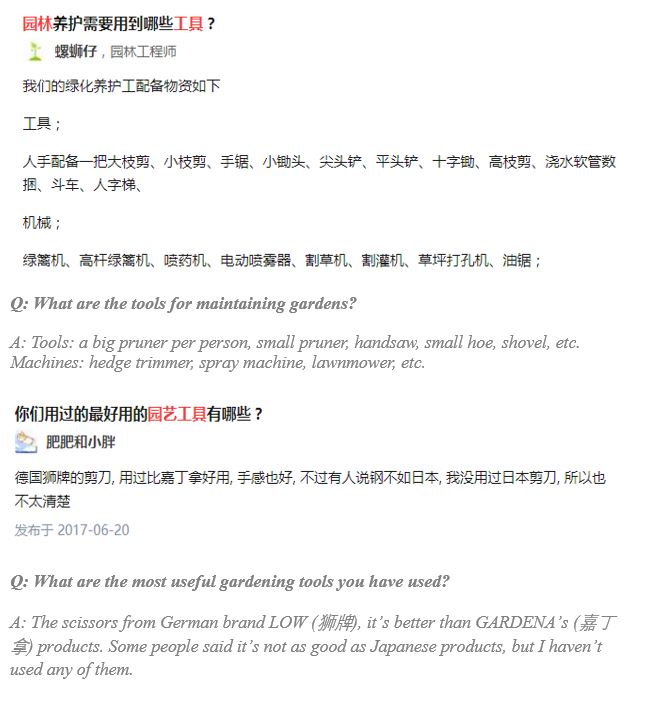

Zhihu.com is the most prominent Chinese online Q&A platforms with social media features. People ask questions about gardening tools on Zhihu.com to gather useful information:

What Chinese consumers say about gardening tools

Weibo and Wechat are two major social media platforms in China. Many people have posted on gardening tools/machine.

According to the social media research done by Daxue, positive feedbacks on these products are mainly focusing on the following aspects:

- Easy to use/carry, saving the labor;

- Good quality;

- Long service life;

- Environmentally friendly.

There are also negative feedbacks online on those products, such as:

- Engine noise and exhaust gas;

- Cannot do continuous work;

- Easy to be damaged;

- Cannot achieve expected outcomes.

On Weibo and Wechat, brands introductions and requests for product authentication are the main contents among the posts about gardening tools and machines in China.

E-Commerce platform buyers concerns quality as a priority

Major e-commerce platforms such as Taobao/Tmall and JD.com all have functions for online customers to leave a review after purchase, whether positive or negative. Most discussions about gardening tools are focusing on products’ quality and prices. Consumers can post pictures of the real goods they receive in the review for others’ reference. Also, some sellers online offer a small amount of cash or gift card reward for those positive and detailed buyer’s reviews.

On Tmall/Taobao and JD.com, most positive feedback focus on good qualities, easiness to use/carry, effectiveness, fast delivery, reasonable prices, and good aftermarket services; while negative feedbacks focus more on bad quality, fake products, high prices, short product life, and bad aftermarket services.

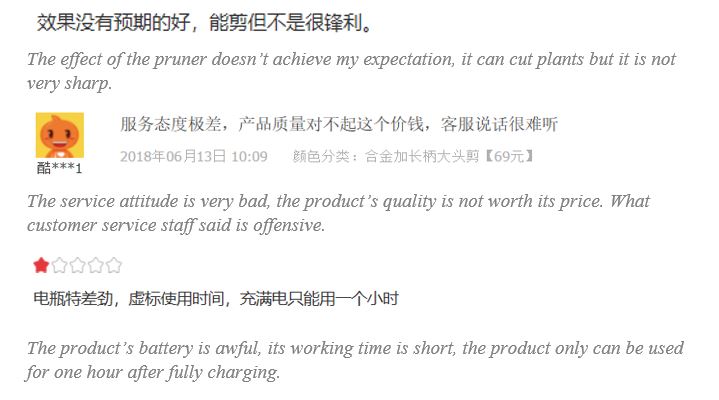

Positive Reviews:

Negative Reviews:

The gardening tool market composition – Products analysis

Gardening Shears

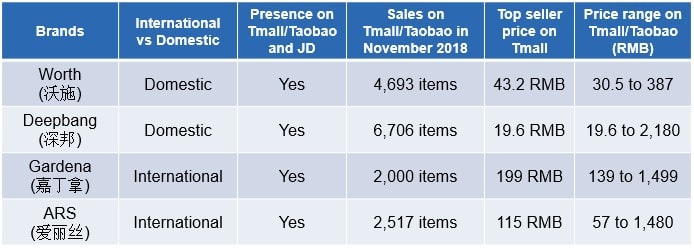

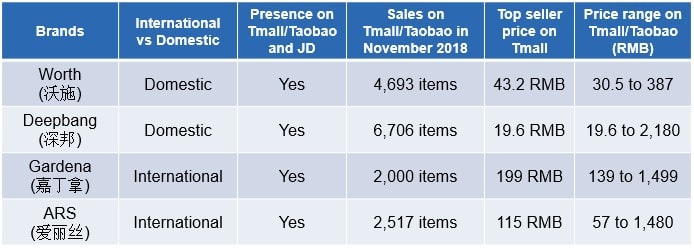

Gardening shears are one of the essential gardening tools in China. Data from online retailing platform Tmall/Taobao shows that domestic brands have potentially a higher monthly sale than their international counterparts. Domestic brands Deepbang (深邦) and Worth (沃施) ranked 1st and 2nd in November monthly sale in 2018. International brands Gardena (嘉丁拿) and ARS (爱丽丝) only reached 40%-50% of the sales of domestic brands at the same time. The top seller prices of the products are relatively low, and it is the main reason for their outstanding sales.

Garden shears are the most common garden tools. The price range is quite broad on Tmall/JD.com. Price is a significant criterion for purchases, and domestic brands usually have lower rates because of their lower production costs.

Shovels

Local brands Qinglin (青林) is undeniably the leader in sales for this product in November 2018 with more than 10,000 items sold. Zhuoshi (卓石), another domestic brand also sold more than 5,800 items. These two brands contributed significant sales volume in November 2018 for Shovels than their international counterparts. For global brands, Gardena (嘉丁拿)’s sale reaches a bit over than 10% of that of Qinglin (青林), making international brands’ sales insignificant compared with domestic brands.

Shovels and hoes are the basic gardening tools in Chia. Their prices are relatively low on Tmall and JD.com. Retail prices do not dominate the sales of shovels and hoes. Many consumers value products’ quality over price. The overall cost is not very high.

Lawnmower

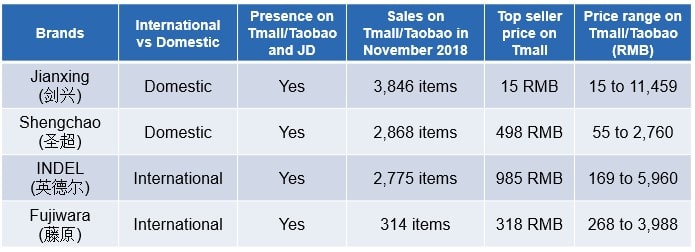

Sales of a domestic branded lawnmowers are higher than international brands. Local top seller Jianxing (剑兴) has extremely low prices compared with the international top seller and have sold more than 1,000 items in November 2018. However, INDEL (英德尔), the global top seller does not trail behind too much compared with the second top domestic seller Shengchao (圣超). The difference in their sales is less than 100 items. Fujiwara (藤原), another international brand, did not perform well with only 314 items sold at the same time. Overall, domestic brands all play better than international brands at a lower price.

The lawnmower is one of the most important gardening machines. The costs of lawnmowers range mostly different on Tmall and JD.com. International brands selling imported products will typically have a much higher rate than domestically produced and branded goods.

Handsaw

Most handsaw brands have built their official stores on the leading e-commerce platforms such as Tmall/Taobao and JD.com in China. International brands usually have higher prices. As a result, their sales are much lower than those of domestic brands. In November 2018, local leading brand Juli Jin’gang (锯力金刚) sold more than 2,200 items, and this is more than four times the sale of which the top international brand ARS sold at the same time.

The gardening tool market composition – Manufacturer analysis

Worth (沃施)

Worth is one of the major gardening tools providers in China. It has built an official website for showing brand stories, product catalog, and news/events updates. Worth has three major product series: power tools, petrol tools, and hand tools. Among these series, hand tools are primarily sold online on different e-commerce platforms including Taobao/Tmall, JD.com, and others. Worth consider its products have long product life, making those tools handy with high qualities. The significant sales points including long product life, easiness of use, efficiency, low maintenance costs, and environmentally friendly designs.

Worth has a digital presence on major e-commerce platforms with no existence on newly inducted e-commerce operators such as Kaola and Pinduoduo. This means Worth is still operating in a conventional online retailing pattern as Kaola and Pinduoduo are based on an entirely different rationale for e-commerce.

Customer view this brand as high quality guaranteed. Aftermarket services and excellent craftsmanship are also praised among all customer review posts online. The only drawback pointed out is that its products are selling at relatively higher prices among the entire product category.

Worth has its Weibo account with 69,564 followers and 11 posts till November 2018. But it has no Wechat presence at all. Its entire social media profile is not active.

Gardena (嘉丁拿)

Gardena is a favorite gardening tool brand based in Germany. Its official Chinese website contains different product types (series), updates on company news, service information and customer support. In China, Gardena primarily sells four kinds of products: watering tools, lawn care, grass shears, soil and ground, and smart system solutions for gardening. To further promote its products, Gardena describes its products as having good quality with long product life, effective and efficient while very handy and easy to use.

Gardena has a digital presence on both Taobao/Tmall and JD.com, which offers a convenient way of e-commerce in China. In new e-commerce platforms such as Kaola and Pinduoduo, Gardena has no active presence. Its conventional e-commerce presence is as strong as Worth (沃施), which make these two brands the major gardening tools providers in the Chinese market.

Customers consider this brand as a representative for high quality and great designs. Easy to use and useful application is also being praised on significant e-commerce platforms. Similar to Worth, Gardena’s product is relatively pricey. In addition, online customers think their products, through effective and user-friendly, are having insufficient sizes.

Gardena maintains both presences on Weibo and Wechat with 9,580 and 319 followers respectively. However, they did not show active status and remained inactive during Daxue’s research period.

STIHL (斯蒂尔)

The official website of STHIL China contains three subsites for its trading company in Taicang, Jiangsu, its manufacturing factory in Qingdao, Shandong, and its official German website in Germany. The primary body of these websites is related to the company news and events updates as well as the product series. These websites also provide detailed knowledge of equipment caring and handbooks for different types of power tools. STIHL mainly sell power tools in China including chainsaws, hedge trimmers, and brush cutters.

STIHL has a digital presence on both Tmall/Taobao and JD.com. Compared with Gardena and Worth, STHIL’s sale is not significant. This is mainly due to the nature of its products being power tools which incorporate more technologies than the other two brands. One surprising fact about STHIL is that this brand has a presence on Pinduoduo, and have a relatively high sales volume per day when Daxue was conducting the research.

Customer view STIHL as a brand with good quality and user productivity. STIHL’s chainsaw is especially being regarded as an enduring tool with great value. Some negative feedbacks indicate the product is on a mediocre level of quality with bad aftermarket services. These are only the minority. Most of the feedbacks praise STIHL for its high quality and long product life. Some suggest the product is ‘worth to buy.’

STIHL has an active presence on both Wechat and Weibo with 47,418 and 8,385 followers respectively. It has maintained an active status on Weibo for it has posted 21 posts during November 2018.

CONTACT US NOW TO ANSWER YOUR QUESTIONS ABOUT BUSINESS IN CHINA

Gardening tools bran naming

Choosing an appropriate Chinese name for your brand not only conveys the ideologies and doctrines embedded in your brand but is also a way for people to keep your brand in mind. Several gardening tool brands have made good examples. These names connect with the concept of gardening and create the image of gardeners and plant growth.

Worth – ‘沃施’ The Chinese name consisted of the two Chinese characters: ‘沃’, meaning ‘to irrigate’, and ‘施’ meaning ‘to spread manure.’ Together the Chinese name implies the brand is related to growing plants, such as gardening tools and farming tools.

Gardena – ‘嘉丁拿’ The Chinese name consisted of three Chinese characters. ‘嘉’ means ‘good or wonderful,’ ‘丁’ implies the concept of a gardener, and ‘拿’ means ‘hold.’ This Chinese name implies that the products are of high quality and are the best matches for gardeners.

STIHL – ‘斯蒂尔’ The Chinese name based on the pronunciation of its original name. The Chinese name accommodates the pronunciation and uses Chinese characters.

The gardening tool market composition – Distribution channels

Online retailing coverage in China

JD.com has far more presence of brands in gardening tools. This phenomenon may due to the higher security deposit Tmall/Taobao require for registering and opening up an official store on its platform. The online promotional activities mainly happen during double 12 shopping festival (following the success of double 11 shopping carnival created by Taobao, double 12 shopping festival was also created several years ago to stimulate the consumption potential of online retailing further).

Offline retailing coverage: case in Shanghai

Major offline retailing points for gardening tools are specialized stores and wholesale markets. The number of those offline retailing points are limited, and most of them are located outside the residential areas and business districts. The possible location for those stores is in the surrounding suburbs of a city.

Searching keywords ‘gardening tools’ renders 16 results of stores on Baidu Map and 14 results of stores on Dianping.com. Among those, 16 are specialized gardening tool store, and only 5 of them are wholesale markets.

In China, people usually buy gardening tools and machines from specialized stores and wholesale market. In those places, gardening hand tools and gardening machines are separated on different shelves, large size tools/machines are placed on the ground. Many stores are small with a narrow product range.

Image source: daxue consulting, photos of gardening tool distributors in China, cheap tools are often sold in neighborhood shops, higher end tools are sold over e-commerce and specialized shops

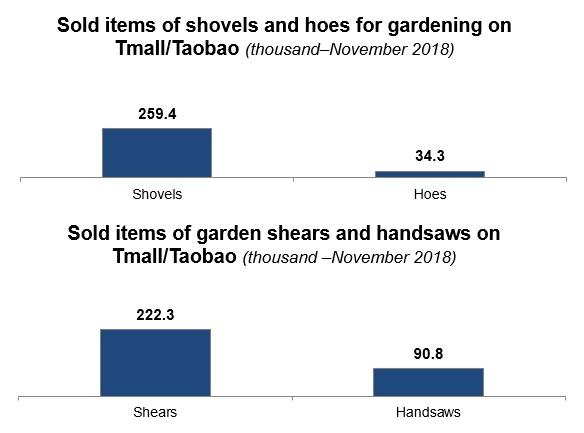

Shovels, hoes, garden shears, and handsaws are widespread gardening tools in China. On Taobao/Tmall, the sales of shovels (for gardening) were far more than hoes (for gardening) in November 2018. The sales of garden shears were also more than handsaws during the same period.

What brands should know aboutChina’s gardening tools market

- Both commercial and household segments drive the market. Within the household segment, Chinese garden tools consumers are more urban and upper class. However, many urbanites live in apartments and do not have their own yard, and those living in the suburbs or in villas in the city still have limited yard space. Therefore, size and length of hoses is not as important as maneuverability.

- Another consumer segment that is important in China is car owners. Cars double as a status-symbol and therefore many Chinese car owners cherish their cars and invest in car care. Hence, washing their cars at home is an increasing market, and many Chinese purchase hoses just for this reason.

- Gardening tools is a segment where consumers have shown more trust to foreign brands’ quality, giving more market opportunities to foreign brands so long as they uphold the promise to high quality.

- The hot months in China’s gardening tools market are April through August, with another sales for the 11.11 shopping festival.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Daxue Consulting helps you get the best of the Chinese market

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast