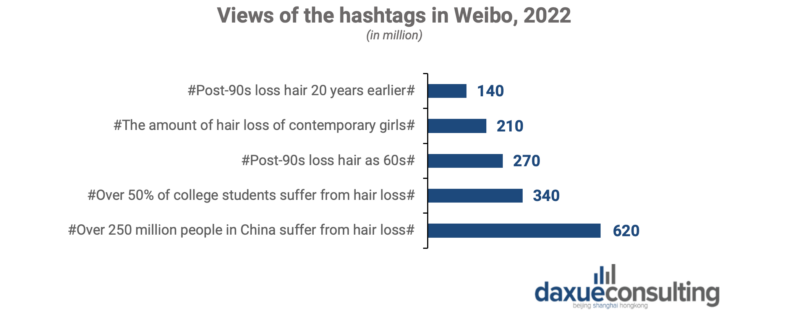

Today, hair loss is an extremely common problem in China. In 2021, over 250 million Chinese experienced hair loss, meaning 1 out of 6 Chinese people suffer from thinning hair. While image and appearance occupy an increasingly important place in everyday life, thinning hair has become a real social issue, especially since the most concerned ones are no longer just middle-aged people, but also the youngsters. In general, hair loss has become a nationwide popular topic, hence it is not surprising that the most discussed hashtag about such topic on Weibo #Over 250 million people in China suffer from hair loss# received about 620 million views.

Hair loss in China is affecting more and more young people

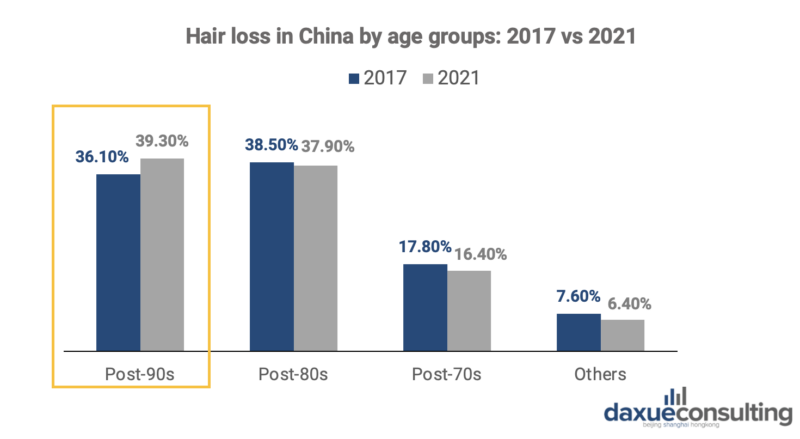

Surprisingly, more and more young people in China are losing their hair. In 2021, Chinese born after 1990 became the main group suffering from hair thinning, jumping from 36.1% in 2017 to 39.3% in 2021. At present, people under 30 and those aged between 31- and 40-years old account for 69.8% and 25.4% of the population who is going bald. The average age of those suffering from hair loss is 30.1 years old, which is 20 years earlier than the age people started losing hair in the previous generation. According to DataTouch, hair and scalp care was the hottest personal care category on most social media and e-commerce platforms in 2020.

Why Chinese young folks are going bald

To explain why Chinese young people are losing their hair, several phenomena can be taken into account:

Young people have irregular routines and late sleeping hours

The 2019 Chinese Sleep White Paper shows that the elderly sleep better than young folks do. The average sleep time of the post-70s and post-80s exceeds 7 hours per night, while staying up late is common among the post-90s and post-00s. Indeed, 43% of the 90s and 27% of post-00s have the habit of staying up late, and the average time for post-90s to fall asleep is after midnight. Post-00s also show an obvious tendency to sleep late, and it is predicted that more and more post-00s will suffer from hair loss in the next 5-10 years. Lack of sleep increases stress, thereby leading to hair loss due to telogen effluvium.

Unhealthy diet

Bad eating habits are a very common cause of telogen effluvium. On the one hand, the youngsters rely too much on food delivery. According to Meituan Research Institute, food delivery users aged from 20 to 29 accounts for 61.5% of the total. High-fat, high-sugar, high-calorie, spicy and irritating food can easily lead to seborrheic dermatitis and folliculitis. On the other hand, young people adopting a too strict diet to lose weight can easily incur in hair loss due to malnutrition.

Mental stress and anxiety

Anxiety and stress are technically two separate conditions; however, they do overlap. The linking point between anxiety and hair loss is stress. In a lot of ways, anxiety causes a long term and persistent stress, which can affect the growth phase of your hair. Moreover, mental health, physical health, sleep patterns, social relationships, and even our biological development can all affect the immune system, nervous system, and blood circulation, thereby accelerating hair loss.

Hair loss in China has untapped a huge market

In 2021, China’s per capita disposable income reached 35,128 yuan, recording a nominal increase of 9.1% over the previous year, and a real increase of 8.1 percent after deducting inflation. The nominal growth rate was 14.3% higher than in 2019. The increase in disponible income has induced Chinese consumers to spend more money to take care of their personal image and appearance. Thus, consumption upgrade in China has resulted in the growth of the cosmetics and personal care market. The cosmetics industry in China has experienced steady growth in recent years. The overall market has expanded by over 150% between 2012 and 2020, with household spending on personal care and cosmetic products expected to further grow by 6.3% by 2025. During 618 shopping festival in 2022, demand in hair care products increased by 33.1%.

As hair loss issues get more frequent among Chinese youngsters, along with increasing per capita spending on personal care products in China, the anti-hair loss market is bound to thrive. Nowadays’ most popular hair loss treatments can be divided into three categories, depending on the seriousness of the loss:

1. Anti-hair loss shampoo

Anti-hair loss shampoos are the most popular treatment among Chinese consumers. In 2020, sales of shampoos for thinning hair in China generated approximately 1.54 billion yuan, boasting a steady growth in the past years. A survey conducted by MobTech showed that anti-hair loss shampoos are the first step for people suffering from thinning hair. According to a survey conducted by Ipsos, 69% of 3,000 Chinese respondents purchased an anti-hair loss shampoo in 2022.

2. Topical medication, such as minoxidil

The main purpose of anti-hair loss shampoos is to supplement nutrition to the scalp and promote hair growth, but it is ineffective for patients that are already going bald. While hair transplantation is mainly for people with severe hair loss and its cost is relatively high, topical medications appears to be a relatively cost-effective and convenient solution. It is a key treatment for primary and mid-stage hair loss, but it needs to be used on a regular basis.

Among such kind of medications, finasteride, spironolactone, and minoxidil are most popular ones. The sales growth of anti-loss brands such as Mandi and Dafeixin have increased rapidly. Tmall data show that the sales of Mandi Minoxidil tincture spray on Taobao and Tmall in the first quarter of 2021 reached nearly 60 million yuan. In contrast, according to the results released by Zhendong Pharmaceutical, Dafeixin’s annual sales grew from 11 million yuan in 2018 to 116 million yuan in 2021.

3. Hair transplant is the ultimate hair loss treatment

The first two methods can cure the symptoms but not the root cause, while hair transplantation drastically solves the problem of hair loss. Since 2016, China’s hair transplantation industry has begun to flourish, vaunting a market size of 5.8 billion yuan that same year and reaching about 13.4 billion yuan in 2020. However, in 2020, just 516,000 hair transplant surgeries were performed in China and the penetration rate of hair transplantation in the country was 0.2% in 2020. According to iResearch 2018 survey, people refuse hair transplant mainly because they think that they do not need it (31%), because they are scared about possible risks (17%) or because of the high price of such kind of surgery.

Key takeaways of China’s hair loss market

- An increasingly larger number of Chinese are suffering from hair loss, and in the latest years young people have turned into the most affected group.

- With the upgrade of consumption and increasing attention on image and appearance, people are willing to spend money to prevent and treat hair loss.

- The hair loss market can untap great opportunities for brands, from anti-hair loss shampoos to topical medications and hair transplants.